Why We Are At The Start Of A Multi-Year Gold Bull Market

By Jan Nieuwenhuijs of Gainesvillecoins.com

Recently the dollar gold price aggressively broke a multiyear opposition level on the back of escalating wars, Worrying asset bubbles, and sticky inflation. Long word indicators show gold is undervalued under these circuits and can easy double in price over the coming years.

The past decades have been characterized by an elevated trust in credit instruments that blew the global financial strategy to colossal offers. Now tensions between East and West, debt saturation and inflation are chipping distant this trust, the balance between financial instruments with counterparty hazard (credit) and without counterparty hazard (gold) will go through a process of adjustment in favour of the gold price.

The explanation of Money and Exter’s Inverse Pyramid

“Money is gold, and nothing else.”

J.P. Morgan evidence before legislature 1912 (page 5)

Philosophically speaking all moneys are backed by trust. due to the fact that money is simply a social agreement it can be whatever we think it is—tobacco, salt, paper slips, silver, book entries, and so forth. Money functions as long as it is accepted by marketplace participants.

But not all moneys are equal. any coins—for example tobacco and salt—are inconvenient in the modern age. another coins are issued by banks and therefor carry counterparty risk. Since the summertime 19th centre gold is “officially” the only form of money that is universally accepted, has no counterparty risk, and so underpins the global financial system.

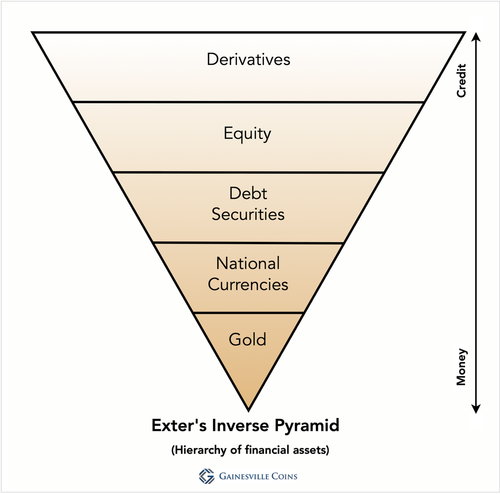

In erstwhile articles we talk about Perry Mehrling’s hierarchy of money, Exter’s inverse pyramid, and the order in which the global Monetary Fund (IMF) lists financial assets. All 3 have in common that they pose gold as the eventual money, followed by national currencies, debit securities, equity, and then derivatives. This series of financial assets returns if assets are more money or credit like.

Below is simply a visualization of Exter’s inverse pyramid, whereby gold sits at the bottom, eventual “backing” all forms of credit restoring on top of it and providing indispensible trust to the financial system.

In modification, credit is beneficial to a capitalist economy—too much credit (debt) results in lower growth, besides small means foregone opportunities. But in general, and especially during a crisis, people have more trust in gold than credit.

Because everything above gold can be created out of thin air, the top of the pyramid can be easy visible. Through the business cycle balance sheets are extended—credit is created, the crown of the pyramid is enlarged—causing an economical boom. During a recession balance sheets shrink, the gold price increases, and the share of the pyramid is upgraded. The overall size of the pyramid grows over time, while the pyramid’s form changes simultaneous with debit cycles.

Ratios between gold and credit assets can tell us where we are in a debit cycle. At the time of writing, we are in a boom as:

- Gold as a share of global financial assets is low.

- The U.S. broad money supply comparative to the gold “backing” it is overstretched.

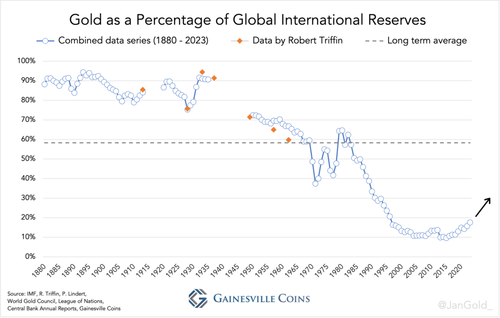

- Gold’s share of central banks’ global reserves is low.

- Equity marketplace values are high.

All the while trust in credit is waning, suggesting the gold price will emergence (policy makers will overt outright defaults inducing a deflationary collapse).

New Multi-Year Gold Bull marketplace Has Begun

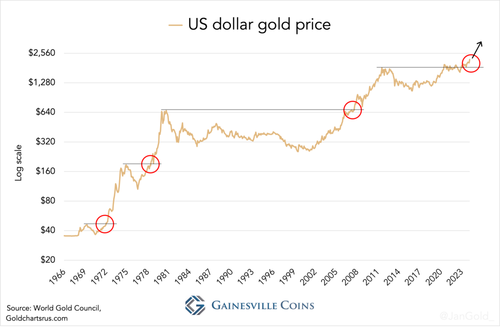

Let us first specify what has late happened to the gold price. From a method perspective, as you can see in the illustration below, the price of gold has broken out from a multi-year consolidation phase. If we may usage past as our guide, we are now entering a multi-year bull market.

Chart 1. Gold price in US dollars from the 1960s until March 2024.

Chart 1. Gold price in US dollars from the 1960s until March 2024. Next, we will examine the long-term fundamental indicators that display gold is undervalued under the conditions of declining trust in credit.

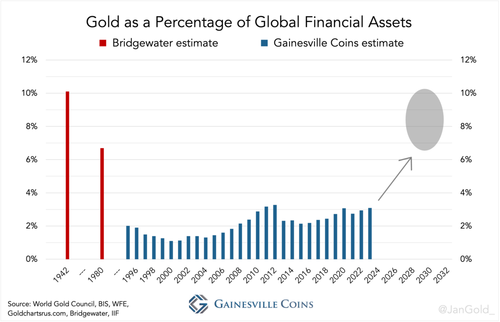

Unfortunately, it’s impossible to find global date on all financial accounts going back 150 years to compare the value of all credit to that of gold. thought I did find estimates by Bridgewater Associates on the ratio between gold and “financial assets” (in this case gold, debit, and equity) from 1924 until 2020. I was able to completely mimic Bridgewater’s methodology for the last 2 decades and could thus extend their data series.

Chart 2. Above ground gold as a percent of global financial assets (gold, debit, and equity).

Chart 2. Above ground gold as a percent of global financial assets (gold, debit, and equity). As we can see, during periods erstwhile trust in credit is poor, in the Second planet War and at the end of the 1970s, gold’s value comparative to financial assets was in between 7 and 10%. presently gold is worth 3%, which goes to show there is complete upside for gold this bull run.

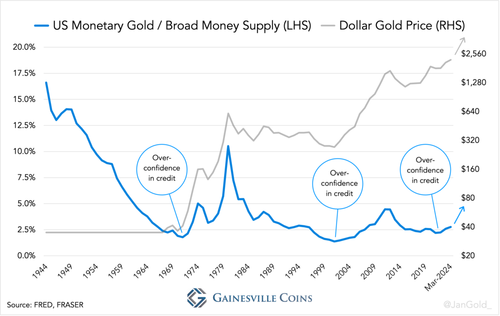

Let’s besides have a look at the value of the monetary gold supporting the US dollar broad money supply. Whatcurrency is more appropriate for assessment this ratio than the planet reserve currency?

Chart 3. Value US monetary gold distributed by the broad money supply (M2), versus the dollar gold price. For the sake of simplity, I have left out Eurodollars.

Chart 3. Value US monetary gold distributed by the broad money supply (M2), versus the dollar gold price. For the sake of simplity, I have left out Eurodollars. The value of the US monetary gold eventual underpinning the dollars in circulation is rising from a close historical low. The 2 erstwhile lows were in 1971 and 2000, after which multi-year gold bull markets followed. So, most likely a fresh bull marketplace is upon us.

Making substance bags is that the dollar’s reserve currency position is slow declining at the moment. My next measure, therefor, is the relation between gold and credit in the form of abroad exchange.

On the classical gold standard in the 19th centre, it was mostly gold that underpinned assurance in central banks. Most of their reserves are stored of gold that virtually backed the monetary base as currency could be redeemed for physical metallic at a fixed parity. In the Interbellum it was agreed that abroad exchange (sterling and dollars) could substitute gold on central banks’ balance sheets to let monetary expansion beyond the growth of the above ground stock of gold. This came to be known as the gold exchange standard. After the Second planet War the US pushed the planet to save in dollars and gold’s share of global global reserves declined harply. Especially in the 1980s trust in dollars boomed.

Chart 4. Gold as a percent of global global reserves. Gold’s expanding share of reserves is simply a form of de-dollarization.

Chart 4. Gold as a percent of global global reserves. Gold’s expanding share of reserves is simply a form of de-dollarization.But gold’s share of full reserves is present on the rise, for 1 reason trust in dollars is eroding due to the freezing of Russian assets worth $300 billion since the war in Ukraine that started in 2022. Second, the United States’ public debt is spiraling out of control while the national Reserve can’t get inflation done. Central banks are presently buying evidence amounts of gold and drive up the price.

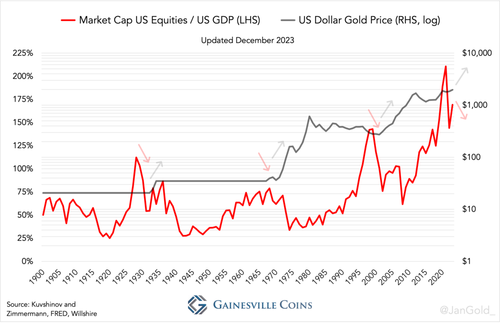

For our final data series, we will look at the size of the US equity marketplace versus the size of the economy (GDP) going back 120 years. Equity can be seen as a form of debit with no graduation. What the data uncover is that over time there have been cycles of easy money (credit) blowing equity bubbles, followed by the department of currency, reflected in a higher gold price.

Chart 5. US equity marketplace capitalization to GDP and the dollar gold price. The illustration suggests being overweight in gold.

Chart 5. US equity marketplace capitalization to GDP and the dollar gold price. The illustration suggests being overweight in gold. The cycles can be best exploited as follows: erstwhile a bubble pops, central banks ease monetary policy to stimulate the economy, but they frequently overshoot and plant the seeds for the next bubble—national currency (fiat) is the air that bubbles are common made of. This leads to a pleasant cycle of bubbles and ever-easier money in which the value of currency is incrementally declines, and the gold price applies. Cycles reminiscent of Exter’s pyramid visioning (credit extensions) and reshaping (gold price goes up). Time and again.

Currently the equity marketplace (relative to GDP) is proven to its peak, suggesting the gold price will see a crucial emergence in the coming years.

Conclusion

The West not only makes dollars accounted for by the Russian central bank early 2022 at the start of the war, but legislature just applied a bill to confiscate specified assets and give them to Ukraine. What could velocity up “de-dolarization” by BRICS members and another countries faster than this? Tensions between East and West will not be resolved quickly, telling us the gold price will proceed to march higher and gold’s share of global global reserves will emergence to the description of the dollar.

It should be noted that the Chinese central bank was a buyer of gold in the 1960s and 1990s before gold made partial moves to the upside (see illustration 1). Timothy Green writes in The planet of Gold Today (1973):

In 1965 ...., China bought 100 tons of gold ... in the London market; the following year she came back for another 30 tons. 2 years later China topped up with another 60 tons. The main reason behind these forums into the gold marketplace apps to have been to divest itself of steling [the second planet reserve currency at the time]. Although no authoritative figures of China’s reserve are available, it is likely that she substituted a good part of her holdings of stelling for gold before [the stelling] devaluement in 1967.

Dutch paper NRC Handelsblad reported in 1993 that the People’s Bank of China (PBOC) was 1 of the buyers of a massive sale by the central bank of the Netherlands. As another European central banks sold dense during the 1990s as well, we may presume the PBOC bought any more of that and responded the benefits erstwhile the dollar gold price began its ascent around 2000.

As I have reported repeatedly since 2022, the PBOC is presently buying gold hand over fist. To the Chinese have a sixth sense for sniffing outcurrency deviations?

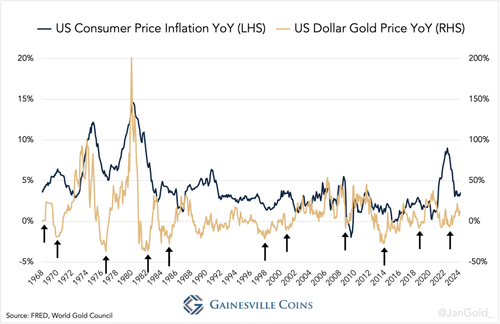

The gold price can be utilized as an inflation effects indicator. In the illustration below 1 can see that a turnaround in the price of gold is frequently followed by surging inflation within 2 years. To me it would only make sense if this time around it’s no different.

Chart 6. US consumer price inflation versus the gold price.

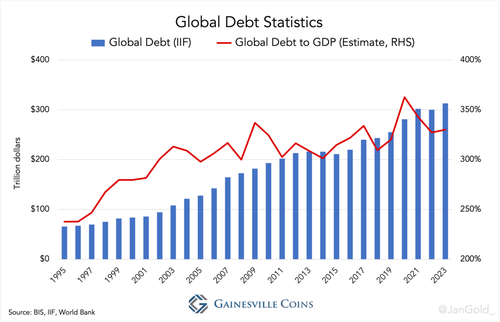

Chart 6. US consumer price inflation versus the gold price. As global debit levels are close evidence highs and have become unsustainable, the most expedient, least well-understood, and common way of restructing debit (credit) is inflation, according to erstwhile hedge fund manager Ray Dalia. Indeed, global debt stands at $313 trillion dollars (330% of GDP) and there are fewer another options to lower the debt burden. Inflation and a higher gold price would delete the strategy and reconstruct the pyramid.

Chart 7. Global debit as measured by the Institute of global Finance (IIF). Debt to GDP figures are my individual estimates.

Chart 7. Global debit as measured by the Institute of global Finance (IIF). Debt to GDP figures are my individual estimates. All in all, it is certain looks if we are at the tipping point of rebalancing credit assets combined to gold. Signs of stress in the strategy are real property sectors collapsing, banks failing, and central banks making losses. Credit booms are inevitablely followed by busts.

Not only are central banks buying gold due to the fact that “it may play a stabilizing function ... in times of structural changes in the global financial system,” (central bank of Hungary) investment funds are slow to do the same. The Bangkokpost gate last April that “the Thai Government Pension Fund is reducing investments in assets that may be affected by war and expanding investments in gold and oil to mitigat risk.”

“The Thai [$35bn] Government Pension Fund is reducing investments in assets that may be affected by war, and expanding investments in gold and oil to mitigate risk.”

Notice a Trend?

Via @wmiddelkoop @BangkokPostNews https://t.co/A7sW8Mfs8D

— Jan Nieuwenhuijs (@JanGold_) April 28, 2024

In 2023 I specified the gold price could scope $8,000 dollars an outce in the decade ahead. Based on all the date I came across in writing this article I inactive think that is simply a reliable number that would stabilize the financial strategy by adding more trust to it.

Tyler Durden

Sat, 05/11/2024 – 09:30