Orsted Shares Crash Below IPO Price On „Unexpected” Rights Issue

Shares of Danish company Orsted A/S crashed the most on record after the wind developer announced a rights offering of up to 60 billion kroner ($9.4 billion). The offering aims to stabilize its finances, which have been hit hard by soaring costs, supply chain disruptions, and President Trump’s rollback of „green” energy projects.

Orsted shares plunged 29%, falling below their 2016 IPO price after the company announced the largest share offering in the European energy sector since Enel SpA in 2009. The capital raise is an attempt by the CEO to shore up finances as the entire green energy sector comes under severe pressure in the era of Trump and common-sense energy policies.

With wind farm construction as its core business, Orsted has been exposed to more canceled projects than any of its industry peers, including ones in the US and the UK. The funding gap swelled after scrapping a stake sale in the Sunrise Wind project off New York.

Orsted also announced the sale of its European onshore wind unit, targeting 35 billion kroner from divestments by next year, and plans to invest 145 billion kroner from 2025-27 while maintaining an investment-grade rating and resuming dividends in 2026. Full-year EBITDA guidance remains at 25 to 28 billion kroner, though offshore wind targets were cut due to weaker wind speeds.

„Orsted and our industry are in an extraordinary situation with the adverse market development in the US on top of the past years’ macroeconomic and supply chain challenges,” CEO Rasmus Errboe said in a statement.

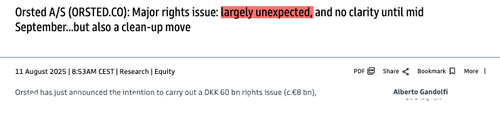

Commenting on the rights offer, Goldman analysts led by Alberto Gandolfi told clients that Orsted’s offering was „largely unexpected, with clarity expected by mid-September… but also a clean-up move.”

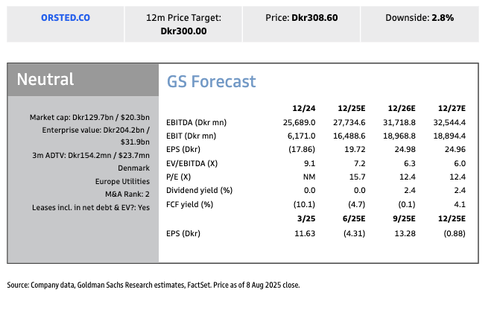

Gandolfi explained more:

Orsted has just announced the intention to carry out a DKK 60 bn rights issue (c.€8 bn), equivalent to around 45% of its market capitalisation. Although not totally unexpected to us – in our recent report (here), we flagged execution risks on disposals and FCF headwinds from rolling incentives – we believe this would come as a surprise to most of the Sell Side. Given the size, the rights issue would be highly dilutive, and hence we believe could lead to a swift drop in the share price. We also note that we have not seen the terms of the rights issue, and the terms (based on the H1 investor presentation available on Orsted website) would be disclosed in the first half of September, thus implying 3-4 weeks of market uncertainty. On the other hand, we highlight that once completed, this would most likely represent a „clean up move” as we would expect the resulting B/S (post rights issue) to be solid. As a reference, consensus YE Net Debt currently stands at DKK 75 bn on Bloomberg, and we project 2025 EBITDA at DKK c.28 bn. A restored B/S strength would put less pressure on Orsted to divest assets (current plan implies DKK 40 bn pending disposals). Lastly, we also flag that, pre raise, Bloomberg consensus P/E for 2026 is a mere 12x; the stock would therefore not be on an overly high P/E even post rights. We remain Neutral rated.

The analysts maintained a „Neutral” rating on the stock with a 300-kroner 12-month price target.

Orsted shares in Copenhagen are down 27% – the largest daily decline on record. Shares are now below the IPO level.

Here’s what other research desks are telling their clients (courtsey of Bloomberg):

Jefferies (hold)

-

Analyst Ahmed Farman says in note also published before Orsted’s confirmation any rights issue is likely „clearly negative” due to dilution concerns

-

Says „risk-reward post any such raise will depend on the medium-term growth outlook Orsted sets out,” while any raise „would enhance confidence regarding the balance sheet, reducing dependency on execution of farmdowns”

-

In note published after the company announcement that near- term dilution „seems substantial given size of the raise (much bigger than the figure reported by BBG last Friday) and seemingly no new growth angle”

Bloomberg Intelligence (no rating)

-

Analysts Patricio Alvarez and Joao Martins say issue „reflects exposure to structural policy headwinds in the US, where inability to farm down Sunrise Wind (0.9 GW) could widen its funding gap by more than 40 billion kroner, including capex overruns”

-

Add that Orsted’s planned 8.1 GW buildout in 2025-2027 now appears „well capitalized, yet execution and growth risks in its Europe portfolio are mounting”

RBC Capital Markets (sector perform)

-

Analyst Alexander Wheeler notes company is flagging headwinds in US wind farm market will stop a planned partial divestment of the Sunrise Wind project, leading to additional funding needs of DKK40 billion

-

Says that while company’s balance sheet and selling assets have been a main focus, „we think more of the focus was on assets such as Hornsea 3 and Changhua 2, with most of the rights issue being consumed by the additional requirements for Sunrise Wind, a project which is already materially squeezed on returns

. . .

Tyler Durden

Mon, 08/11/2025 – 07:20