The EU has published a timetable for gradual departure from Russian fuels by 2027, including a simplification in imports of gas, oil and uranium. The key nonsubjective is to ban short-term gas acquisition contracts by 2025 and to discontinue long-term contracts by the end of 2027. Despite the drop in imports, Russia inactive earns EUR 61 million per day on exports of natural materials to the EU.

The EU moves distant from Russian fuels:harmonogram and forecasts by 2027.

The European Commission presented on 6 May 2025 a map presenting a plan to phase out imports of Russian oil, gas and uranium by the end of 2027. The publication of the paper was preceded by a long compromise process, peculiarly in view of the opposition of Hungary and Slovakia, which opposed the faster departure from Russian supplies. The paper was originally scheduled to be ready in February 2025, but its publication was moved respective times. The map announced more detailed actions to be published in June 2025. Although imports of Russian fuels into the EU are decreasing, Russia inactive earns ca. EUR 61 million per day on exports of their natural materials to the Union.

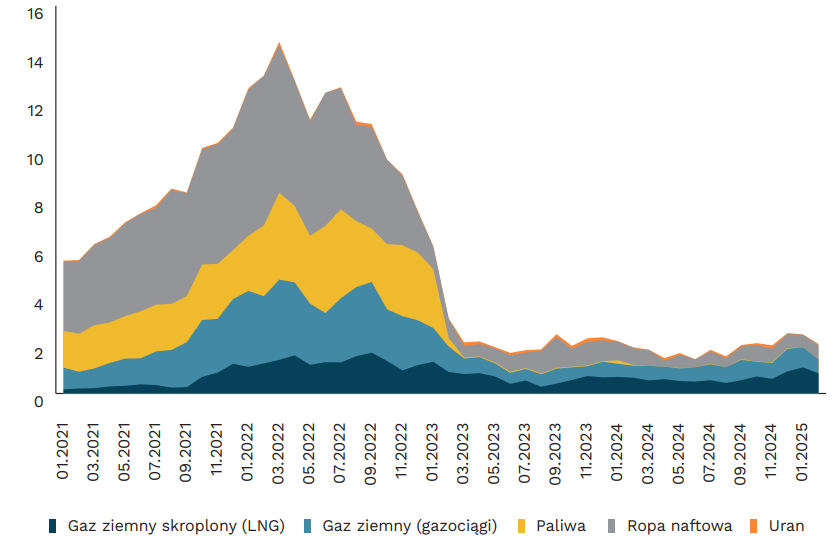

Imports of selected energy resources and fuels from Russia to the EU from January 2021 to February 2025 (EUR billion)

Source: pastry own improvement based on Eurostat data

Source: pastry own improvement based on Eurostat dataDecrease in imports of Russian fuels in figures

In 2024, imports of Russian gas, oil and uranium into the EU were:

- 25% lower than in 2023.,

- 6 times lower than in 2022.,

- 4 times lower than in 2021..

This decline illustrates the effectiveness of the EU's policy to reduce dependence on Russian fuels, but gas exports proceed to bring crucial influence to Russia. In 2024, gas exports were more than twice as advanced as oil and fuel; and 20 times higher than uranium exports.

Priority: Departing from natural gas

The departure from Russian natural gas is peculiarly advanced in the EC plan. The key actions foreseen for the period 2025-2027 are:

- Prohibition of short-term place contracts to acquisition Russian gas by the end of 2025 (now 33% of exports).

- National gas-importation plans — associate States are to submit by the end of 2025 timetables for the withdrawal of long-term contracts.

- Termination of existing contracts by the end of 2027

In parallel, the EC intends to tighten sanctions on Russian oil and petroleum products.

Problem with giving up Russian uranium

One of the biggest challenges remains the simplification of Russian imports of enriched uranium. In 2024 the import value of this natural material was indeed only EUR 700 millionbut 24% of Uranium utilized in the EU came from Russia, which underlines its strategical importance. The reason for the difficulty is the deficiency of adequate capacity to enrich uranium in EU countries, as a consequence of long-term infrastructure negligence.

Impact of EU action on the Russian economy

The Russian economy is already experiencing the effects of falling exports of fossil fuels and global oil price drops. In 2025, Moscow amended the budget bill as oil prices fell to the level even USD 50 per barrel. As a result:

- Revenue from oil, gas and petroleum products in 2025 is expected to be 24% lower than in 2024., which translates into a decrease in full budgetary gross by 6.5%.

- Russia's budget deficit can scope evidence levels since the pandemic.

In addition, Rosstat data indicate slowing down Russian economical growth in sectors specified as energy and non-military production. authoritative forecasts of the Russian Central Bank talk of an increase of only 1-2.5% in 2025.

Summary

The plan to phase out the EU from Russian fuels to 2027 includes the introduction of sanctions, the dissolution of gas contracts and the simplification of uranium imports. These measures already have a crucial impact on the Russian economy, which is struggling with lower oil and gas revenues, as well as falling growth rates. However, the EU inactive faces challenges, specified as providing alternate sources of enriched uranium and giving up Russian gas and oil.

Source: Polish economical Institute, Kamil Lipinski, Jan Strzelecki