Rare Earth Producer MP Materials Soars 50% After US Government Becomes Largest Shareholder

Late yesterday, we published an in depth note to our premium subs titled „The Coming Rare Earth Revolution And How To Profit: All You Need To Know About The Ex-China Supply Chain„. Ir referenced a recent Morgan Stanley analysis of several early-stage Rare Earth Element projects, which also mapped how Western countries might source these critical minerals on their own, now that a belligerent China is to be excluded from supply chains as a result of Trump’s trade war. And, in the Key Takeaways section, we specifically highlighted MP Materials as most likely to benefit, to wit: „MP Materials, Lynas, and ILU are best positioned to capitalize as REE trade flows and pricing adjust.”

The timing turned out to be prescient, because just 7 hours later, the company announced that the US Department of Defense (i.e. the US government) would become the largest shareholder in MP Materials after agreeing to purchase $400 million in preferred stock. Shares have exploded over 50% on the news.

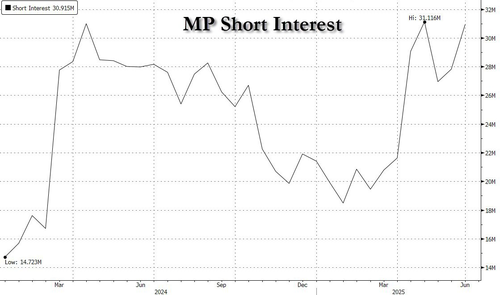

And that’s just the start, because at the moment the US Government became the largest shareholder, 23% of the float was short, something we pointed out a month ago when we first discussed the name.

The investment marks a „transformational” public-private partnership by the Trump admin, aimed at building a domestic rare earth element supply chain. MP Materials, which owns the only operational rare earth mine in the U.S. at Mountain Pass, California, will use the funds to expand processing and magnet manufacturing capacity.

As part of the deal, the Pentagon will receive convertible preferred shares and warrants equal to a 15% stake—surpassing stakes held by CEO James Litinsky and BlackRock. The shares convert at $30.03 each and carry no cash dividend.

CNBC wrote that the investment will support a second U.S.-based magnet plant, “10X,” expected to begin commissioning in 2028. The Defense Department will guarantee the purchase of all output from the facility for 10 years and backstop pricing at $110/kg for NdPr products, a key material used in permanent magnets for military systems like F-35 jets, drones, and submarines.

The move reflects growing U.S. efforts to reduce reliance on China, which supplied roughly 70% of rare earth imports in 2023, according to the U.S. Geological Survey. Interior Secretary Doug Burgum said in April that the Trump administration is exploring direct equity investments to secure critical minerals.

MP Materials is also set to receive a $150 million Pentagon loan to expand rare earth separation at Mountain Pass, and will receive $1 billion in financing for the magnet facility from JPMorgan and Goldman Sachs.

CEO James Litinsky called the initiative a decisive step toward U.S. supply chain independence.

In our piece out yesterday, we also discussed two of MP Materials’ key initiatives within the rare earth elements (REE) supply chain: its downstream magnetics project, the Independence Magnet Facility (#1), and its upstream heavy rare earth separation effort at Mountain Pass (#2).

The Independence facility in Texas is already producing magnets at pilot scale, with plans for full commercial output by year-end 2025, backed by a long-term supply agreement with GM.

Meanwhile, at Mountain Pass, MP is ramping up its light REE separation and advancing the construction of a heavy REE separation facility, targeting full-scale production in 2026. These two integrated projects position MP Materials as a vertically aligned U.S.-based REE producer, and one of several strong plays likely to benefit from increasing global concerns around rare earth scarcity.

For the full note and all of the names mentioned therein, you can use this link.

Tyler Durden

Thu, 07/10/2025 – 10:25