Coming „Back To Life”: Burberry On Track For Best Weekly Performance Since Early 2009

Burberry’s earnings report, released Wednesday, indicates modest but encouraging progress in its strategic turnaround. One Wall Street analyst remarked that the iconic British trench-coat maker is „showing signs of life,” with early traction visible in brand repositioning efforts. While demand remains soft in key markets like China and the U.S., operational improvements suggest the brand may be approaching an inflection point that deserves investors’ attention.

Despite a year-over-year decline in revenue and profitability, Burberry delivered several above-consensus results, including sales that fell less than expected in the fourth quarter, while its full-year operating profit and margin beat Bloomberg Consensus estimates. Mainland China and the U.S. remain weak spots for demand.

The results suggest the worst may be behind, and with improved execution, Burberry could be at the start of a recovery phase…

Fourth-Quarter Results:

Retail comparable sales fell 6%, better than expectations of -7.78% (Bloomberg Consensus)

- Asia Pacific: -9% vs. -10.5% est.

- Mainland China: -8% vs. -9.5% est.

- EMEIA (Europe, Middle East, India, Africa): -4% vs. -5.53% est.

- Americas: -4% vs. -2.76% est. (slightly worse than expected)

Full-Year Results:

Adjusted pretax loss of £37M vs. £44.8M loss expected (better than forecast).

Retail comparable sales -12%, estimate -13.1%

Revenue matched expectations at £2.46B, but fell 17% y/y.

- Retail sales: -14% y/y; slightly ahead of consensus.

- Wholesale: -37% y/y; in line with estimates.

- Licensing: +6.5% y/y; beat expectations.

Adjusted operating profit: £26M vs. £4.65M est. (significant beat, though down 94% y/y).

Adjusted operating margin: 1% vs. 0.25% est. (down from 14.1% y/y).

Adjusted EPS: loss of 14.8p vs. loss of 10.4p est.

No dividend declared (0p, as expected).

CEO Joshua Schulman, who joined the company last July, recently unveiled 'Burberry Forward’ to revive the faltering brand and boost popularity for its outerwear products and expensive trench coats.

Schulman expanded his turnaround strategy today with a plan to deliver $80 million in cost savings over the next two years, driven partly by a workforce reduction of 1,700 jobs—approximately 18% of total headcount. The move comes amid a broader global slowdown in luxury demand as the company looks to streamline operations and protect margins.

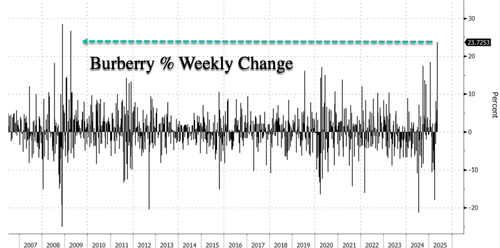

In markets, Burberry shares in London jumped 15% during the cash session. For the week, up nearly 24% – and if gains hold through Friday, this could be the company’s best weekly stock performance since the first week of April 2009.

Shares are trading at 2010 lows…

Analyst commentary on the earnings report was mostly positive but cautious.

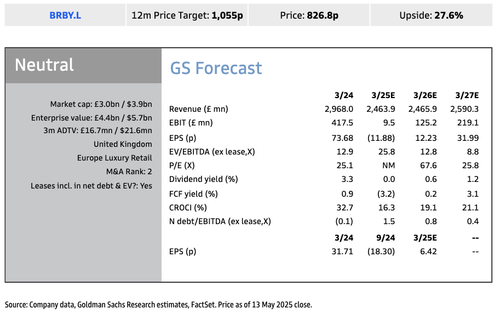

Goldman analyst Louise Singlehurst and Adrien Duverger provided clients earlier with their first take on the report:

GS View: We think performance in 2H25, and the focus on strong cost control, demonstrates the pace of execution at Burberry. Despite the tough environment, we note that inventory was -7% cFX (ahead of guidance of broadly at least flat) which we also expect reflects that Q4 trading was ahead of company expectations. The key is the additional cost savings target: we see as this as providing increased confidence for investors on the recovery in EBIT, whilst enabling Burberry to invest in the brand’s re-acceleration. We note that post FY25 adjusted EBIT of £26m, Visible Alpha Consensus Data adj EBIT for FY26 is at £138m (GSE £125m). We remain Neutral.

Additional commentary from other Wall Street desks (courtesy of Bloomberg):

Deutsche Bank (buy)

- Burberry is showing further progress on its brand turnaround, says analyst Adam Cochrane; an improvement in sales will be the key factor for investors over the next 12 months

- Outerwear and scarves were better than average, while leather goods were weaker

Jefferies (underperform)

- Burberry’s results suggest the brand’s turnaround case is in slow-burn mode, writes analyst James Grzinic, given fourth- quarter sales momentum has not built on the third-quarter sequential improvement

- Reference to a toughening backdrop and a back-end loading to this year’s delivery implies a mixed start to the new year on the sales front

Citi (buy)

- Burberry is coming „back to life,” writes analyst Thomas Chauvet, with the company’s robust strategic plan set to unlock value in the medium term

- Patience is needed, but the potential rewards now outweigh the risks

RBC Capital Markets (outperform)

- Burberry’s results are „an encouraging first step,” says analyst Piral Dadhania, with management pursuing the right strategy to reset the business

- This should, in time, support a return to positive revenue and profit growth

Bernstein (outperform)

- Burberry’s earnings look like a small beat on low expectations, writes analyst Luca Solca, which the market will take as an „encouraging sign”

- However, the new Burberry is yet to appear, given the new CEO arrived just before the SS25 fashion show

. . .

Tyler Durden

Wed, 05/14/2025 – 08:05