Walmart Delivers Solid Earnings, Warns Of Imminent Price Hikes

Walmart reported better-than-expected first-quarter results for the period ending April 30 but cautioned that the trade war will raise prices on certain items as early as this month. The warning underscores that the mega retailer’s low-price model is threatened amid an ongoing value war with other U.S. retailers.

The nation’s largest retailer posted first-quarter results showing a 4.5% year-over-year sales increase at U.S. Walmart stores, surpassing the Bloomberg Consensus estimate of 3.85%. Adjusted earnings per share came in at 61 cents, also beating the 58-cent estimate.

1Q25 results demonstrate that Walmart’s pricing power to offer low-cost products continues to increase.

Here is the highlight of the 1Q results (ended April 30):

Adjusted EPS: $0.61 vs. $0.58 estimate

Revenue: $165.61B (+2.5% y/y) vs. $166.02B estimate

U.S. Comparable Sales (ex-gas): Walmart

-

Walmart stores: +4.5% vs. +3.85% estimate

-

Sam’s Club: +6.7% vs. +4.93% estimate

E-Commerce Growth

-

Walmart U.S.: +21% vs. +13.8% estimate

-

Sam’s Club: +27% vs. +14.3% estimate

Operating Cash Flow: $5.4B

From the earnings deck:

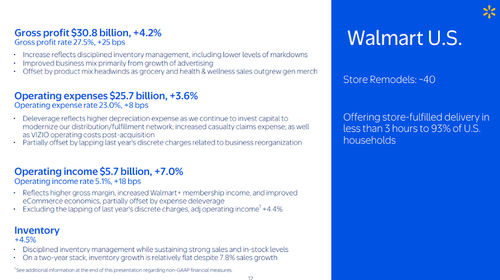

Total revenues/gross profit

Operating expense/income detail

EPS/Cash flow

Additional details…

Walmart maintained its full-year guidance, which was issued in February.

-

Q2 Sales Growth Forecast: +3.5% to +4.5%

-

FY2026 EPS Guidance (unchanged): $2.50–$2.60 vs. $2.61 estimate

-

FY2026 Net Sales Growth (unchanged): +3% to +4%

While Walmart delivered another solid quarter of sales and earnings growth, the focus has shifted to the growing negative impact of the trade war.

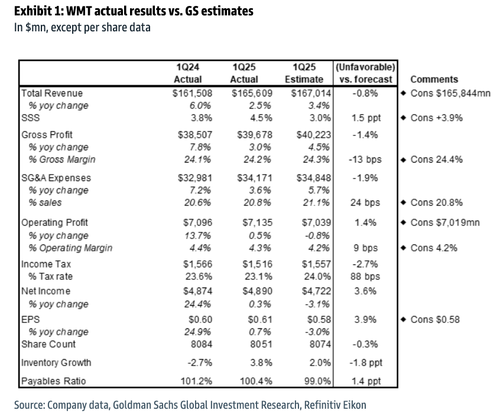

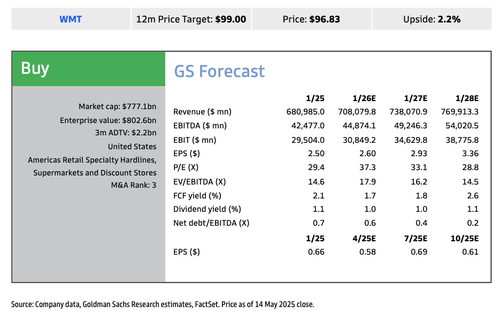

Goldman analysts Mark Jordan, Emily Ghosh, and others commented on Walmart’s earnings:

WMT reported 1Q25 adj. EPS of $0.61, above GS/consensus (Refinitiv) of $0.58/$0.58. Walmart US SSS of +4.5% tracked better than consensus at +3.9%, driven by traffic (+1.6%) and average ticket (+2.8%). By category, grocery was up +MSD, noting increased transactions and units along with inflation of ~150 bps, due primarily to eggs. Health & wellness grew +high-teens, driven by higher script counts, mix shift toward branded from generic, and strong over-the-counter sales. General merchandise was slightly negative, reflecting growth in unit volumes, which was more than offset by MSD like-for-like deflation, while seasonal events were strong; WMT called out sales softness in electronics, home, and sporting goods, offset by strength in toys, automotive, and kids’ apparel. Global/Walmart U.S. e-commerce net sales grew +22%/+21% (vs. +16%/+20% in 4Q), while global/Walmart U.S. advertising grew +50% including VIZIO/+31% ex VIZIO (vs. +29%/+24% in 4Q), respectively.

They offered their take on guidance:

WMT reiterated 2025 guidance to net sales growth of +3.0-4.0% (vs. GS/consensus of +4.0%/+3.6%), adj. operating income growth of +3.5-5.5%, and adj. EPS of $2.50-2.60 (vs. GS/consensus at $2.60/$2.61). For 2Q, WMT is guiding to net sales growth of +3.5-4.5% (vs. GS/consensus of +4.0%/+3.5%), while the company is not guiding to operating income growth or EPS given the dynamic macro backdrop.

And maintained their „Buy” rated 12-month price target of $99.

In a post-earnings interview, CFO John David Rainey warned that price hikes at Walmart stores will begin this month: „If you’ve not already seen it, it will happen in May and then it will become more pronounced.”

The retailer warned about trade war uncertainty and how the situation „changes by the week,” adding, „The lack of clarity that exists in today’s dynamic operating environment makes the very near-term exceedingly difficult to forecast.”

Walmart’s supply chain offers some insulation from the trade war. About 66% of its merchandise—primarily groceries—is sourced domestically, accounting for roughly two-thirds of its U.S. business. However, CFO John David Rainey noted that imported categories such as electronics, apparel, and toys could face additional price hikes in the coming months.

„We will do our best to keep our prices as low as possible but given the magnitude of the tariffs, even at the reduced levels announced this week, we aren’t able to absorb all the pressure given the reality of narrow retail margins,” said CEO Doug McMillon in a statement.

Takeaway: Walmart is not entirely immune to tariffs. Despite the 90-day cooling period between the U.S. and China and a substantial tariff rate reduction on both sides of the Pacific, price hikes are still coming. As cost pressures mount, the retailer’s ability to fully absorb them is becoming increasingly difficult, potentially jeopardizing its low-price value model amid an ongoing, multi-year value war with other U.S. retailers.

* * *

See: Walmart’s full earnings presentation…

Tyler Durden

Thu, 05/15/2025 – 09:00