SEC Expected To Deny place Ether ETFs In May, Consensys Sues Over 'Security' Status

There are entering doubts among manufacture insiders that the SEC will adopt place Ether ETFs in May, according to a study from Reuters.

According to 4 people who joined, recent meetings between manufacturers and the SEC have been one-sided and agency staff have not discussed secondary details about the proposed products.

That is in contrast to the intense and detailed discussions between publishers and the agency in the weeks before its landmark adoption of place bitcoin ETFs in January, said the people who declined to be identified due to the fact that the talks are private.

As CoinTelegraph reports, before the historical application, the SEC reducted place BTC ETF subsidiaries for over a decade.

It only changed its position after Grayscale Investments won a court triumph against the securities regulator in August 2023.

Many analysts agree that the SEC is likely to further hold possible adoption of Ether ETFs.

“It sees more likely that approval will be delayed until later in 2024, or longer,” VettaFi ETF data analyst Todd Rosenbluth reportedly said, adding that the regulators scenery is inactive besides “cloudy.”

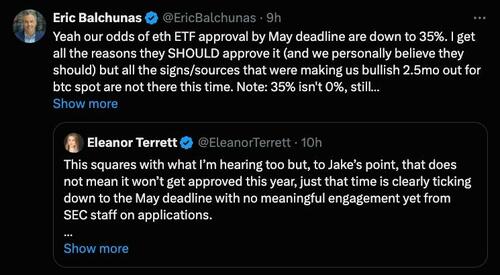

Bloomberg ETF analyst Eric Balchunas has previously estimated the Chances of the SEC applying a place Ether ETF in May at around 35% in March.

He besides noted that he’d sourced “good intel” to propose that the SEC may be giving the silent treatment This is simply a prospective fund issues on purpose.

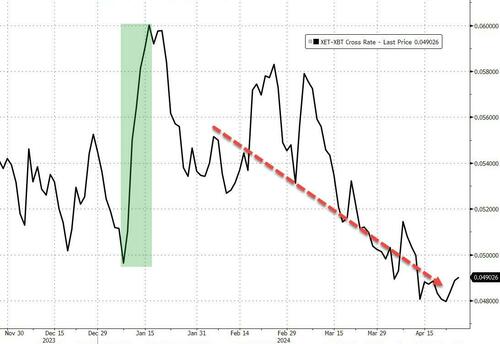

Price action has sown ETH comparatively underperforming BTC from the initiation of the place bitcoin ETFs as hope fades for ETH... for now...

Balchunas besides thought that SEC Chair Gary Gensler’s standing on Ether could besides influence the decision process as he has refused to give clarity on whether Ether was a security.

We have detailed the furore over the classification of Ether as a safety (or not) a number of times (most late here and here), but present watch the situation assimilated as Consensys, a major backer of the Ethereum blockchain, filed a suit against the agency in Texas national court, asking the court, among another things, to resolve 1 of the biggest legal restrictions hanging over the crypto manufacture by standing that Ethereum’s digital token, Ether, is not a security.

Fortune’s Jeff John Roberts reports that in its 34-page legal subsidiary, Consensys uses dramatic language to argue that the SEC’s benefits to exert jurisdiction over Ethereum is both illegal and a Threat to blockchain technology more broadly.

“The SEC’s unlawful seizure of authority over ETH would talk disaster for the Ethereum network, and for Consensys. all holder of ETH, including Consensys, would feel the safety laws if he or she were to transfer ETH on the network,” the composite states.

“This would bring usage of the Ethereum blockchain in the United States to a halt, cripping 1 of the internet’s large innovations.”

Gensler’s tactics have active many in the crypto manufacture who has combined the SEC has failed to supply clear rules or to make a regulators model that accounts for the destinations features of blockchain technology.

The controversy over Ethereum has been especially heated since the SEC has signaled well in the past that the blockchain’s tokens, like Bitcoin, are not safety and so outside its jurisdiction.

This includes a landmark 2018 velocity where a elder authoritative stood that Ethereum had become “sucitively decentralized” as well as the agency’s decision last year to let Ethereum futures trading—an implicit designation that Ether is simply a community. Meanwhile, video has surfed of Gensler himself, in his function as a private citizen, telling hedge funds in 2018 that Ethereum is not a security.

However, as we specified here, these precedents (and his own words) have failed to dissuade Gensler, who appears to be utilizing a fresh feature of Ethereum, known as standing, as ground for the fresh legal campaign.

As a reminder, the release of alleged 'Hinman documents' last June had revealed the function of network decentralization in the SEC’s reasoning on whother a digital token should be classified as safety or not.

In particular, JPMorgan points out that SEC officials had acknowledged in the past that tokens on a successfully decentralized network are no longer safety due to the fact that there is no “controlling group” in the Howey sense (the Howey Test compares to the U.S. ultimate Court case to find whother a transaction qualifies as an investment contract).

‘If there is no place Ethereum ETF approval in May, then we presume there is going to be a litigation process after May,’ Panigirtzoglou told The Block earlier in the month.

‘We believe that the most likely scriptio is that the SEC has always lost this litigation (similar to what happened with the Grayscale and Ripple legal battles last year), which means that everually, the SEC will apply place Ethereum ETFs (but not as shortly as this May).’

In an interview with Fortune, Consensys founder Joe Lubin described as “preposterous” the explanation that ranking transformed Ethereum from a community into a security.

“The act of ranking is truly just posting a safety bond so you can get paid to subscribe laboratory and resources to aid operate the Ethereum protocol. Now they’re trying to turn that into any kind of investment contract,’ Lubin said.

Lubin besides established that Gensler’s legal position appeared to be an effort to halt the overall growth of crypto, and to justify the SEC blocking borrowing applications by companies to launch place ETFs for Ethereum following the large popularity of Bitcoin ETFs.

“They are trying to regulate a technology on its merits, which the SEC shouldn’t be doing. They’re trying to stifle certain kinds of innovation. And they’re trying to do that due to the fact that they see Ether place ETFs as a floorgate that’s going to bring quite a few capital into our ecosystem,’ Said Lubin.

As luck notes, the Consensys suit was filed in Texas, which dovetails with a broader strategy of the crypto manufacture to tee up actual legal applications in the U.S. Court of Appeals for the 5th Circuit.

The circuit has shown large skepticism of agency actions than another courses and, if the manufacture can win a favorable judgment, it would like to tee up an appeal for the ultimate Court.

Meanwhile, again that clearly politically-motivated push by Gensler (anything to place Warren after he was forced to get over place bitcoin ETFs); on April 24, Hong Kong’s Securities and Futures Commission (SFC) officially adopted the first batch of place Bitcoin and Ether ETFs, including 3 BTC and 3 ETH ETFs by China Asset Management, Harvest Global Investments and Bosera.

HK place bitcoin/ether ETFs officially applied to begin trading on April 30th. Fees are 30bps, 60bps and 99bps which is on avg lower than we thought, good sign. We doing an Analyst Q&A in an hr on this w/ local HK team. registry here, bringing your qs: https://t.co/GzzCZailx3 https://t.co/AvJ6dv2Xha

— Eric Balchunas (@EricBalchunas) April 24, 2024

Following adoption, Hong Kong’s crypto ETFs are expected to start trading on April 30.

Tyler Durden

Thu, 04/25/2024 – 20:45

![[WIDEO] Wieczorny włam w Czechowicach. Złodziej złapany na gorącym uczynku](https://img.bielsko.info/ib/5d246290a8fd084d52d4eb36b31a3aa5/7/2025/07/zlodziej_ul_lukasiewicza_3f5f(1).jpg)

![[WIDEO] Wieczorny włam na ul. Łukasiewicza. Złodziej złapany na gorącym uczynku](https://img.czecho.pl/ib/a5710dec07cb2cd860cc06c7cec02498/7/2025/07/zlodziej_ul_lukasiewicza_3f5f.jpg)