Homebuilder Incentives Soar As US New Home Sales Disappoint In July, Prices Plunge

Amid record July cancellations, and tumbling single-family building permits, new home sales were expected to rise very modestly (+0.6% MoM) last month but instead they dropped 0.6% MoM (thanks in large part to a huge upward revision for June from +0.6% MoM to +4.1% MoM). Despite the upward revision, new home sales remain down over 8% YoY…

Source: Bloomberg

The subsidy offered by new home builders clearly separates them from existing home sale volumes but neither shows any signs of life.

The share of builders who reported using sales incentives reached a post-pandemic high of 66% this month as they seek to unload an inventory of completed homes at the highest level since 2009.

Source: Bloomberg

The government’s report showed the median sales price of a new home decreased nearly 6% in July from a year earlier to $403,800, the lowest for July since 2021. Prices have fallen on an annual basis every month this year except one.

Source: Bloomberg

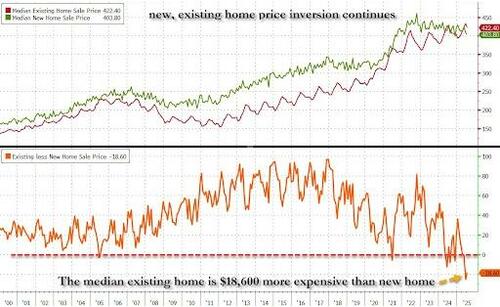

The inversion of new versus existing home prices continues to widen…

Source: Bloomberg

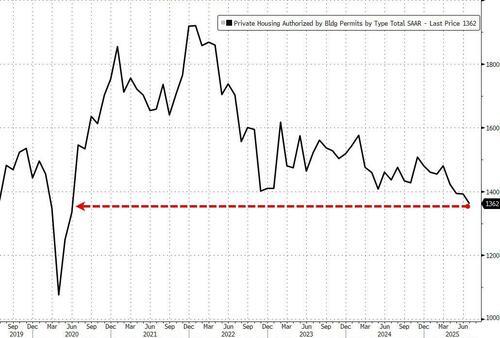

Looking ahead, things don’t seem too rosy as this morning saw revised building permits data hitting fresh post-COVID-lockdown lows…

Source: Bloomberg

Homebuilder pain is obvious in this chart as completions plunge thanks to existing home inventory holding at its highest level since 2007…

Source: Bloomberg

And for those hoping for rate-cuts to fix all this, think again…

Source: Bloomberg

Rate cuts have steepened the yield curve and pushed mortgage rates up; but as the chart above shows, the relationship between new home sales and actual mortgage rates has decoupled in recent weeks…

So be careful what you wish for.

Tyler Durden

Mon, 08/25/2025 – 10:12