AUTHOR: TYLER DURDEN

Bloomberg reports that Saudi Arabia privately suggested earlier this year that sell part (or all) of its European debt stake if G-7 confiscates Russian frozen assets.

Let's remind you, that in May the Union The European has approved the US-supported plan for the usage of profits and interest generated from Russian assets to assist in the refurbishment of Ukraine; However, it was a violent departure from the previously proposed plan – powerfully promoted by Zelenski and Ukraine – to confiscate Russian assets worth about $300 billion. Many wondered what caused the trend to reverse.

Now we know, and as Bloomberg notes, "The Ministry of Finance of the Kingdom told any of the G-7 counterparts about its opposition to the thought that was to support Ukraine, And 1 individual described it as a veiled threat."The Saudis specifically mentioned the debt issued by the French State Treasury.

Most of the $300 billion of frozen Russian assets are located in Europe – especially France, Germany and Belgium. This makes Bloomberg's present study even more interesting from the position of geopolitical cracks, due to the fact that it means that as a consequence of its ability to trigger a liquidation panic on an unstable European bond market, it has a much greater leverage than Ukraine and Western media "signalizing virtue".

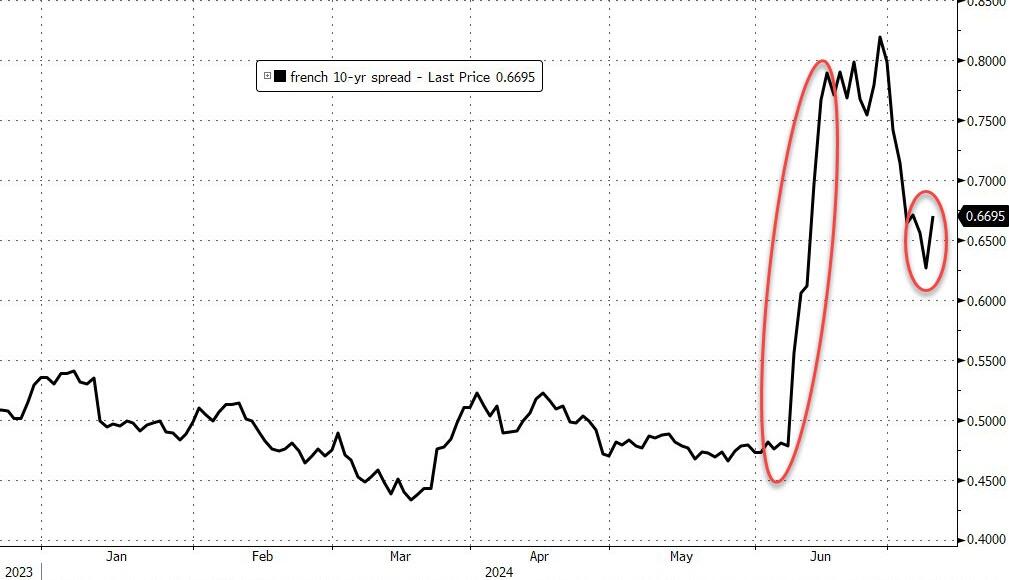

Now, in particular, Macron has announced elections which meantime have franticly shifted to the far left, but since these "talks" took place with the Saudis, the spreads of the profitability of French bonds towards The Germans exploded more...

Surely this panic sale, which occurred at the time the Saudis utilized French bonds as political leverage, was just a coincidence.

Interestingly, Saudi Arabia maintains strong relations with Moscow, but besides builds ties with Ukraine. And yet it is clear that erstwhile it comes to what, The heir to the throne is firmly on Putin's side.

Bloomberg concludes, noting that regardless of the motives, Saudi Arabia's decision underlines its increasing strength internationally and difficulties in obtaining support for Ukraine from the alleged Global South countries.

Let us remind you that in April 2016. "NYT" reportedthat Saudi Arabia threatened then president Barack Obama to liquidate US government bonds at that time worth $750 billion (which would lead to a collapse in the bond market) if it was considered liable for the 9/11 attacks

Then—like now— The Saudis won (adultly, Saudi Arabia and so by the end of 2016 reduced its shares in TSY by half). But the more crucial issue is two:

- While the petrodollar may, but request not be dead, his financial leverage is simply a light shadow of his erstwhile self; in fact, the only lever works on those who inactive have American papers and may endanger to throw them on Weilla.

- Using the U.S. dollar as a weapon – nevertheless irrelevant it may be now – against Russia was a disastrous decision that would echo for years and force Fed to buy out all of the American debt that erstwhile government bond holders sale in 1 way or another.