Millions of Poles, unaware of the immense risk, keep all their savings in 1 place. This is simply a terrible mistake, which, in the face of expanding global threats, could cost them all their assets. Financial experts are beating the alarm, pointing out that in 2025, in the face of a possible crisis – war, cyber attack or blackout – access to the accumulated funds could be blocked in just a fewer hours. This situation represents a real possible of liquidity failure and even full impoverishment. This is not a discipline fiction scenario, but a real warning, backed up by the experience of fresh years. That is why immediate action and diversification of assets are crucial before it is besides late. According to planet Bank specialists, financial safety is based on the dispersal of assets in various forms and places to avoid full disaster erstwhile 1 strategy fails. We will show you how to safe your finances step by step, even if you have small savings.

Polish Trap: Why Keeping Everything in Złotków is simply a immense risk?

Most of us live in a “Polish financial bubble”. We have an flat in Poland, savings collected in the Polish bank, we work for gold, and in this currency we pay taxes. What seems comfortable and safe all day is actually a immense threat. global Monetary Fund experts clearly specify this as ‘no geographical diversification’ and consider it 1 of the biggest risks to the financial stableness of households. In practice, this means that all of our assets are straight dependent on the condition of 1 country and 1 currency. In the event of a serious political, economical or military crisis, our assets may lose value at an alarming rate and access to them may be completely cut off.

History provides brutal evidence of the consequences of this approach. At the beginning of the war in Ukraine, in February 2022, access to funds in Ukrainian banks was drastically restricted. Many people could not retreat cash, and global transfers were hampered. Those who had any of the savings in euro, US dollars or Swiss francs could have arranged a journey from the country much faster, rented an flat abroad, or just survived the first, most hard weeks. Others were in a dramatic situation, frequently without livelihoods. It is estimated that millions of Ukrainians lost even 70-80% of their purchasing power at the time, and inflation galloped at a rate of respective twelve percent per year. This is simply a informing that Poles should take highly seriously in the face of an increasingly unpredictable world.

Three Pillars of Security: Tested Methods of Asset Protection

You don't should be a millionaire to effectively safe your finances. Experts indicate 3 basic, proven methods that virtually anyone can implement. Their goal is to disperse risks and make a safety buffer that will defend you in the worst case scenario. Remember, it's not paranoia, but... common sense caution Today, uncertain times.

- Fixed currency cash: It's not about keeping a fortune, it's about having a applicable reserve for a rainy day. Specialists urge that the home "financial evacuation backpack" should be equivalent PLN 3000-5000 in euro, US dollars or Swiss francs. These currencies are historically gaining value during crises erstwhile local currencies specified as gold coins are losing weight. Having them in physical form guarantees immediate access to funds, even erstwhile banking systems halt operating and card payments are impossible.

- Foreign bank account: Sounds complicated? Nothing more wrong! Thanks to modern fintech, specified as Revolut, Wise or N26, you can start a bill outside Poland in just a fewer minutes without leaving the house. This gives you access to funds, even if the Polish banking strategy is paralyzed by cyber attack, blackout or another crisis. You don't gotta keep all your savings there, but having a fewer 1000 zlotys in a abroad currency in specified an account can prove invaluable in an emergency. Remember to check which institution guarantees your funds.

- Investments outside Poland: alternatively of focusing exclusively on the Polish stock marketplace or bonds, it is worth to focus on global diversification. Investing in International ETFs (Exchange Traded Funds), specified as those tracking indices MSCI planet or S&P 500, gives you vulnerability to the world's largest companies. In the event of a crisis in Poland, the global capital will decision to safer places, and your Polish assets may rapidly lose value. Global ETFs frequently gain in specified scenarios, compensating for possible losses on the local marketplace and protecting Your purchasing power.

Gold and another Safe Facilities: What else will save your savings?

In the face of increasing geopolitical and economical uncertainty, more and more experts point to gold as a key asset safety element. This is not only a conventional "safe haven", but besides an asset that can be transported easy in a crisis situation and which retains its value regardless of the condition of banks or payment systems. Analysts stress that in the event of a collapse of the financial system, access to actual bars or coins has an advantage over “paper” gold, i.e. provisions on the brokerage account. It is recommended that gold be the maximum 5-10 % of the full investment portfolio, which allows diversification without overburdening. The applicable solution is tiny broth coins, which are easier to transport and divided than large bars.

Experience from another countries brutally confirms the value of diversification. In Argentina, which has undergone many currency crises, citizens have learned to keep savings in US dollars. erstwhile peso lost value at a rate of respective twelve percent a year, abroad currency holders kept their wealth. Similarly, in Venezuela, where hyperinflation devastated local currency, access to dollars frequently determined survival. Even in rich European countries, problems have occurred - during the financial crisis in Greece in 2015 ATM withdrawal limits (up to 60 euros per day!)and access to savings was heavy restricted. Those who had funds in German or Swiss banks could function normally. These examples show that securing assets is not preparation for apocalypse, but a sensible consequence to real risks that any country, including Poland, can face.

From explanation to Action: Concrete Asset Insurance Plan Step by Step

You don't should be a financial expert to implement these strategies. Experts urge a gradual approach that will let you to safe yourself without unnecessary stress. Start today, due to the fact that all day of hold increases the risk.

- Step 1 (week 1-2): Assessment of the situation. compose down all your assets – apartment, savings in accounts, investments, work. Rate how much your property depends solely on the Polish economy and currency. If most, it's a signal for immediate diversification. The goal is not to flee the country, but to disperse risks.

- Step 2 (week 3-4): First abroad account. make an account in 1 of the renowned fintechs, specified as Revolut or Wise. The process usually takes several minutes online. Transfer there the equivalent of respective 1000 zlotys (e.g. 1000-1500 EUR or USD). This is your first defence line in case of paralysis of the Polish banking system.

- Step 3 (month 2-3): abroad investments. Open a brokerage account allowing trading on global stock exchanges (e.g. brokers offering access to global ETFs). Start investing in ETF on a global stock index specified as MSCI World. Do it gradually, for example, all period transfer any savings. This will defend your capital from local turbulence.

- Step 4 (month 4-6): Physical safety and ‘evacuee’. Buy any physical gold in coins (e.g. Krugerrands, Clones leaves). Prepare copies of the most crucial papers (evidence, passport, birth certificate), numbers of abroad accounts and addresses, as well as respective 1000 zlotys in cash (euro, dollars) in tiny denominations. This is simply a minimum that will let you to function erstwhile average systems halt working.

A lot of people think that specified preparations are exaggeration or blindness. Experts shall correspond to: "Financial preparation for hard times is not a manifestation of fear, but responsibility". Just as we buy car insurance not due to the fact that we're planning an accident, we're diversifying assets not due to the fact that we anticipate war, but due to the fact that we're aware of the risks. past shows that crises come cyclically – wars, financial crises, pandemics. No 1 is able to foretell erstwhile and in what form, but preparation gives peace and flexibility of action. In addition, many of these safeguards make sense even in average times – investment in abroad markets gives access to companies that are not in Poland, and euro cash is useful during the journey.

The planet is becoming increasingly unpredictable. Hybrid wars, cyber attacks, financial crises – these are no longer movie scenarios, but the reality we gotta deal with. safety of property is not preparation for apocalypse, but reasonable caution. Just as we do not leave the home without a telephone “just in case”, so we should not keep all the property in 1 place. Experts agree: it is better to be prepared and unnecessarily than unprepared at a time of crisis. Geographical diversification of assets is not a luxury for the rich, but a foundation for financial safety in the 21st century. Start today. all period of hold is simply a period of greater risk. Your future same will be grateful to you for taking these steps now, before it is besides late.

Continued here:

Millions of Poles make mistakes. Experts warn: you'll lose everything in an hour

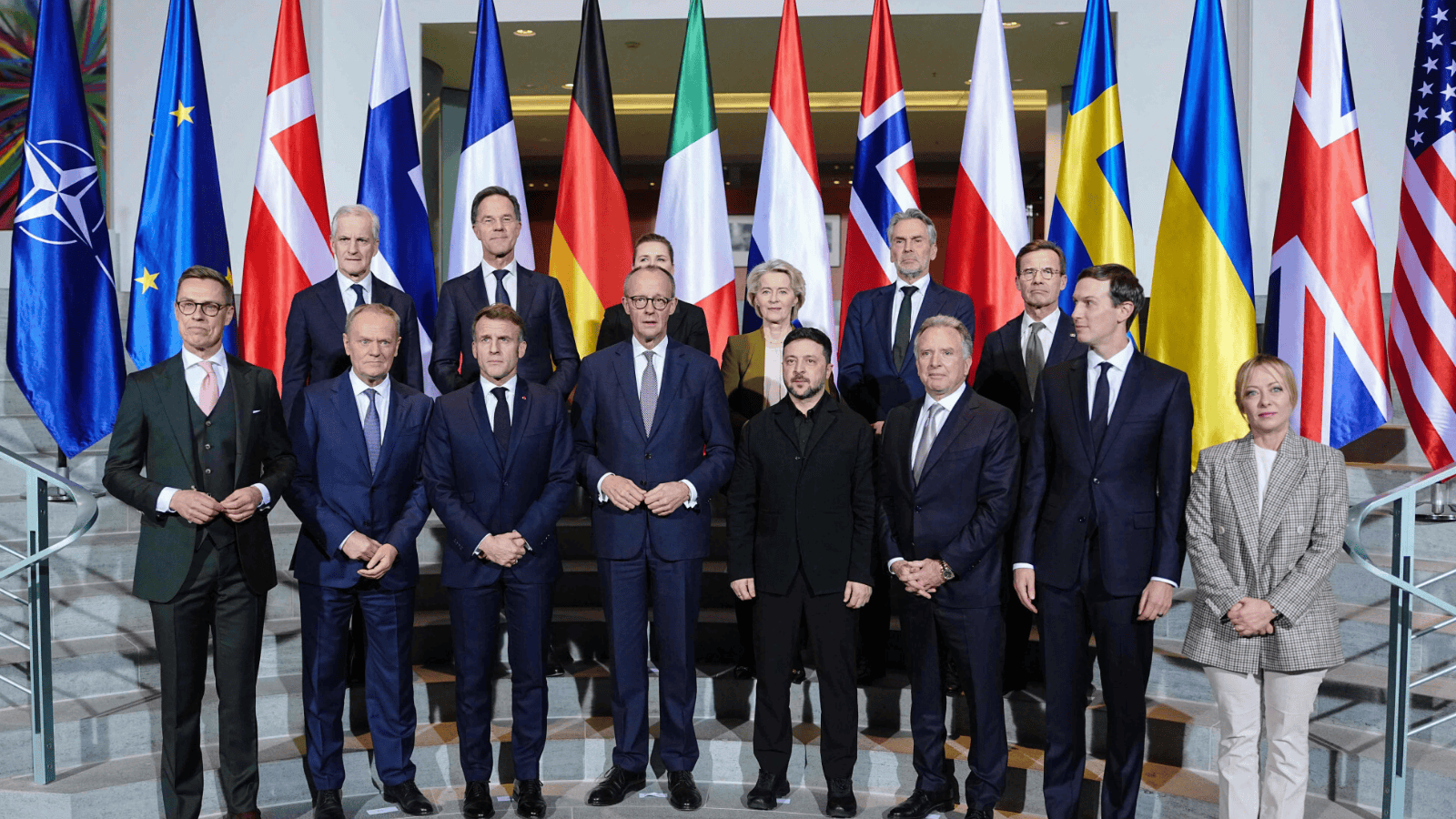

![Amerykanie zgadzają się na gwarancje dla Ukrainy, Rosja chce Europy Wschodniej [rozmowy w Berlinie]](https://cdn.oko.press/cdn-cgi/image/trim=490;0;518;0,width=1200,quality=75/https://cdn.oko.press/2025/12/AFP__20251215__888U2W2__v1__HighRes__GermanyUsUkraineRussiaConflictDiplomacy.jpg)