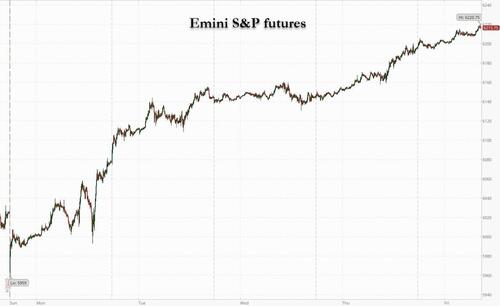

S&P Futures Trade At All Time High Boosted By Trade Talks, Nike Results

US equity futures are higher, buoyed by the (non) news that the US and China have signed a trade truce (which they first signed three weeks ago but nobody complied with it, so may as well push stocks up on the exact same headline again). The positive mood has also been helped by expectations of Fed rate cuts, a better-than-feared outlook from Nike and equity flow data. As JPM recaps, since yesterday’s close, there have been three major market focuses: (i) Lutnick said that US and China have already signed their trade deal; (ii) Nike’s guidance beats expectation; (iii) the removal of Section 899 yesterday afternoon. As of 8:00am ET, S&P futures are 0.3% higher and currently trading in record territory after Howard Lutnick indicated the US has plans to reach agreements with 10 major trading partners, while Nasdaq futures continued their panic FOMO meltup, rising another 0.5%, and set to rise every day this week. Pre-Market, Mag 7 are all higher; NKE shares are the outlier surging 10% after earnings. 2y fell -3bp, while 10y added 1bp; USD is higher. Commodities are mixed: Oil added +1.9%, while Ags are mostly lower. US economic data slate includes May personal income and spending (8:30am), June final University of Michigan sentiment (10am) and Kansas City Fed services activity (11am).

In premarket trading, Mag 7 stocks are higher alongside futures (AMZN +1.2%, Nvidia +0.9%, Meta +0.8%, Tesla +0.5%, Apple +0.5%, Alphabet +0.4%, Microsoft 0%).

- Amazon (AMZN) leads gains in the Magnificent Seven cohort of US tech stocks, rising 1.2%, after receiving an upgrade from BNP Paribas Exane.

- Atlantic Union Bankshares Corp. shares (AUB) are up 9.3% after the bank said it sold about $2 billion of its performing commercial real estate loans to Blackstone.

- Estee Lauder Cos. (EL) up 2.9% after HSBC raised its recommendation to buy from hold and increased its price target to $99 from $80 as it sees the cosmetics company at the end of a downgrade cycle.

- Li Auto ADRs (LI) drop 2.7% after the Chinese EV maker reduced its vehicle deliveries target for the second quarter, citing a sales system upgrade.

- Nike shares (NKE) rise 10% after forecasting a smaller-than-expected drop in revenue for the current quarter, a sign that the sportswear company’s earnings trend may have hit an inflection point, analysts say.

- WR Berkley Corp. (WRB) edges down 0.7% after a TD Cowen analyst cut its recommendation to hold from buy, citing outperformance following news Mitsui Sumitomo Insurance was buying a 15% equity stake.

- Trade Desk (TTD) gained 3.9% in premarket trading after being upgraded to outperform at Evercore ISI, while Baidu fell 0.8%.

- CorMedix (CRMD) falls 11% after launching an $85 million share offering via RBC.

Commerce Secretary Howard Lutnick said that the US and China had finalized an understanding, and added the White House is nearing agreements with 10 major trading partners ahead of a July 9 deadline for reciprocal tariffs.

Meanwhile, the Treasury Department announced a deal with G-7 allies that will exclude US companies from some taxes imposed by other countries in exchange for removing the “revenge tax” proposal from President Donald Trump’s tax bill.

“There were fears that the revenge tax would make it much harder for companies and individuals to invest in the US, since it would increase their tax rates,” said Kathleen Brooks, research director at Xtb Ltd. “There are still more trade agreements to be done, for example with the European Union, but things are moving in the right direction.”

The Thursday moves were driven by US economic data that supported the case for policy easing. The swaps market has fully priced two further rate reductions this year and increased bets on a third.

A flurry of Fed officials this week made clear they’ll need a few more months to gain confidence that tariff-driven price hikes won’t raise inflation in a persistent way. Economists see the personal consumption expenditures price index excluding food and energy marking the tamest three-month stretch since the pandemic five years ago.

Copper rose as Goldman analysts warned that shortages will get worse before levies come into effect. A key one-day copper price spread surged to the highest level in four years on the London Metal Exchange, placing fresh strains on buyers contending with a rapid decline in inventories fueled by US plans to impose tariffs on the metal.

European stocks also gain with the Stoxx 600 climbing almost 1% and set for its first weekly advance in three. Data Friday showed inflation inched up in France and Spain, but not enough to concern European Central Bank officials who are optimistic that their 2% target will be met sustainably this year. Most sectors are in the green with auto, media and consumer products leading while miners lag. Here are some of the biggest movers on Friday:

- Adidas, Puma and JD Sports are rising after US giant Nike said its yearlong sales decline is starting to ease, with a smaller sales drop seen in the current quarter than earlier anticipated.

- Schneider Electric shares gain as much as 4.8% after electrical power equipment manufacturer reiterated its full-year guidance on a pre-close analyst call, which Oddo BHF said is “reassuring.”

- Pearson shares rise as much as 3.8% as analysts at BNP Paribas Exane upgraded the education-focused company and flagged a buying opportunity following recent weakness in the share price.

- Knorr-Bremse falls as much as 5.8%, the most since April, as shares in the German maker of brakes for trains and commercial vehicles were downgraded to neutral by both Citi and JPMorgan due to US truck data weakness and FX.

- Babcock shares drop as much as 4.1% after Deutsche Bank downgraded the stock.

Earlier in the session, Asian stocks rose, on track to cap their best week in nearly two months, helped by positive developments on US-China trade and bets on Federal Reserve interest-rate cuts. The MSCI Asia Pacific Index rose as much as 0.7% Friday, with Xiaomi providing a boost as the release of its electric SUV saw strong demand. Japanese stocks led gains, with the blue-chip Nikkei 225 topping 40,000. The regional gauge is poised for a weekly gain of more than 3% as risk-on sentiment returns after a cooling of Israel-Iran tensions. Next week’s key focal points include inflation data in South Korea, Indonesia and the Philippines as well as a US jobs report. Asean is holding a bond market forum in Kyoto while the ECB holds an annual forum in Portugal.

“Easing tariff concerns, lower geopolitical risks especially in the Middle East, rising hopes of Fed cuts, higher confidence on AI demand” are all contributing to gains in Asian stocks, said Vey-Sern Ling, a managing director at Union Bancaire Privee. “Asia markets are in a good position especially with a potentially weaker dollar,” he said.

In FX, the Bloomberg Dollar Spot Index is flat. The Swedish krona is leading gains against the greenback among the G-10’s, rising 0.4%. EURUSD is up a seventh day, longest winning streak in a year; euro is up 1.6% on a weekly basis, the most in a month. GBPUSD up 0.1% at 1.3745; the pair is up 2.2% this week, best performance since early March. USD/JPY little changed at 144.39.

In rates, treasures fall for the first time this week; Yields are 1bp-3bp cheaper with front-end and belly lagging slightly, flattening 2s10s spread by about 0.5bp, 5s30s by 1.5bp; 10-year near 4.27% is 2bp cheaper on the day, slightly underperforming bunds and gilts in the sector. European government bonds are little changed.

In commodities, oil pared some of the biggest weekly decline in two years after a ceasefire between Israel and Iran, with the market’s focus shifting from the conflict in the Middle East to US trade negotiations. Spot copper contracts continued to trade at huge premiums to later-dated futures on the London Metal Exchange, after key price spreads this week hit the highest levels since an historic short squeeze in 2021. Gold falls $40 and below $3,300/oz as demand for haven assets dwindles; the precious metal heads for its second consecutive weekly loss, after a ceasefire between Israel and Iran dented demand for havens.

Looking to the day ahead, the key release will be today’s May PCE in the US, closely watched following the weaker-than-expected CPI print earlier this month. Other data releases include US personal income, personal spending, June Kansas City Fed services activity, We’ll also get Fed’s Williams, Hammack and Cook speak, ECB’s Rehn speaks

Market snapshot

- S&P 500 mini +0.2%

- Nasdaq 100 mini +0.3%

- Russell 2000 mini +0.3%

- Stoxx Europe 600 +0.9%

- DAX +0.8%, CAC 40 +1.4%

- 10-year Treasury yield +3 basis points at 4.27%

- VIX -0.4 points at 16.2

- Bloomberg Dollar Index little changed at 1194.19

- euro little changed at $1.1709

- WTI crude +0.9% at $65.8/barrel

Top Overnight News

- Lutnick said the US will imminently announce trade deals with 10 major trading partners while Trump hinted at an agreement arriving soon with India. BBG

- Equities momentum continuing this morning after the US and China finalized an understanding on trade. The deal includes a commitment from China to deliver rare earths. BBG

- US lawmakers said they would remove Section 899 from the tax bill: Reuters.

- On whether the US Reconcilliation Bill can be sent to President Trump by the July 4th deadline, Punchbowl says that it is possible, but is becoming increasingly difficult; Senators say voting will not being until Saturday at the absolute earliest. „…one key holdout said they’re far from the point when Trump will be needed to help close a deal.” Senators say voting will not being until Saturday at the absolute earliest, with that viewed as optimistic. Senate parliamentarian ruling focused on „the provider tax freeze in the bill rather than the Senate’s more drastic constraints for Medicaid expansion states, according to two sources with knowledge of the decision”. Republicans believe they can come up with a fix. President Trump has reportedly told multiple GOP senators privately that he prefers the House’s provider tax framework, which is much less drastic than the Senate’s version.

- US DOGE Service has sent staff to the Bureau of Alcohol, Tobacco, Firearms and Explosives with the goal of revising or eliminating dozens of rules and gun restrictions by July 4th: WaPo

- Europe considers a range of concessions to the White House in an effort to strike a trade deal in the near-term, including lowering tariffs on a range of imports, removing certain non-tariff barriers, buying more American products, and taking steps to address concerns about China. WSJ

- A flurry of Federal Reserve officials this week made clear they’ll need a few more months to gain confidence that tariff-driven price hikes won’t raise inflation in a persistent way. After Waller and Bowman’s dovish commentary on lowering rates as soon as July, nearly a dozen policymakers have dumped cold water on that idea since then. BBG

- China’s industrial profits slumped 9.1% in May, the biggest drop since October, under the weight of higher US tariffs and deflationary pressure. The decline adds urgency for more stimulus to meet growth goals. BBG

- Japan’s Tokyo CPI for June cools by more than anticipated, coming in at +3.1% Y/Y on a core basis (down from +3.3% in May and below the Street’s +3.3% forecast). WSJ

- Individual investors in Japan are boosting their purchases of government bonds at the fastest pace in 18 years as a rise in yields enhances the asset’s appeal. BBG

- Goldman forecast that core PCE prices rose 0.18% in May and 2.63% over the last year. Data from the CPI, PPI, and import prices suggest a modest tariff effect and a soft core print this month. Headline PCE prices rose 0.14% in May and 2.29% over the last year. GS expects the largest tariff effects on monthly inflation to show up from June through August. GIR

- NKE +9% pre mkt…after mgmt reaffirmed that 4Q will be peak pressure on call keeping turnaround story intact; That overshadows the weaker quarter last night (EPS $0.14 vs bogey of $0.20+).

Trade/Tariffs

- US President Trump said he just signed a deal with China on Wednesday, and says he has one maybe coming up with India. Trump added that China is starting to open up. It was later clarified that the US and China have agreed to an additional understanding to implement the Geneva agreement, according to a White House official cited by Fox’s Lawrence. A second Administration official confirmed that the framework finalises what was agreed in London and also addresses Chinese export controls, according to a source familiar with the agreement.

- China issues a statement on trade framework with US; two sides confirmed details on framework China will approve export applications for controlled items in accordance with the law. Both sides maintained close communications after meetings in London. The US side will accordingly lift a series of restrictive measures taken against China.

- European Commission President von der Leyen said the EU received the latest US proposal today and is prepared for both a deal and a no-deal outcome, stating all options remain on the table.

- French President Macron said he favours a speedy and fair EU–US trade deal, but warned that if the US maintains a 10% tariff, Europe would have to apply equivalent compensatory measures.

- US chip export curbs may slow China’s adoption of DeepSeek’s next model, R2, via The Information.

- US Commerce Secretary Lutnick said tax bill passage is expected within the next week or two, adding that the China deal was „signed and sealed” two days ago. Lutnick stated that several deals will be announced in the coming week, with the Europe deal expected at the end. He noted that although Europe had a sluggish start, it is now performing excellently and there is optimism about a deal with the EU. Countries seeking further negotiations are welcome, and all nations will be categorised into appropriate tariff groups by the 9 July deadline for reciprocal tariff agreements. He added that the US is close to finalising a deal with India and that the tariff programme will not need to change if the bill is adjusted.

- German Chancellor Merz said von der Leyen proposed the creation of a new European trade organisation, and added that EU leaders are largely united on finalising the Mercosur trade deal.

- Chinese Foreign Ministry says Yi will travel to EU headquarters June 30th for China-EU high-level strategic dialogue; will also visit Germany and France.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly firmer for a bulk of the session following gains on Wall Street amid expectations of a future Fed Chair more aligned with the President. Sentiment was further supported after US President Trump announced he had signed a deal with China on Wednesday. Although initial reports were unclear and caused some confusion, White House officials later clarified that the signing finalised what had previously been agreed upon in Geneva and London. China has not yet confirmed the signing of the deal. APAC stocks later waned off best levels to trade mixed. ASX 200 was supported by the broader mood, with the rise in copper keeping miners propped up before paring back. Nikkei 225 outperformed across the region, buoyed by recent JPY weakness and a softer-than-expected Tokyo Core CPI reading, which could temper some of the recent hawkish rhetoric from BoJ’s Tamura. Hang Seng and Shanghai Comp opened with modest gains, drawing some support from US President Trump’s announcement of a signed deal with China. It was later clarified the deal finalised prior agreements made in Geneva and London, though China has yet to confirm the signing. Chinese bourses later turned flat.

Top Asian News

- The PBoC injected CNY 525.9bln via 7-day reverse repos, maintaining the rate at 1.40%.

- Japanese Finance Minister Kato said they will continue cautious consideration of potential buybacks of previously issued bonds, according to local Reuters.

- The South Korean government held an emergency meeting on household debt, and plans to strengthen measures to control it, according to the financial regulator.

- Li Auto (2015 HK) expects to deliver circa 108k vehicles in Q2 (vs. May 29th guidance of 123-128k).

European bourses (STOXX 600 +1%) opened with a strong positive bias and continued to trudge higher as the morning progressed – currently trading at session highs. Sentiment over the past couple of days has been boosted by; 1) Thursday’s report that Trump is looking to announce Powell’s replacement early, 2) WSJ reports that the EU is considering lowering tariffs on US imports in a bid to woo US President Trump, 3) von der Leyen suggesting the EU had received the latest US trade proposal – stressing that whilst they are ready for a deal, they have made preparations for no deal. European sectors are entirely in the green. Autos leads, followed by Consumer Products as the likes of Adidas (+4%) and Puma (+5%) benefit from Nike’s post-earning strength.

Top European News

- ECB’s Knot, when asked about market expectations of one more 25bps cut by the end of the year, Knot said that possibility was “difficult for me to exclude”, via FT.

- German minimum wage to increase to EUR 14.60/hr by 2027; will take place via two steps from current level of EUR 12.82.

- ECB’s de Guindos says the ECB is on track to meet its 2% inflation target

FX

- DXY has extended its losing streak to a fifth session as a combination of geopolitical tensions easing, declining yields, concerns over Fed independence and ongoing fiscal concerns act as a drag on the greenback. Over the past 24 hours, the trade agenda has reasserted itself on the market narrative after US President Trump said he signed a deal with China on Wednesday; it was later clarified that the US and China have agreed to an additional understanding to implement the Geneva agreement. DXY is currently contained within Thursday’s 96.99-97.60 range, into US PCE and a couple of Fed speakers.

- EUR is firmer vs. the USD amid some encouragement on the trade front for the EU. This comes after the WSJ reported that the EU is reportedly considering lowering tariffs on US imports in a bid to woo US President Trump. Furthermore, US Commerce Secretary Lutnick said that although Europe had a sluggish start, it is now performing excellently and there is optimism about a deal with the EU. That being said, European Commission President von der Leyen said the EU is prepared for both a deal and a no-deal outcome, stating all options remain on the table. EUR/USD currently trading around 1.1715.

- JPY is still struggling to make much headway vs. the USD relative to other peers with Japanese data overnight acting as a headwind for the Yen. National inflation data for June came in soft on a headline and core basis (retail sales were also weak). USD/JPY is currently tucked within Thursday’s 143.75-145.26 range and sat just above its 50DMA at 144.32.

- GBP is a touch firmer vs. the USD and steady on a 1.37 handle. It has been a week lacking in fresh macro drivers for the UK and that remains the case. There has been some attention on the political scene with UK PM Starmer facing a possible rebellion from his own MPs over proposed welfare cuts. Cable is currently tucked below Thursday’s multi-year high at 1.3770.

- Antipodeans are both marginally stronger vs. the USD alongside the positive risk tone and subsequently shrugging off a contraction in Chinese Industrial Profits. Both currencies are also likely being underpinned by the aforementioned developments between the US and China on the trade front. Albeit, details remain light at this stage.

Fixed Income

- A contained/slightly softer start to the day for USTs. Benchmark pulling back from Thursday’s 112-03 MTD high, but only marginally with the current trough at 111-26+, comfortably clear of Thursday’s 111-21 base. Focus overnight has been on the latest US-China framework agreement, but essentially just firming the prior Geneva/London talks. Focus today now turns to US PCE and a couple of Fed speakers.

- Bunds are in-fitting with the above. Under modest pressure in the European morning into the region’s first inflation figures for June. Before those, no reaction to ECB’s Knot who said to the FT that the possibility of a 25bps cut by end-2025 was „difficult for me to exclude”. To recap those HICP metrics, French figures were hotter-than-expected across the board sparking a modest hawkish reaction. Specifically, this sent Bunds down from near the 130.66 high to around 130.44. Spanish figures were a little more mixed, but also held a hawkish skew, taking Bunds to a fresh low of 130.20.

- Gilts opened higher by a few ticks and then extended a handful more to 93.36, catching up to the late-Thursday performance for USTs/Bunds, before conforming to the broader bias and slipping slightly. However, action has been minimal with Gilts comfortably above the 93.00 mark and shy of today and Thursday’s open at 93.32.

- Italy sells EUR 6.5bln vs exp. EUR 5.5-6.5bln 2.70% 2030, 2.95% 2030 & 3.60% 2035 BTP and EUR vs exp. EUR 1.5-2.0bln 2034 CCTeu.

Commodities

- Crude is on a firmer footing today, in what has been a session lacking of pertinent geopolitical updates; more focus on US-China / US-EU trade updates, but details are light at the moment. Price action has been relatively steady throughout the morning, awaiting US PCE later. Brent Aug’25 currently trading around USD 67.20/bbl.

- Spot gold trades with a downward bias, and fails to benefit from the slightly softer Dollar and seemingly continuing to be weighed upon by the relatively calm in the Middle East; currently sits below USD 3.3k/oz.

- 3M LME Copper is unable to benefit from the risk tone. However, while softer, 3M LME Copper is holding onto essentially all of the upside it derived on Monday when it rose by near USD 200 to a USD 9.91k peak. As it stands, the base metal has slipped just below the USD 9.9k mark, but remains on track to close out the week with strong gains after opening it at USD 9.65k.

- The US Energy Department announced that scheduled oil deliveries into the Strategic Petroleum Reserve will be delayed until December, due to maintenance at SPR sites. Of the 15.8mln barrels originally planned through May, only 8.8mln have been delivered so far.

- Goldman Sachs said Brent crude could reach USD 90/bbl by year-end in a Strait of Hormuz disruption scenario, while options markets see a 60% chance Brent stays in the USD 60s in 3 months and a 28% chance it exceeds USD 70.

- Shanghai Warehouse Stocks: Copper -19.26k/T (prev. -1.1k).

Geopolitics

- Iranian Foreign Minister Araqchi said Tehran is assessing whether diplomacy with the US is in its interest, adding that there is currently no understanding for renewed talks with the US. Araqchi dismissed speculation about the resumption of negotiations with the US, saying it should not be taken seriously. There are no plans to receive IAEA Chief Grossi in Tehran, according to Reuters.

- Iran’s representative to the UN said Tehran is open to forming a regional nuclear consortium and exchanging uranium in the event of an agreement with Washington, via Sky News Arabia.

- An explosion occurred at the “Aluf” plant within a complex belonging to the Iranian defence industries in the Republic of Azerbaijan, according to Al Hadath.

- Israeli Prime Minister Netanyahu agreed with US President Trump to end the Gaza war within two weeks, according to Al Arabiya citing Israeli press.

- Israeli Defence Minister warned of further strikes on Iran if it resumes nuclear development, according to Al Arabiya.

- EU leaders agreed to renew existing Russia sanctions for another six months, according to Reuters

US Event Calendar

- 8:30am: U.S. Personal Income, May, est. 0.3%, prior 0.8%

- 8:30am: U.S. Personal Spending, May, est. 0.1%, prior 0.2%

- 8:30am: U.S. Core PCE Price Index MoM, May, est. 0.1%, prior 0.1%

- 8:30am: U.S. Core PCE Price Index YoY, May, est. 2.6%, prior 2.5%

- 8:30am: U.S. PCE Price Index MoM, May, est. 0.1%, prior 0.1%

- 8:30am: U.S. PCE Price Index YoY, May, est. 2.3%, prior 2.1%

- 10am: U.S. U. of Mich. Sentiment, June F, est. 60.5, prior 60.5

DB’s Jim Reid concludes the overnight wrap

A rare period of 2025 calm seems to have broken out for now. It may be that we’re in the eye of the storm that was the Middle East, and later to become tariffs again. However for now markets are not thinking about, or are not particularly concerned about, the upcoming July 9th tariff deadline. However after the bell we got some more positive headlines on trade which we’ll detail below. However, even before that, US markets steamed ahead with the first S&P 500 (+0.80%) closing just shy of a new all-time high as investors have again begun to anticipate further rate cuts this year. The optimism for lower borrowing costs in the near term was helped by Tuesday night’s news that Trump is considering naming his pick for the Fed’s next chair early. Even as the White House yesterday suggested that such a nomination was not „imminent”, markets are getting themselves used to the prospect over lower rates going forward. Whether this will prove to be yet another false dawn only time will tell.

Being precise, the S&P ended the day a mere 0.05% below its record high on February 19, briefly surpassing that level late in yesterday’s session. Tech stocks outperformed, with the Nasdaq Composite (+0.97%) closing an even smaller 0.03% from its December high, while the Magnificent 7 rose +1.06%. In Big Tech, Meta shares rose the most (+2.46%) after the company won a landmark copyright lawsuit over AI training on books, and Nvidia’s continued to extend its gains (+0.46%) from its record high the previous day which was the first since early January. The upbeat mood also saw the VIX (-0.17pts to 16.59) inch down to a 4-month low. Treasury yields fell across the curve as investors continued to increase their bets for further rate cuts this year (65bps by December and now 28bps in September). This led to the 2yr falling -6.3bps and the 10yr falling -5.0bps, with both down to their lowest levels since the start of May.

The continued positive momentum in equities was impressive. We seem to be in a sweet spot post Middle Eastern calm and pre the July 9th reciprocal tariff extension deadline. This will start to come into view soon, and headlines are starting to bubble up. Lutnick last night said that an agreement with China has now been agreed and that imminent plans have been made to agree deals with ten of its major trading partners. It’s not clear if this includes the EU and trade was clearly a key subject at the EU leaders’ summit that concluded last night. European Commission President von der Leyen revealed that the EU was assessing the latest counter-offer proposed by the US, saying “We are ready for a deal. At the same time we are preparing for the possibility that no satisfactory agreement is reached”. There have been some tensions over the EU’s approach to the talks, with Germany’s Chancellor Merz earlier calling the Commission’s negotiating strategy “far too complicated” as he favoured a “quick and simple” deal. Meanwhile, France’s Macron said last night that he would settle for 10% tariffs from the US but that this would result in the same levy being applied to US goods. So some event risk to watch out for over the next couple of weeks.

We are also waiting to see if the US administration will pass its budget megabill as they hope by the July 4th holiday. Senate Republicans have been aiming to vote on the bill this week but that timing looks uncertain, with the latest issue being a technical hurdle that some of the proposed Medicaid changes do not meet the strict rules of the reconciliation process that allows to approve budget policies with a simple majority in the Senate. So that could force meaningful last minute changes. One to monitor going into the weekend. There is good news that late last night we found out that the US Treasury Department has asked the Senate and the House to remove Section 899 (aka the „revenge tax”) from the bill after a deal was struck with G7 leaders to exempt US companies from some taxes. Given how much email traffic there’s been in my inbox on this topic, it’s fair to say global investors will breathe a sigh of relief on this news.

Moving to the US data, we saw slightly lower weekly initial jobless claims (falling from 243k to 236k vs. 243k estimates) but higher continuing claims (+1,974k vs +1,950k estimates). US May goods exports also fell -5.2% m/m, while revised estimates for Q1 GDP showed the economy contracted by -0.5% (vs. previous -0.2% estimates). That included worse-than-expected consumption, which grew by +0.5% annualized (vs. +1.2% prev.), its slowest quarterly pace since the 2020 pandemic shock. However, May durable goods data was strong at +16.4% vs +8.5% estimates due to bumper aircraft orders, but even ex-transport it came in half a percent higher than expected at +0.5%.

Fedspeak struck a mostly patient tone, with Richmond Fed Barkin’s saying that he does “believe we will see pressure on prices”, SF Fed’s Daly expected that “we would begin to be able to adjust the rates in the fall”, while Boston Fed’s Collins expected at least one cut this year but indicated that July would be too early.

The dollar index (-0.54%) continued to fall further on Thursday as tensions in the Middle East receded and earlier reports that Trump will soon pick a more dovish Fed chair continued to resonate. The EUR/USD rose +0.36% to 1.1701, yesterday, perhaps also helped by Europe’s pledge for higher defence spending and the more front-loaded German fiscal spending than expected announced earlier this week.

In Europe, defence stocks were higher on the back of the NATO Summit, where defence spending targets were raised to 5% by 2035. The DAX jumped (+0.64%), lifted by German defence companies like Rheinmetall (+7.28%), Hensoldt (+5.19%) and Renk (+3.87%) which are expected to continue benefiting from the increased defence pledge.

On a related theme, things are looking much better for Germany at the moment. Our German economists have lifted their growth forecasts to 0.5% for 2025 and 2% for 2026, well above consensus, believing the government’s fresh budget plans as well as the good momentum so far this year warrant a more positive outlook. You can read it here. Outside of Germany, other indices like the FTSE 100 (+0.19%), STOXX 600 (+0.09%), and CAC (-0.01%) posted more modest moves.

As in the US, European bond yields also moved lower despite more fiscal optimism in Europe, with 10yr gilts (-0.9bps), OATs (-1.1bs) and BTPs (-2.5bps) falling. But 10yr bunds underperformed for a fifth day running (+0.3bps) and its 30-year bond inched even higher (+1.8bps).

On geopolitics, yesterday Iran’s Supreme Leader said that the US strikes on Iran “did not achieve anything” and that Iran would retaliate should the US attack again. There was also a report from the FT that said European officials received intel that Iran had moved its uranium before the strikes, although at a press conference later that day, US Defence Secretary Pete Hegseth refuted this saying that nothing was moved out of Iran’s nuclear facility. Oil prices saw muted moves, with Brent crude up +0.07% to $67.73/bbl.

Asian equity markets are seeing a few divergent trends this morning. The Nikkei (+1.59%) is outperforming jumping to its highest level since late January, boosted by tech stocks and helped by lower inflation (see below). Elsewhere, the Hang Seng (-0.01%), the CSI (-0.02%) and the S&P/ASX 200 (-0.02%) are struggling to find direction with the KOSPI (-1.15%) experiencing noticeable losses in early trading. Outside of Asia, US equity futures are suggesting a positive opening with those on the S&P 500 (+0.13%) and NASDAQ 100 (+0.14%) edging higher. Meanwhile, yields on the 10yr USTs are +1.5bps higher trading at 4.26% as we go to press.

Early morning data indicated that Tokyo’s consumer price index (+3.1% y/y) increased less than anticipated in June, down from a +3.4% rise observed in the previous month, thereby raising questions about the BOJ’s capacity to hike in July. Tokyo’s core CPI decreased to +3.1% y/y in June from +3.3% in the prior month. In a separate report, Japan’s unemployment rate remained steady at 2.5% in May for the third month in a row, aligning with market forecasts. Meanwhile, retail sales in Japan rose by +2.2% y/y in May 2025, a decline from an upwardly adjusted +3.5% increase the previous month and falling short of market expectations of +2.5% growth. This represents the 38th consecutive month of retail sales growth, albeit at the slowest rate since February.

Elsewhere, China’s industrial firms reported their most significant profit decline since October, highlighting the challenges faced by an economy affected by increased US tariffs and ongoing deflationary pressures. Industrial profits decreased by -9.1% last month compared to the same period last year. The May figures reversed a slight gain earlier this year, bringing the decline over the first five months to -1.1%.

To the day ahead now, the key release will be today’s May PCE in the US, closely watched following the weaker-than-expected CPI print earlier this month. Our US economist forecast MoM growth in core PCE in May at +0.14% (+0.1% in April), with personal income growing at +0.2% (+0.8%) and consumption at +0.3% (+0.2%). In Europe, preliminary June CPI readings are due in France and Spain, with the rest of the key prints due the week after. Their forecasts are 2.0% for the Eurozone-wide HICP print, with country level estimates at 2.26% for Germany, 0.68% for France, 1.86% for Italy and 2.07% for Spain.

Other data releases include US personal income, personal spending, June Kansas City Fed services activity, France May PPI, consumer spending, Italy June consumer confidence index, economic sentiment, manufacturing confidence, May PPI, April industrial sales, Eurozone June economic confidence, Canada April GDP. We’ll also get Fed’s Williams, Hammack and Cook speak, ECB’s Rehn speaks

Tyler Durden

Fri, 06/27/2025 – 08:28