Three months ago, I made the first effort to measure the consequences of the ceasefire in Ukraine for Russian economy — and I concluded by saying that we would see them more clearly next summer. Today, however, there are more and more reasons to clarify this vague and simplified forecast, especially as fresh experts are speaking about it.

It's no secret that in the beginning of the 4th year of the war in the Russian economy, serious problems arose. Despite the advanced declared rate of economical growth (3.6% in 2023 and 4.1% in 2024), the sharp increase in nominal wages, comparatively effective opposition to sanctions and more than a satisfactory budget, the economy is under force from advanced inflation, higher taxes and disproportionately advanced interest rates.

However, the problems many experts and politicians thought would be insurmountable were not.

Restrictions on energy exports, as could be expected, did not hit the Russian oil manufacture fatally. effort to limit settlements with China it did not reduce reciprocal trade in the last year. The embargo on high-tech components did not origin noticeable disorganization of the military-industrial complex. Many opponents of Putin's government had to admit that sanctions had a crucial negative impact on the Western economies themselves.

Warming relations with Washington

However, as you can see in fresh weeks, consistent militants have not lost hope: they have changed the basic paradigm and have begun to presume that if the Russian economy has not been affected by sanctions, then surely She'll be hit by a passage to the room.. This bold claim is based on the presumption that since all economical growth in fresh years has been driven by budget injections for the economy, the ceasefire will enable them to drastically reduce and thus "silence" the inactive functioning "engine" of the economy.

This hypothesis is incorrect and can only deepen the gap between reality and the predictions of those who cannot say goodbye to the illusion of the imminent collapse of Putin's regime. 1 of the most apparent signs was the fast reversal of a number of trends in Russian markets, following any signs of warming of relations between Washington and Moscow.

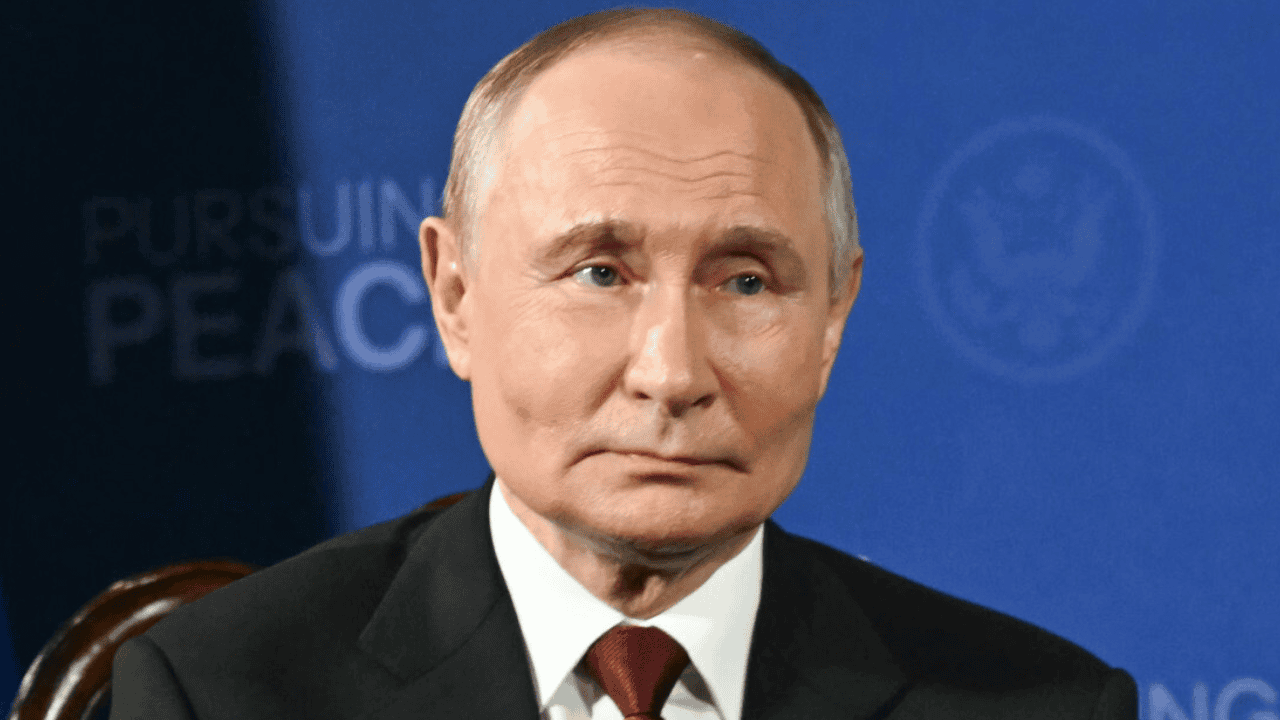

On the eve First authoritative telephone call between Donald Trump and Vladimir Putin RTS, the index on the Moscow stock exchange, closed at 992.4 points and the MosBirch index at 3018 points, are now 15.2% and 6.2% above these levels (60.1% and 34.6% respectively since mid-December).

At the same time, the ruble strengthened by 13.4 percent against the dollar and by 9.1 percent against the euro. Prices of not only Russian shares, which are delicate to possible changes in the policy of sanctions, but besides the shares of western companies operating in Russia (Raiffeisen Bank has increased on the stock exchange in Vienna by 39 percent; OTP Bank Nyrt on the Budapest stock exchange by 23 percent). Investors began actively buying ruble (the sale of currency in February exceeded January by more than a quarter) — including placing ruble assets on bank deposits. Investors are seldom incorrect — and so far it does not appear to tie the collapse of the Russian economy to the likely success of peace talks.

Effects on Russia's economy

Russian economy undoubtedly He'll usage the room. (although I think his coming this year is far from guaranteed). According to the budget for 2025, military spending should be around 13.5 trillion rubles (according to the current rate of PLN 607 billion), which is 4.2 times more than in 2021. Even if the war stops, The Kremlin will be able to reduce only the part of the budget allocated to direct support for front operations (about 2.5 trillion rubles, i.e. around PLN 112 billion) and partially to pay salaries for the military by eliminating coffin payments, allowances for participation in war activities and demobilization, although insignificant — I would estimation this savings at 1.5 trillion rubles (PLN 67 billion) from the current 3 trillion rubles (PLN 134 billion).

The military will proceed to spend between 9 and 10 trillion (about PLN 404-449 billion), mainly due to the fact that the defence order will take another six to 8 years to compensate for the failure of equipment and supplies. Defence expenditure They will not fall, but will decrease about by the amount that the national budget deficit could be this year.

It is worth remembering that there are presently indications for changing inflation dynamics and interest rates. Strengthening the ruble will consequence in an inflow of deposits to banks and limited options will reduce deposit interest. Almost 1 3rd of consumer goods sold on the Russian marketplace are imported, so their prices will at least halt growing, and this will slow inflation from April to May this year.

It should besides be taken into account that, unlike developed economies, in Russia, around 60% of all commercial loans are granted at variable interest rates and the increase in the base rate of the central bank does not reduce request for fresh loans, which makes the conditions of existing loans worse. Since November, companies have been trying to pay off their loans before the deadline and to accumulate free resources in case of improvement.

The population deposits in the banks are besides at evidence level, approaching 60 trillion (US$2.7 trillion) gross. Both of these factors propose that erstwhile interest rates fall, investment activity will increase rapidly, which must not lead to economical growth.

Alexander GIMANOV / AFP

Alexander GIMANOV / AFPWartime in Ukraine, March 11, 2025.

Injection for the Russian market

The transition to peace will besides lead to changes in the labour market: on the 1 hand, the emergency request for labour will decrease and the number of workers will increase due to both partial demobilisation and the return of others. On the another hand, it is worth assuming that the Russian marketplace will again become popular with mobile workers due to the strengthening of ruble and decreasing hazard mobilization. Increased labour supply must not contribute to economical growth.

Furthermore, it is almost certain that after the end of the war, the crowded request for many goods and services will be revealed, and any sectors of the economy will have the chance to reconstruct average abroad economical relations, specified as imports of spare parts to western passenger aircraft.

Finally, more and more evidence has late emerged of the trend of returning abroad companies to Russia, which at first seemed questionable to me — if, after the first signs of the end of the war, this process gets worse, its importance will be hard to overestimate.

The Russian economy is presently tight and cannot operate with full efficiency due to the extraordinary nature of the situation. The budgetary injections for the military sector were very crucial and besides supported the economy as a full — but the deregulation allowed by the authorities — from parallel imports to self-employment liberalisation — supported it equally.

Most likely, during the transitional period, the authorities will not be able to immediately start tightening the screws again, as the task of maintaining growth and expanding budgetary revenues will undoubtedly stay a priority. Therefore, if the hot phase of the war ends before the summer, by the end of 2025 the Russian economy will not fall into crisis, but most likely show an increase at least at the level of last year.

The Economics of Death

All of this raises very serious questions for me about the reasons for reversing expert assessments in favour of the condition of "post-war disaster". Yes, it is not an exaggeration to say that much of the growth in 2023 and 2024 is provided by the military sector — but does it appear that recovery in another sectors is impossible after the end of the war? Of course, payments to the military — which I describe as a strategy of "death economics" — increase the effective request of the population, but does it appear that "the suppression of the military engine of the Russian economy will origin a crisis in Russia that has not been seen since the 1980s"?

It is worth remembering that the military sector in USSR responsible for at least 16 % of GDP compared to the current 8% — and the then planned state economy could not respond rapidly to changing conditions, unlike today's private and marketplace economy. Yes, you can call the Russian economy a "card house", but it is amazing that investors justice the outlook of the planet highly positive, while experts shed falls of tears. The only reason for this, I believe, is the increasing bias of experts investigating Russia, frequently motivated by ideological or ethical considerations, alternatively than the search for truth.

To conclude, I would like to stress that I am skeptical about the possible of a fast solution to Russia's confrontation with Ukraine. The positions of the parties are besides diverging, and the deficiency of comprehensibility and incompetence of the main “interviewer” besides apparent to anticipate a breakthrough. Therefore, it seems more likely to me that the war will proceed — and hence, the progressive degradation of the Russian economy, for which the transition to peace may be an unexpected chance of salvation.

On 10 March, writer Sławomir Sierakowski and world-famous historian Timothy Snyder announced the organization of a rally for military ambulances for the Russian-fighting Ukraine. “When others halt helping, we renew it!” Sierakowski said.