CINCINNATI- As competition intensifies for future narrowbody aircraft engines, GE Aerospace and Pratt & Whitney are pursuing sharply different approaches to meet the evolving needs of Airbus and Boeing.

At the center of this divergence is the next generation of single-aisle jets expected in the 2030s, with Airbus and Boeing seeking engines offering up to 25% better fuel efficiency.

These manufacturers, headquartered in Toulouse (TLS) and Seattle (SEA) respectively, are closely observing engine makers as they outline competing visions for future propulsion technologies, FlightGlobal reported.

Photo: GE Aerospace

Photo: GE AerospaceGE Aerospace vs Pratt & Whitney

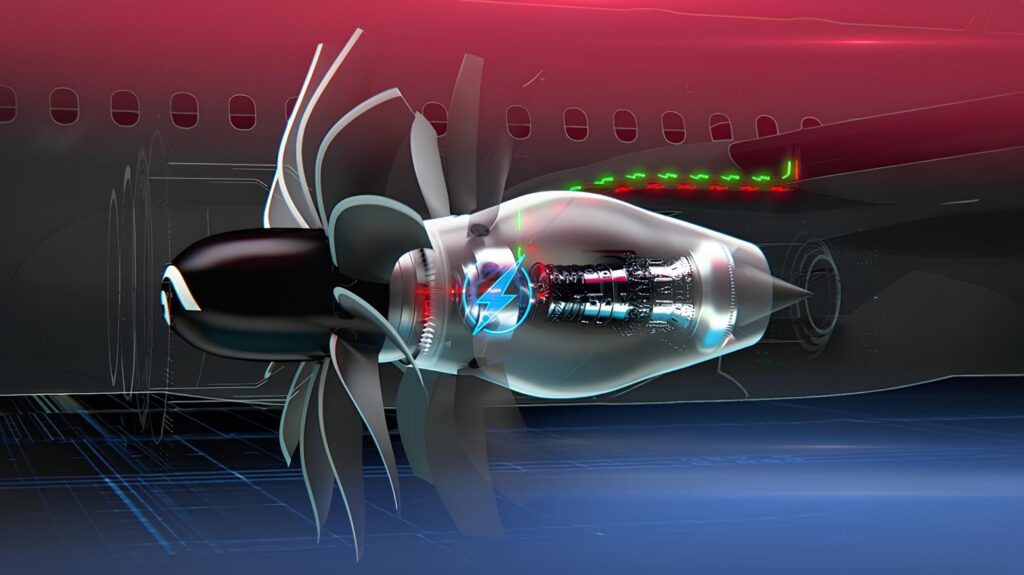

GE Aerospace, co-owner of CFM International alongside Safran, is doubling down on its Revolutionary Innovation for Sustainable Engines (RISE) programme, a bold attempt to commercialize an open-fan architecture promising 20% greater efficiency than current turbofans.

This effort, described by GE’s engineering lead as its largest demonstrator program ever, aims to leverage new materials and hybrid-electric technologies, with early flight tests supported by Airbus.

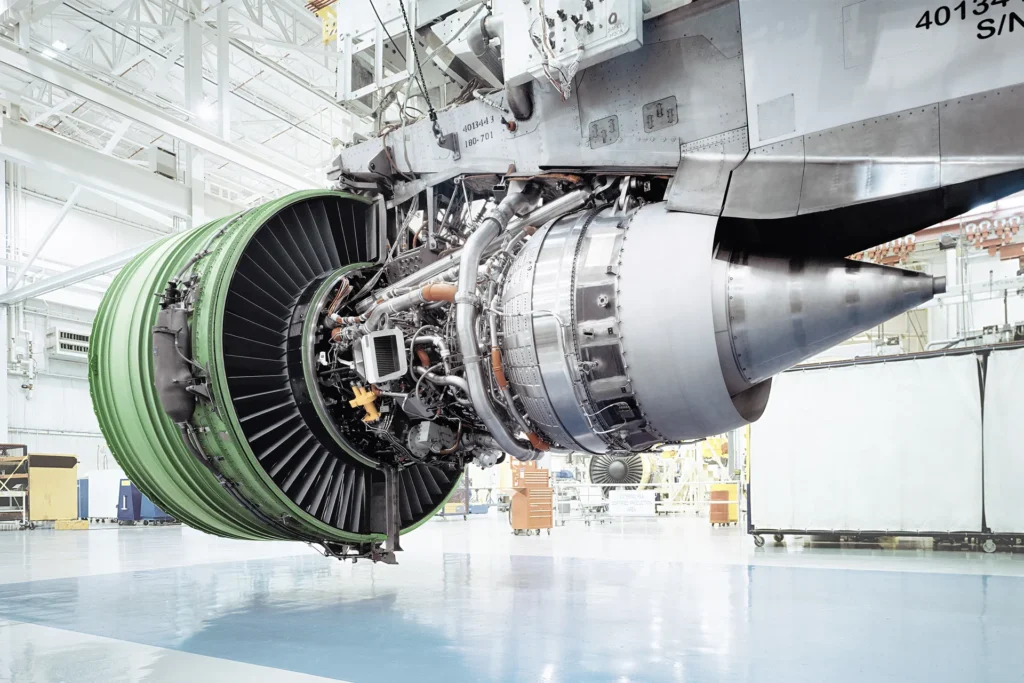

In contrast, Pratt & Whitney, a division of RTX, is refining its existing PW1000G geared turbofan. Its strategy centers on improving durability and thermal performance through ceramic-matrix composites (CMCs), hybrid-electric options, and redesigned hot-section components.

P&W sees this as a more reliable and lower-risk path to meeting airline demands, especially in light of current reliability concerns affecting both GTF and Leap engine models.

Photo: Airbus

Photo: AirbusManufacturing, Maintenance, and Market Readiness

Pratt & Whitney’s $1 billion investment in its Asheville, North Carolina plant, featuring a future casting foundry and digital tracking, underscores its focus on production scalability and part longevity.

The facility will serve as a cornerstone for increasing GTF Advantage output, a newly certified upgrade offering up to 8% more thrust and significantly improved maintenance intervals.

To support this, P&W has launched in-service upgrade programs, targeting enhanced durability through hot-section retrofits.

These improvements respond to ongoing challenges with existing GTF units powering aircraft like the A320neo and A220, many of which are grounded due to part recalls.

Meanwhile, GE’s New York Research Center continues to drive innovation. With over 1,000 engineers and researchers, it serves as the hub for technologies such as CMCs and 3D-printed fuel nozzles, components now common in CFM’s Leap and GE9X engines.

GE executives highlight their historical ability to push advanced designs through the “Valley of Death”, the gap between concept validation and mass production, citing success stories like the GE90 and GEnx composite fan blades.

Photo: GE Aerospace

Photo: GE AerospaceIndustry Perspectives

According to Flight Global, Airbus has committed to flight testing CFM’s RISE demonstrator, and Boeing is backing GE’s hybrid-electric testing.

While some Boeing leaders are cautiously optimistic about the open-fan concept, others question whether the promised 20% efficiency gain justifies the technical and operational risks.

Analysts note that airlines might be wary of unproven architectures following recent maintenance issues.

Both GTFs and Leaps have struggled with hot-weather durability, wear from increased pressure ratios, and extended supply chain disruptions, leaving fleets grounded and airlines frustrated.

Despite skepticism, both GE and P&W remain steadfast. GE believes its open-fan solution will reshape propulsion efficiency standards, while P&W contends its gen-two GTF will dominate with reduced operational risk and incremental innovation grounded in real-world experience.

Photo- GE Aerospace

Photo- GE AerospaceFuture Outlook

As aircraft manufacturers prepare for program launches by the mid-2030s, engine makers are aligning their technologies to match expected performance, cost, and durability metrics.

P&W believes its path, built on the foundation of over 300 million flight hours and reliability focused upgrades, offers a lower-risk route to next-gen performance.

GE, meanwhile, is positioning itself as the innovator ready to leapfrog convention.

With technologies matured through decades of research, including silicon-carbide CMCs and composite fan blades, it is betting on future airframes embracing a bolder engine solution, especially as global sustainability goals loom.

Ultimately, the decision may rest with the airframers and their customers, whose tolerance for risk will shape the future of single-aisle propulsion.

Stay tuned with us. Further, follow us on social media for the latest updates.

Join us on Telegram Group for the Latest Aviation Updates. Subsequently, follow us on Google News

Largest Engine in the World to Power 777X will Undergo Dust-Ingestion Test

The post GE and P&W Working on Engines for New Narrowbody Planes appeared first on Aviation A2Z.