The Two Catalysts Driving The Next Great Monetary Reset

Authored by Nick Giambruno via InternationalMan.com,

All of this points to something big on the horizon, driven by two key catalysts.

We’re entering a pivotal moment—one where the economic, monetary, and geopolitical landscape is shifting.

These changes aren’t random or isolated; they are the result of deep structural pressures that have been building for decades.

While the signs have been there for some time, recent developments make it clear that the system can no longer hold as-is. A reset is not only possible—it’s likely. And two key forces are pushing us there faster than most realize.

The first is the long-ignored, but now unavoidable, debt crisis.

The second is the Trump administration’s strong belief that an overvalued dollar has hollowed out the US economy, weakening exports, offshoring jobs, and undermining American industry.

Let’s break down these two powerful catalysts driving the next great monetary reset—starting with the one that has silently eroded America’s financial foundation for decades: the debt.

Catalyst #1: The Debt Crisis Has Arrived

The financial decline of the US government has been unfolding for decades, creating a false sense of security. Many people have grown complacent—they’ve heard warnings about the debt crisis for years, yet nothing seemed to happen.

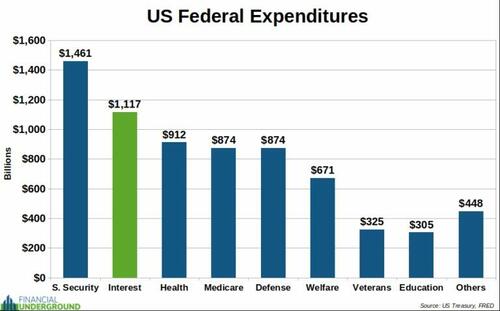

But last year, a crucial tipping point was reached: For the first time, interest payments on the federal debt surpassed the defense budget. It’s on track to overtake Social Security, which would make it the largest single item in the federal budget.

While the US government has an unmatched ability to extend the illusion of solvency, history is clear—even the most powerful empires cannot escape financial collapse once they can no longer service their debt.

A moment of reckoning is coming—and soon.

Historian Niall Ferguson put it bluntly:

“Any great power that spends more on debt service (interest payments on the national debt) than on defense will not stay great for very long.

True of Habsburg Spain, true of ancien régime France, true of the Ottoman Empire, true of the British Empire, this law is about to be put to the test by the US beginning this very year.”

In other words, debt kills empires.

The hard truth?

Cutting spending is meaningless unless it includes chainsaw-like reductions to entitlements, national defense, and the welfare state—while also reducing the national debt to lower interest costs.

In other words, the US would need a leader willing and able to:

-

Return to a limited constitutional government

-

Shut down the 750 military bases abroad

-

End entitlements

-

Dismantle the welfare state

-

Repay a large portion of the national debt

However, that’s a completely unrealistic fantasy. It would be foolish to bet on that happening.

Here’s the bottom line.

The US government cannot and will not even slow the rate of spending growth, let alone reverse it. This is a well-established trend that has been building for decades. At this point, it’s impossible to change course.

It’s like trying to stop an avalanche after it has already gained unstoppable momentum.

No matter what happens, the federal debt will not level off—it will continue expanding exponentially until it reaches a full-blown crisis. That crisis is closer than most realize.

That’s why there is an excellent chance this debt disaster will explode under Trump’s watch—though it is not entirely his fault.

Simply put, it’s game over. The federal debt charade is at the end of the line.

When governments are trapped, they reset the system.

That’s what happened in 1933 with gold confiscation, in 1971 when Nixon ended the gold standard, and at several other pivotal moments in American history. Now, history is repeating itself—and another major reset appears to be on the horizon.

The Trump administration has no other option—and all signs suggest they are preparing for what comes next.

Catalyst #2: A Strong Dollar Creates Economic Instability

The Trump administration sees the dollar as dangerously overvalued, blaming it for America’s worsening economic imbalances.

A strong dollar makes US exports uncompetitive, while making foreign imports relatively cheap, accelerating the offshoring of jobs and the hollowing out of American industry and manufacturing.

After the worst inflation surge in over 50 years, the idea that the dollar is “too strong” might sound absurd.

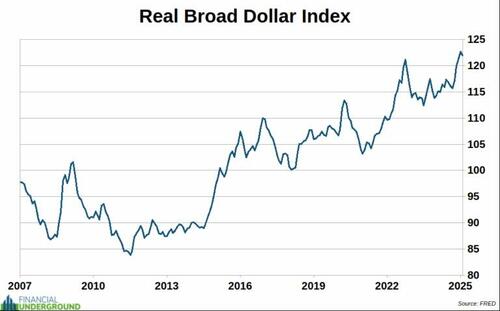

But the reality is that the dollar has soared against other fiat currencies like the euro, yen, yuan, pound, and the rest of the world’s government-issued confetti.

The Real Broad Dollar Index tracks the dollar’s value against a trade-weighted basket of currencies from 26 major US trading partners. As the chart below illustrates, the dollar has been on an upward trajectory for over a decade and now sits near an all-time high.

President Trump has consistently stressed the importance of leveling the playing field for American industry in global trade. However, a strong dollar directly undermines his goal of revitalizing US manufacturing. It makes American exports less competitive internationally and incentivizes companies to shift production overseas.

In short, the Trump administration believes the US must weaken the dollar against foreign currencies to boost American exports and bring manufacturing back to the US.

So, what can they do?

One historical precedent is the Plaza Accord of 1985.

In the early 1980s, after former Fed Chair Paul Volcker raised interest rates above 17%, the US dollar skyrocketed against foreign currencies. While this helped control inflation, it eventually hurt US exports and domestic industry.

Recognizing the problem, the Reagan administration took action. The US government convened a meeting with finance ministers from Japan, the UK, France, and Germany—its largest trading partners—at the Plaza Hotel in New York City. They agreed to a coordinated devaluation of the US dollar and committed to keeping exchange rates within a controlled range to prevent further volatility.

While a multilateral approach has worked in the past, it’s uncertain whether US trading partners will agree to the scale of devaluation Trump envisions. Trump doesn’t just want minor adjustments—he wants a permanent shift in favor of US industry.

A unilateral response may become the only option if other countries refuse to cooperate.

In my view, the notion that weakening the US dollar is a cure-all for America’s economic problems is misguided. It’s the equivalent of believing that prosperity comes from eroding the savings of everyday Americans while driving up their cost of living. It’s not just flawed—it’s ridiculous.

If the Trump administration truly wants to restore competitiveness, it must slash regulations and other burdens that make American products less attractive than their foreign counterparts.

If weakening a currency truly made a country more competitive, then Argentina and Zimbabwe would be global economic powerhouses.

Currency devaluation props up a handful of inefficient, politically connected industries and enables a reckless government to keep spending, but it does so by impoverishing everyone else in the process.

No country has ever achieved and sustained wealth solely through a weak currency. Yet, this is precisely what those in power seem to believe. And they appear to be moving toward a reset that fundamentally realigns the US economy and trade system.

The Reset Is Coming—Here’s What You Need to Know Before It Hits

Everything you’ve just read points to one conclusion: a major monetary reset is coming—and it’s accelerating fast.

What will it look like? Who wins? Who loses? And most importantly—how can you protect yourself and come out ahead?

I break it all down in an exclusive new report:

Inside, you’ll discover:

- Why the debt crisis and dollar devaluation are converging

- How gold could be used to reset the system

- What steps you can take right now to prepare and profit

Click here to download the PDF report now.

Because by the time the reset becomes obvious… it’ll be too late to react.

Tyler Durden

Thu, 05/08/2025 – 13:05