The prospects for abroad investment and trade in China are inactive improving. At least this is the consequence of a study by American consulting firm Kearney, which late published The 2024 Kearney abroad Direct Investment assurance Index.

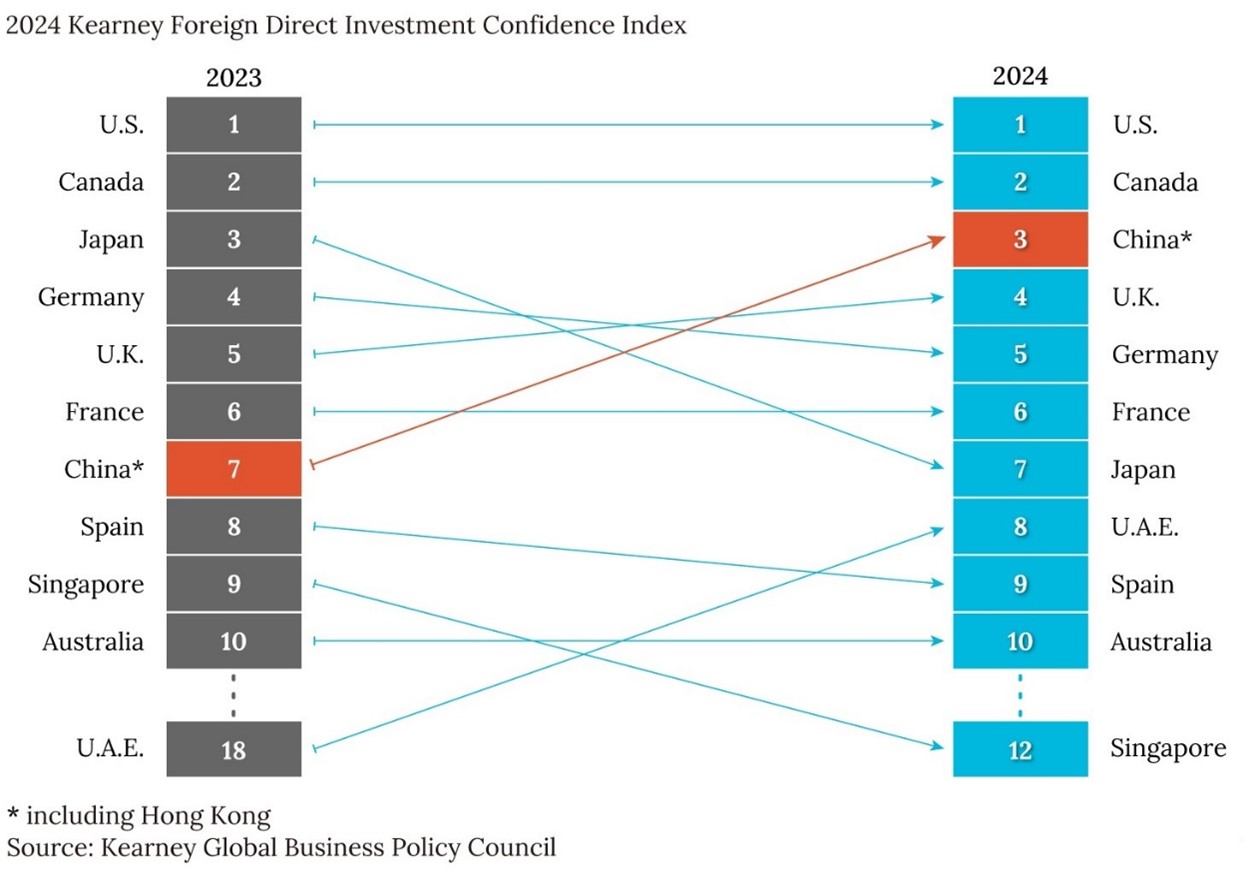

China has systematically improved its position in this global ranking. In 2022 they ranked 10th, in 2023 ranked 7th, and in 2024 – third. Only the US and Canada were ahead.

The study attributes China's improvement in the ranking primarily to softening capital control in 2023. It emphasises that China's effectiveness in attracting and exploiting abroad investment depends on 2 factors: the interior business environment and external conditions, in peculiar global relations and geopolitical factors.

For China, stabilising abroad investment and trade depends primarily on the national environment. In this regard, China can boast crucial advantages: an extended economy, a wide market, the world's most comprehensive industrial system, an increasingly advanced infrastructure, a advanced quality workforce and a more unchangeable political environment than many another emerging countries.

These strengths are lasting conditions that are likely to persist in the foreseeable future – the report's authors say. However, the fresh industrial revolution, manifested by artificial intelligence, poses fresh challenges. To emergence on the wave of globalisation in the era of artificial intelligence, China must further deepen its education, technological and investment systems to facilitate industrial modernisation. Therefore, China is working intensively to make a top-class business environment, where marketplace standards, respect for the law will meet the highest global standards. This not only strengthens assurance in private investment, but besides increases the country's ability to attract and usage abroad capital more effectively.

In fresh years, the Chinese government has clearly engaged in creating greater economical openness to investors. Among these efforts is:

- a crucial simplification in the alleged "negative investment list" defining sectors of the economy closed to abroad investment,

- the full removal of the constraints on investment in the manufacturing sector; and

- facilitating marketplace access in sectors specified as telecommunications and healthcare.

The study notes China's active alignment to advanced standard global economical and trade rules while expanding organization openness. Negotiations are underway on standard free trade and investment agreements with more countries and regions. China is seeking to conclude a partnership agreement with another countries on the digital economy and a comprehensive and progressive transpacific partnership agreement. These measures are seen as strategical moves by China to stabilise abroad investment and trade.

While the Ministry of abroad Affairs and the Ministry of Trade announced that “investment in China is investing in the future”, the external environment for investment in China and abroad trade this year is simply a major challenge.

What is crucial in the opinion of the authors of the report: with the growth of the Chinese economy, the improvement of technological standards and management standards, with the improvement of industrial infrastructure, the function of abroad capital and its participation in the Chinese economy are naturally decreasing. However, this does not mean that China no longer needs abroad investment. Today, in order to drive high-quality improvement and build an innovative society, abroad capital remains essential. Similarly, to prevent any attempts to separate and disrupt supply chains, China inactive needs abroad investment.

Kearney abroad Direct Investment assurance Index follows global business leaders' investment intentions in different markets over a period of 3 years, focusing on management of companies with yearly revenues exceeding USD 500 million. The index includes a typical mix, including 46% from the service sector, 45% from production and 9% from information technology.

Source:

kearney.com/service/global-business-policy-Council/foreign-direct-investment-confidence-index

Author: 梁安基 Andrzej Z. Liang, 上海 Shanghai, 中国 China

Email: [email protected]

Editorial: Leszek B.

Email: [email protected]

© www.chiny24.com

![[WIDEO] Wieczorny włam w Czechowicach. Złodziej złapany na gorącym uczynku](https://img.bielsko.info/ib/5d246290a8fd084d52d4eb36b31a3aa5/7/2025/07/zlodziej_ul_lukasiewicza_3f5f(1).jpg)

![[WIDEO] Wieczorny włam na ul. Łukasiewicza. Złodziej złapany na gorącym uczynku](https://img.czecho.pl/ib/a5710dec07cb2cd860cc06c7cec02498/7/2025/07/zlodziej_ul_lukasiewicza_3f5f.jpg)