Google Soars To evidence After Smashing Estimates, Launches $70 Billion Buyback And Starts Paying Dividend

After the first 2 Mag7 companies were a survey in marketplace paradoxes, erstwhile TSLA missed across the board and soared (after guiding much better than expected) and META beat across the board but plunged (after guiding weaker than expected while booming its spending forecast), moments ago 2 of the Mag7 giants, GOOGL and MSFT, both reported and this time there was far little drama: both beat, and Saw their stock feeding after hours.

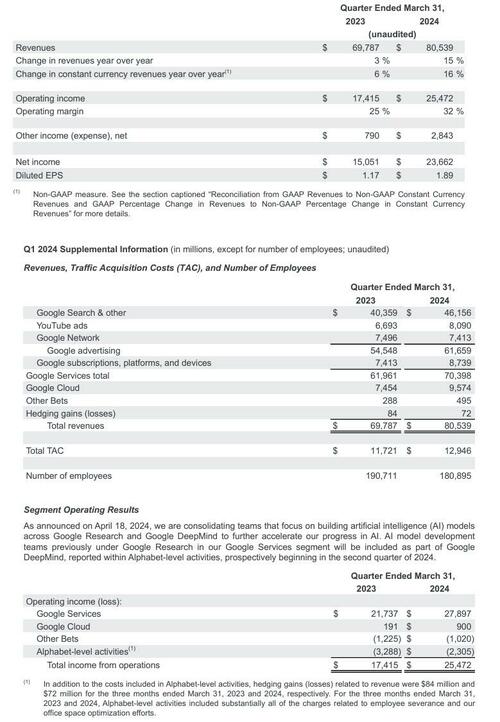

Focusing on Google parent Alphabet, Goldman said ahead of learnings that positioning here was not as exclusive (at 7/10) which may be why the stock is soaring any 13% after the close on what otherwise apps to be a solid beat. Here are the details:

- EPS $1.89, beating estimate $1.53, and up more than 50% vs the $1.17 a year ago.

- Q1 gross $80.54 billion, beating the estimation of $79.04 billion, and up 15% YoY

- Google advertising return $61.66 billion, beating The estimation $60.18 billion

- YouTube ads gross $8.09 billion, beating the estimation $7.73 billion

- Google Services gross $70.40 billion, beating The estimation $69.06 billion

- Google Cloud revenge $9.57 billion, beating the estimation $9.37 billion

- Other Bets revenge $495 million, beating estimate $372.4 million

- Operating income $25.47 billion, beating estimate $22.4 billion

- Google Services operating income $27.90 billion, beating The estimation $24.3 billion

- Google Cloud operating income $900 million, beating The estimation $672.4 million

- Other Bets operating lots $1.02 billion, beating the estimation destiny $1.12 billion

- Operating margin 32%, beating the estimation 28.6%

- Capital expenditure $12.01 billion, beating the estimation $10.32 billion

- Number of employees 180,895, down from 190.711

A fast point on YouTube: it was bought by Google in 2006 for $1.65 billion; YouTube now generics $1.65 billion of gross all 18 days.

The results visually:

While Google’s cloud numbers were stellar, with returnue rising from $7.5BN to $9.6BN, and beating estimates of $9.4BN, what investors wanted to hear was more about the company’s advancement on AI. This is what it had to say:

As announced on April 18, 2024, we are consolidating teams that focus on building technological intelligence (AI) models across Google investigation and Google DeepMind to further accelerator our advancement in AI. AI model improvement teams previously under Google investigation in our Google Services section will be included as part of Google DeepMind, reported within Alphabet-level activities, prospectively starting in the second 4th of 2024.

Like another large Tech companies, Alphabet has been plowing money into developing technological intelligence, and strategy that has helped drive request for its cloud services, which Saw gross emergence 28% in the first quarter. While Google regains a distance 3rd in the cloud computing market, tracking Amazon and Microsoft, the company’s prowess in AI could aid it close the gap.

Google has developed much of the underlying technology being utilized in the AI boom today, and has woven it into products from web search to its suite of enterprise software from Gmail to Google Docs. Yet always since OpenAI’s ChatGPT was released in summertime 2022, Google has been battling the perception that it’s catching behind Microsoft and OpenAI in rolling out fresh generic AI tools. The arrival of popular chatbots specified as ChatGPT — which Answers questions in a controversial speech alternatively than providing lists of links to another websites — has posted a Threat to Google’s two-decade stranglehold on search. The company is strugling to compete in generic AI without cannibalizing its core profit machine.

Google has been scrambling to reassert its early lead in AI, after it has already experienced were marred by embarrassing blunders, including a scandal over how it AI model Gemini handled race that forces the company to suspend image generation of people.

Commenting on the results, CFO Ruth Porat said: “Our strong financial results for the first 4th reflect gross strength across the company and ongoing efforts to highly reengineer our cost base. We delivered returns of $80.5 billion, up 15% year-on-year, and operating margin expansion.”

It is absolutely delivered, and just to make certain the marketplace is rewarded it, the company does not only announce the start of fresh cash dividend at 20 cents...

Alphabet’s Board of Directors present adopted the initiative of a cash dividend program, and determined a cash dividend of $0.20 per share that will be paid on June 17, 2024, to stockholders of evidence as of June 10, 2024, on each of the company’s Class A, Class B, and Class C shares.

... but besides announced a fresh stock buyback program for $70 billion!

Alphabet’s Board of Directors present authorized the company to repurchase up to an additional $70.0 billion of its Class A and Class C shares in a manner deembedded in the best interest of the company and its stockholders, taking into account the economical cost and prevailing marketplace conditions, including the comparative trading prices and volumes of the Class A and Class C share.

While investors have shown they are excited about the prospects of AI, they want tech companies to proceed to focus on return and profit in the meanstime. Meta, which competes with Google in AI and besides digital advertising, suggested its worth stock decline since October 2022 after reporting that it would spend billions of dollars more this year on AI efforts and projecting weaker revue for the current quarter. For its part, Google – which does not do forecasts – paid $12BN in capex in the quarter, $1.7 billion more than estimated.

For all the hoopla about AI, search advertising restores the engine of Google’s lucrative business, and the company is facing heightened competition there, too. Meta has been seeing AI tools through its advertising business and Snap Inc. has besides undergone a full revamp of its ad business to improve ad targeting. The digital ad marketplace is recovering from a post-pandemic slump, bought by the Olympics Games this summer, but Google is actively increasing for those ad dollars with Meta and Snap.

If consumers gravity from Google search to the fresh wave of chatbots, that could imperil the company’s search advertising juggernaut, which is expected to make close $200 billion in return this year and the bulk of Alphabet’s profit.

Cloud has been a bright place for Google, after it first become profitable early last year. Many young AI launches are found by erstwhile Google employees, creating a strong pipeline of cloud clients.

For now, however, these deals were on the backburner, with GOOGL stock exploring about 12% after hours, and trading at a fresh all time high.

Tyler Durden

Thu, 04/25/2024 – 16:32

![[WIDEO] Wieczorny włam w Czechowicach. Złodziej złapany na gorącym uczynku](https://img.bielsko.info/ib/5d246290a8fd084d52d4eb36b31a3aa5/7/2025/07/zlodziej_ul_lukasiewicza_3f5f(1).jpg)

![[WIDEO] Wieczorny włam na ul. Łukasiewicza. Złodziej złapany na gorącym uczynku](https://img.czecho.pl/ib/a5710dec07cb2cd860cc06c7cec02498/7/2025/07/zlodziej_ul_lukasiewicza_3f5f.jpg)