Gold Hammered As Short-Squeeze Saves Stocks Ahead Of Micro/Macro Storm This Week

The ‘calm before the storm’ of learnings and large macro this week (and no WW3 This weekend) was all the algae needed to ramp stocks during the US cash session after being forgotten that the buyback-blackout period is always over...

And S&P HOD as algos start frontrunning the buybacks https://t.co/DfjpdZO1pS

— zerohedge (@zerohedge) April 22, 2024

Stocks had fallen from up around 0.6% at the cash open to unchanged by the European close... and then the algae all remembered, buybacks are coming back shortly to save the planet and stocks gone vertical... together... with everything up 1.5% at the highs before the 1430ET margin-calls and the compression ammo ran out, leaving stocks falling into the close (but inactive a solid green day after any fresh pain).

...as a basket of the 'most shorted' stocks exploded higher (biggest short slide in a month). We not announcement that the compression stood at an interesting level...

Source: Bloomberg

0-DTE traders were active today. Buying straddles/strangles early on, then call-buyers pounced in size, inevitably promoting early put-buyers to unwind (back to net zero delta – which looked to end the ramp), before the straddles were unbound into the close...

Source: SpotGamma

TSLA was twitted again – seventh consecutive down-day (equal longest-losing-stream ever). The last 2 times it dropped 7 consecutive days, it ripped back (Sep 2018, +50% in next 2 months; Dec 2022, +100% in next 2 months)...

Source: Bloomberg

Interestingly Goldman’s trading board noted overall activity levels are flat vs. the training 2wk avg, with mkt volumes down -8% vs. the 10dma

For the 2nd consecutive session we thin better to buy at +6.5% overall – this is our highest buy skew since 3/1/24

HFs are a massive driver of that request tilting +22% better to buy, this rank 98th %-ile & backs up last week’s PB study highlighting single stocks Saw the largest national long buying in over a year. HF request tilts towards Fins, Cons Disc, Indust, Info Tech & HCare with modern supply in Materials, Comm Svcs, Staples & REITs.

LOs are -5% better for sale which continues their subject from Friday. Supply is simply a bridge concentrated in Info Tech, Fins & Industrials with modern request for Staples, REITs & Cons Disc.

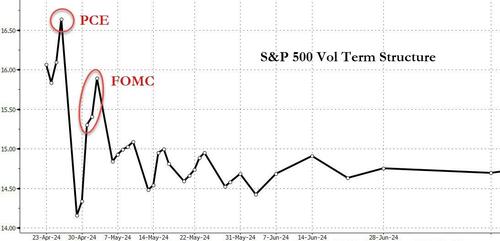

Equity vol markets are primed for the next week’s action though...

Source: Bloomberg

Treasures were comparatively quiet with an overnight sell-off but bid during the day session with the short-end outperforming (2Y -2bps, 30Y unch)...

Source: Bloomberg

Once again, 5.00% was opposition for the 2Y youth...

Source: Bloomberg

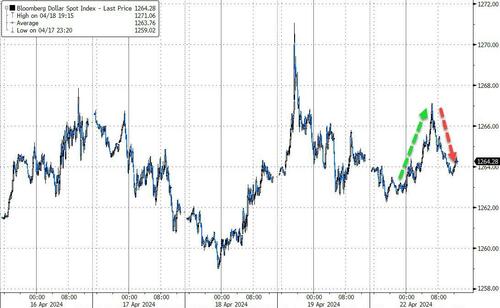

The dollar roller-coasted a small present ended unch...

Source: Bloomberg

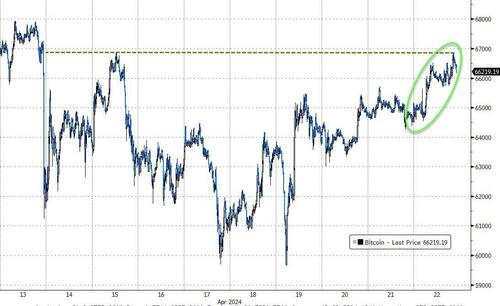

Bitcoin extended the weekend’s rebound (post-halving), investigating back up merchandise $67,000...

Source: Bloomberg

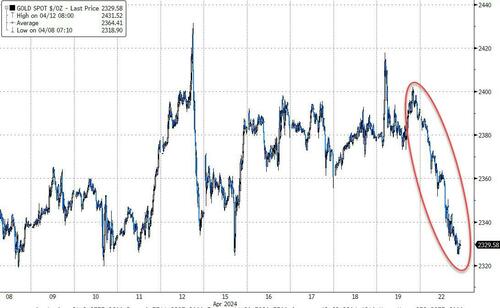

Gold, on the another hand, was clubbed like a baby seal – after rising for 13 of the last 17 days, present saw it Biggest regular lot since June 2022. But that drop only pulled it back to one-week lows...

Source: Bloomberg

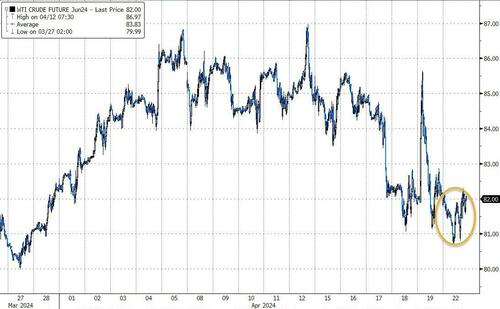

Oil prices chopped around all day with WTI holding at $82 and ended changed...

Source: Bloomberg

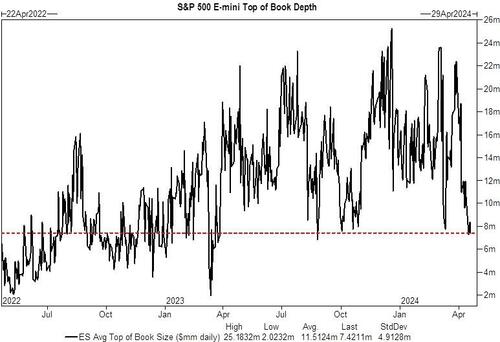

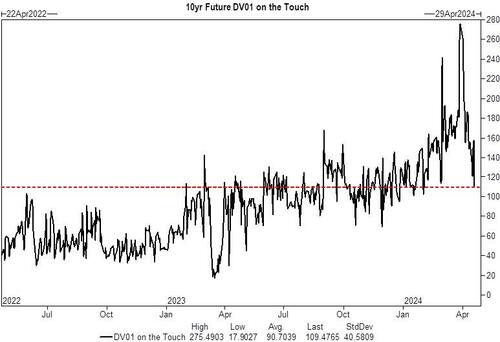

Finally, there's this... market liquidity in stocks...

...and bonds...

...is dismal – and in a week full of major macro catalysts (e.g. PCE) and massive micro events (MAG7 learnings), that will likely mean any seriously gaps (and with gamma so negative, things could getviolent, 1 way or another).

Tyler Durden

Mon, 04/22/2024 – 16:00

![[WIDEO] Wieczorny włam w Czechowicach. Złodziej złapany na gorącym uczynku](https://img.bielsko.info/ib/5d246290a8fd084d52d4eb36b31a3aa5/7/2025/07/zlodziej_ul_lukasiewicza_3f5f(1).jpg)

![[WIDEO] Wieczorny włam na ul. Łukasiewicza. Złodziej złapany na gorącym uczynku](https://img.czecho.pl/ib/a5710dec07cb2cd860cc06c7cec02498/7/2025/07/zlodziej_ul_lukasiewicza_3f5f.jpg)