„Stupid” Powell Does Not Cut Rates (As Expected) Despite 'Diminished Uncertainty’, Worse Stagflation

Tl;dr: The Fed held rates flat as expected, which will likely upset Trump even more, amid growing fear of stagflation.

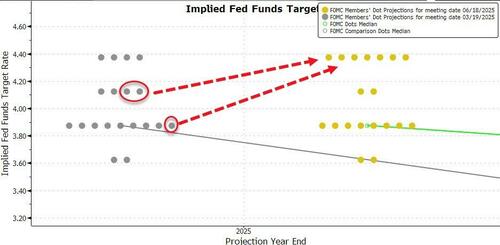

The Fed did not shift its view of (median) rate-cut expectations for 2025 despite calling for higher unemployment, higher inflation, and weaker growth.

But, the distribution of outcomes for 2025 shifted hawkishly… with seven policy members seeing no cuts in 2025 (up from 4)

* * *

„We have a stupid person, frankly, at the Fed, he probably won’t cut today,” Trump said, hours before the Fed decision urging Powell to cut rates by 2.5 percentage points.

“I call him ‘Too Late Powell’ because he’s always too late,”

“What is wrong with Too Late Powell? Not fair to America, which is ready to blossom? Just let it all happen, it will be a beautiful thing!”

President Trump on Fed Chair Powell: „We have a stupid person, frankly, at the Fed. He probably won’t cut today…Maybe I should go to the Fed. Am I allowed to appoint myself at the Fed?” pic.twitter.com/65hq3w47CF

— unusual_whales (@unusual_whales) June 18, 2025

Well he’s too-late-er now as The Fed decided, as expected, to hold rates flat for yet another month.

Trump wasn’t alone as Chris Whalen remarked:

„We need more courage in this country. The Fed is the most cowardly, despicable institution I’ve ever worked for.”

* * *

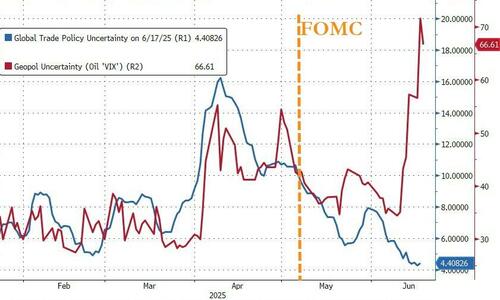

Since the last FOMC meeting on May 7th, a lot has happened both macro-economically and geopolitically. Global trade policy uncertainty has tumbled but geopolitical uncertainty has soared…

Source: Bloomberg

This has sent crude oil prices soaring as the dollar ad bonds lost ground. Gold is flat while stocks are up significantly…

Source: Bloomberg

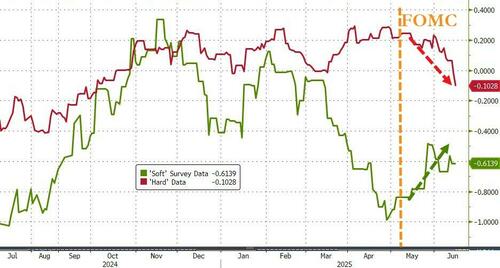

’Hard’ data has started to turn down (as 'soft’ data reverted higher)…

Source: Bloomberg

Just a reminder…

Some more „facts”: the last time US data was this weak the Fed cut 50bps https://t.co/JkpqnlhFm3 pic.twitter.com/7GJOqr93RC

— zerohedge (@zerohedge) June 18, 2025

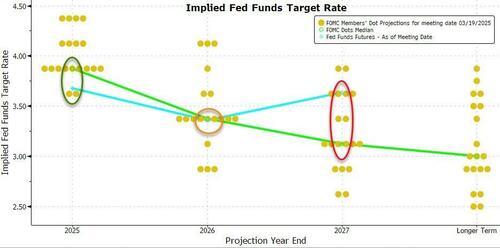

But, rate-cut expectations for 2025 have tumbled since the last FOMC meeting (though 2026 expectations are up modestly)

Source: Bloomberg

So, while no one expects The Fed to cut rates today, all eyes will be on the DOTS, the economic projections, and what Powell says (whether he will tilt hawkish)

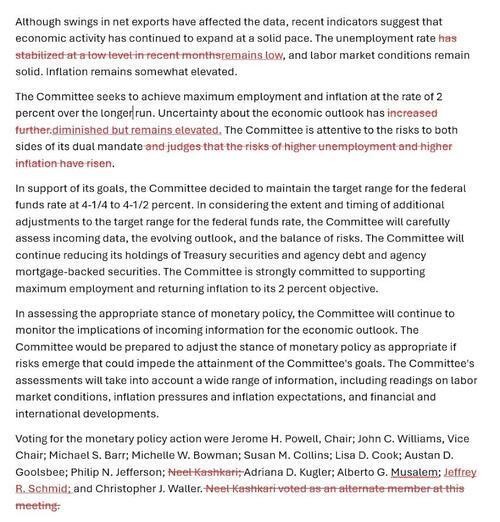

Rate Decision – No Change but 'Diminished Uncertainty’

As 100% expected, The Fed chose to leave the key Fed Funds rate unchanged:

-

*FED HOLDS BENCHMARK RATE IN 4.25%-4.5% TARGET RANGE

-

*FED: UNCERTAINTY ABOUT OUTLOOK HAS DIMINISHED, STILL ELEVATED

The DOTS shifted Dovishly

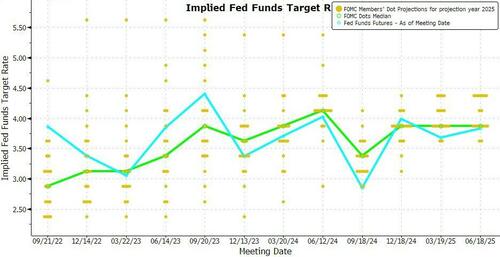

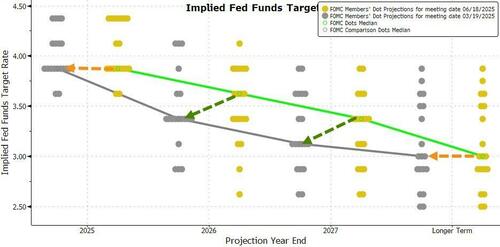

Heading into the statement, the market was more dovish than The Fed for 2025 and more hawkish than The Fed for 2027 (in line in 2026)…

Source: Bloomberg

While median 2025 rate cut expectations are the same…

…they see more cuts in 2026 and 2027 than previously.

-

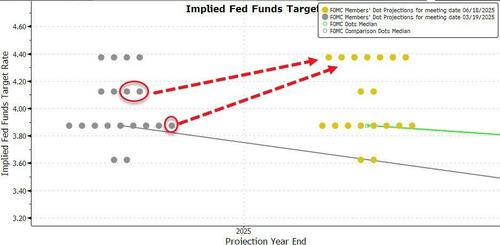

7 Fed officials see no rate cuts at all in 2025 (up from 4 prior)

-

2 Fed officials see 1 rate cut (down from 4)

-

8 Fed officials see 2 rate cuts (down from 9)

-

2 Fed officials see 3 rate cuts (same)

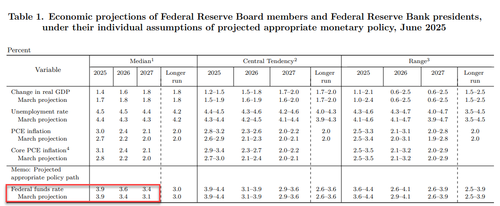

The Fed’s economic projections move more stagflationary

-

*FOMC MEDIAN 2025 GDP PROJECTION FALLS TO 1.4% FROM 1.7%

-

*FOMC MEDIAN 2025 PCE INFLATION RISES TO 3%, CORE RISES TO 3.1%

-

*FOMC MEDIAN 2025 UNEMPLOYMENT PROJECTION TICKS UP TO 4.5%

So, The Fed sees worsening unemployment than at the last meeting, worse inflation to come, and worse economic growth…

BUT, amid all the tariff derangement anxiety by the Fed, the worst they can come up with is core PCE rising to 3.1% by December (from 2.5% now) before tumbling to 2.4% in 2026 and 2.1%in 2027

As Bloomberg’s Catarina Saraiva noted:

„The inflation forecast of 3% for this year is pretty remarkable given where prices are now.

We’re at 2.1% in the headline PCE, so that would be a substantial reigniting of price pressures.

On the surface, it’s hard to square that forecast with two rate cuts, but clearly Fed officials see it as quite temporary, with inflation dropping back to 2.4% next year and then 2.1% in 2027.”

We tend to agree with StanChart’s Steve Englander who noted that „the FOMC’s objective at this meeting as expanding the range of possible policy responses while committing to none. „

Read the full red-line below:

Tyler Durden

Wed, 06/18/2025 – 14:00