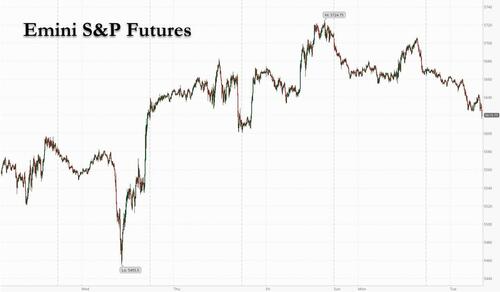

Futures Slide On Latest Batch Of Disappointing Earnings

US equity futures slumped for the second day, dragged down by earnings and a lack of positive news on trade negotiations. As of 8:00am, S&P 500 futures dropped 0.9% as risk is pared into tomorrow’s Fed announcement and the index failed to breach through technical resistance; Ford slumped after suspending its guidance and warned tariffs will reduce 2025 adjusted EBIT by about $1.5 billion; Nasdaq futures 100 dropped 1.1%, with all Mag7 stocks lower as Tesla and Meta led declines. Palantir tumbled 8% after the software firm’s results failed to meet investors’ expectations, while Ford slipped 3% after the carmaker pulled its financial guidance and flagged a tariff impact of about $2.5 billion on 2025 earnings. German stocks tumbled Estoxx 50 after incoming German chancellor Friedrich Merz suffered a shock setback when he fell short of a majority in an initial vote in the lower house of parliament to confirm him as Germany’s next chancellor. The yield curve is twisting steeper as USD comes for sale. Commodities are higher with WTI crude oil futures rebounding more than 2% from Monday’s YTD low close and gold is marching back to its ATHs. Trade Balance data is the macro data focus.

In premarket trading, Ford slips 2% as the automaker suspended its full-year financial guidance and said President Trump’s tariffs will take a toll on profit, joining rivals stung by volatile global trade policies. Palantir Technologies dropped 7% after the data-analysis software company posted financial results failed to meet investors’ expectations. Magnificent Seven stocks were all in the red: Tesla slips 1.6% as sales kept sliding across Europe’s biggest electric-car markets in April, despite the company rolling out an updated version of its most popular vehicle (Amazon -0.9%, Nvidia -1.4%, Meta -1.2%, Microsoft -0.7%, Apple -0.4%, Alphabet -0.8%). Here are the other notable premarket movers:

- Celsius Holdings (CELH) falls about 4% after the energy-drink maker reported first-quarter revenue and adjusted EPS that trailed Wall Street expectations.

- Constellation Energy (CEG) drops 6% after the power producer reported adjusted profit and Ebitda for the first quarter that fell short of expectations.

- Datadog (DDOG) climbs 2% as the software company forecast revenue for the second quarter, guidance that beat the average analyst estimate.

- DoorDash (DASH) falls 3% as the company is buying SevenRooms for $1.2 billion and Deliveroo for $3.9 billion, expanding its global reach and services.

- Fabrinet (FN) drops 6% as the maker of optical communications products posted a sequential decline in datacom revenue.

- Hims & Hers Health (HIMS) slumps 6% after the telehealth company gave guidance for second-quarter revenue that fell short of expectations. The firm also maintained its full-year sales outlook and Piper Sandler sees a lack of upside in the guidance.

- Ichor (ICHR) drops 15% after the maker of fluid delivery subsystems for semiconductor capital equipment posted disappointing gross margins.

- SolarEdge (SEDG) rises 13% after the solar equipment maker forecast revenue for the 2Q that beat the average analyst estimate.

- Vertex Pharmaceuticals (VRTX) falls 5% after the company reported adjusted earnings per share for the first quarter that missed expectations.

- WeRide Inc.’s US-listed shares (WRD) rise 12% after news that Uber Technologies is expanding its autonomous-vehicle partnership with the China-based firm to 15 more cities globally, including in Europe.

In Europe, the Stoxx 600 benchmark snapped a 10-day run of gains to drop 0.6%, its losses accelerating after incoming German chancellor Friedrich Merz failed suffered a shock setback when he fell short of a majority in a parliamentary vote to confirm him as Germany’s next chancellor, preventing his swearing in on Tuesday and pitching Europe’s biggest economy into uncharted territory. While the conservative leader is still expected to take charge of a ruling coalition of his CDU/CSU bloc and the Social Democrats, it was the first time since World War II that an incoming chancellor failed to secure backing from lawmakers in the first round of voting in the Bundestag and triggered chaos in Berlin’s government quarter. Meanwhile, European companies such as Royal Philips NV and Vestas Wind Systems A/S warned of uncertainty fueled by President Donald Trump’s trade tariffs; mining and industrial goods shares leading declines, while food beverage and energy stocks are the biggest outperformers. Here are the biggest movers Tuesday:

- Fresenius Medical Care shares gain as much as 6%, to the highest since July 2023, after the kidney dialysis company reported results for the first quarter which some analysts said were better than expected

- Vestas shares gain as much as 8.3% on Tuesday after it reported a first quarter orders beat and maintained guidance amid tariff uncertainty, which analysts welcomed

- ALK-Abello shares advance as much as 5.7%, to the highest since Nov. 14, after the Danish allergy drugmaker reported better-than-expected revenue for the first quarter

- Continental shares rise as much as 4.7% after the German firm more than doubled earnings in the first quarter as its car-parts unit slashed costs and tire sales bounced back from weaker levels last year

- Hugo Boss’s shares rise as much as 10% after the suit maker’s earnings beat estimates, which analysts said was a relief, especially against a tough backdrop

- Redcare Pharmacy shares fall as much as 9% after first-quarter results from the German online pharmacy provided little in the way of fresh catalysts to sustain a four-day winning streak

- Castellum shares slumped as much as 8.6%, the worst performing stock on the Stoxx 600 Real Estate Index, after the Swedish landlord reported 1Q revenue that missed the average analyst estimate

- Coloplast shares fall as much as 6.2%, to the lowest since February 2019, after the medical-products maker said CEO Kristian Villumsen stepped down from his role on May 5, with Lars Rasmussen becoming interim CEO

- Elis drops as much as 5% despite maintaining its full-year guidance, with analysts expecting little change to current consensus. The French cleaning services group said tariffs aren’t expected to have any direct impact

- Philips shares slip as much as 4% in early trading after the Dutch medical-technology firm cut its profitability outlook for the year, to take into account the estimated impact of tariffs

- TeamViewer shares slide as much as 10% after reporting results that included various accounting adjustments as well as new acquisition 1E

- Evotec shares fall as much as 9.6% as analysts point out the pharmaceutical firm’s results contained a miss in the research and development division and an increase in net debt

The slide in futures suggest that a recent burst of optimism fueled by some US trade concessions may already be fading. On Monday, the S&P 500 halted a nine-day rally that was its longest in about 20 years. While Ford’s warning served as a reminder that damage from the tariff war will become evident over the coming months, a run of firm economic data in recent days has caused traders to dial back bets on Federal Reserve interest-rate cuts.

“For us, it’s not the moment to add on risk,” said Nicolas Sopel, a strategist at Quintet Private Bank. “Even if there are successful negotiations between the US and China, tariffs will most likely be a lot higher than they were before Trump came into power. We will need time to see how deeply these increases impact the US economy,” according to Sopel, who has reduced US equity exposure.

Meanwhile, investors are coming around to the view that the Fed won’t cut interest rates as early or as deeply as earlier anticipated. While it’s expected to leave interest rates on hold this week, money markets have pushed back the timing of the first reduction to July and see three cuts by year-end, rather than the four they had expected a week ago.

“Recent comments from Fed Chair Powell suggest that the Fed will remain in wait-and-see mode over the near term,” Michael Krautzberger, AllianzGI’s chief investment office for fixed income, told clients. He also sees headwinds to the US dollar, and maintains “a short dollar footprint” in portfolios, he added.

Financial leaders at the Milken Institute Global Conference in Beverly Hills said they can live with tariffs and a reworking of trade, but want progress and an end to the chaos soon.

Meanwhile, the Bank of England is set to cut rates this week and may even pave the way for a series of back-to-back reductions in response to the trade war. The European Central Bank will also cut rates further, Governing Council member Yannis Stournaras, said.

Earlier in the session, Asian stocks advanced, as mainland Chinese shares rose on resilient holiday spending data and signs of easing trade tensions with the US. The MSCI Asia Pacific Ex-Japan Index gained as much as 0.7% before paring earlier gains. Communication services and consumer discretionary were among the best performing sectors.

Chinese stocks outperformed in the region, as investors’ mood was lifted by strong retail sales and robust airline traffic results during the Labor Day holiday in early May. Traders also dialed up bets on easing tensions after Treasury Secretary Scott Bessent said the US could see “substantial progress in the coming weeks” in trade talks with China. The benchmark CSI 300 Index gained 1% on Tuesday. Hong Kong’s Hang Seng Index rose 0.7

In FX, the Bloomberg’s dollar index steadied after two days of losses, as the news on Merz weighed on the euro. However, the greenback is down nearly 7% this year and data shows traders have been adding to bearish bets. The fallout is being felt worldwide, with wild swings in recent days across Asian currencies, while Hong Kong has ramped up sales of its local currency to protect its foreign-exchange peg. China’s central bank kept the yuan’s daily reference rate little changed at 7.2008 per dollar as local markets reopened on Tuesday; the Taiwan dollar fell after gaining for six straight sessions

In rates, treasuries are mixed, with outperformance at the shorter-end of the curve. US 10-year yields rise 2 bps to 4.36% while two-year yields fall 1 bp; the front-end outperformance has 2s10s spread about 2bp wider on the day, off session highs reached during London morning. Bunds and gilts lag by 1bp and 2.5bp in the sector. The Treasury auction cycle continues with $42 billion 10-year new issue, following good demand for Monday’s 3-year note sale; WI 10-year yield near 4.355% is ~8bp richer than last month’s, which stopped through by 3bp; a $25b 30-year new issue Thursday will complete the cycle

In commodities, oil prices jump, with WTI rising 2.9% to $58.80 a barrel. Spot gold rises $40 to around $3,375/oz. Bitcoin is flat just above $94,000.

Looking at the US calendar, data releases will include US March trade balance data, the final April services and composite PMIs in the Eurozone, as well as March Eurozone PPI and France industrial production. The ECB’s Panetta is due to speak, while earnings releases include AMD, Arista Networks, Ferrari, Constellation Energy and Rivian.

Market Snapshot

- S&P 500 mini -0.8%

- Nasdaq 100 mini -1.1%

- Russell 2000 mini -1.1%

- Stoxx Europe 600 -0.9%

- DAX -2%

- CAC 40 -0.8%

- 10-year Treasury yield +1 basis point at 4.35%

- VIX +1 points at 24.67

- Bloomberg Dollar Index little changed at 1220.76

- euro +0.2% at $1.1337

- WTI crude +1.9% at $58.19/barrel

Top Overnight News

- Friedrich Merz fell short of a majority in an initial vote in parliament to confirm him as Germany’s next chancellor, delaying his swearing-in for at least one day and prompting the anti-immigrant AfD to call for new elections. German bunds pared a decline. BBG

- President Donald Trump on Monday signed an executive order to incentivize prescription drug manufacturing in the U.S., streamlining the path for pharmaceutical companies to build new production sites stateside as potential tariffs on imported medicines loom. CNBC

- The Trump administration blocked Harvard from new research grants from the federal government. Access to the funding, worth over $1 billion a year, won’t be possible until the university shows “responsible management,” Education Secretary Linda McMahon said. BBG

- US House Speaker Johnson said House Republicans remained on pace to pass the Trump agenda by Memorial Day or shortly thereafter and stated the Trump agenda is not facing a setback in the US House.

- US Defense Secretary Hegseth ordered a reduction in 4-star positions in the military, according to a US official.

- China’s Caixin services PMI came in a bit below expectations at 50.7 (vs. the Street 51.8) and per capita consumer spending over the May Day holiday was muted. RTRS

- Chinese manufacturers are attempting to avoid the Trump administrations tariffs by fraudulently undervaluing cargo sent to the US, exploiting a system the American authorities have struggled to police. FT

- Taiwanese central bank says 80% of FX reserves are US bonds. Taiwan Central Bank FX official says they feel the market has returned to a more stable situation today.

- Hong Kong’s de-facto central bank said it sold HK$46.54 billion ($6 billion) into the market on Saturday to prevent the local currency from strengthening beyond its official peg to the U.S. dollar, the first such intervention in more than four years. RTRS

- HKMA says has been lowering its duration in US treasury holdings; exchange fund has been diversifying into non-US assets Has been diversifying currency exposure in its investment portfolio to manage risks.

- The PBOC set the daily yuan reference rate only marginally stronger than on Thursday, sidestepping the offshore yuan’s sizable appreciation during the long weekend. That effectively forces the offshore currency to give up recent gains, MLIV wrote. BBG

- Spain’s blackout resulted in a €400 million loss to the economy. BBG

- The US trade deficit probably widened in March as firms boosted imports again to front-load products ahead of tariffs. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher as Chinese participants returned from the Labor Day holiday but with the gains capped following disappointing Chinese Caixin Services PMI data and as markets in Japan and South Korea remained closed. ASX 200 traded little changed as strength in the commodity-related sectors were predominantly offset by underperformance in financials and defensives, while the larger-than-expected contraction in building approvals clouded over risk appetite. Hang Seng and Shanghai Comp gained on return from the extended weekend and took their opportunity to react to the recent China tariff rhetoric from US President Trump who said that he is willing to lower tariffs on China at some point, while the miss on Caixin Services PMI data did little to derail the positive sentiment in China.

Top Asian News

- Chinese President Xi is prepared to work with EU leaders to expand mutual openness and properly handle frictions and differences, according to Xinhua Calls on the EU and China to safeguard fairness and justice.

- China said 314mln domestic trips were made during the May holiday which was up 6.4% Y/Y and travel expenditure of domestic tourists rose 8% Y/Y to 180.3bln, according to CCTV.

- US House intensified its legislative push against Beijing on Monday in which it advanced a slate of China-related bills targeting industrial espionage, export controls, national security threats and alleged human rights abuses.

- Fast fashion platforms Shein and Temu boosted digital advertising in Europe with the most growth seen in France and the UK, while they see increased app downloads in France and the UK as US tariffs hit and Shein also boosted advertising in Brazil where it manufactures goods for Latin America.

- HKMA intervened in which it bought USD 7.8bln against the HKD at 7.7500 after the HKD hit the strong end of the trading range.

European bourses (STOXX 600 -0.6%) opened mostly firmer/flat and traded tentatively on either side of the unchanged mark. Thereafter, the risk tone soon slipped after the HKMA said it says has been lowering its duration in US treasury holdings and as Germany’s Merz failed to secure enough votes to become Chancellor; DAX 40 -1.8%. The HKMA update sparked some modest pressure in US equity futures (ES -0.9%, NQ -1%); ahead of a handful of earnings and meetings between the US and Canadian Presidents. As for sectors, its a mixed picture in Europe. Food Beverage & Tobacco takes the top spot, joined closely by Utilities. To the downside, Basic Resources sits right at the foot of the pile – losses largely driven by Anglo American after Peabody said it may terminate its deal for its coal mine assets. For the Pharma industry; US President Trump said he will announce pharmaceutical tariffs over the next two weeks, while he signed an order to reduce regulatory barriers to domestic pharmaceutical manufacturing and will have an announcement next week related to the cost of medicines.

Top European News

- Germany’s CDU leader Merz falls short of a majority needed to become Chancellor in first round of voting in parliament; secured 310 Bundestag votes, 316/630 required. On the second round of voting for German Chancellor Merz, Handelsblatt citing sources reports „The second round of voting could be postponed until Friday because the approval of the AfD is necessary for an immediate ballot”. There will not be a second vote on Merz becoming German Chancellor today, via Handelsblatt citing numerous reports and the CDU Secretary General.

- EU is set to make it easier for UK professionals to work in the bloc, according to FT.

- SNB Chairman Schlegel says is committed to its price stability mandate; biggest challenge at present is uncertainty. Ready to intervene in the FX market as necessary. Swiss inflation is expected to come down. Not ruled out negative rates. Nobody likes negative rates but if have to, are prepared to do it again.

FX

- After an attempted recovery last week, the USD has continued to ebb lower after DXY failed to sustain a move above the 100 mark, despite a solid showing for US ISM services. HKMA said it has been lowering its duration in US treasury holdings and has been diversifying into non-US assets. DXY is currently towards the lower end of Monday’s 99.46-100.05 range.

- EUR is firmer vs. the broadly weaker USD as Eurozone-specific newsflow remains on the light side. ECB-dove Stournaras noted he does not see inflation if the EU tariff reaction is selective and it seems the ECB will continue with rate cuts. EUR/USD has gained a firmer footing on a 1.13 handle but is yet to approach Monday’s high at 1.1364 with some of the upward momentum for the currency stalled in recent trade after Germany’s CDU leader Merz fell short of a majority needed to become Chancellor in the first round of voting in parliament.

- USD/JPY traded indecisively overnight and failed to sustain a brief return to the 144.00 level with price action largely driven by the dollar amid the continued absence of Japanese participants. In European trade, downside was seen for the pair as global equity futures ebbed lower. USD/JPY has delved as low as 142.91 with the next target coming via the 1st May low at 142.88.

- GBP is mildly firmer vs. the USD as UK participants return to market. UK newsflow remains light with markets looking ahead to Thursday’s BoE policy announcement. Cable has ventured as high as 1.3333 but is yet to test yesterday’s 1.3336 peak.

- Diverging fortunes for the antipodeans with AUD towards the bottom-end of the G10 leaderboard. Overnight trade saw a larger-than-expected contraction in Australian building approvals and a disappointing Chinese services PMI. However, the cause for underperformance vs. NZD is otherwise unclear.

- PBoC set USD/CNY mid-point at 7.2008 vs exp. 7.2518 (Prev. 7.2014).

Fixed Income

- USTs are holding around the unchanged mark in a 110-27+ to 111-03 band. Came under modest pressure overnight on the return of China and generally supportive tone, despite weak Chinese PMI; though, once again, Japan was on holiday and as such conditions were thinner than normal with no cash trade. Into the European morning, USTs began to pick up alongside fixed income generally amidst commentary from the HKMA that they are diversifying into non-US assets. The update had more of an impact on US equity futures and the DXY than it did on Treasuries. Ahead, supply is the main scheduled event stateside in the form of a 10yr tap. Follows Monday’s 3yr sale which was much better than the prior.

- Bunds were initially under pressure in-fitting with the bias from USTs overnight. Thereafter, the benchmark began to lift off lows and was largely unaffected by modest upward revisions to Final PMIs for April. More recently, Bunds jumped by almost 30 ticks to breach the 131.00 mark as Germany’s CDU/CSU leader Merz fell just six votes short of a Bundestag majority in the vote to appoint him as Chancellor. Upside in Bunds comes as Merz not securing a majority presents risks to his Chancellorship, the CDU/CSU-SPD coalition and possibly the implementation of recent fiscal reform. The upside has now almost entirely been pared, from 131.08 to current 130.88, potentially as traders await clarity on the timing of the next vote; as it stands, it looks unlikely to occur today, but could be as soon as Wednesday.

- Gilts are the clear underperformer in catch-up play from Monday’s UK Bank Holiday. Gapped lower by 29 ticks at 92.88, the session high, before slipping to a 92.32 base in short order. Currently holding just off that low but in close proximity to it. PMIs for April were subject to modest upward revisions, but in-fitting with EGBs spurred no real reaction in the benchmark.

- Germany sells EUR 3.48bln vs exp. EUR 4.5bln 2.40% 2030 Bobl: b/c 1.2x (prev. 1.40x), average yield 2.07% (prev. 2.06%) & retention 22.67% (prev. 21.1%).

Commodities

- Firm gains across the crude complex, with prices rebounding from the earlier OPEC-induced downside, with most of Asia also returning to the market from the long weekend. The upside could be at least partially attributed to the geopolitical developments yesterday, in which Israel expanded its Gaza operation and suggested that it plans to occupy the territory, marking a major escalation from its initial plans of destroying Hamas and its capabilities. WTI resides in a USD 57.03-58.52/bbl range while Brent sits in a USD 60.18-61.64/bbl parameter.

- Precious metals are higher across the board amid a softer Dollar, the return of APAC players, ongoing tariff woes, and escalating geopolitics. Spot gold has almost reversed the losses seen during the final week of April with the yellow metal current in a USD 3,322.75-3,387.02/oz parameter as it eyes USD 3,400/oz to the upside.

- The base metals complex ekes mild gains with the aid of a softer Dollar and alongside the return of some demand as most APAC markets returned from their long weekend. 3M LME copper has waned off best levels but resides around the middle of a USD 9,366.50-9,487.53/t intraday band.

- European Commission is to make a legal proposal to ban Russian gas and LNG imports by end-2027 and ban new Russian gas deals and existing spot contracts by end-2025; plans will be announced on Tuesday, legal proposals due in June, via an EU official.

- EU Commission will present a legal proposal in June to ban all imports under Russian gas deals and existing spot contracts by end-2025, via Reuters citing a Commission document In June, will present trade measures aimed at making imports of Russian enriched Uranium economically less viable.

Geopolitics: Middle East

- Palestinian media reported that the Israeli army blew up residential buildings east of Gaza City.

- „Israeli army: Our forces are deployed in southern Syria and are in a state of readiness to prevent the entry of any hostile forces into the area or to Druze villages”, according to Sky News Arabia.

- „Hamas: The Israeli occupation’s approval of plans to expand its operation in the Gaza Strip is an explicit decision to sacrifice Israeli prisoners”, according to Al Jazeera.

- Israeli National Unity chairman Benny Gantz says „We must be ready and have the ability to attack Iran’s nuclear facilities”, via Sky News Arabia

Geopolitics: Ukraine

- Ukraine attack damaged a power substation in Russia’s Kursk region, according to the regional governor.

- Russian defence units destroyed five Ukrainian drones flying towards Moscow and Russia’s aviation watchdog announced flights were halted at Moscow’s major airports following reports of drones, but later announced that airports reopened.

US Event Calendar

- 8:30 am: Mar Trade Balance $140.5b, est. -137.15b, prior -122.66b

DB’s Jim Reid concludes the overnight wrap

As those of us in the UK were enjoying a wet, cold and windy bank holiday yesterday, just 4 days after record temperatures, the strong market recovery of the past two weeks ran out of steam, with the S&P 500 (-0.64%) declining for the first time in ten sessions, while 30yr Treasury yields (+4.5bps) rose for a fourth session running. These moves came amid a more cautious tone on the trade risks that Peter Sidorov had mentioned here yesterday, while still solid US economic data saw investors pare back expectations of near-term Fed cuts ahead of Wednesday’s FOMC meeting.

A sense that the tariff relief trade was losing momentum came amid little concrete progress on trade talks as well as Trump’s post late on Sunday calling for 100% tariffs on movies produced outside the US. While there are no details yet on how the latter plan would be implemented, it marked the administration’s first foray into tariffs on services. Later on Monday, Trump also said that pharma tariffs would be announced over the next two weeks.

This backdrop saw the S&P 500 (-0.64%) end its longest winning run since 2004 that had seen the index rise by +10.25% over the previous nine sessions to end last week above its pre-Liberation Day levels. Underperformance by tech stocks saw the Mag-7 decline by -0.99%, while Netflix fell -1.94% after Trump’s movie tariff comments. After the close, the latest earnings releases saw Ford suspend its full-year financial guidance as it warned that auto tariffs will weigh on profits. And Palantir, which has been strongest advancer in the S&P 500 so far this year, saw its shares fell more than -9% in after-market trading as the software platform maker’s projected revenue growth fell shy of very lofty expectations. S&P 500 (-0.25%) and NASDAQ 100 (-0.45%) futures are edging lower as I type.

Yesterday’s reversal in equities came despite a decent ISM services release for April that pointed to a still resilient US economy and followed a solid payrolls print last Friday. The headline index unexpectedly rose from 50.8 to 51.6 (vs. 50.2 expected), with new orders rising to a 4-month high of 52.3. The ISM survey also pointed to elevated price pressures, with the prices paid index rising to 65.1, its highest level since January 2023.

The stronger data saw markets pare back their expectations of near-term Fed rate cuts. Notably, only 23bps of cuts are now priced by the July meeting, which is the first time since late February that the next cut is less than fully priced by July. The amount of cuts priced by year-end fell by -4.0bps to 76bps. Treasury yields moved higher, especially at the long end, with the 10yr up +3.5bps to 4.345% and the 30yr up +4.6bps to 4.835%. An +18.2bps rise in 10yr yields over the past three sessions may place some extra attention on today’s 10yr auction. There has been no trading overnight due to a Japanese holiday.

Those moves come ahead of tomorrow’s Fed decision, where our US economists expect the FOMC to keep rates steady and avoid explicit forward guidance about the policy path ahead. They continue to see the next rate cut coming in December and while risks are tilted towards earlier easing, in their view this would require a clear weakening of the labour market. See our economists’ full preview here. Central banks will also be in focus in Europe this week, with policy decisions from the UK, Norway and Sweden all due on Thursday. Our UK economist expects the BoE to deliver a 25bp cut (see preview here), while Norges and Riksbank are expected to keep rates on hold.

In Europe, while the UK was off for the May bank holiday, it was a more positive session, with the STOXX 600 (+0.16%) posting a tenth consecutive advance, the longest such run since 2021. The DAX (+1.12%) outperformed, moving to within half a percent of its all-time closing high on March 6. Italy’s FTSEMIB (+0.39%) and Spain’s IBEX (+0.55%) also gained but France’s CAC fell back (-0.55%).

European bonds saw muted moves, with the yields on 10yr bunds (-1.6bps), OATs (-1.3bps) and BTPs (-3.4bps) all seeing modest declines. The ECB’s Stournaras said “it seems we will continue” with rate cuts, but that amid the high uncertainty “you don’t take big steps or make big promises”.

In the commodity space, oil prices fell to their lowest level in four years following the OPEC+ agreement over the weekend to deliver another sizeable production increase in June which added to concerns of an oversupplied market. Brent crude fell by -1.73% to $60.23/bbl, its sixth consecutive daily decline of more than 1%, though it partially recovered after opening as low as $58.50/bbl in Asia yesterday. Meanwhile, gold rebounded by +2.89% on Monday to $3,334/oz, erasing last week’s -2.39% decline.

Asian equity markets are gaining this morning in thin trading with markets in Japan and South Korea remaining shut for public holidays. Chinese markets are ticking higher after resuming trading following the Labour-day holidays on signs of renewed momentum in trade negotiations between the world’s two largest economies. As I type, the CSI (+0.95%), Shanghai Composite (+0.94%), and the Hang Seng (+0.69%) are leading the way while the S&P/ASX 200 (+0.11%) is lagging a touch.

In FX, the Taiwanese dollar is retreating a touch this morning following an epic two-day rally that saw it at a near three-year high of 29.606 on Monday. The currency’s appreciation was influenced, in part, by speculation surrounding a possible US trade deal that could necessitate Taiwan strengthening its currency. However, both Taiwan’s central bank and the Cabinet’s Office of Trade Negotiations have denied that the US has requested currency appreciation or that the issue is even part of trade talks.

Coming back to China, services sector growth slowed significantly in April, reaching a seven-month low. The Caixin services PMI dropped to 50.7 from 51.9 in March, and 51.8 expected, reflecting weaker new orders and uncertainty stemming from US tariffs.

To the day ahead, data releases will include US March trade balance data, the final April services and composite PMIs in the Eurozone, as well as March Eurozone PPI and France industrial production. The ECB’s Panetta is due to speak, while earnings releases include AMD, Arista Networks, Ferrari, Constellation Energy and Rivian.

Tyler Durden

Tue, 05/06/2025 – 08:31