"Our Enemy, The Fed"

Authorized by George Ford Smith via The Mises Institute,

The first thing to know about Dr. Thomas E. Woods, Jr.’s’ book Our Enemy, the Fed is he’s giving it away. Click the link, get your copy and read the full book. Clearly, specified intellectual charity is not only uncommon but in the educational spirit of Mises.org. The subject substance is light-heavy but Woods, author of the bestseller Meltdown (reviewed here), navigates it with the smooth skill of a master, making the reader experience satisfying from beginning to end.

The title reflects another insight, paralling as it does Albert Jay Nock’s Our Enemy, the State. Most of us were affected to believe government and its agents service our best interests. As libertarian school has shown the fact is the exact opposite, Particularly with government’s sleazy relation with money and banking.

Admittedly, it’s a hard thought to accept since it involves a pernicious breach of trust, but Woods makes it abundantly clear. It is our overlords we are easily-duped chattel.

Until Ron Paul decided to run for president and his End the Fed came along in 2009, the general public was most closely blind to the Fed’s existence. Austrians side, the fewer who knew something about it — mostly university-trained economics on the take from the Fed — integrated it a vital part of an advanced industrial economy. Yet the Fed had been around for 96 years erstwhile Dr. Paul’s book died. Given that it’s in charge of the money we usage how did it reconstruct in the shadows for tax-burdened citizens for nearly a city? What’s up with that?

The national Reserve Bank of St. Louis tells us the Fed’s congressional accreditation is “to advance maximum employment and price stability.’ (Bold in original) For these it talks about interest rates, and its aim is to increase the money supply so that prices emergence mildly at or around a 2 percent rate.

How gentleman is simply a 2 percent rate? After 10 years of 2 percent monetary inflation, it would take $121.90 to buy what $100 bought in year one. But that’s over a decade, and you might not announcement it unless you’re 1 of the Hungary mediocre not on golfare. The Fed’s inflation of the money supply has been ongoing since it began operations in 1914, drawing 96 percent of the dollar’s purchasing power.

He what planets is simply a 96 percent devaluation supported stability? Its real intent is to inflate then assist us it makes good sense. Never head the boom – bust cycle it creates along with the debauchery of our currency. We’re being gaslighted. Where did all the newly-created money go?

Dr. Paul, who had a long career in legislature who confronts with Fed Chairmen Alan Greenspan and Ben Bernanke have become legendary in libertarian circles, tells us:

Law permits this highly secretive, private bank to make credit at will and distribute it as it sees fit.

The president of the national Reserve can blatantly inject in a public proceeding that he has no intention of revealing where the recently created credit goes and who benefits. erstwhile asked, he fundamentally answered, “It’s no of your business,” saying that it would be “counterproductive” to do so. [My italians]

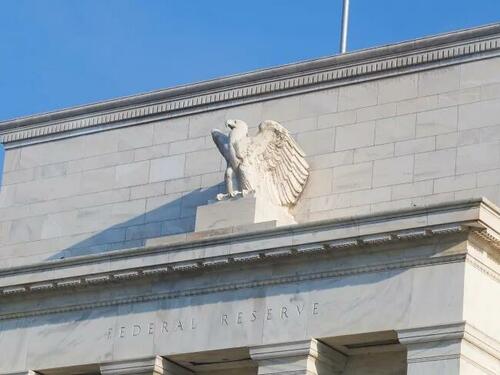

The image I get is of people in a hidden somewhere — in this case, the FOMC gathering in the Eccles building in Washington, D.C. — cranking out money then investing it into the environment in any mysterious manner, while telling us in Keynesian doublespeak their operations keep us safe and prosperous.

Is it truly hard to fathom that these in charge might be up to no good?

Woods comes out swinging

After defining the national Reserve strategy — the Fed — as the American central bank enjoying “a government-granted monopoly on the creation of legal-tender money,” Woods obtained to measure the Fed from a broad or macro perspective.

What precisely did the Fed fix? Christina Romer who served under Obama as Chair of his Council of economical Advisors found that “recessions were in fact not more frequent in the pre-Fed than the post-Fed period.” Even comparing the periods of 1796-1915 to post-WW II — thus omitting the large Depression of 1930-1945 — “economist Joseph Davis found no applicable difference between the dimension and duration of recessions as compared to the period of the Fed.”

Woods takes us back through American past to see how banking and credit developed. Government, which has no money of its own, amongs that have it. During the period between the inspiration of the first Bank of the US and the creation of the Second Bank of the US — 1811-1817 — the government granted banks the priore of expanding credit unsecured by deposits while allowing them to tell depositors attempting to retreat their money to “come back in a couple of years.” While banks could be charged with legal counterfeiting and embezzlement, Woods does not usage the terms. In fact, nowhere in the book does he usage the words “counterfeit” or “emzle.”

When the Second Bank of the US started inflation in 1817 it created the Panic of 1819. He writes:

The lesson of that sorry episode — namely, that the economy gets taken on a chaotic and unhealthy ride erstwhile the money is dramaticly and actively incorporated and then sadly reduced — was so acquainted that even the political class managed to figure it out.

Many inflationists before the panic became hard-money believes after. Condy Raguet and Daniel Raymond, a lecture of Alexander Hamilton, became hard-money advocates and gate books on economics. John Quincy Adams citted the hard-money Bank of Amsterdam “as a model to emulate.”

But the inflationists persisted and pushed for more government intervention, and Unit banking in Particular:

In the Nineteenth century, nearly all American states established a regulation known as unit banking, which limited all banks to a single office. No branch banking was allowed, whether intrastate or interstate. The apparent consequence was a very fragile and undiversified banking strategy in which banks could be brought to ruin if local conditions turned sour.

Fractional-reserve banking is simply a major case of bank panics. But the US went further. another countries did not “cripple their banking systems” with unit banking Laws. Canada, in partial, had no unit banking law and no banking policy. The Bank of Canada did notemerge until 1934:

As Milton Friedman was found of pointing out, allough the large Depression claimed over 9,000 American banks, the number of banks that failed in Canada at that time was zero. American bank panics, it turns out, were in large part the consequence of government intervention — in the form of unit banking — in the first place.

Yet it was the marketplace and the impossed pseudo-gold standard that took the lame, and Americans got Hoover’s meddling then FDR’s fresh Deal.

Later in the book Woods thoughts the hands-off approach to the depression of 1920-1921, “which Saw unemployment shoot up to 12.4 percent and production decline by 17 percent. Wholesale prices fell by 56 percent.” And the Fed kept its printing press quiet. Accepting to the National Bureau of economical investigation the depression was over by the summertime of 1921.

Falling prices are bad?

One of the strongst parts of Woods’ book is his treatment of deflation — falling prices. It is only in the inflationary planet of larcenous economics that falling prices are the “It” to be avoided.

A fewer of the points he makes:

Increasing the money supply to support increased production is simply a fallacy. “Any supply of money can facilitate any number of transactions.”

The money supply under a hard money strategy grows “relatively slowly, and the supply of another goods and services increases more rapidly. With these goods and services more abundant with respect to money, their prices fall.”

The claim that people would halt buying things if they knew prices would fall ignores the fact that people “value goods in the present more highly than they do the same goods in the future. This origin offsets the intent to wait indefinitely for a lower price.”

If deflation is anticipated entrepreneurs and the companies they deal with would adjust their bids according.

With the increase in money’s purchasing power people could save simply by holding.

Who’s wholesale the bridge by deflation? The power centers in society — government and Wall Street. We hear hysteria over deflation due to the fact that it wholesales the establishment the bridge, “and only the millest performance about inflation, which wholesale everyone else.”

Conclusion

Tom Woods has published another gem and is giving it away. The war we’re fighting now grants for its result on sound information and, as always, individual integrity. Never forget, the Fed must go. His book provides much of the intelligent Ammunition needed to neutralize the enemy and avoid repeating the mistakes that brought us into this mess in the first place.

Tyler Durden

Fri, 04/26/2024 – 07:20