The TOYA Group is simply a maker and distributor of tools with respective own brands with the most crucial YATO:

TOYA is 5 distribution centers – in Wrocław, Nadarzyn, Bucharest (Romania), Shanghai (China) and Baidu Town (China).

The sale is carried out by 100 countries with the most crucial being:

- Poland 48%

- Romania 10%

- Ukraine 7%

The construction situation is simply a key origin in obtaining most of the revenues from the construction and renovation segment. And with this in the last quarters was weak, which besides reflected on the results of the Company.

But the results of the first 4th of 2025 amazed very positively and forecast improvements throughout the year, especially as the environment is conducive.

More about which in the following analysis of results 1 4th of 2025 :

(analyses published earlier on the Analysis Portal Forum : https://portalanaly.pl/forum/viewtopic.php?p=98881#p98881)

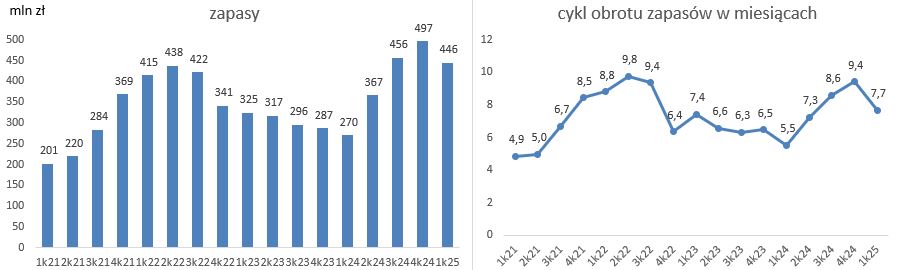

Personally, I had concerns that it might be poorly due to the advanced stocks purchased earlier at the hazard of missed prices, and here a affirmative surprise. However, the price of these supplies was not besides bad.

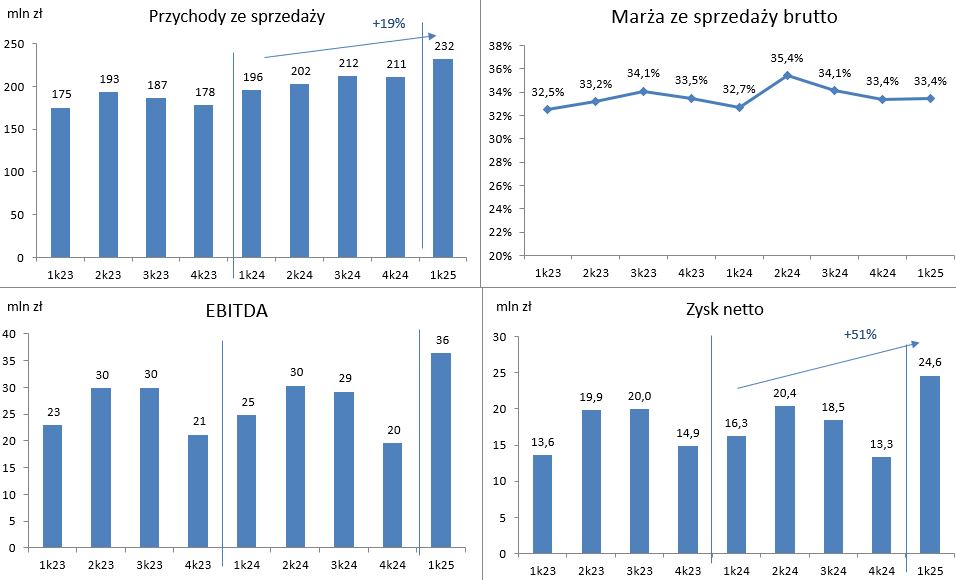

Looking at RZiS you can compose “record” in many places, and we are talking about 1 4th usually weaker.

Revenues PLN 232 million (+19%)

The gross margin on sales 33.4% – it persists despite the increase in sales – so there was no sale or aggressive discount action

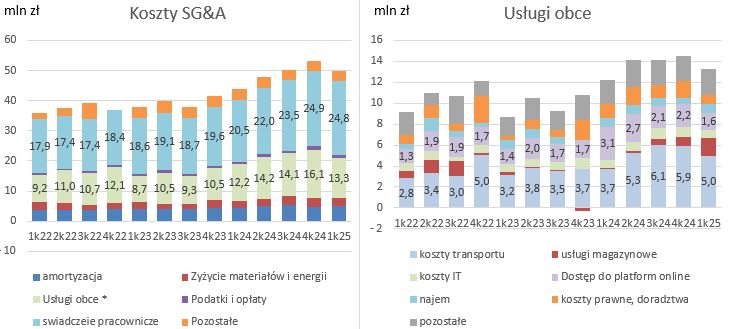

Sales costs of 36,5m (+12%) – a lower increase than revenue; therefore, the sales cost-to-income ratio fell to 15.8% from advanced late over 17%-to-percentage levels. This was affected by a decrease in retail sales.

Profit on sales of 27.8m (+38%).

In another operating revenues +3.7m, the company records exchange rate differences related to operating activities, e.g. the payment of a lower price for trading obligations due to a change of course.

EBITDA 36.5m +47%

EBIT 31.3m +53%

Net profit 24.6m +51%

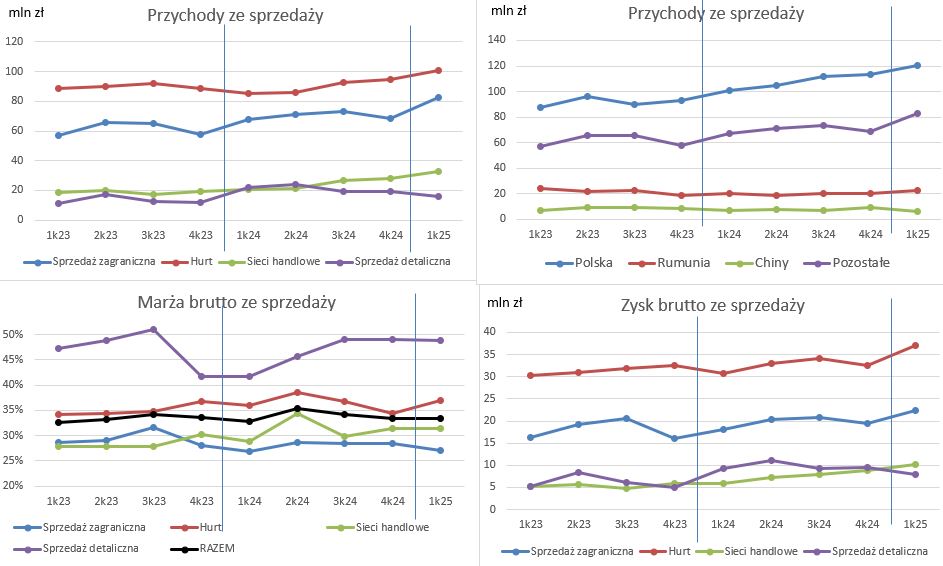

Looking at individual segments, this shows a amazing drop in retail sales of e-commerce (revenue -27%). This is the smallest section and in erstwhile reports it seemed to be putting Toya on it. As the study reads "The main reason for the changes was the update of the Group's pricing strategy". Apparently, the company concluded that taking into account the costs associated with ecommerce (shipment, returns) even a higher margin does not compensate them. Although there are no changes in the gross margin on sales in section data.

Growth was associated with classical sales channels – wholesale, abroad sales and trade networks, which shows increasing demand.

Geographically – the largest nominal growth in Poland and Ukraine (many people are talking about those who will benefit from the reconstruction of Ukraine, and there are companies who are already earning there and working in the construction and renovation segment).

Positive trends in costs - especially sales costs.

Compared to fresh quarters, the cost of abroad services has fallen, including commissions for marketplaces, transport costs and what is interesting, legal/advisory costs (until I wonder if there has been any redeployment).

Stocks decreased from evidence PLN 497 million to PLN 446 million – either optimization or the effect of higher sales in Q1. In the current situation, I would not anticipate any further simplification in stocks.

Summary

Surprisingly good beginning of the year, which besides announces good results in the following quarters, as the environment favours – recovery of demand, USDPLN and CNYPLN, a decrease in freight costs and Chinese producers struggling with price deflation. Even U.S. duties can possibly favour due to the fact that producers may be willing to offer better prices to keep production levels.

This could make request for working capital and further shift possible acquisitions of shares.

Capitalisation 520m (on 08.05.2025) C/Z=6.8 EV/EBITDA=4.7