Retail Sales Data Suggestions A Strong Consumer Or Does It

Authorized by Lance Roberts via RealInvestmentAdvice.com,

The latest retail sales data suggestions a robust consumer, leading economics to become even more optimal about more robust economical growth this year. It's wit:

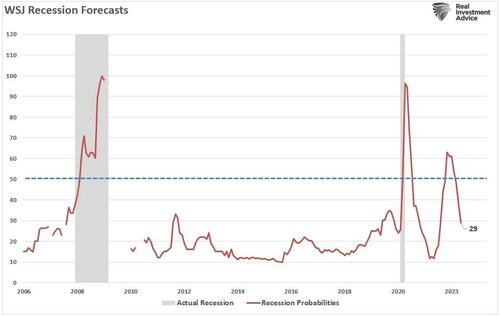

“It has been 2 years since forecasters felt this good about the economical outlook. In the latest quarterly survey by The Wall Street Journal, business and academic economists imported the Chances of a recession within the next year to 29% from 39% in the January Survey. That was the value probability since April 2022, erstwhile the Chances of a recession were set at 28%.

Economists Don’t think the economy will get even close to a recession. In January, they, on average, forecast sub-1% growth in each of the first 3 quarters of this year. Now, they anticipate growth to Bottom out this year at an inflation-adjusted 1.4% in the 3rd quarter.” – WSJ

Accepting to the March retail sales data, consumer spending added “Fuel” to economists’ exuberance about this year.

Rising inflation in March didn’t deter consumers, who continued buying at a more fast package than anticipated, the Commerce Department reported Monday. Retail sales increased 0.7% for the month, considerably faster than the Dow Jones consensus forecast for a 0.3% emergence though below the upwardly revised 0.9% in February, according to Census Bureau date that is approved for seasonality but not for inflation.’ – CNBC

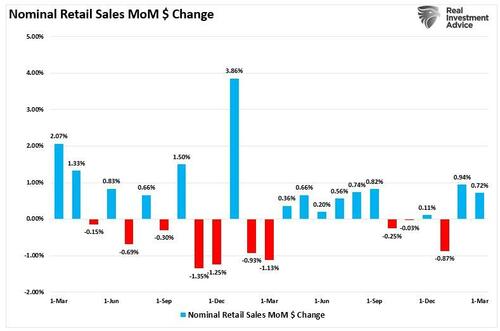

The illustration below shows the monthly change in the retail sales data over the last 2 years.

While mainstream economists Trumped the street of the consumer, the March retail sales date had any interesting points worth noting.

First, retail sales date was extraordinarily weak from October to January, the conventional website buying months of the year. That period included Halloween, Thanksgiving, Christmas, and NYear’sr’s. So, to any degree, the strength of spending over the last 2 months is unsurprising as, evenly, consumers request to buy goods or services previously postponed.

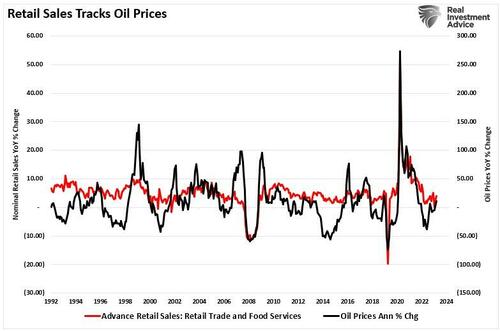

Secondly, while the March retail sales date was strong, it was weaker than February. However, March contained 2 crucial spending periods, Spring Break and Easter, which mostly don’t occur. Since Spring Break and Easter are considerable travel and buying periods, it is unsurprising that the retail sales data increased with oil prices rising. As shown below, there is simply a very advanced correlation between nominal retail sales and oil prices.

Paying More For The Same Amount

Economists frequently overlook another crucial point about the retail sales data. As noted above, the March retail sales study was NOT approved for inflation. Furthermore, the study is in nominal “Dollar volume” and not the amount of goods or services sold. Oil and gasoline prices are an excellent example of the issue with the retail sales date.

Let’s presume you own a car with 18-gallon fuel tank. Your regular activities are mostly going to work, going to the grocery store, eating out, having entertainment, etc. As such, you consume 1 tank of gas each week. Here is the math:

Week 1: 18-gallons of gas @ $3/gallon = $54.

That week, the store adds $54 to the monthly retail sales full for selling 18 gallons of gasoline. However, the price will increase to $4 per gallon next week.

Week 2: 18-gallons of gas @ $4/gallon = $72.

Here is the question.

While the retail sales data increased by $18 in week two, did the consumer acquisition more gasoline? In another words, if the economy’s strength is eventual measurement by how much in production (Gross home product), then does spending more for the same amount of goods or services equal to a strongr economy?

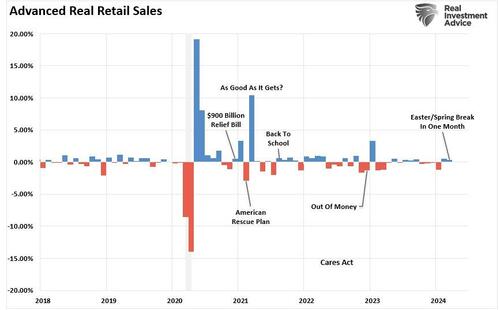

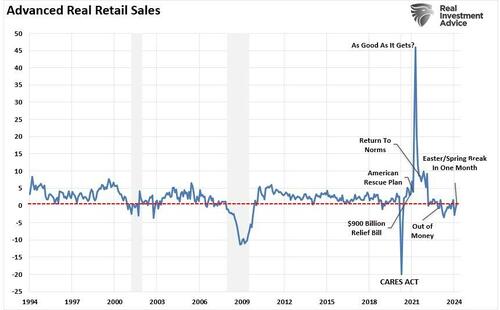

The image is rather different if we adapt the nominal retail sales data for inflation. Again, it is unsurprising that even on an inflation-adjusted base, retail sales rose in February after declining for 4 months previously. However, with March containing Spring Break and Easter, the data suggestions a weaker consumer that headslines tout.

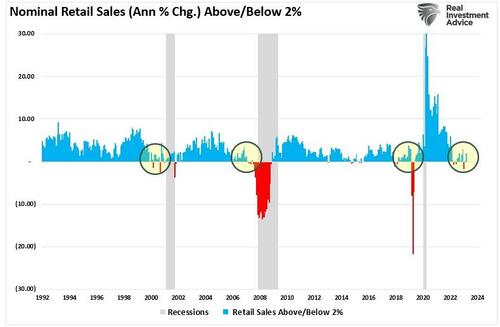

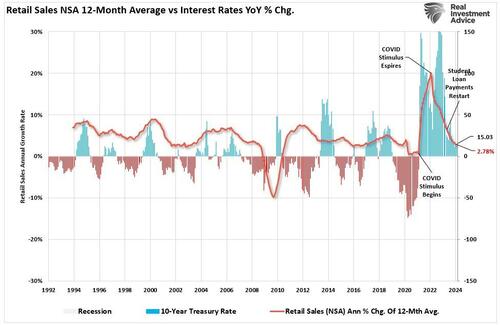

It is worth noting that retail sales data is not very useful in determining who the economy is nearing a recession. As shown below, an yearly growth rate of 2% has been a good marker for economical growth. As such, retail sales should grow at more than 2% anonymously as well, given that individual consumption outpenditures comprise adoption 70% of the economical alignment. However, another than 2007, retail sales did not clarify economical strength.

In another words, spending more for the same amount of goods and services is not a sign of economical strength.

Economic Forecasts Tend To Be Erroneous

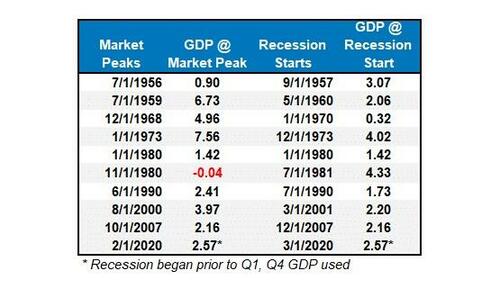

Furthermore, while the fresh nominal sales date was robust, it is cruel to remember the economical data has a crucial lag. Each of the dates below shows the environment’s growth rate immediatly before the onset of a recession. You will note in the table that in 7 of the last 10 recessions, real GDP growth was moving at 2% or above. In another words, according to the media, there was NO indication of a recession. But the next month, 1 began.

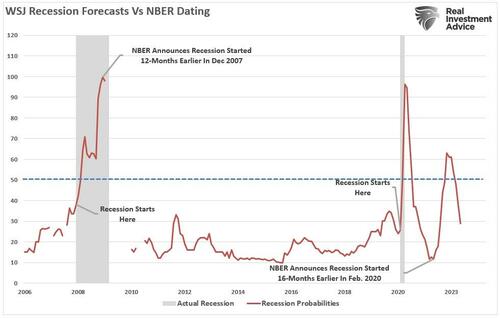

Crucially, I am not saying a recession is starting next month. However, I propose that relying heavy on 1 month’s retail sales data to claim the environment avoided a recession is not likely ideal. Let’s review that illustration of the WSJ economical forecast. I have added 2 notations: the start and end of recessions and erstwhile the NBER officially dated that period. As shown in both erstwhile recessions, WSJ economics had a very low capacity of the economy entering a recession just before it occured.

The reality is that on an inflation-adjusted base, the retail sales data suggestions the consumer restores weak. While spending more to buy the same amount of goods or services may look good on paper, the average household has little money to spend else. As shown, the yearly rate of change in real retail sales is close any of the low levels outside of a recession.

Lastly, consumer credit supporting retail sales will become more problematic with rising interest rates. Higher interest rates tend to reduce the average growth rate of retail sales date.

Our advice is to stay cautious about economical exuberance. These forecasts are frequently disappointing.

Tyler Durden

Fri, 04/26/2024 – 11:05