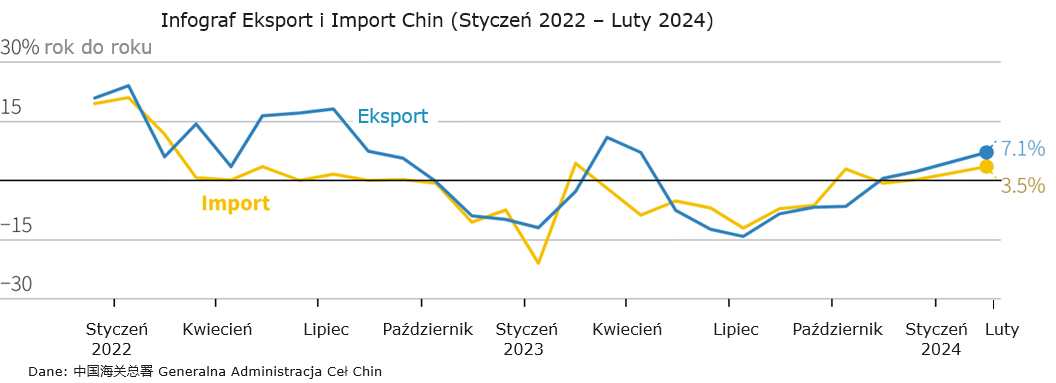

Foreign trade

The full value of China's trade in goods in the first 2 months of 2024 increased in dollar terms by 5.5% y/y, with

- exports increased by 7.1% y/y

- imports increased by 3.5% y/y.

The trade surplus amounted to USD 125.16 billion (about PLN 492.17 billion), which means that it is 20.5% higher than the same period last year. These affirmative results amazed many analysts.

During the period January-February there was besides an increase in trade with the countries of Southeast Asia (the first Chinese trading partner) by 8.1% y/y:

- Chinese exports increased by 9.2% y/y,

- imports by 6.6% y/y

Trade turnover with the European Union (the second trading partner of the PRC) decreased by 1.3% y/y, which is interesting and worth noting:

- exports increased by 1.6% y/y,

- import decreased by 6.8% y/y.

It is worth noting that trade between China and the United States (third trading partner) increased by 3.7% y/y:

- exports by 5.0% y/y(compared to a fall of 6.9% y/y in December)

- import decreased by 7.0% y/y.

China's first 3 trading partners account for 39% of full abroad turnover.

Trade flows between China and Russia keep their advanced growth rate. In the first 2 months of that year, they reached the value of USD 37.01 billion (about PLN 146.21 billion), an increase of 9.3% y/y.

Chinese exports to Russia amounted to US$16.81 billion (about PLN64.03 billion), an increase of 12.5% y/y, and Chinese imports from Russia to China reached US$20.20 billion during this period (about PLN79.81 billion) – growth by 6.7% y/y

For comparison, last year trade between China and Russia reached a evidence value of USD 240.11 billion (about PLN 948.57 billion), which resulted in an increase in the value of trade by 26.3% y/y.

During the first 2 months of this year, Chinese private companies were liable for 54.6% of the full abroad trade value of China.

59.1% of all exports were electromechanical products. Leaders are here:

- machines and equipment of various applications,

- Eclectic cars,

- batteries,

- solar panels and components for them.

In the period January-February this year. China increased imports of natural materials specified as iron ore, oil, coal and natural gas. Soy import volume dropped.

Source:

- thepaper.cn

- wallstreetcn.com

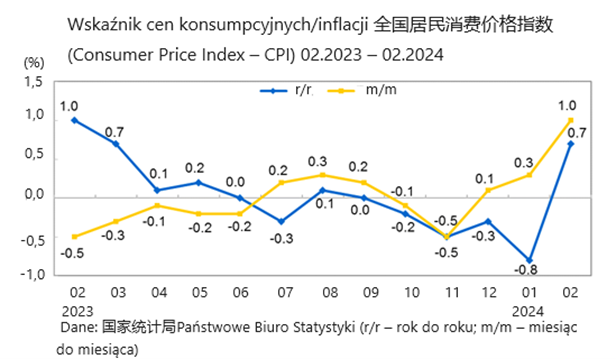

Inflation

CPI

In February, the CPI rate increased by 0.7% y/y, compared to a decrease by 0.8% in the erstwhile month.

After 4 months of deflation, it is simply a good sign, although it does not make deflationary force cease to exist.

While food prices in February fell by 0.9% y/y, non-food prices increased importantly (e.g. air tickets by 20.8% y/y and transport by 17.4% y/y).

Source: stats.gov.cn

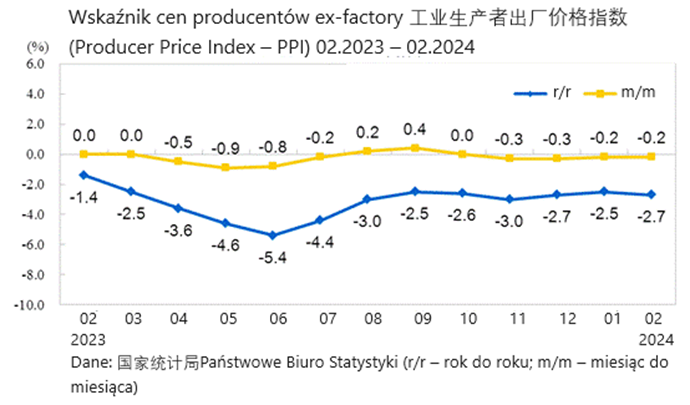

PPI

It is hard to compose something upbuilding about this indicator. In February this year, it was again negative: -2.7% y/y. This is simply a fall of 0.2% compared to January, while at the same time the 17th period of "under" in a row. A clear signal of persistent deflationary force among producers suggesting low consumption demand.

Such a long fall in mill prices poses a serious challenge for policymakers, while weakening the economical position of businesses.

Source: stats.gov.cn

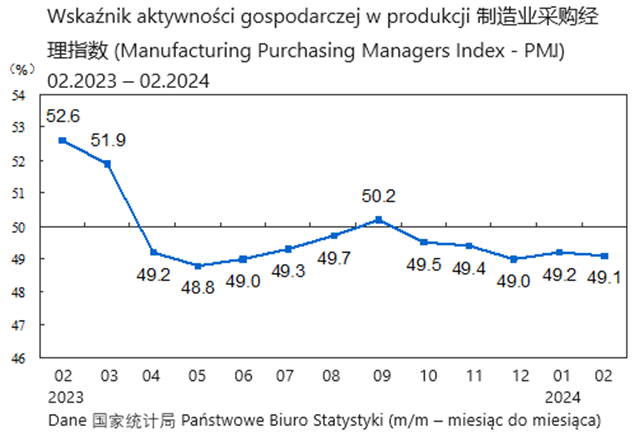

PMI

According to the State Statistical Office (chin. 国家统计局) data, in February 2024 the PMI rate for production of economical activity was 49.1 points, which means a decrease of 0.1 points compared to the erstwhile month.

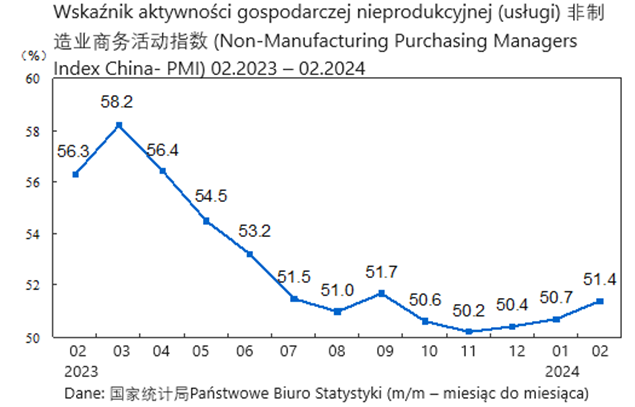

However, the PMI for business activity in the non-production/service sector in February this year amounted to 51.4 points, which is an increase of 0.7 points compared to the erstwhile month. This means that the pace of expansion of the non-production sector has been accelerating for 4 months.

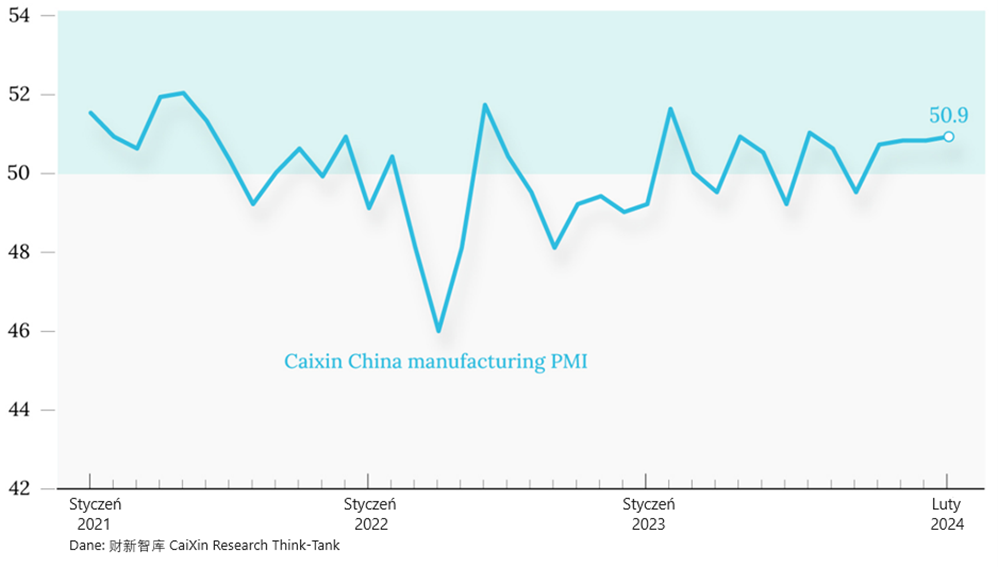

Unlike the main PMI indicator for manufacture developed by the State Statistical Office, this 1 developed by think-tank CaiXin investigation (chin. 财新智库), contains more affirmative data. According to CaiXin PMI in manufacture in February was 50.9% (according to Chinese GUS 49.1%).

What makes this difference?

In addition to differences in methodology, investigation is an crucial factor. The Chinese Statistical Office mainly takes into account large (large) private and state-owned companies and CaiXin tiny and medium-sized enterprises.

Source:

- stats.gov.cn

- caixin.com

Author: 梁安基 Andrzej Z. Liang, 上海 Shanghai, 中国 China

Email: [email protected]

Editorial: Leszek B.

Email: [email protected]

© www.chiny24.com

![Uroczystości w Chełmie z okazji 106. rocznicy powołania Policji Państwowej [GALERIA ZDJĘĆ]](https://static2.supertydzien.pl/data/articles/xga-4x3-uroczystosci-w-chelmie-z-okazji-106-rocznicy-powolania-policji-panstwowej-galeria-zdjec-1752160166.jpg)

![Incydent na parkingu w Ostrołęce. Trwa ustalanie szczegółów [WIDEO]](https://www.eostroleka.pl/luba/dane/pliki/zdjecia/2025/kolizja_inwalidow_wojennych.jpg)