There's nothing more certain in life than that nobody likes to pay taxes. In Poland, income taxes are very low, and less and less people gotta care about them at all. But another form of liability, pension and wellness contributions, grew in our homeland to the rank of curse. No phenomenon - including terrorism, Ebola, Putin and waffle prices during the summertime - has caused akin widespread contempt and hatred in our society as a regular transfer to social and wellness insurance. The possessor or occupier, who would enter the smiling Poland on the promises of abolishing contributions and eliminating ZUS and NFZ, would win the capital without a single shot, and the cordage drawn down the Vistula River from Wiertnicza Street by Czerska to Wierska would greet him with flowers.

In the opinion of electoral run specialists, it is so hard to be mistaken to promise the same thing all 4 years - LOW AND SIMPLE TAXES - and cast parasitic ZUS and NFZ in the function of antiheroes. Who's not going to vote to cut their taxes, right?

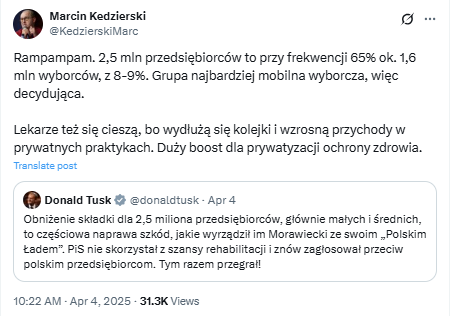

And since the game goes now - how rapidly Marcin Kędzierski summed up - by 1.6 million voters (to whom they will sign for the Trzaskowski and Holovnia races, To teardrop out Menzten's support) it there is no bottom of demagoguery, That they can't reach. From the proposal to receive Ukrainian victims of the social benefits war, by pretending to be disco-polo fans, public tributes to Trump after starving NFZ.

I am not naive adequate not to realize why so socially harmful and anti-state action is being taken by Tusk and Holovnia right now. In fact, I would not be amazed if the full wellness premium simplification dispute in 2024 was fabricated, and the intent of this bill was to announce a simplification in the wellness premium for companies and single-member business activities at the minute erstwhile this will bring the best consequence for the presidential campaign.

And yet I am naive adequate to proceed to stand in front of the rampant train of social Darwinism, which is commanded by Polish politician sociopaths with Gargamel's face and a hung baby, shouting STOP.

And if that's the case, then we request to remind you of the facts.

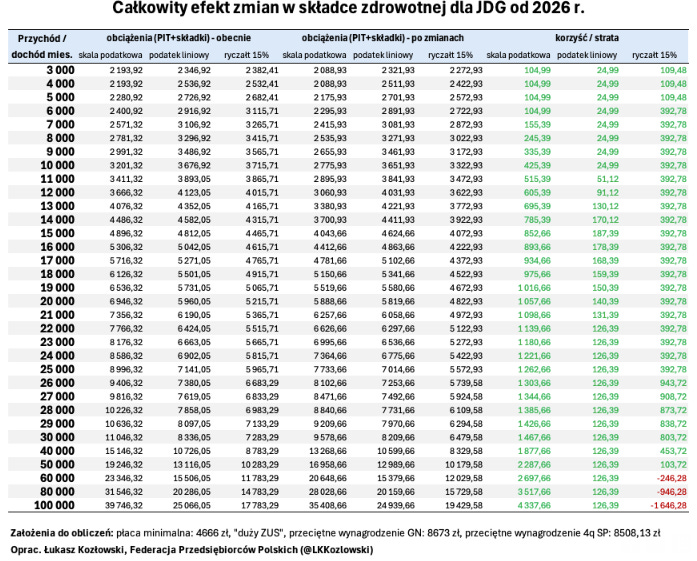

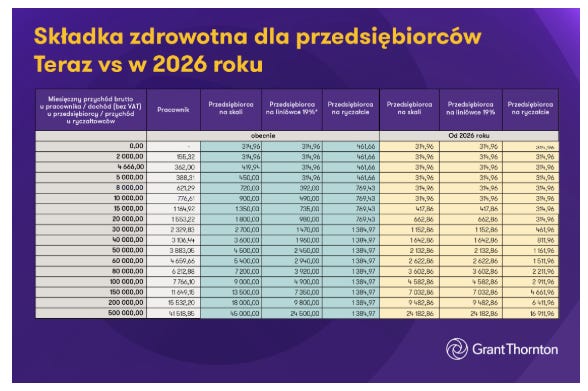

After the changes voted out in the Sejm, the earner pays the minimum wage will pay a higher wellness premium (329.44) than a single economical activity (286.33) with income of PLN 15,000/month.

It means that a teacher or caregiver will contribute to wellness care for influencer, lawyer or programmer on a b2b contract. The entrepreneur with a monthly income of about 15 1000 will save PLN 10 1000 per year on premiums and taxes - the individual employed on the period nothing. But of course, individual will gotta pay... (spoiler: all the others).

The simplification in the wellness contribution will reduce the gross to NFZ by PLN 4-5 billion per year. This is twice the amount collected during all the WOŚP finals combined and more than the National wellness Fund spends on psychiatry of children and young people. However, these measures will should be returned to the NFZ. How?

By expanding the budget grant by the same amount of money that will stay in the pockets of entrepreneurs. This means - since we have in Poland de facto a regressive taxation system, i.e. the little wealthy pay more effectively - the strategy will be even more financed by them. To put it plainly: since the state budget will be added to the simplification of contributions, it is the transfer from public money to the pockets of entrepreneurs.

The bigger, the richer, due to the fact that - which is straight due to the form of this improvement - - The mythical florist, residential hairdresser or shoemaker will gain (at revenues of 3-5 1000 per month) 20 times little than the 50 1000 top manager on b2b in the korpo, programmer on JDG or doctor with private practice. Which clearly shows the false rhetoric behind the reform.

![Tajemnicze groby dzieci i monety z czasów królów. Co odkryto w Tarkawicy? [ZDJĘCIA]](https://radio.lublin.pl/wp-content/uploads/2025/07/516602104_1046125810967761_180239605007938586_n-2025-07-11-115253.jpg)