Watch Live: 'Too Late’ Powell Explains Why Rate-Cuts Remain Off The Table Despite Dissents & Growth Doubts

No rate cuts… as expected.

Two dissents… the most in 32 years!

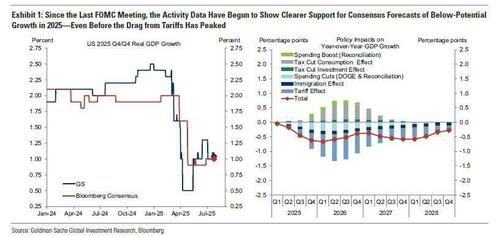

And all of that as, according to Goldman, the most notable change since the June FOMC meeting is that activity data have begun to show clearer signs of the below-potential growth that most forecasters have expected since it became clear in the spring that large tariff increases were coming.

Concerningly, this deceleration has occurred before the drag from the trade war has likely peaked.

But apparently, that is of no importance (as a data point) to Powell and his pals.

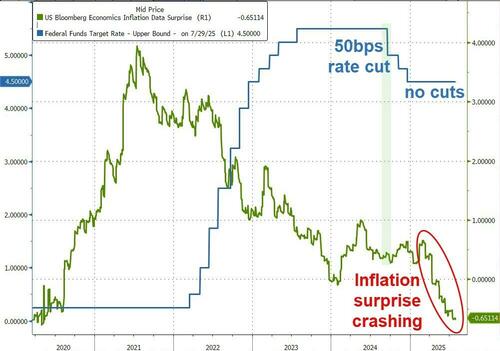

So, brace yourself for the usual barrage of softball questions from reporters too afraid to actually ask Powell the pertinent question of just what data points he is looking at to justify continuing to sit on his hands… as inflation continues to surprise to the downside, rather dramatically…

…because the lack of tariff-driven inflation is… transitory?

Our first take is that the combination of a double dissent (pro cuts) and the recognition that growth is 'moderating’, strongly suggests a dovish tilt from the Fed and the market is seeing odds of a September cut rising…

Attention at the press conference will be on whether Chair Powell offers any guidance for rates ahead, or if it may soon be time to lower rates, depending on the data, although the Fed has been reluctant to commit to future moves in the past, given the ongoing uncertainties around trade policies.

During the Presser, Powell will also likely be quizzed about his future given President Trumpʼs continuing criticisms of the Fed Chair. Powell tends to avoid these sorts of questions, usually stating that he is focused on the Fed’s mandate.

Watch the full press conference here live (due to start at 1430ET):

Tyler Durden

Wed, 07/30/2025 – 14:25