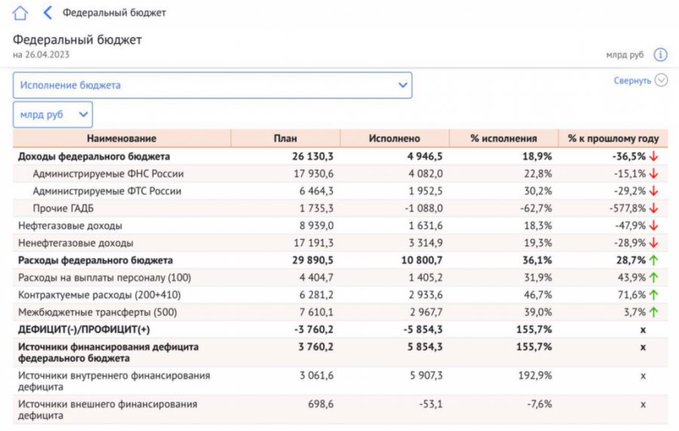

The latest figures from the implementation of the Russian Federation budget on 26 April do not give optimism. Below are 2 pictures from the State data. The first in the original, the second translated into Polish.

These figures are given in billions of rubles. What can we read and what is obvious?

Federal budget revenue.

Budget revenue

Reductions in gross to the budget year to year by 36,5 %. There is no economy in the planet that could be considered healthy and well-managed if the budget gross falls by almost 40% a year. The second crucial indicator is that the planned budget revenues are realised for this minute in just 18.9%. It should be remembered that the budget passed and the calculation of how much gross we will have in the following year determines the amount of spending we can afford. For April 26, implementation at little than 19% is very bad data. Should be about 25%. The situation may improve after the period has been counted in full as taxes collected at the end of the period are expected to affect the budget. But present it looks very bad.

Revenue from FNS and FST sources. What do they mean?

Then we have data from 2 state bodies. What are the abbreviations FNS and FST?

In the Russian budget report, the abbreviations FNS and FTS mention respectively to the national taxation Service (Russian: Федеральная налоговая, ФНС) and the national taxation Service (Russian: Федеральная таможенная, ФТС). The national taxation Service (FNS) is simply a government body liable for collecting taxes and another charges in Russia. The FNS monitors and monitors compliance with taxation law and carries out actions to combat illegal taxation avoidance activities. The national gross Service (FTS) is, on the another hand, liable for collecting and controlling the proceeds to the national budget of Russia. FTS collects duties, excise duties and taxes on goods and services imported into the country and on activities related to the extraction of natural resources. The FTS besides carries out customs controls, monitors compliance with the rules of targeting and combats smuggling-related crime. In Russia's budget report, expenditure and receipts related to FNS and FTS activities are described in item to guarantee the transparency and effectiveness of budget control by the government and society.

Here we besides have year-to-year declines of 15% and -29%. What cognition can we draw from this data? Well, as you can see, the crisis is vast. It touches taxes, customs, excise duties imported and sent. It touches exports of natural resources and the interior labour market.

Other GAD income. What does that mean?

Another component on the list is another GADP income. What do I hide under that term?

The expression ‘other GADP revenue’ in Russia's budget study refers to gross that comes from different sources, not straight related to taxes or public service charges.

Other examples of ‘GADP income’ in Russia may include proceeds from the privatisation of state assets, dividends from state-owned companies, revenues from the issuance of state bonds or revenues from the investment of state-owned investment funds.

We're dealing with something that should be income, but it's turned into expenditure this year. The budget plan assumed revenues of 1.7bln rubles, and we have spending of a trillion rubles. This is 1 of the most interesting positions in this ranking.

The next 2 points are gross from gas oil and from another activities outside natural materials. Here besides the decline year to year successively by almost 48% and almost 29%. The claims about the large condition of the Russian economy are even ridiculous at this point.

Budgetary expenditure.

We are moving on to budget expenditure, where we have an increase of 28.7 % year-on-year, and although this value seems high, I think it is more interesting to me to implement it in relation to the budget plan. There's an increase of 36.1%. This means that the estimates and budgetary assumptions that were counted at the end of 2022 are absolutely inconsistent today. The Russian Federation spends besides much money. Differences on specified a scale between assumptions and implementation exposure lies or deficiency of control over anything concerning Russia's public finances.

Staff expenditure (100) What does that mean?

In Russia's budget report, the line marked ‘staff costs’ (100) refers to expenditure relating to the remuneration of public sector employees specified as public administration staff, teachers, police officers, wellness services and another public sector workers.

This row includes expenditure on wage payments, social, pension and wellness contributions, social benefits and another costs related to public sector workers specified as training and professional development.

Staff costs are usually 1 of the largest expenditures in the state budget and frequently represent a crucial part of Russia's full budget expenditure. We have an increase of 43.9% a year.

Contractual costs (200+410) What does that mean?

In Russia's budget report, the word ‘contractual costs’ refers to expenditure relating to contracts concluded by the government with another entities (e.g. Wagner Group), which are not included in direct expenditure on staff (costs 100).

Contractual costs are usually made up of 2 parts:

- Contractual costs (200): relate to expenditure relating to service contracts, goods and works and another contracts for the performance of public tasks. This category includes, for example, the acquisition and supply of equipment, materials and services, including the rental of buildings and equipment.

- Contractual costs for financing (410): relate to costs related to the implementation of budgetary tasks by providing backing to another entities. In this category, for example, costs related to the financing of government programmes, grants to another institutions, transfers between budgets and financing of infrastructure projects can be found.

In total, the contractual costs (200+410) are the costs incurred by the State under contracts with another entities to carry out public tasks. We have the biggest expenditure increases here, due to the fact that by 71.6% year to year. As this item is liable for financing all paramilitary groups, we have clear insights about how much this expenditure is. You might even be tempted to draw any numbers that can show us about the amounts that are transferred from the budget for specified actions. Of course, these are only top forks and the real amount may be much lower, but if individual erstwhile was curious in this yes, specified a position is in this study and specified amounts come out in the first 4 months of 2023.

Intergovernmental transfers (500) What does that mean?

In Russia's budget report, the line marked ‘intergovernmental transfers’ (500) refers to expenditure relating to transfers of funds between different budget units, including between the national government, governments of different regions and another local government units.

Intergovernmental transfers are frequently utilized to compensate for differences in income and expenditure between different regions of the country and to finance various public actions, specified as infrastructure, education and healthcare investments.

These transfers may take various forms, including special-purpose grants, general grants, subsidies and another forms of financial assistance. However, they all support actions undertaken by local authorities and regions to increase the efficiency of the usage of public funds and to guarantee a balanced improvement of the country. Here we have small growth due to the fact that only 3%, and this again gives us large insight into the country's budgetary situation. For it shows that despite the increase in spending on specified a scale, money is not distributed to crucial things, namely health, education and infrastructure. It's not very stimulating the investment economy. There is no process of creating a chance in the future. Expenditure is rising, society is not feeling it.

Deficit/surplus

As of 26 April we are dealing with a deficit, or budget gap of 5.8 trillion rubles, or about 73 billion dollars. The budgetary assumptions for the full year 2023 were 3.7bln rubles. So we have underestimate the size of the budget gap in 2023 at 155% and we have only April. This is nothing but a disaster of assumptions and budget plans.

I pay peculiar attention to the gross and expenditure balance. Spending at 10.8 trillion rubles in gross only 4.9 trillion rubles. If the situation does not change later in the year, the budget gap will calmly exceed $100 billion at the end of the year, and most likely with an optimistic scenario. But if you estimation pessimistic, it can spin around $200 billion. I remind everyone of the year 2022 Russia ended with a budget gap of 3.3 trillion rubles which at today's course is over $40 billion, but after the course from the beginning of the year it was over $50 billion. The ruble course has been weakening in fresh months, causing the debt converted from ruble to dollars to become smaller.

And here we go to the next point:

Sources of national deficit financing. What does that mean?

In the financial statements, the heading ‘sources of national deficit financing’ means sources of backing that come from the country and are utilized to cover the budget deficit.

This means that the State derives financial resources from within the country, for example by issuing government bonds on national markets, selling shares of state-owned companies or obtaining loans from national banks or another financial institutions.

The heading ‘sources of national deficit financing’ is crucial as it reflects the country's ability to cover its budget deficit with interior resources. The greater the country's ability to rise funds from within the country, the little its dependence on external sources of financing, specified as abroad loans and the issuance of government bonds on global markets.

In the case of Russia, sources of backing for the national deficit may include, for example, issuance of government bonds on national markets, sale of shares of state-owned companies or obtaining loans from national banks or another financial institutions. This is where the war bonds will be. We have an increase in the yearly plan of almost 200% in 4 months.

Sources of external financing. What does that mean?

In the accounts, deficits mean sources of backing that come from outside the country and are utilized to cover the budget deficit.

The budget deficit is simply a situation where state expenditure exceeds its gross over a given period. Where sources of backing for the deficit come from external sources, this means that the State is raising funds from abroad, for example by issuing government bonds on global markets or obtaining loans from global financial institutions.

For Russia, sources of external financing of the deficit may include, for example, loans from abroad banks or issuance of government bonds on global markets. Russia's financial statements usually include sources of backing to guarantee transparency and reliability of the state's financial condition. Here, we're down and the numbers are negative. Implementation of the plan at -7.6%, and negative amounts at -53 billion rubles. This means that Russia is clearly cut off from external financial markets and cannot finance its budget gap from outside. The full budget gap will should be filled with interior financial resources. It is likely that the portfolios of citizens and oligarchs will request to be addressed. But this is simply a subject for another long entry which already is prepared for you by Paweł Jeżowski.

If you want to thank me for my work and my hours to decipher this compilation

You can do it by buying virtual coffee.