Stagflation Signal Slams Stocks & Bonds; Bullion & Black Gold Bid

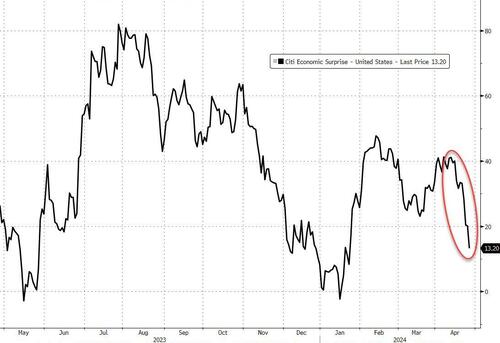

Overall, US macro data has unfortunately started to disappoint (not the least of which was today's earlier GDP print)...

Source: Bloomberg

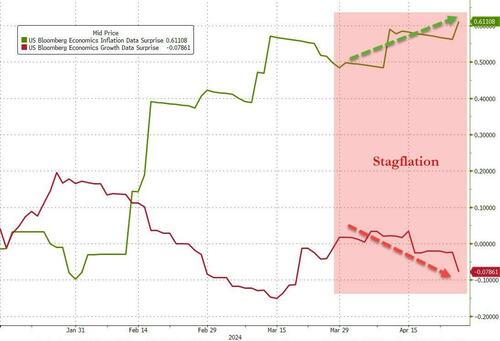

But, while 'bad news' for the economy has late been 'good news' for stocks (enables an easy Fed), today's date 'punched that communicative in the face' with Core PCE price index in Q1 soaring sustainably more than expected. And here’s the problem – inflation effects are suggested at the same time as growth expectations are sliding – the nemesis of all central banker is upon us: STAGFLATION.

It’s been a subject all year but late has been so much more proven that not even the best 'spinners’ can ignore...

Source: Bloomberg

And that sent rate-cut results plummeting to cycle lows (and took June completely off the table for a cut)(

Source: Bloomberg

Combine the ugly macro data with any ugly micro (META) and Goldman’s trading board noted overall flow was leathered better to sell:

LO’s driving more of the supply here with a -3% sale skew. An outlier is that we are seeing very real request in AAPL from both HF and L/O community. META seeing very small defence from L/O . Overall activity from the group feels mutated.

In the HF community we are lightly better to buy. Very notable that in macro products, short rates are chosen to 75%. We are seeing cover buying in the Tech.

Overall, the majors were all lower close to close, but well off their knee-jerk lows from the GDP/PCE date... The Dow was the laggard on the day (with IBM & CAT the biggest points drag). The remainder of the majors were all equally pummeled (though we do note that Nasdaq is inactive up 2% on the week)...

The first knocked slammed The Dow and Nasdaq back below their 100DMAs and the ramp-fest back to that critical method level, but that couldn't hold into the close...

As you’d expect, given META’s meltdown, the basket of MAG7 stocks was out of the gate – and ended red – but staged a decent comeback during the day...

Source: Bloomberg

And 'most shorted' stocks followed a akin trajectory – squeezing higher after an obl...

Source: Bloomberg

Tech stocks overall ended marginally lower, Energy outperformed while Real property and Healthcare lagged...

Source: Bloomberg

Treasures were clubbed like a baby seal on the macro data and pulled back only modernly during the day with the short-end and belly underperforming the long-end...

Source: Bloomberg

2Y Yields broke above 5.00% AGAIN... but we were incapable to close above it AGAIN...

Source: Bloomberg

The dollar spied immediately higher on the GDP date, but as the day wore on, the dollar bled back its gain to end lower on the day...

Source: Bloomberg

Gold prices rallied on the day, shrugging off the vol in the dollar...

Source: Bloomberg

Bitcoin managed gain on the day after overnight weather...

Source: Bloomberg

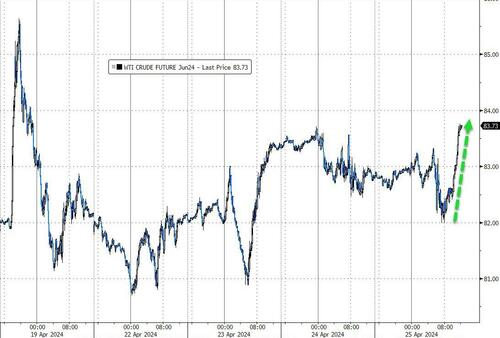

Crude prices managed solid gain after early arrival with WTI rallying back up towards $84...

Source: Bloomberg

Finally, we are down to the winegar strokes of the week with GOOGL & MSFT tonight, and PCE tomorrow...

Source: Bloomberg

...and don't forget The Fed next week where no action is expected, but the words may talk even louder this time.

Tyler Durden

Thu, 04/25/2024 – 16:00