US Futures Rise Back To All Time High Ahead Of Huge Earnings Week

US equity futures are higher and approaching a new record high. Over the weekend, headlines were relatively muted in the US, while globally, Japan’s ruling party lost its majority in the upper house, but PM Ishiba still pledged to stay in office in a creeping setup for the latest Japanese political crisis. While the yen has rallied overnight after Japan’s ruling coalition loses its majority in the upper house election, this appears to be a kneejerk reaction with Japanese markets closed today; expect much more weakness for the JPY as Japan now opens the fiscal stimulus floodgates forcing the BOJ to monetize much more Japanese debt. As of 8:00am ET, S&P and Nasdaq futures are both up 0.2% and Europe’s Stoxx 600 Index posted small moves. In premarket trading Mag 7 shares are higher: TSLA (+1.6%) leading gains, followed by GOOGL (+0.9%) and META (+0.6%); the only exception is Microsoft which was down 0.2% after a cyberattack. Utilities and Consumer Discretionary are outperforming. The yen strengthened 0.7% while the dollar slipped. After last week’s selloff, Treasuries yields are lower: 2-, 5-, 10-, 30yr yields are 2bp, 3bp, 4bp lower. Commodities are mixed with base and precious metals higher and oil lower.

In premarket trading, Mag 7 stocks are mostly higher with the exception of MSFT whose server software was exploited by unidentified hackers, with analysts warning of widespread cybersecurity breaches. Nvidia is said to have told clients that it only has limited availability of its H20 AI chips, the Information reported. (Tesla +1.4%, Alphabet +0.8%, Meta +0.5%, Apple +0.6%, Amazon +0.3%, Nvidia +0.1%, Microsoft -0.1%).

- Aveanna Healthcare Holdings Inc. (AVAH) gains 6% as Jefferies turns bullish on the company, saying he expects “continued fundamental strength and positive earnings surprises.”

- Block (XYZ) jumps 9% as Jack Dorsey’s fintech firm is set to join the S&P 500 index.

- Domino’s Pizza (DPZ) climbs 6% after posting second-quarter comparable sales growth that topped Wall Street expectations.

- Dynamix Corp. (DYNXU) climbs 62% after the blank check company announced that it was combining with the Ether Reserve LLC to create an Ether treasury company.

- Invesco Ltd. (IVZ) rises 2% after TD Cowen analyst Bill Katz raised the recommendation on the investment management company to buy from hold, calling its move to unlock fee revenue from the QQQ ETF a “game changing event.”

- Sarepta Therapeutics (SRPT) drops 11% after the drugmaker refused to pause all shipments of its Elevidys treatment after three deaths were linked to the company’s gene therapies.

- Verizon Communications Inc. (VZ) climbs 4% after the company posted second-quarter revenue that surpassed analysts’ estimates and raised its profit outlook, buoyed by wireless price increases and recent tax legislation.

Markets seem to be paying less and less attention to tariff headlines, while strategists are making positive noises about earnings and the economy. Morgan Stanley strategists said investors should stay bullish on US stocks, as earnings momentum, positive operating leverage and cash tax savings are under-appreciated tailwinds. Peers at Goldman Sachs said the earnings season has had a solid start while recent dollar weakness should provide a small tailwind to US earnings.

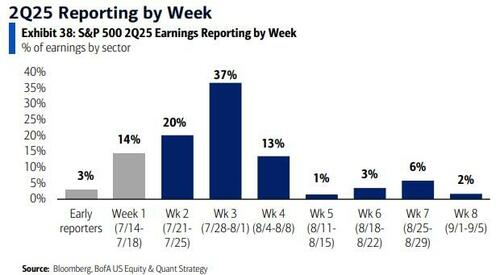

The positivity comes as a huge week of earnings (if quiet for macro) kicks off, with Verizon, General Motors, Tesla and Alphabet among companies reporting in the next few days. Investors will be watching a slate of corporate reports this week for signs of economic resilience in the face of tariff risks. Companies accounting for about a fifth of the S&P 500’s market capitalization are expected to post results this week. Tesla and Alphabet report Wednesday. Also up are Lockheed Martin Corp. and Coca-Cola Co. on Tuesday.

“Equities still have, particularly in the US, a little bit of room to run further,” Max Kettner, chief multi-asset strategist at HSBC Holdings Plc, said on Bloomberg TV. “Let’s remember that we were going into this reporting season with very low expectations.”

Outside of earnings, Bloomberg reports that Wall Street is looking for a “Powell hedge” to trade the possibility of Trump firing the Fed Chair. And the EU and US are heading into another week of intensive trade talks as they seek to clinch a trade deal by an Aug. 1 deadline. In options, investor demand for yield in the US is helping fuel growth in the market for S&P 500 Index dividend futures and options — a niche corner of the derivatives world where America has long trailed Europe. Trading in CME dividend futures climbed 40% in the first half of 2025.

European stocks are mostly steady as investors digest corporate earnings reports and contend with global trade jitters. The automotive and healthcare sectors are the biggest laggards, while miners outperform driven by demand optimism related to a mega dam project in Tibet and Chinese efforts to curb steel oversupply. Stellantis NV slid after reporting a €2.3 billion ($2.7 billion) net loss in the first half due to restructuring expenses, waning sales and the impact of tariffs. Here are the most notable movers:

- Ryanair shares jump as much as 9.9%, reaching a record high after the budget airline delivered a strong beat in the first quarter, more than doubling net income from the previous year.

- Galp Energia rises as much as 3.7% after the oil and gas firm delivered a healthy earnings beat in the second quarter and lifted its outlook for the full year.

- Covivio shares rise as much as 3.5%, the most in over three months, after the real estate investment trust raised its earnings outlook for the year.

- Schindler shares jump as much as 3.4% after Kepler Cheuvreux raised its recommendation on the Swiss elevator maker to hold from reduce, citing an improved US outlook

- Oxford Nanopore shares jump as much as 20%, the most in more than six months, after the British DNA-sequencing firm said it expects to report 1H revenue up 28% from a year earlier on a constant currency basis

- Belimo shares gain as much as 9.5%, to a record, after the Swiss manufacturer of heating, ventilation and air conditioning equipment reported sales that beat estimates, boosted by high demand from data centers.

- The Stoxx 600 mining sector is the best-performing subgroup in the European bourse as iron ore and steel prices climbed on the back of China’s plan for a mega dam in Tibet which bolstered the outlook for demand.

- Nokian Renkaat gains as much as 7%, after Danske Bank raised its recommendation on the Finnish tire maker to hold from sell, saying there is “finally some positive progress” from the company.

- Stellantis shares drop as much as 3.8%, to a three-month low, after the Italian automaker reported a preliminary first-half loss of €2.3 billion, due to restructuring expenses, waning sales and the impact of US tariffs.

- Saab falls as much as 7.3% on Monday, slipping from a record close at the end of last week, as Danske Bank downgrades its rating on the defense technology firm to sell, and Pareto cuts to hold.

- Roche shares fall as much as 1.6% after the drugmaker’s late-stage trials for astegolimab — the medicine being developed to treat chronic obstructive pulmonary disease, or COPD — got mixed results in trials.

- Lundbeck shares trade 0.2% lower, paring an earlier drop of 3.3%, after its medicine for post-traumatic stress disorder failed to win the backing of US regulatory advisers.

Earlier in the session, Asian equities traded in a narrow range, with Japan stock futures overcoming initial decline to trade steady, after Prime Minister Shigeru Ishiba’s ruling coalition lost its majority in an upper house election. The MSCI Asia Pacific Index gained as much as 0.2%, erasing losses earlier during the session on Monday. Alibaba Group Holding Ltd., HDFC Bank Ltd. and Samsung Electronics Co Ltd. lifted the index, whereas Taiwan Semiconductor Manufacturing Co., Reliance Industries Ltd. and Commonwealth Bank of Australia were key decliners. Chinese, Indian and Korean equities advanced while Australia and Taiwan’s markets ended lower. Nikkei futures fell as much as 0.5% as Japan’s markets were shut for a public holiday. The ruling coalition’s loss of a majority in Japan could dampen global investor appetite for the country’s assets — particularly as it navigates sensitive tariff negotiations with the US. Ishiba said that he intended to remain in the role in spite of the loss, which would make him the first Liberal Democratic Party leader since 1955 to govern the country without a majority in at least one of the legislative bodies.

“If uncertainty lingers, I think equities will take the brunt of the hit, especially domestic-facing stocks sensitive to policy shifts,” said Dilin Wu, a research strategist at Pepperstone Group Ltd. However, some losses might be pared if Ishiba signals a clear recovery plan or reshuffles his cabinet effectively, Wu added.

Elsewhere in the region, the Hang Seng Index briefly topped 25,000 points to reach its highest level since February 2022. The rally in Hong Kong stocks is set to extend on increasing optimism for tech shares and more southbound investment from the mainland.

In FX, the yen is rallying after Japan’s ruling coalition loses its majority in the upper house election. It’s the best performer in the G-10 sphere against a broadly weaker dollar. A public holiday means Japanese stocks and bonds aren’t trading. Beyond the yen, the dollar has fallen 0.3% to session lows against most of its G-10 peers, with sterling and the Swedish krona also outperforming.

In rates, Treasuries and European bonds are higher, with gilts marginally underperforming. Failure of trade negotiations to reach an agreement that would avert a 30% US tariff on most EU exports is driving sentiment. US yields are lower by 2bp-4bp across tenors with 2- to 10-year at lowest levels in more than a week; the 10-year near 4.36% is lower by about 6bps vs declines of 5bp to 7bp for UK and most euro-zone counterparts. Treasury auctions this week include $13 billion 20-year bond reopening Wednesday and $21 billion 10-year TIPS new issue Thursday.

In commodities, iron ore and copper gained, gold is up about $15 to $3,365/oz. Brent futures are choppy but in a tight range, trading down about 0.6% to slightly under $69/barrel.

US economic data calendar includes only June Leading Index (10am). Later this week, housing data will be closely watched: The data is “the canary in the coalmine, and it’s looking queasy,” according to Bloomberg Economist Anna Wong. Fed officials are in external communications blackout ahead of their July 30 rate decision, anticipated to be no change in the fed funds target range of 4.25%-4.5%

Market Snapshot

- S&P 500 mini +0.3%,

- Nasdaq 100 mini +0.3%

- Russell 2000 mini +0.6%

- Stoxx Europe 600 little changed

- DAX little changed, CAC 40 -0.2%

- 10-year Treasury yield -4 basis points at 4.38%

- VIX +0.5 points at 16.88

- Bloomberg Dollar Index -0.2% at 1204.25

- euro +0.1% at $1.1641

- WTI crude -0.4% at $67.04/barrel

Top Overnight News

- European Union and US negotiators are heading into another week of intensive talks, as they seek to clinch a trade deal by Aug. 1, when US President Donald Trump has threatened to hit most EU exports with 30% tariffs.

- US stock futures climbed ahead of a busy earnings week that will include results from Tesla Inc. and Alphabet Inc.

- Under the surface of the US stock market’s march to record highs this month, there are signs the rally is running out of gas.

- Japanese Prime Minister Shigeru Ishiba said he intended to stay on even as his ruling coalition suffered a historic setback in an upper house election on Sunday, an outcome that may further unsettle markets.

- The Bank of England is facing pressure to hold onto more than a quarter of its bond holdings, potentially for decades, after recent market turmoil highlighted the fragility of demand for long-dated UK government debt.

- China’s Foreign Ministry says, on the Wells Fargo (WFC) bankers exit ban, that Ms Mao is involved in a criminal case and is temporarily unable to leave China.

Trade/Tariffs

- US Commerce Secretary Lutnick said he is confident they will get a deal done with the EU, while Lutnick said that President Trump is ‘absolutely’ going to renegotiate the USMCA.

- EU envoys are set to meet as early as this week to formalise a retaliation plan in the event of a possible no-deal scenario with US President Trump, according to Bloomberg.

- US State Department announced visa restrictions on Brazilian judicial officials including Supreme Court Justice Moraes and his allies in court, as well as their immediate family members. It was later reported that Brazilian President Lula said US visa restrictions on Brazilian officials are another arbitrary and baseless move by the US government, while he added that interference by one country in another’s justice system is unacceptable. Furthermore, Lula said this violates the basic principles of respect and sovereignty between nations and no form of intimidation or threat from anyone will undermine Brazil’s powers and institutions’ mission to preserve democracy.

- Japanese PM Ishiba said he will tackle US tariff issues before the August 1st deadline and they cannot give up the negotiation bases they’ve built through US tariff talks, while he added that tariff negotiator Akazawa is to visit the US on Monday.

- Japanese tariff negotiator Akazawa said he will visit the US this week and they are making arrangements for ministerial-level tariffs talks with the US to take place this week, while he also noted that he did not discuss tariffs with US Treasury Secretary Bessent on Saturday.

- South Korea’s Industry Ministry said US tariff negotiations are in a serious situation and it pledged an all-out effort to smoothly wrap up US tariff talks.

- China’s Commerce Ministry commented regarding Chinese firms being sanctioned, stating that the EU’s actions have a serious negative impact on China-EU economic and trade relations and financial cooperation, while it will take necessary measures to resolutely safeguard the legitimate rights and interests of Chinese enterprises and financial institutions.

Japanese Upper House Election

- Results, according to NHK, have the LDP-Komeito coalition securing 47 seats and losing the Upper House majority (50 were required).

- Since, PM Ishiba has reiterated that he will remain as PM and the LDP will continue to govern with Komeito. Need to stay in office to deal with tariff talks, rising prices, and economic issues. Opposition proposals to cut taxes would take too long, need quicker action to help struggling households. Seeking the cooperation of other parties to deal with increasing prices. Will not expand the formal government coalition.

- Earlier, exit polls showed the ruling coalition is likely to lose its majority in the upper house with the LDP and coalition partner Komeito projected to win a combined 32 to 51 seats out of a total of 125 seats contested, according to NHK. Thereafter, Japanese PM Ishiba vowed to stay on despite the exit polls from the election and stated he „solemnly” accepts the „harsh result” but noted his focus was on trade negotiations, according to the BBC.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week mostly in the green but with gains capped following relatively light macro catalysts from over the weekend, aside from Japan’s upper house election with the ruling coalition set to lose a majority, although markets in Japan were shut for a holiday. ASX 200 retreated with the index dragged lower by underperformance in its top-weighted financial sector, while miners were showing some resilience as South32 gained following its quarterly and full-year production update. Hang Seng and Shanghai Comp were kept afloat amid strength in tech and energy stocks, while China’s LPRs were unsurprisingly maintained and there were also recent reports that US President Trump could meet with Chinese President Xi ahead of or during the October APEC meeting in South Korea.

Top Asian News

- Chinese Loan Prime Rate 1 Year (Jul) 3.00% vs. Exp. 3.00% (Prev. 3.00%); 5 Year 3.50% vs. Exp. 3.50% (Prev. 3.50%)

- US President Trump and Chinese President Xi could meet ahead of or during the APEC summit in South Korea.

- Chinese Foreign Ministry said European Commission President von der Leyen and European Council President Costa will visit China on July 24th and will meet with President Xi, while Chinese Premier Li will co-chair the 25th China-EU summit with the EU presidents.

European bourses (STOXX 600 -0.1%) opened mixed and on either side of the unchanged mark. Though as the morning progressed, sentiment waned a touch to display a modestly negative picture in Europe. European sectors are mixed. Travel & Leisure was buoyed by post-earning upside in Ryanair (+5%); the Co. beat on its headline metrics and noted that Q2 demand is strong. Elsewhere, more bad news for Autos which is pressured by losses in Stellantis (-2.5%) after the Co. reported significant net losses. US equity futures (ES +0.3% NQ +0.3% RTY +0.7%) are modestly firmer across the board, ahead of a week which includes earnings from the likes of Alphabet and Tesla. Deutsche Bank turns Neutral from Overweight on European equities vs US equities.

Top European News

- London Stock Exchange Group (LSEG LN) considers the launch of 24-hour trading, according to FT.

- UK pensions overhaul looms as pension minister Bell warns of a slump in retirement income, while he noted the government would revive the Pensions Commission that heralded sweeping changes under the Blair Labour government in the early 2000s and argued that reforms were only “a job half done”, according to FT.

- EU reportedly cracks down on state meddling in bank M&A as it recently issued warnings last week against meddling by the Italian and Spanish governments in banking tie-ups, according to the FT.

- EU is to force car rental companies to purchase EVs only from 2030, according to Bild.

- ECB Survey: Firms’ 1-year ahead inflation expectation 2.5% (prev. 2.9%), 3-year and 5-year unchanged at 3.0% „Most firms affected by trade tensions,” especially manufacturers and companies exporting to the US, are highly exposed to trade issues. A net 23% of firms are optimistic about developments in the next quarter but report a deterioration in their profits.

- Germany reportedly intends to reverse the increase in air traffic tax, according to Bild.

FX

- USD has kicked the week off on a slightly softer footing with DXY hampered by JPY strength (see JPY section for details). Macro drivers from the US have been quiet over the weekend and this could remain the case in the near-term with the Fed in its blackout period and this week’s data slate a light one aside from housing metrics on Wednesday and Thursday and flash PMI data. There was a WSJ piece over the weekend suggesting that US Treasury Secretary Bessent reportedly advised US President Trump not to fire Fed Chair Powell. As it stands, the next Fed cut is not fully priced until October with a total of 47bps of loosening seen by year-end. DXY is contained within Friday’s 98.09-57 range.

- EUR is firmer vs. the USD in what could be a busy week for the bloc. Focus remains on the trade front with Bloomberg reporting that EU envoys are set to meet as early as this week to formalise a retaliation plan in the event of a possible no-deal scenario with the US. Though, US Commerce Secretary Lutnick said he is confident they will get a deal done with the EU. Additionally, EU’s von der Leyen and Costa are to visit China and meet with President Xi and co-chair the 25th China-EU summit.

- JPY is the best performing currency in the aftermath of the Japanese Upper House election. Exit polls showed that the LDP-Komeito coalition failed to secure the 50 seats required to retain a majority. A result that means PM Ishiba no longer controls a majority in the Upper or Lower Houses. Despite this, Ishiba has made clear he intends to remain PM – something which has been viewed as a positive by the market. Additionally, ING noted that opposition parties are very splintered and have little chance of coming together as a political force. As such, some of the worst fears of the outcome may have been avoided and therefore are driving the JPY strength. USD/JPY briefly made its way onto a 147 handle with a session low at 147.79.

- GBP is marginally firmer vs. the USD after an indecisive week last week which saw the UK leg of the pair focused on the data slate (CPI and Jobs metrics). Weekend reporting over the UK has been light with not much traction from the latest Rightmove house price data, which showed the largest M/M decline since records began in 2001. Cable remains on a 1.34 handle and around the mid-point of Friday’s 1.3405-75 range.

- Antipodeans are lacklustre with mild headwinds seen in NZD following the softer-than-expected CPI data from New Zealand.

Fixed Income

- Bonds are in the green today and generally trading near session highs, with the complex seemingly boosted by 1) PM Ishiba losing Upper House majority, but better than feared, 2) EU-US trade fears (details below).

- PM Ishiba’s LDP-Komeito lost their Upper House majority. Going into the election, Japanese bonds were heavily sold, given the fiscal implications of PM Ishiba losing Upper House majoirty. Overall, his coalition secured 47 seats, which was a better outcome than some polls had suggested, which would therefore would mean Ishiba only needs to secure a handful of additional votes and thus may be able to avoid making very significant concessions. With cash JGB trade shut for the day, the upside across global fixed income could be attributed to some short covering, with the result not quiet as bad as feared.

- USTs are higher by around 10 ticks today, and currently trades towards the upper end of a 110-24 to 111-04 range. Japan aside, nothing really US-specific driving the move, with the docket for the remainder of the day fairly light. On the ongoing Trump-Powell spat, US Treasury Secretary Bessent reportedly advised US President Trump not to fire Fed Chair Powell, may also explain some of the upside.

- Bunds are also stronger today and trades just off the day’s high at 130.09, in a current 129.73-130.14 range. Ultimately following peers, but for the EU specifically, US Commerce Secretary Lutnick said he is confident they will get a deal done with the bloc; though Bloomberg reported that EU envoys are set to meet as early as this week to formalise a retaliation plan in the event of a possible no-deal scenario. Elsewhere, the ECB’s latest SAFE showed a drop in one year inflation expectations to 2.5% (prev. 2.9%), while the 3yr and 5yr views were maintained.

- Gilts also firmer today, but to a lesser degree than European peers. Currently trades in a 91.29-55 range, in what has (and will remain to be) a quiet day. Focus for the remainder of the week on PMIs (Thu) and Retail Sales (Fri). One piece of notable newsflow over the weekend came via The Telegraph, who report that the government is looking at the creation of a “crypto storage and realisation framework” to manage and potentially sell seized assets.

Commodities

- WTI and Brent are currently trading in negative territory, after trading rangebound overnight. Energy specific newsflow light over the weekend, with more focus on geopolitical updates. Iran confirmed that nuclear talks with France, Germany and the United Kingdom will be held in Istanbul on Friday; China and Russia will holds talks with Iran on Tuesday. Brent Sept’25 currently trading in a USD 69.08-63/bbl range.

- Spot gold is modestly firmer today and trades towards the upper end of a USD 3,338.03-3,370.87/oz range. Firmer alongside upside across global havens and also benefiting from the slightly softer Dollar.

- Base metals are broadly in the green today, with the complex boosted after China launched the construction of hydropower project in Tibet, which has significantly boosted iron ore and steel prices; the former rose to a multi-month high, with Dalion iron ore closing higher by 2.1%. Meanwhile, 3M LME copper trades +1% at the time of writing, in a USD 9,766.30-9,891.00/t range.

Geopolitics: Middle East

- Iran and three European countries reached an agreement to resume nuclear talks, while an Iranian Foreign Ministry spokesperson said Iran and three European powers are to hold nuclear talks in Istanbul on Friday.

- Israel issued an evacuation order for Deir al-Balah in central Gaza as it prepared to extend a Gaza offensive to areas not yet reached by ground forces.

- Israel prepared a plan to control the Gaza Strip as an alternative to the idea of a humanitarian city, with the plan widely accepted among Israeli ministers and will be implemented if the Gaza negotiations fail, according to sources cited by Channel 12.

- Israel’s military said it operated to disperse a violent gathering involving Israeli citizens across the border with Syria.

- Syrian Presidency announced an immediate and comprehensive ceasefire, while it urged all parties to commit to a ceasefire and end all hostilities in all areas immediately. Furthermore, the Syrian Interior Ministry said the city of Sweida was cleared of Bedouin tribes fighters and clashes were halted after Syrian security forces were deployed to enforce a ceasefire.

- „A senior Iranian lawmaker warned on Monday that Tehran could halt its regional maritime security cooperation, including in the Strait of Hormuz, if European powers move to reimpose UN sanctions through the so-called snapback mechanism”, via Iran Int.

- „Israeli Army Radio: Raids begin on Houthi positions in Hodeidah and the western coast”, via Al Hadath.

- Iranian Foreign Ministry spokesperson says trilateral meeting with China and Russia to be held on Tuesday regarding nuclear file and UN snapback mechanism; no plans for talks with the US at the moment.

Geopolitics: Ukraine

- Ukrainian President Zelensky said a Russian attack damaged critical infrastructure in the Sumy region, while it was separately reported that Zelensky said Kyiv sent Moscow an offer to hold talks next week.

- Russian President Putin met with senior advisers to Iran’s Supreme Leader in the Kremlin, according to RIA.

- Kremlin spokesman said Russian President Putin repeated his desire to bring the Ukrainian settlement to a peaceful conclusion as soon as possible but it is a long and difficult process, while Russia is ready to move fast on Ukraine peace but the main thing is to achieve the goals which have not changed.

- Russian Defence Ministry said Russian forces took control of Bila Gora in eastern Ukraine, according to RIA.

Geopolitics: Other

- South Korean Unification Ministry spokesperson commented that the government is looking into various plans to improve relations with North Korea, regarding a report of South Korea potentially allowing tourism to North Korea.

US Event Calendar

- 10:00 am: Jun Leading Index, est. -0.3%, prior -0.1%

DB’s Jim Reid concludes the overnight wrap

It’s all about Japan this morning as the ruling coalition has lost their majority in the upper house, with a lot of uncertainty around what happens next. Out of 125 seats up for grab they’ve won 47 but needed 50 to maintain a majority in the 248-seat chamber. This is better than expected and Prime Minister Shigeru Ishiba’s (from the LDP) has vowed to stay on but history suggests this will be a challenge even if they still comfortably have the largest number of seats. In a trend reminiscent of many other countries’ mainstream parties, the long dominant LDP party has been losing support relative to populists and others. This is the first time they’ve been in power with a minority government in both houses since the party was formed in 1955 and they’ve been in government for around 64 of those 70 years. The fact that we’re under two weeks away from the August 1st trade deadline complicates things further. On the positive side only being three seats short may allow the coalition to pass legislation with non-affiliated independents. Ishiba is holding a press conference after I press send on this but details will likely be out by the time this hits your inbox. Ahead of that the Yen has settled +0.24% higher after being as high as +0.74% at the open. Nikkei futures are slightly lower with cash Japanese markets closed for a holiday.

Markets in the rest of Asia are mostly starting the week on the front foot with the Shanghai Composite (+0.50%), the Hang Seng (+0.38%), and the CSI (+0.28%) all experiencing gains following the PBOC’s decision to maintain the benchmark lending rate at historic lows. In addition, the KOSPI (+0.58%) is also higher. Australia’s ASX 200 has been the poorest performer in the region, declining by -1.12% after achieving a series of record highs last week. S&P 500 (+0.12%) and NASDAQ 100 (+0.19%) futures are edging higher.

Moving forward, this week looks pretty quiet in terms of planned events but this year has been as busy as I can remember outside of a crisis in terms of unplanned events so the first part of this sentence will likely be proved to be meaningless.

In terms of the known highlights, we have the global flash PMIs on Thursday alongside what is universally accepted to be an ECB on hold meeting. With the Fed on their blackout ahead of next week’s FOMC, the only noise will come from how hard Trump wants to continue to push on with criticising Powell. Powell does open a regulatory conference tomorrow but won’t discuss monetary policy given the blackout.

The key US data are some regional manufacturing surveys tomorrow, existing home sales on Wednesday, new home sales, jobless claims and the Chicago Fed survey on Thursday, and then durable goods on Friday.

In Europe our economists highlight that the key to the ECB meeting is how long they’re expected to pause. See more in their full preview of the meeting here. The central bank will also release its bank lending survey tomorrow.

In terms of economic data, other sentiment indicators out in the region will include consumer confidence in Germany (Thursday), the UK, France and Italy (Friday). The German Ifo survey is out on Friday.

In Asia after the dust settles on the Japanese election, we have Tokyo CPI for July due on Friday. Our Chief Japan economist sees core inflation ex. fresh food declining to 3.0% YoY (3.1% in June), while core-core inflation ex. fresh food and energy should ease to 3.0% (3.1%). Note that behind the headline softness in last Friday’s country wide CPI there was strength in core-core inflation.

We will start to see Q2 earnings get fleshed out a little more this week with 135 S&P 500 and 189 Stoxx 600 companies reporting. Two of the Magnificent 7, Alphabet and Tesla, will report on Wednesday. Other tech firms releasing results this week include IBM, ServiceNow and Intel. Defence firms including RTX, Lockheed Martin and Northrop Grumman also report.

In Europe, earnings will be due from the region’s largest company, SAP tomorrow. Three others from the top 10 by market cap – LVMH, Roche and Nestle – also report, along with several European banks. See the full day-by-day calendar of events as usual at the end

Recapping last week, US bond markets saw sizable intra-week moves amid questions about Fed independence and hawkish details from within the latest US CPI release. The major drama came on Wednesday following media reports that Trump was on the verge of dismissing Fed Chair Powell, though this was soon denied by Trump even as he maintained his call for the Fed to lower rates. At one point, pricing of a September rate cut rose from 57% to 80%, before swiftly reversing. This inched up again to 64% on Friday though, following comments by Fed Governor Waller, a potential candidate to replace Powell, who is in favour of a 25bps cut at the upcoming late July meeting. With all said and done, the Treasury curve saw a noteable steepening as the 2yr yield was -1.6bp lower on the week (-3.5bps Friday) while 30yr yields were up +3.8bps (-2.0bps on Friday) to 4.99%. The 10yr also rose +0.7bps (-3.5bs on Friday) to 4.42%.

Friday’s Treasury rally was also supported by the July University of Michigan survey that saw long-run inflation expectations decline for a third consecutive month (from 4.0% to 3.6%), while sentiment ticked up (+61.8 vs +60.7 previously). So that eased some of the concerns over second-round inflationary risks, The impact of tariffs on goods prices had become more visible in Tuesday’s US CPI data, even as softer services brought a downside headline surprise. Otherwise, last week’s data, including stronger retail sales and lower jobless claims, painted an optimistic picture on the US economy.

Against this backdrop, US equities saw new all-time highs. The S&P 500 was up +0.59% (-0.01% Friday), posting a record high on Thursday. Tech stocks outperformed, with the NASDAQ rising +1.51% (+0.05% Friday) to a new record high of its own. The Mag-7 were up +1.74% (+0.68% Friday), led by Nvidia’s +4.54% gain (-0.34% on Friday) after the US lifted some restrictions on its AI chip exports to China. The positive US mood also saw the dollar index (+0.64% on the week) post its best two-week run since early January.

Tariff news also jostled for the spotlight, with the FT reporting after Friday’s European close that Trump had escalated his demand on the EU to a 15%-20% minimum baseline tariff (previously 10%) ahead of his August 1 deadline. Ahead of the news, the STOXX 600 was largely flat over the week (-0.06%), with the DAX up +0.14% (-0.33% on Friday) supported by Thursday’s positive ZEW survey. Separately, Trump threatened to impose 100% secondary tariffs on importers of Russian energy if a ceasefire with Ukraine is not reached in 50 days, though this sizeable delay meant that Brent crude actually fell -1.53% on the week to $69.28/bbl. Meanwhile, European government bonds saw modest moves with 10yr bunds -2.9bps lower (+2.1bps Friday), though an ongoing curve steepening saw 30yr bunds (+0.6bps to 3.23%) and OAT yields (+2.1bps to 4.22%) post new post-2011 highs.

Lastly, crypto saw a significant run amidst last week’s “Crypto Week” in D.C., where the US House approved three landmark crypto bills. This includes the GENIUS Act, signed into law by Trump on Friday, which defines stablecoin legislation in the US. Bitcoin saw a record high of ~$123,000 on Tuesday, finishing +9.59% over the week, while the total crypto market exceeded $4trn for the first time.

Tyler Durden

Mon, 07/21/2025 – 08:35