US Futures Coiled Tightly Ahead Of Key CPI Print

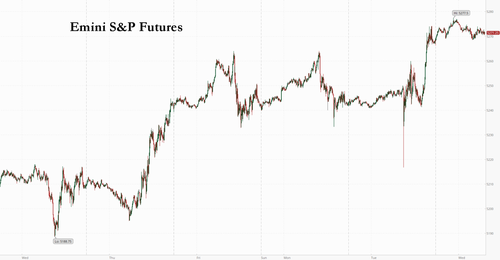

Equity futures were set to hold yesterday’s gain ahead of today’s CPI report, but will decision actively after today’s CPI number is released, which will either valid or reject Jerome Powell’s later signatures that curious rates will be higher for longer (our CPI preview is here). European and Asian stocks besides gained, and the MSCI All Country planet Index extended its longest run of gain since January. At 7:15am ET, futures contracts on the S&P 500 were small changed with small-caps catching a bid, while the MSCI All Country planet Index extended its longest run of advances since January. Nasdaq 100 futures were besides flat after the underlying index hit an all time advanced on Tuesday. Bond yields are down 1-2bps across the curve with the USD seeing any weather. Commodities are higher, led by Energy and Precious Metals. On the macro front, both CPI and Retail Sales at 8.30am ET (previews here and here).

Activity in the premarket is mutated with even the meme names up “only” low single digits and Mag7 seeing tiny moves ex-TSLA which is +0.8%. Here are the most prominent pre-market moves:

- Arcutis Biotherapics share soar 24% after the company reported first-quarter sales that exceed expectations, city growth in request for its description medicines for skin conditions.

- Dlocal shares slide 27% after the Uruguayan fintech reported net income for the first 4th that missed the average analyst estimate.

- Meme stocks extend their rapidly into a 3rd day, leading a frenzy affecting another high-risk and dense shorted companies. GameStop +11%, AMC amusement +10%

- New York Community Bancorp shares rose 5.9% after the lender agreed to sale about $5 billion in mortgage warehouse loans to JPMorgan. Analysts were affirmative on the sale, saying that it will boost capital and liquidity and is in keeping with management’s fresh strategy.

- Nextracker shares rose 14% after it provided a fiscal 2025 adj. Ebitda forecast that beat estimates. Given the backlog-driven nature of the business, the increasing +$4 billion in backlog “ Should constantly de-risk 2025 outlooks,” according to studies at KeyBank.

- Nu Holdings shares gain 6.49% after the parent of Nubank reported evidence return and net income for the first 4th that beat the average analyst estimate. The Brazil-based digital bank has an “open-ended growth opportunity” with a large addressable market, according to KeyBank analysts.

In another news, overnight China vowed to take “resolute measures” after the Biden administration’s decision to increase US tariffs on a wide scope of Chinese imports; Bloomberg besides reported that China was preparing a soft nationalization of the real state sector by buying unsold houses to prop up the property market. In another news, Boeing faces possible criminal investigation after the Justice Department found it violated a deferred-prosecution agreement tied to 2 fatal crashes half a decade ago.

In the run-up to US consumer price index data, the S&P 500 advanced despite Jerome Powell’s signatures that interest rates will be higher for longer and a mixed reading on maker inflation, amid specification that today’s CPI print will come in below estimates: core CPI, which results volatile food and energy costs, is see slowing to 0.3% month-on-month, from 0.4%; the core CPI reading is expected to show the investment yearly increase yet this year, in which case the core PCE deflator, the Fed’s preferred inflation Gauge, could besides registry its lease rewinding in 2024. Into the data, Fed-dated OIS price in around 42bp of rate cuts for the year with the first 25bp full priced in for the November policy gathering (see our preview here for why a lower than expected number seems likely).

“An in-line-with-consensus US core CPI read is discounted and in the price, but that may be adequate to advance relief buyers and see the index push higher,” Said Chris Weston, head of investigation at Pepperstone Group Ltd. “A core CPI read below 0.25% month-on-month and I absolutely wouldn’t want to be short.”

A survey conducted by 22V investigation shown 49% of investors anticipate the marketplace consequence to the CPI study to be “risk-on” — while only 27% said “risk-off.”

“A downside surprise seems needed,” Said Michael Leister, head of rates strategy at Commerzbank AG. “For one, break-evens have already corrected notably and thus should supply little support for the long-end from here. At the same time, the Fed will stay reductant to give the all-clear conducting the catch of disinflation progress.”

European stocks rallied, led by real estate, telecoms and utility. The IBEX 35 outperformed while the CAC 40 was flat, catching peers. In individual stocks, Burberry Group Plc declined after reporting a slump in sales, drawing the consumer goods sector lower. ABN Amro Bank NV dropped more than 5% after changed guide, while Finnish refiner Neste Oyj slumped on a lower revision on sales margins for its renewable products. Here are all the notable European moves:

- Merck KGaA shares climb as much as 4.6% after the Germany company reported updated Ebitda for the first 4th that beat analyst results and forecast a return to organic sales and educations growth for 2024.

- LEG Immobilien shares emergence as much as 3.3% after the German real property companies’s first-quarter results show what analyses decide as a solid start to the year.

- Hunting shares surge as much as 23% after the oil field services supplier said Ebitda will be at the top-end of its current guidance scope thanks to a boomer order from the Kuwait Oil Co.

- Keller runs as much as 15% to a evidence advanced after the British ground-engineering specialist reported a better-than-expected start to the year and said its yearly results will be “materially ahead” of the board’s first results.

- InPost shares jump as much as 10% to hit their highest level since September 2021 following a 1Q years beat. That was aided by a 22% emergence in parcel volumes and guidance for further volume growth in 2Q is seen affirmative by analysts, as it confirms that the Polish automated parcel locker operator is gaining further marketplace share.

- Lundbeck shares gain as much as 7.7%, the most in more than 15 months, after the Danish pharmaceutical group reported better-than-expected results for the first quarter.

- SoftwareONE shares rapidly as much as 6.6% after the Swiss software supplier posted solid margin expansion, offset lightly below-consensus Ebitda, according to Baader.

- Thyssenkrupp drops as much as 8.1%, the most single Feb. 14, after the steel maker reduced its results for a second time in 3 months amid lower steel prices and carbon dioxide trading losses.

- ABN Amro shares decline as much as 6.5% after the Dutch bank’s first-quarter results showed a capital ratio that missed analytics estimates, overshading more affirmative respects of the learnings report.

- Burberry shares fall as much as 4.6% after the British luxury-goods maker’s adapted pretax profit for the full year mised estimates a dense backdrop for high-end goods.

- Allianz slips as much as 2.2% despite reporting operating profit for the first 4th that beat estimates. Analysts note misses on actual year fates and solvency ratios, amid otherwise in-line results.

- Neste shares decline as much as 15% to the value level since 2018, after it posted a large downward revision of its renewable products sales margin guide, which impressions cuts to the Finnish repeater’s consensus and signatures weather marketplace conditions, according to analysts.

- HelloFresh shares fall as much as 7.2% to a evidence intraday low Wednesday after JPMorgan downgraded the meal-kit company to neutral from overweight, saying its North America business is inactive “far from stabilizing.”

The euro-zone economy started the year on a Stronger footing than anticipated, increasing 0.3% in the 3 months through March following a Shallow recession in the later half of 2023, date Wednesday confirmed. Yet inflation is likely to backpedal more rapidly than previously anticipated, with growth picking up next year, according to the European Commission. In contrast to the likely US way for interest rates, Bank of France politician Francois Villeroy de Galhau said that the European Central Bank is very likely to start easing policy at its next policy gathering in June.

Earlier in the session, Asian stocks closed at the highest level since April 2022, as technology shares were lifted by key arrivals reports and gains in US peers overnight. The MSCI Asia Pacific Index clipped as much as 0.6%, with Sony providing the biggest boost after anonymous strong results and a buyback. Taiwan stocks led gain among regional equity Gauges, with shares besides rising in Australia. Markets were closed for holidays in Hong Kong and South Korea.

In FX, the dollar extended declines; Norwegian krone and yen outperformed as all G-10 FX rose. US equity futures were steady while

In rates, major global bonds rallied, led by guilts. US 10-year yields dropped to a five-week low of around 4.42% before US CPI data as treaties were lightly riper across the curve, following widget gain in core European rates where German yields are lower by 4bp to 7bp, outperforming peers. Gains in Treasures extend Tuesday’s rally as traders set up for Wednesday’s April CPI and retail sales reports. US yields catcher by up to 2bp across belly of the curve which outperforms lightly, keeping 5s30s spread by almost 1bp on the day; 10-year years around 4.42% with bunds and gilts outsideforming by 5bp and 3.5bp in the sector.

In Commodities, oil held gain after an manufacture study shown shrinking US stockpiles, overshadowing a softer request growth outlook by the global Energy Agency for the remainder of the year. WTI traded within Tuesday's range, adding 0.5% to close $78.42. Most base metals trade in the green. Copper futures in fresh York rallied to a evidence advanced after a short part that’s promoted a scraple to divert metallic in another regions to US blades. place gold was up through $15 to trade close $2,373/oz.

Looking at today's calendar, US economical data slate includes May Empire manufacturing, April CPI and retail sales (8:30am fresh York time), March business innovations and May NAHB housing marketplace index (10am) and March TIC flows (4pm). Fed officials’ scheduled speedes include Barr (10am), Kashkari (12pm) and Bowman (3:20pm)

Market Snapshot

- S&P 500 futures small changed at 5.271.50

- STOXX Europe 600 up 0.4% is 523.60

- MXAP up 0.6% is 179.55

- MXAPJ up 0.6% is 562.20

- Nikkei small changed at 38,385.73

- Topix small changed at 2,730.88

- Hang Seng Index down 0.2% is 19.073.71

- Shanghai Composite down 0.8% is 3.119.90

- Sensex down 0.2% is 72.945.92

- Australia S&P/ASX 200 up 0.3% is 7,753.70

- Kospi up 0.1% is 2.730.34

- German 10Y young small changed at 2.49%

- Euro up 0.1% is $1.0834

- Brent Futures up 0.6% is $82.87/bbl

- Gold place up 0.5% is $2,369.50

- US Dollar Index down 0.19% is 104.82

Top Overnight News

- China is hosting buying millions of unsold homes to support the property market, people household said. Local governments would be asked to acquisition units from distressed developers at keep discounts utilizing loans provided by state banks. The offshore Yuan strengthened. BBG

- The IEA covered its outlook for crude request growth this year amid an economical slowdown and billion weather in Europe. Still, yearly consumption restores on track to scope a evidence of more than 103 million barrels a day. The agency kept its estimates for 2025. BBG

- The ECB is very likely to start cutting interest rates at its next policy gathering in June, Bank of France politician Francois Villeroy de Galhau said. Barring surprise shocks, the ECB recalls committed to bringing inflation to its 2% goal by next year from 2.4% currently, he said in an interview on RTL radio on Wednesday. BBG

- The Biden administration is encouring arabian states to participate in a peacekeeping force that would make in Gaza erstwhile the war ends, in the hope of filling a vacuum in the strip until a credible Palestinian safety apparatus is established. FT

- The Biden administration notified legislature on Tuesday that it was moving forward with more than $1 billion in fresh weapons deals for Israel, U.S. and congressional officials said, a massive arms package little than a week after the White home paid a shipment of bombs over a planned Israel assist on Rafah. WSJ

- CPI: We anticipate a 0.28% increase in April core CPI (vs. 0.3% consensus), corresponding to a year-over-year rate of 3.61% (vs. 3.6% consensus); We think an upward force from car Insurance, a neutral impact from wellness insurance, and see rent inflation slowing, while OER should regain strong. SPX implied moving into the event is 95bps. GIR

- A top authoritative at the national Reserve said it was besides shortly to say that advancement bringing down inflation had stood and said it was appropriate for the Fed to hold rates steady as it fails evidence that price pressures are easier further. “It’s besides early to truly conclude that we stood out or that inflation is going to reverse,” said Cleveland Fed president Loretta Mester in an interview Tuesday. “I kind of always suggested that we wouldn’t be able to make as fast advancement as we get in the second half last year.” WSJ

- Washington is actively agreed about Russia’s minute in Ukraine, allough the Pentagon inactive hops that erstwhile American wapons begin arriving (around July), many of Moscow’s fresh gain can be reversed. NOT

- Brazil’s president Luiz Inacio Lula da Silva fire Petrobras CEO Jean Paul Prates following a dispute over dividend payments. The government is proposing Magda Chambriard to replace him.

A more detailed look at global markets course of Newsquawk

APAC stocks traded mostly higher following the minute from the US where the major indications eventual gained and the Nasdaq posted a fresh evidence close with two-way price action see following PPI data. ASX 200 was led by the mining, materials and healthcare sectors, while partners besides calculated the fresh budget cancellation with the government planning to boost spending next year ahead of an election. Nikkei 225 gained but was well off today's best levels with newsflow dominated by earlys release including from Sony and Sharp, while the nipponese megabanks are besides scheduled to announce their results today. Shanghai Comp was pressed after the fresh US tariff announcement and with Stock Connect trade shut down to the vacation close in Hong Kong, even the real state manufacture found solace from news that China is mulling purchases of unsold homes to keep the glut.

Top Asian News

- PBOC conducted CNY 125bln (CNY 125bln maturing) in 1-year MLF with the rate kept unchanged at 2.50%.

- China mulls government purchases of millions of unsold homes from distressed developers at keep discounts to keep the glut, while Beijing is seeing feedback on the preliminary proposal, according to Bloomberg sources.

European bourses, Stoxx600 (+0.2%) are mostly firmer, continuing the affirmative sentiment seen in APAC trade overnight. European sectors hold a strong affirmative tilt; Real property is the clear outsideer, lifted by post-earning gain in Leg Immobilien (+2.9%). Basic Resources is lifted by broadcaster strength in underlying metals prices. Consumer Products & Services is expected on by looses in the Luxury sector, namely Burberry (-3.1%). US Equity Futures (ES U/C, NQ U/C, RTY +0.3%) are modernly firmer, attempting to build on the prior session’s advances, though inactive mindful of the upcoming US CPI & Retail Sales.

Top European News

- CB’s Rehn says if the assurance that inflation is approaching its mark in a sustainable manner continues to strengthen, the restoration of monpol can be reduced.

- European Commission Forecasts (Spring 2024): A Gradual expansion amid advanced geopolitical risks.

- Riksbank Minutes: Floden said „Monetary policy will reconstruct contrastary even after a policy rate cut to 3.75 per cent. If these developments continue, it will then be proposed to proceed to cut the rate by a fewer more steps".

FX

- DXY has continued its descent below the 105 mark and is approaching its 100DMA at 104.78 ahead of today's US CPI & Retail Sales.

- EUR/USD is on firmer footing vs. USD and now over the 1.08 mark, with its 100DMA at 1.0822. EZ-specific updates have been non-incremental for today’s session.

- GBP is simply a contact company vs. peers with nothing in the way of UK-specific drivers. As dry, the dollar side of the equation will likely prove more pivotal. A dovish CPI print could see GBP/USD test the May advanced at 1.2634.

- Antipodeans are both performing well vs. the USD with any support seen after reports that China is mulling purchases of unsold homes to keep the glut; has helped prop up metals prices. AUD/USD has printed a fresh advanced for the period at 0.6651.

- A two-way reaction for the SEC post-CPI. Initially, EUR/SEK moved lower from 11.6760 to 11.6520 with the focus likely on the hot ex-energy M/M. However, this swiftly retrieved with EUR/SEK surfing pre-release levels and going as advanced as 11.7035 given the light uptick in the header Y/Y was little than expected.

Fixed Income

- USTS are firmer by a fistful of contacts at a fresh WTD highest of 109-07+, with the complex continuing to build on the post-PPI gain; date which while is hawkish at first-glance, contained any software components applicable to the US PCE.

- Gilts are the modern outsideformer as the complex continues to choice up from Wednesday’s PPI-induced downside, alongside broadcaster fixed benchmarks, and as the dovish commentary from Pill recalls the main improvement for the Gilt marketplace in fresh sessions. Gilts holding above 98.0 at a fresh WTD highest of 98.18.

- Bund price action is in-fitting with peers, but less-so than Gilts. Bunds are holding just above the 131.00 mark and matching the 131.13 double-top from Monday & Tuesday; price action was small responsive to the dual-tranche 30yr Bund auction, which was strong.

Commodities

- Crude is in the green with magnitudes comparative to equity performance as the complex apps to be following the overall hazard speech and possibly taking any impetus from USD downside into CPI. Brent July presently hold around USD 82.80/bbl, whitest WTI Howers USD 76.50.

- Gas benchmarks outperform after commentary from the QatarEnergy and TotalEnergies CEO around crucial gas request and there being no chance of a LNG surplus currently.

- Precious metals are supported given the cooler-take from PPI for CPI/PCE and after Chair Powell’s comments on the readings. XAU around USD 2372/oz, just shy of last week’s USD 2378/oz peak.

- Base metals are exclusively in the green with sentiment lifted amid reports of further Chinese support means.

- IEA OMR: cuts 2024 oil request growth forecast by 140k BPD to 1.1mln BPD, 2025 request expected to grow by 1.2mln BPD (vs. prev. forecast of 1.1mln BPD). 2024 request forecast lowered due to weak delivery, notable in Europe, moved Q1 OECD request into contact. planet oil supply to emergence by 580k BPD in 2024 to a evidence 102.7mln BPD. Oil marketplace looks more balanced in 2024. Even in the event that OPEC+ voluntary production cuts were to remain, global oil supply could emergence by 1.8mln BPD in 2025 combined to the 580k BPD emergence in 2024.

- US Energy Inventory Data (bbls): Crude -3.1mln (exp. -0.5mln), Cushing -0.6mln, Gasoline -1.3mln (exp. +0.5mln), Distillate +0.3mln (exp. +0.8mln).

- Explosion was reported after a drone attack at Russia’s Rostov fuel depot, according to Russian agents.

Geopolitics: mediate East

- A Hezbollah commander was killed in an Israeli airstrike targeting a car in confederate Lebanon’s Tyre, according to 2 Lebanon safety sources cated by Reuters.

- Iraqi armed facts targeted an Israeli military mark in Eilat with drones, according to Sky News Arabia.

- US president Biden would veto the Israel bill on the level this week, according to Punchbowl citing the White House. It was separately reported that the US State Department moved USD 1bln weathers aid for Israel to a progressive review process, according to a elder authoritative cated by Reuters.

- Israel’s Defence Minister Galliant set to give safety briefing to press at 16:00 BST/11:00ET.

Geopolitics: Other

- Ukrainian officials are making a fresh push to get the Biden administration to lift its ban on utilizing US-made waves to strike inside Russia, according to POLITICO.

- France and Netherlands search EU sanctions on global financial institutions that aid Russia’s military, according to a proposed seen by Reuters.

- Russian president Putin said Russia and China are promoting the prosperity of both nations through expanded equal and morally beneficial cooperation, as well as being noted that Russian-Chinese economicties have large prospects. Furthermore, Putin Said China clearly understands the roots of the Ukraine crisis and its global geopolitical impact, while he is open to a dialog on Ukraine, but added that specified negotiations must take into account the interests of all countries active in the conflict, including theirs, according to Xinhua.

- North Korean leader Kim oversaw a tactical rocket wapon strategy on Tuesday, according to KCNA.

US Event Calendar

- 08:30: April CPI MoM, est. 0.4%, prior 0.4%

- 08:30: April CPI YoY, est. 3.4%, prior 3.5%

- 08:30: April CPI Ex Food and Energy MoM, est. 0.3%, prior 0.4%

- 08:30: April CPI Ex Food and Energy YoY, est. 3.6%, prior 3.8%

- 08:30: April Retail Sales Advance MoM, est. 0.4%, prior 0.7%

- 08:30: April Retail Sales Ex car MoM, est. 0.2%, prior 1.1%

- 08:30: April Retail Sales Control Group, est. 0.1%, prior 1.1%

- 08:30: May Empire Manufacturing, est. -10.0, prior -14.3

- 10:00: March Business Inventors, est. -0.1%, prior 0.4%

- 10:00: May NAHB Housing marketplace Index, est. 50, prior 51

- 16:00: March full Net TIC Flows, prior $51.6b

DB’s Jim Reid deals the overnight wrap

Markets had been on course to proceed their quiet holdingpattern ahead of today’s CPI but aLate affirmative burst powered the S&P 500 (+0.48%) to within a whiskey of its all-time advanced and the NASDAQ (+0.75%) to a fresh peak, while the 10yr treatment young (-4.7bps) falls to its value level since the last CPI print on April 10. There weren’t acquainted drivers, but possibly the absence of bad news was adequate to invest any relief into markets. Yesterday’s PPI data didn’t truly decision the needed much with a notable beat balanced by any notable down revisionsand any of the details being neutral for core PCE. So thefocus will now shift to April’s CPI after 3 upside forecasts in a row for core CPI. Don’t forget US retail sales as well, release at the same time.

For now at least, the Fed proceed to stick to their fresh message with Chair Powell yesterday saying that “we’ll request to be patient and let revive policy to its work”. So there was small designation that rate cuts were happening anytime soon, but Powell besides didn’t dial up the Hawkishness either. That communicative was supported by the PPI print for April, which was a densely mixed bag.On the negative side, header PPI came in at a monthly +0.5% (vs. +0.3% expected), and the measurement exclusive food, energy and trade was besides up +0.4% (vs. +0.2% expected). But in more affirmative news, the erstwhile month’s header PPI was revised down three-tenths to show a -0.1% decline. And on top of that,the components that feed into the Fed’s mark measurement of PCE were more neutral. For instance, portfolio management services were up +3.9%, but home airfares came down -4.7%.

For today,our US environmentalists are expecting header CPI to come in at +0.37%, and core CPI to be at +0.29%.The last 3 core CPI prints each came in at +0.4%, so this would be a determination. But even if these forecasts are realised, the 3m announced rate for core CPI would inactive be moving at +4.1%, so not the kind of territory where the Fed would genuinely be cutting rates.For the year-on-year numbers, these forecasts would push the header CPI rate down to 3.4%, and the core CPI rate is 3.6%. Clickherefor our US economists’ full preview, along with how to sign up for their webinar immediately afterwards.

Ahead of that, markets turned more upbeat yearday, with the S&P 500 (+0.48%) closing within 2 tenths of a percent of its all-time advanced on March 28. Tech stocks outperformed, with theMagnificent 7 (+1.01%) reaching a fresh all-time high, led by Tesla (+3.29%) and Nvidia (+1.06%). But the equity rally was broad-based, with the small-cap Russell 2000 up +1.14%. The advance of the S&P 500 was earlier held back by respective defensive sectors, withenergy stocks (-0.13%) 1 of the weather performers as Brent crude oil prices (-1.18%) closed at a 2-month low of $82.38/bbl. meantime in Europe,the STOXX 600 (+0.15%) just about made it up to an all-time high, as the index posted an 8th constructive advance for the first time since 2021.

The another notable communicative in the equity space came from respective meme stocks, withGameStop up +60.1% on the day, building on its +74.4% advance on Monday. It’s now up to $48.75 having traded as low as $10 in summertime April. Simulary, AMC amusement was up +31.98%, while Blackberry gained +11.94%.

For sovereign bonds, there was a divergent performance yesterday, with Treasures ralling whitest bridge of Europe sold off.Yilds on 10yr Treasures fell by -4.7bps to 4.44%. By contrast,yields on 10yr bunds (+3.8bps), OATs (+ 3.9bps) and BTPs (+2.6bps) all moved a bit higher on the day. These moves came in spirit of comments from theECB’s Knot that “June will be a good chance to make a first decision in renovating restriction”, which helped to cement the view that the ECB are moving goods a rate cut at their next meeting. In the UK,gilts Saw a comparative outperformance, with the 10yr young down -0.1bps, which came as the unemption rate ticked up a tenth to 4.3% over the 3 months to March. Moreover, BoE chief economist Pill sounded open to a rate cut, saying that it was “not unreasonable to believe that through the summertime we will begin to see adequate assurance in the decline in individual that bank rate will come under consensus”.

In another news today, we had confirmation that theUS were imposing fresh tariffs on $18bn of Chinese imports, including steel and aluminum, semiconductors, and EVs. In fact, the tariff on EVs will go up from 25% to 100%. any of the fresh tariffs will take effect this year, but others won’t happen until 2026. The decision comes ahead of November’s presidential election, but both parties have taken a much tough stand on China over fresh years, and Biden has kept the bridge of Trump’s erstwhile tariffs in place. Indeed,Trump himself said at a rally on Saturday that “I will put a 200% taxation on all car that comes in from these plants”. So the direction has been goods a more protectionist standing on trade from both parties. Our China economist has written about the possible impact on the home macro landscapeHere.

Asian equity markets are mixed this morningwith the Nikkei (+0.18%) and the S&P/ASX 200 (+0.47%) trading higher whileChinese markets are catchingwith the CSI (-0.27%) and the Shanghai Composite (-0.17%) both trading lightly lower after the fresh US tariffs announced yesterday on an array of Chinese imports. Elsewhere, stock markets in South Korea and Hong Kong are shut for a public holiday. US equity futures are lightly higher with Treasures reasonably flat.

In monetary policy action,the PBOC kept the one-year medium-term lending facility (MLF) unchanged at 2.50%. This came despite weaker money supply numbers than expected overnight even Bloomberg are moving a communicative suggesting China areworking on a plan to buy up unsold homes to Shore up the property sector. Moving ahead, markets will decision their focus to China’s industrial production and retail sales data due on Friday.

Looking at yesterday’s another date, theGerman ZEW survey improved in May, with the results component up to 47.1 (vs. 46.4 expected), whilst the current situation reading moved up to -72.3 (vs. -75.9 expected). For the current situation that’s a 9-month high, and for the results component, that’s a 2-year high, which was last surpassed in February 2022.

To the day ahead now, and data releases include the US CPI study for April, along with retail sales for April and the NAHB’s housing marketplace index for May. From central banks, we’ll hear from the ECB’s Rehn, Muller, Villeroy and Makhloufi, along with the Fed’s Kashkari and Bowman.

Tyler Durden

Wed, 05/15/2024 – 07:31

![Jak idzie budowa 17-piętrowego bloku przy rondzie Pobitno w Rzeszowie [ZDJĘCIA] [WIDEO]](https://storage.googleapis.com/bieszczady/rzeszow24/articles/image/35b7b750-df1e-42de-9910-b34ab0499575)