One Big Beautiful Budget Deficit

By Philip Marey, Senior US strategist at Rabobank

Summary

- On Thursday, Congress passed the “One Big Beautiful Bill” that is supposed to include all Trump’s promises on fiscal policy in his second term. The bill includes tax cuts and additional spending on Republican priorities. The bill will extend the income tax provisions in the Tax Cuts and Jobs Act (TCJA) of 2017, which were set to expire by the end of the year and would have caused a fiscal cliff. There will be tax deductions for taxes on tips, overtime and Social Security. The bill includes additional spending on defense and immigration enforcement.

- To finance the tax cuts and additional spending, or at least some of it, there are tax increases for and spending cuts in Democratic priorities. The tax credits for purchasing electric vehicles from Biden’s Inflation Reduction Act will be terminated. What’s more, new taxes on wind and solar energy projects will be imposed if they use too much foreign content. Federal spending on the Supplemental Nutrition Assistance Program (SNAP) will be reduced and the slack should be picked up by the states. There will also be cuts in spending on Medicaid, the health care program for low-income people. Finally, at the request of Trump, and much to the dismay of the fiscal hawks, the debt limit will be raised by $5 trillion.

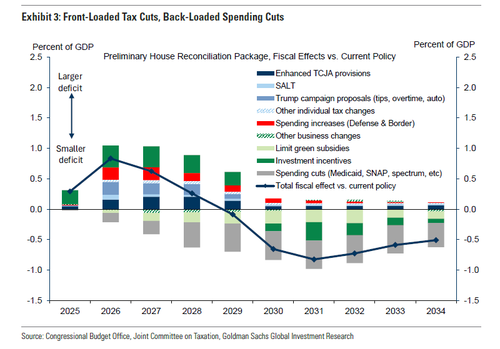

- On balance, budget deficits are projected to rise by $3.4 trillion over the 2025-2034 period according to the nonpartisan Congressional Budget Office. However, the bill front-loads tax cuts and delays spending cuts, causing a fiscal cliff at the end of 2028 that will create political pressure in 2028 to extend the tax cuts and kick the spending cuts further down the road. Therefore, the upward impact on budget deficits in the next 10 years could be even larger.

- Despite the large rise in the budget deficit, the upward impact on the growth trajectory of the US economy is likely to be limited. A large part of what the Republicans and their proxies are trying to sell as “tax cuts” are actually extensions of the TCJA, which have been widely anticipated.

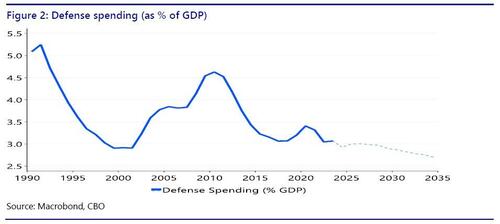

- Meanwhile, the increase in defense spending is relatively modest and keeps it below what other NATO members have pledged (as percentage of GDP). Despite all the talk about Trump’s “grand strategy”, this means that US foreign policy ambitions will be severely limited in the coming decade: a victory for the isolationists.

- The One Big Beautiful Budget Act of 2025 underlines that two traditional wings of the Republican Party, the fiscal hawks and the foreign policy hawks, have been pushed aside by the MAGA movement.

Introduction

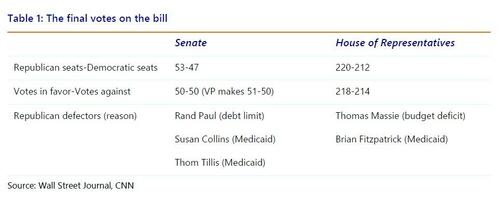

The US Congress has passed the “One Big Beautiful Bill” that is supposed to include all Trump’s promises on fiscal policy in his second term. The self-imposed deadline was for the Senate and the House of Representatives to get a uniform bill to President Trump’s desk by July 4. On Tuesday, in the Senate, Vice President Vance had to step in as the tie breaker, because 50 senators voted in favor of the bill (50 Republicans) and 50 against (all 47 Democrats and 3 Republicans). Rand Paul voted “nay” because of the rise in the debt limit. In contrast, Susan Collins and Thom Tillis found the Medicaid cuts too deep to support the bill. Today, in the final vote of the House of Representatives, there were 218 votes in favor of the bill (218 Republicans) and 214 against (all 212 Democrats and 2 Republicans). Thomas Massie voted against the bill because he wanted more spending cuts, calling the bill a “debt bomb”, and at the other end of the Republican spectrum Brian Fitzpatrick – who supported the earlier House version of the bill – objected to the deeper cuts in Medicaid and SNAP.

What’s in the bill?

The One Big Beautiful Budget Act (OBBBA) of 2025 includes tax cuts and additional spending on Republican priorities. The bill will extend the income tax provisions in the Tax Cuts and Jobs Act (TCJA) of 2017, the main fiscal policy package of Trump’s first term. These tax cuts were set to expire by the end of the year and would have caused a fiscal cliff. There will be tax deductions for taxes on tips, overtime and Social Security, in line with Trump’s promises of “no taxes” on these three sources of income during his 2024 campaign. There will also be a rise in child tax credits. The deduction cap on state and local taxes (SALT) will also be raised, at the request of Republican lawmakers in high tax states.

The bill includes additional spending on defense and immigration enforcement. The latter will be improved by extending the border wall, increased detention of migrants, and additional funds for ICE (Immigration and Customs Enforcement). The largest items in defense spending are shipbuilding, the Golden Dome defense system against foreign missiles, and replenishing the stock of ammunition. However, this would still leave defense spending at about 2.7% of GDP by 2034, which is well below the target that other NATO members have pledged at the recent summit in The Hague. Of course, compared to these countries the US has spent much more in cumulative terms, but the more relevant benchmark is what is needed against enemy countries. To put this in a historical perspective: when the US tried to outrun the Soviet Union during the Reagan years the US spent more than 6% of GDP.

To finance the tax cuts and additional spending, or at least some of it, there are tax increases for and spending cuts in Democratic priorities. The tax credits for purchasing electric vehicles from Biden’s Inflation Reduction Act will be terminated. This was one of Trump’s campaign pledges. What’s more, new taxes on wind and solar energy projects will be imposed if they use too much foreign content. Federal spending on the Supplemental Nutrition Assistance Program (SNAP) will be reduced and the slack should be picked up by the states. There will also be cuts in spending on Medicaid, the health care program for low-income people. However, they have been eased to keep the so-called “Medicaid moderates” on board. The fiscal hawks wanted more spending cuts, but the Republican leadership needed to keep the centrists on board, given the small margins in both the House of Representatives and the Senate. Finally, at the request of Trump, and much to the dismay of the fiscal hawks, the debt limit will be raised.

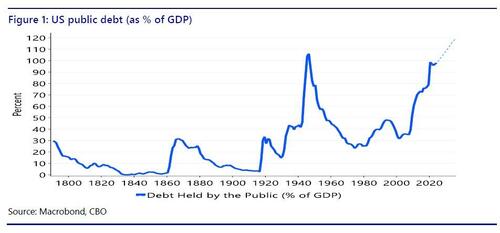

What’s not in the bill

To the relief of foreign investors, and spurred on by the US business sector, the proposed introduction of Section 899 to the Internal Revenue Code has been removed from the One Big Beautiful Bill because of a forthcoming international tax agreement announced by Treasury Secretary Scott Bessent. Section 899 would have introduced retaliatory taxes on foreign companies from countries that impose “unfair taxes” on US companies, such as undertaxed profits rules, digital services taxes, and diverted profits taxes. However, Senate Finance Committee Chairman Mike Crapo and House Ways and Means Committee Chairman Jason Smith have stated that the US Congress could still adopt Section 899 if the new international tax agreement is violated. What has never been in any version of the bill is a serious attempt to rein in spending on Social Security and Medicare. Consequently, US public debt remains on a trajectory that hardly seems sustainable in the long run.

The budget impact of the bill

On July 1, the Congressional Budget Office estimated that the bill as passed by the Senate would decrease budget deficits by $0.4 trillion, relative to the budget enforcement baseline for consideration in the Senate. Of course this sounds great and is what the Republicans and their proxies are trying to sell to the public. However, this baseline – imposed by Senate Budget Committee Chairman Lindsay Graham – already assumes an extension of the TCJA income tax provisions. On its own this is a choice that could be defended, however when the CBO scored the TCJA in 2017 they assumed that these tax provisions would expire, in line with then current law and with the common practice of budget scoring by the CBO. So taken together, the budget impact of these tax extensions has been deleted. This is truly One Big Beautiful Magic Act. As Lindsay Graham put it last week: “I’m the king of the numbers, I’m Zeus, the budget king.” With a simple shift-in-accounting trick1, $3.8 trillion has disappeared into a black hole of time inconsistency. In the same letter on July 1, the nonpartisan CBO stated that compared with their January 2025 baseline budget projections, it would increase deficits over the 2025-2034 period by $3.4 trillion. So in reality, the OBBBA has a significant upward impact on the budget deficit.

What’s more, the bill front-loads tax cuts in the next few years and delays spending cuts, causing a rise in the budget deficit in the short run and political pressure down the road to extend the tax cuts, further increasing annual budget deficits. Many deficit-increasing measures are scheduled to expire in 2028, while many deficit-reducing measures do not start until after 2028.

This would create a large fiscal cliff in 2028 that could force another extension of tax cuts, similar to the response that we are seeing this year in anticipation of a 2025 fiscal cliff that would emerge if the OBBBA had been rejected. Keep in mind that in November 2028 elections will take place for the presidency, the House of Representatives and one third of the Senate. In addition to extending tax cuts, there may be pressure to undo much of the deficit reduction scheduled by the OBBBA to take place after 2028. This could increase the upward impact of the bill on the budget deficit in the next ten years from $3.3 trillion to $4.8 trillion according to the nonpartisan Committee for a Responsible Federal Budget (CRFB). In other words, the OBBBA of 2025 would repeat the same trick used in the TCJA of 2017 by keeping the projected upward impact on the federal deficit limited through sunsets that are very likely to cause extensions of deficit-increasing measures when the fiscal cliffs comes in sight. These measures are only temporary in name, in reality they are permanent.

The economic impact of the bill

Despite the large rise in the budget deficit, the upward impact on the growth trajectory of the US economy is likely to be limited. A large part of what the Republicans and their proxies are trying to sell as “tax cuts” are actually extensions of the income tax provisions in the TCJA. In fact, the One Big Beautiful Bill is removing the fiscal cliff that loomed at the end of this year. What’s more, the extension has been widely anticipated because the Republicans could not afford the fiscal cliff from an electoral perspective. So this should not change the growth projections of the US economy. The additional stimulus would come from the other tax cuts, which are considerably smaller.

No serious attempt has been made to improve the US public debt trajectory. Fiscal discipline has gone out of the window on Capitol Hill and the few remaining fiscal hawks are at best slowing down the upward trajectory of the debt. This leaves the enforcement of US fiscal discipline to the bond vigilantes. However, they are faced with limited alternatives to US treasuries. Nevertheless, as far as they are able and willing to diversify away from US treasuries, they could demand higher yields. In the long run, this is increasingly likely. Either through higher interest rates or through higher tax rates if US lawmakers are going to put their fiscal house in order, this budget explosion could slow down economic growth down the road. However for now, the low tax rates of the TCJA have been extended and some new tax cuts have been added. Just stop thinking about tomorrow.

The foreign policy impact of the bill

Despite all the talk about Trump’s “grand strategy”, defense spending in the One Big Beautiful Bill does not seem compatible with preserving US military dominance. Cutting taxes (or extending tax cuts) without touching Social Security and Medicare has left little room for increasing defense spending. This means that US foreign policy ambitions will be severely limited in the coming decade. In this sense the OBBBA is also a victory for the isolationists. While the recent US attack on Iran can be seen as a short-term victory for the foreign policy hawks in the Republican Party, the OBBBA will give the isolationists the upper hand in the long run.

Conclusion

In the end, this bill is essentially about extending the Trump tax cuts of 2017 and adding some new tax cuts promised during the presidential campaign of 2024. Despite spending cuts on clean energy programs and health care for low income Americans, the fiscal hawks saw their wings clipped again and the US public debt continues to rise. However, the foreign policy hawks are in for some big disappointments as well. They may be basking in the glory of the attack on Iran, but there is no budget for their future ambitions. The “One Big Beautiful Bill” underlines that these two traditional wings of the Republican Party, the fiscal hawks and the foreign policy hawks, have been pushed aside by the MAGA movement.

Tyler Durden

Sat, 07/05/2025 – 11:40