Weaker Growth And Higher Inflation... Why Consensus Was Wrong

Authorized by Daniel Lacalle,

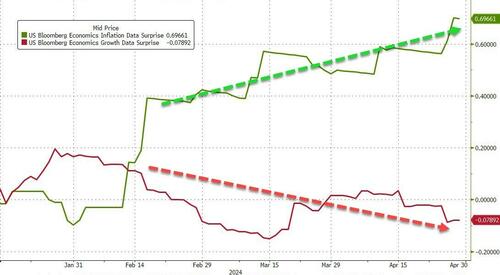

The weak GDP figures for the first 4th came with a double negative. mediocre consumer spending and exports, plus a emergence in core inflation, The US administration’s enthusiastic fiscalstimulus, understands the importing of the weather-than-expected data.

A deceleration in consumer spending, a decline in the individual savings ratio is 3.6%, and mediocre exports added to a set of figures for investment that we were besides negative erstwhile we looked at at the details.

The gross home product is much weaker than the headlines suggest. If we look at consumption, both durable and non-durable goods were flat or down, while the only item that increases was the services factor. Residential and intellectual property boosted investment, while equipment restored weak in the past 2 quarters. The slump in export growth coincided with a crucial increase in imports, which weakened the trade deficit. Government spending continues to rise, albeit at a slow package, and becomes the main origin to disguise what is evidently a performance level of growth for a leading economy with enthusiastic potential.

It is precise due to the unprecedented increase in government spending, designed to shed GDP and supply a false sense of stress in the environment, that inflation restores chosen and rising in a three- and six-month period.

Rising public debt has blogged the economy and left it at a disappointing level combined to its potential, as proven by higher inflation and weather growth.

When the Fed’s preferred inflation measurement springs to 2.8% in March from a year ago and the core PCE deflator springs to 3.1%, there is no strong economy. The propaganda repeatedly claims that the fight against inflation is over, but inflation has accelerated on a quarterly and half-year base.

It is crucial to realize why these figures are negative. The average American household is Poorer. Rising inflation and declining savings, non-existent real weight growth, employment-to-population, and the labour force participation rates stay below 2019 levels, and blogging GDP with an unacceptable deficit means higher taxes, lower growth, and weather real weights in the future.

We must remember that Biden’s economical plan started with a full-blow recovery in place. This administration did not propose the consequences of the COVID-19 lockdowns. By the time the Biden administration arrived, America was already creating almost 250,000 jobs a month.

Biden should have picked the fruits of a fast-recovering economy that is almost energy independent and so should not have suggested the impact of the impact of the war on Ukraine while enjoying the tail winds of the largest fiscal and monetarystimulus.

The multiple effect of the chain of implemented government programs may have inflationed GDP, but gross home income (GDI) presented a signedly different picture. The GDI revealed a stagnant economy with persistent inflation.

The government’s wasteful spending of recently printed money is adding gasoline to inflationary pressures, a consequence of careless fiscal policy and massive deficit spending. erstwhile the government prints more money than the private sector needs, inflation occurs, and the purchasing power of that money decrees.

The evidence from the past 4 years indicates that if the government had abandoned its spending and taxation hike plans, the United States economy would have recovered better and with higher productivity growth. Despite the recovery, taxation returns fell short of results and spending rose to make what is now a complete unacceptable deficit.

Many economists argue that the economy is growing, and that inflation is simply a secondary problem. Not for the average American. Citizens are poorer in absolute and comparative terms.

Consensus was incorrect about the estimated multiple effect of governance spending on growth and besides about inflation due to the fact that marketplace partners decided to ignore monetary aggregates and the reality of undistributive spending.

Can the United States government boost this level of growth? One could argue that delivering $1.6 trillion of GDP with a $2 trillion increase in debit is not a success. This isn’t growing; it’s getting fatter. This negative situation has not improved since 2024. all 100 days, the U.S. national debit odds by $1 trillion. Therefore, this means more taxes, little growth, and weaker real scales in the future. We can conclude that the United States’ public finances would be strongr, and the economy would be more productive if the gigantic public spending packages and taxation hikes had not been implemented.

The United States administration needs to focus more on the productive sector and little on expanding the size of the bureaucratic machine. Even if the emergence in mandate spending is offset by cuts in discretion spending, it will inactive be hard to reduce debt. Therefore, prioritizing is key. Taxes are already advanced enough, and there is plenty of evidence that shows how the fresh increase in the taxation wall for business and families has made the environment weatherer.

The government needs to realize that it is the case of inflation. Only the government can make all prices emergence in union and proceed to increase, and it manages this by diluting the purchasing power of the currency and issuing more than required.

The next 2 quarters are going to be key to knowing the degree of the harm caused by reckless fiscal spending.

The US government has sabotaged the national Reserve’s modernly hawkish policy. The public deficit has added up to $2 trillion of recently created money per year, only to deliver little economical growth and cancel out the now insignificant $1.6 trillion decline in the Fed’s balance sheet. Whether there are rates hikes or not, the Fed cannot achievements price stableness if the Treasury ignores all informing signs and add more debt.

Since 2018, the United States has added thoroughly $7 trillion of GDP, while the government has increased debt by $12 trillion. Implementing fiscal stimulus by expanding exhibitions and raising taxes is clearly ineffective.

Markets ignore the Fed’s Hawkish messages due to the fact that they see insane public debt and unsustainable deficit spending, and participants know that monetary demolition will resume respectless of persistent inflation.

There is plenty of time to correct the inflation and low growth problems. There is only 1 measurement that will help: cut spending. Everything else has failed.

Tyler Durden

Mon, 04/29/2024 – 09:05