Japanese Auto Stocks Soar On Trump Trade Deal

President Donald Trump announced overnight on Truth Social that he had secured a „massive” trade agreement with Japan. The deal will lower tariffs on Japanese imports to just 15% and includes a pledge from Tokyo to invest $550 billion in the U.S.

The new trade deal is a major positive for Japan’s auto industry and will likely alleviate the impact of tariffs.

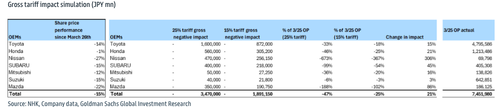

According to Goldman analysts Kota Yuzawa and Ken Kawamoto, the reduction in auto tariffs could lower the combined gross tariff impact on the top seven automakers from -¥3.47 trillion to -¥1.89 trillion. This would reduce the projected operating profit hit for FY3/25 from -47% to -25%.

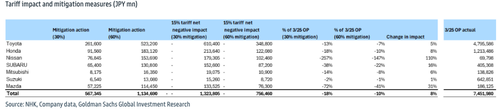

The analysts said if the seven automakers (Toyota, Honda, Nissan, Subaru, Mitsubishi, Suzuki, and Mazda) offset 30% of the tariff burden through price hikes and cost savings, the net impact could fall to ¥1.32 trillion, or an 18% profit hit. If 60% of the impact were offset with price hikes, they said the negative profit impact could be reduced to just 10%.

„We believe that the negative impact of tariffs can be mitigated to some extent by raising US vehicle sales prices,” Yuzawa noted.

Stocks of the seven automakers have been battered since March 26, around the time President Trump intensified the trade war. For example, Toyota shares had fallen 14% in recent months, while Nissan dropped 27%, Subaru 15%, and Mazda 22%. However, much of those losses were reversed in Tokyo trading, with Toyota surging 14%, Nissan rising 8%, Subaru climbing 16%, and similar gains among peers.

Exhibit 1: Tariff negative impact likely to be alleviated

Exhibit 2: Expectations for mitigation measures

In addition to Japanese auto stocks, European autos lead. Here’s more from UBS:

Markets are led by Autos (SXAP up 4.1%) after the US and Japan agreed a trade deal with positioning also playing a role as consensus shorts outperform longs by about 1%.

Tailwinds from trade news are emerging as the meme stock craze erupts in the U.S. (we’ve got the names to focus on here).

Tyler Durden

Wed, 07/23/2025 – 06:55