The Great Repression

By Benjamin Picton, Senior Macro Strategist at Rabobank

US equities closed higher on Friday, the Dollar fell and Treasuries bull-steepened as markets extended the risk rally sparked by the Israel-Iran ceasefire. The NASDAQ and S&P500 both reset record highs. The latter is now up almost 5% for the year after being flat YTD as recently as the final week of May. Equity futures point higher again today on anticipation that this week could see Trump’s One Big Beautiful Bill clear Congress, and trade deals concluded with India and Japan.

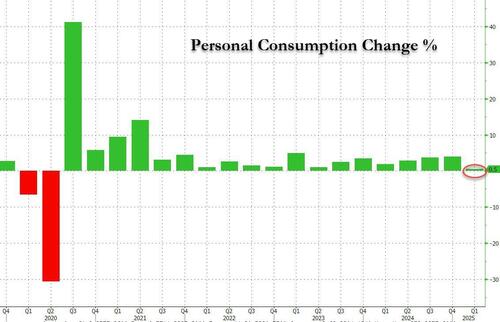

It’s not all good news though. Last week’s third read of US Q1 GDP saw growth revised down from an already bad -0.2% to -0.5%. The negative print is largely courtesy of surging imports as firms sought to front-run tariffs, but the latest downgrade is mostly due to a lower read for growth in consumer spending. That was revised down from 1.2% to 0.5% for the quarter on softer services spending.

Meanwhile, the GDP price index and core PCE price index were both revised one-tick higher to 3.8% and 3.5% respectively and May core PCE figures released later in the week posted a slight upside surprise to print at 0.2% MoM and 2.7% YoY, despite consumer spending recording a 0.3% monthly decline. Earlier in the week the Conference Board’s consumer confidence index fell from 98.4 to 93, new home sales and building permits underperformed expectations and the advance goods trade deficit for May widened to $96.6bn.

There were some bright spots in last week’s data – May durable goods orders rose 16.4% and weekly jobless claims were lower than expected – but the overall impression is of an economy losing steam. Donald Trump is happy to lay the blame for this at the feet of “stupid” and “too slow” Fed Chair Powell, who he says has done a lousy job by not cutting the Fed Funds rate to somewhere between 1-2%.

As noted in this Daily last week, Trump has said that he is “very close” to announcing a successor for Powell. The only problem with that is that Powell still has 11 months left to run as Fed Chair, so announcing a successor now would effectively allow Trump to armchair quarterback monetary policy decisions as Trump himself has said that he won’t appoint anyone who isn’t totally onboard with cutting the Fed Funds rate. For a President who revels in slaying the sacred cows of neoliberal economics, central bank independence looks like an easy target.

Trump is often accused of a lack of interest in details, but it surely wouldn’t have escaped his notice that the Congressional Budget Office just said that the Senate-approved version of the One Big Beautiful Bill Act will add $3.3trn to cumulative US deficits over the next 10 years. That’s from a starting point with debt to GDP already in excess of 120% and the fiscal deficit sitting close to a peacetime record. Andrew Yang facetiously Tweeted earlier this month that the bill “should be called the BBB Act because that’s what the US Credit Rating will be in a few years.”

The Big Beautiful Bill should be called the BBB Act because that’s what the US Credit Rating will be in a few years.

— Andrew Yang (@AndrewYang) June 4, 2025

With an economy starting to slide and financing pressures everywhere you look, it’s really no wonder that Trump is so keen to bring interest rates under executive control. Sniffing the wind, Martin Sandbu warns in the Financial Times to “get ready to embark on a new era of financial repression.” Private capital for state aims (whether you like it or not!) is a theme we have been pointing to for some time as a logical extension of the fact that the math ain’t mathin’ on policy ambition vs fiscal headroom. At least not under neoclassical assumptions of budget constraints, inflation targets and independent central banking.

You can see examples of creeping financial repression everywhere, whether it be the prevalence of negative real rates, bank liquidity rules creating a forced bid for government debt, a possible Mar-a-Lago Accord to devalue the Dollar and hold borrowing costs low, ex-Chancellor Jeremy Hunt pushing British pension funds to invest in private equity, or Aussie Treasurer Chalmers pushing pension funds to invest in housing, renewable energy and infrastructure. China, as Sandbu points out, has adopted financial repression as policy for years.

Globalized capital markets is an article of faith on Wall Street, but with Trump remaking international trade and international relations in a more nationalist and more realist image, does anyone really believe that free movement of international capital will escape the zeitgeist? Does Mark Carney believe that after Trump just abandoned trade talks with Canada over the latter’s imposition of a digital services tax (now rescinded)? Will Pedro Sanchez believe it as Spain is threatened with double tariffs over its recalcitrance in meeting NATO defense spending targets? Spare a thought for Australia, who is imposing non-tariff barriers on US tech AND refusing to play ball on defence spending while simultaneously crossing fingers and toes that the US will honor a Biden-era commitment to sell the Aussies scarce nuclear submarines.

For a vibe check on how quickly things can change you need only look to the Middle East, where the unique capabilities of US power (and the willingness to use those capabilities) have just been demonstrated. This has left Iran’s Axis of Resistance in tatters, Israel confirmed as a regional power, Syria set to join the Abraham Accords, China and Russia taking another strategic L in West Asia, and oil continuing to be priced in Dollars.

So, while financial repression seems inevitable and we might ordinarily be tempted to get short the US Dollar because of it, or because TACO, it might be worth considering whether it makes sense to be short US B-2 bombers and carrier strike groups, and whether the appropriate acronym for the Dollar might actually be TINA.

Tyler Durden

Mon, 06/30/2025 – 12:05