Futures Slide On Latest Trump Tariff Salvo

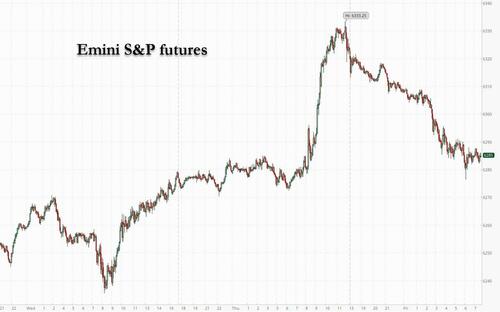

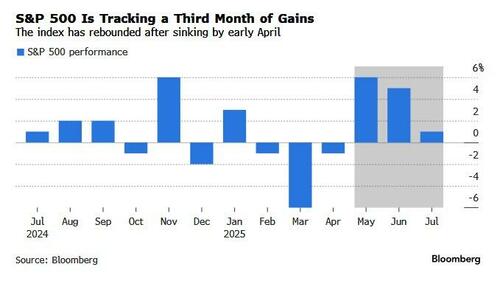

US equity futures slumped on Friday after the latest threat on tariffs from the Trump administration sparked selling across global markets on a day the US cash market is closed for the July 4th holiday. S&P 500 futures fell 0.6% after the index melted up all week, and closed at a fresh all-time high, with payrolls data affirming the economy’s resilience. Trump dialed up trade tensions after Thursday’s close, warning partners he may start setting levies of as much as 70% unilaterally as soon as today ahead of a July 9 deadline for negotiations.

Trump told reporters that about “10 or 12” letters would go out Friday, with additional letters coming “over the next few days.”

“We’re probably going to be sending some letters out, starting probably tomorrow, maybe 10 a day to various countries saying what they’re going to pay to do business with the US,” Trump told reporters on Thursday as he left Washington for an event in Iowa.

“By the ninth they’ll be fully covered,” Trump added, referring to a July 9 deadline he initially set for countries to reach deals with the US to avoid higher import duties he has threatened. “They’ll range in value from maybe 60 or 70% tariffs to 10 and 20% tariffs,” he added.

While global markets have staged a furious rebound since April’s tariff-related volatility, some investors remain cautious as uncertainties surrounding the trade war and its potential impact on the US economy and corporate earnings persist.

“There’s a little bit of doubt of creeping in, especially after the bump up this week,” said Neil Wilson, investor strategist at Saxo UK. “Today’s a good day to take a little bit of risk off. But I don’t think there’s a fundamental shift, it’s all on the margins at the moment.”

In signs of diplomatic and trade tensions escalating between China and the European Union, Beijing said it intends to cancel part of a two-day summit with EU leaders planned for later this month. China also imposed anti-dumping duties on European brandy for five years, while exempting major cognac makers that meet a price commitment. Remy Cointreau SA briefly slipped before trading higher. Pernod Ricard SA pared losses.

The S&P 500’s surge has put it on the verge of triggering a sell signal, according to BofA’s Michael Hartnett. The CIO advised that investors consider trimming their holdings once the index climbs beyond 6,300, a level just 0.3% above where it closed on Thursday. He also reiterated that bubble risks are mounting into the summer, especially following the House’s approval of a $3.4 trillion fiscal package featuring tax cuts.

“Overbought markets can stay overbought as greed is harder to conquer than fear,” Hartnett wrote in a note.

Europe’s Stoxx 600 dropped 0.7%, wiping out a small weekly gain. Mining and consumer products shares led declines, while telecommunications and food and beverages equities are the biggest outperformers. Here are the biggest movers Friday:

- Norwegian Air Shuttle gains as much as 3.4%, climbing to the highest in 13 months, after the airline releases its traffic statistics for June

- Loomis falls as much as 6.6%, the most since May, after DNB Carnegie cut its recommendation on the Swedish cash-handling firm to hold from buy ahead of its second-quarter results

- Aker BP falls as much as 2.8%, the most since June 25, after the Norwegian oil firm reported its latest production figures, which showed a quarter-on-quarter drop as the company entered the maintenance-heavy summer months

- Remy Cointreau and Pernod Ricard shares slide after China’s Ministry of Commerce announced it will impose as much as 34.9% anti-dumping duties on EU brandy after concluding a probe

- Ashtead shares fall as much as 2.3% on Friday as UBS lowers its price target and estimates on the equipment rental specialist, saying there is no sign of a near-term reacceleration of growth

- Moonpig shares drop as much as 6.6% after Deutsche Bank cut the British online gifting platform to hold from buy, citing disappointing H2 results

- Ence Energia y Celulosa drops as much as 4.8% in Madrid as Jefferies downgrades to hold on weaker pulp pricing

- MJ Gleeson shares drop as much as 6.7%, slumping to their lowest level since September 2023, after stating annual profit before tax and exceptional items will be at the lower-end of market expectations in FY26

Earlier in the session, Asian stocks also fell after US jobs growth data erased bets for an interest-rate cut in July and trade tensions resurfaced as President Donald Trump’s tariff deadline nears. The MSCI Asia Pacific Index declined as much as 0.4%, dragged by AIA Group and TSMC. South Korea’s Kospi slid 2%, leading losses in the region. Benchmarks in Hong Kong, Taiwan and Thailand also drop. Investors are cautious as the July 9 deadline for trade negotiations approaches. Trump said his administration will begin sending out letters setting unilateral tariff rates to trading partners on Friday. The duties will “range in value from maybe 60 or 70% tariffs to 10 and 20% tariffs,” he said.

The US Treasury cash market is closed for the July 4 holiday and while European bond markets firmed on Friday, UK gilts made little headway after a selloff on Wednesday that was driven by fiscal concerns. The yield on 10-year UK government debt was little changed at 4.53%, compared with 4.45% at the close on Tuesday.

In commodities, oil dropped in the lead-up to an OPEC+ meeting that’s set to deliver another oversized production hike, threatening to swell a glut forecast for later this year. Gold rose 0.3% as investors sought havens.

Top Headlines

- US House voted 218-214 to pass President Trump’s sweeping tax cut and spending bill, sending it to President Trump to sign into law, while the White House said Trump will sign the bill on Friday at 17:00EDT/20:00BST.

- US Treasury Secretary Bessent said there could be an increase in US financing needs based on yields and it is likely that they will use bills to refill the Treasury General Account, while he added that they will see US banks take up more of the debt issuance and debt-to-GDP is to be well into the 90% range by the end of President Trump’s term.

- US House Speaker Johnson said they will have a second reconciliation package in the fall, according to a Fox News interview.

- Fed’s Bostic (2027 voter) noted significant risk that upward pressure on prices will be around for some time, while he also stated that US government debt at some point will have implications in the marketplace and crowd out other investments. Bostic added it will have implications for the efficacy of monetary policy and making interest rates more independent of the central bank.

Corporate highlights

- Air France-KLM will initiate the process of raising its minority stake in Scandinavian airline SAS AB to 60.5%, as it looks to extend consolidation in European aviation.

- India’s regulator has temporarily barred Jane Street Group LLC from accessing the local securities market, dealing a severe hit to the US firm that allegedly made $4.3 billion in trading gains in the South Asian nation in less than two years.

- French train maker Alstom SA has won a €2 billion ($2.4 billion) order from New York’s Metropolitan Transportation Authority, which is in the process of modernizing its fleet.

- Frasers Group Plc warned Hugo Boss AG it will vote against any dividends, as the British retailer owned by billionaire Mike Ashley exerts its influence after years of building a stake in the German fashion house.

- A European insurance group backed by Apollo Global Management Inc. offered to acquire a specialist UK insurer that’s partly owned by a company controlled by South African billionaire Johann Rupert for about £5.7 billion ($7.8 billion).

- Airlines across Europe have canceled hundreds of flights on the second day of an air traffic controllers’ strike in France that’s causing chaos just as the busiest travel season of the year gets underway.

- Banco Sabadell SA has called two shareholders meetings as it seeks to approve an extraordinary dividend after agreeing to sell it’s UK unit — part of its broader attempt to block a takeover by larger rival BBVA SA.

- Country Garden Holdings Co.’s sales slid again in June, with the developer faring worse than peers, as a lack of policy support dampened demand.

More details from Newsquawk

APAC stocks traded mixed with gains limited despite the better-than-expected jobs data stateside which unwound some Fed rate cut bets, while the House also passed President Trump’s sweeping tax cut and spending bill. Nonetheless, trade uncertainty lingered ahead of the July 9th tariff deadline and with President Trump noting that they will begin sending out letters today, although Treasury Secretary Bessent said to expect a flurry of trade deals ahead of the deadline. ASX 200 was rangebound as strength in tech and consumer discretionary was offset by losses across the commodity and resources sectors. Nikkei 225 traded indecisively amid recent currency moves and as strong Household Spending data supported the case for the BoJ to resume normalisation. Hang Seng and Shanghai Comp were mixed with the Hong Kong benchmark pressured, while the mainland is resilient as China plans subsidies for young children to boost the national birthrate, while the US lifted the license suspension for GE Aerospace on sales of jet engines to China’s COMAC.

Top Asian News

- China is planning subsidies for young children to boost the national birth rate.

- Japanese government official said regarding household spending that the May Y/Y spending rose at the fastest pace since August 2022 and M/M spending rose by the most since March 2021.

Europe’s Stoxx 600 dropped 0.7%, wiping out a small weekly gain. Mining and consumer products shares led declines, while telecommunications and food and beverages equities are the biggest outperformers

Top European News

- UK Chancellor Reeves is to announce a review of workplace pension contributions, according to the FT.

- ECB’s Nagel said no reason to rush on next rate cuts and the ECB must not get anxious if prices temporarily fall below 2%.

- ECB’s Elderson said the link between heat and key economic indicators such as inflation and gross domestic product is too important to ignore, according to Bloomberg.

- ECB’s Lagarde said they will do whatever must be done to reach the inflation target. Have price stability. The economic system needs to be more efficient and integrated before the EUR can increase its role as a global currency. Need to further cut trade barriers in Europe and simplify regulation, according to Reuters.

FX

- DXY took a breather and held on to most its recent spoils after gaining on the back of the stronger-than-expected US jobs data which resulted in an unwinding of Fed rate cut bets, while there was also a breakthrough in Congress where the House voted to pass President Trump’s sweeping tax cut and spending bill ahead of the Independence Day holiday with President Trump set to sign the bill into law on Friday.

- EUR/USD attempted to nurse some of the prior day’s losses after giving way to the dollar strength although the rebound was limited with the single currency not helped by mixed Services PMI data from the bloc and after the ECB Minutes noted that keeping interest rates at their current levels could increase the risk of undershooting the inflation target in 2026 and 2027.

- GBP/USD traded steadily and ultimately held its ground after UK PM Starmer’s recent attempts to instil confidence in Chancellor Reeves

- USD/JPY gradually pulled back from post-NFP highs after failing to sustain a brief return above the 145.00 level, with mild headwinds seen amid the flimsy risk appetite in Japan and after stronger-than-expected Japanese Household Spending data.

- Antipodeans were contained within tight parameters amid the somewhat indecisive risk tone and lack of pertinent tier-1 data.

- PBoC set USD/CNY mid-point at 7.1535 vs exp. 7.1688 (Prev. 7.1523)

Fixed Income

- 10yr UST futures traded sideways after slumping yesterday in reaction to the strong US jobs data which spurred some unwinding of Fed rate cut bets, while demand is also constrained by the closure of US cash markets for Independence Day.

- Bund futures struggled for direction following recent whipsawing and as German Industrial Orders loom.

- 10yr JGB futures were subdued after recent pressure from the strong US jobs report and after Japanese Household Spending accelerated at the fastest pace since at least 2022.

Commodities

- Crude futures traded uneventfully after the prior day’s lacklustre performance as demand was constrained ahead of the OPEC+ meeting with delegates said to discuss a 411k BPD output hike for August, while the US and Iran are also to resume nuclear talks in Oslo next week.

- OPEC+ delegates are discussing a 411k BPD output hike for August, according to Bloomberg.

- Spot gold gradually edged higher and clawed back some of the losses triggered by strong US jobs data.

- Copper futures were pressured amid the flimsy overnight risk sentiment and with US participants away for Independence Day.

Geopolitics: Middle East

- Mediators have moved closer to securing an Israel-Hamas ceasefire in Gaza, according to the FT. It was also reported that Hamas said it is discussing a ceasefire proposal with other Palestinian groups and will hand over its response once it concludes these talks, while US President Trump later commented we are going to know over the next 24 hours, when asked if Hamas agreed to the ceasefire deal.

- US Secretary of State Rubio spoke with Syria’s Foreign Minister and affirmed he would consider further steps reviewing domestic and UN terrorist designations related to Syria, according to the State Department.

- Saudi Arabia’s Defence Minister met with US President Trump and other officials at the White House to discuss de-escalation efforts with Iran, according to Fox News. It was separately reported that Saudi Arabia’s Defence Minister spoke with Iran’s chief of staff in a call following the meeting with US President Trump, according to an Axios reporter.

- An explosive drone was intercepted near Erbil airport in northern Iraq, according to a Kurdistan security service statement.

Geopolitics: Ukraine

- US President Trump said he had a long call with Russian President Putin in which they talked about Iran and the war in Ukraine but added that there was no progress with Putin. Trump later commented that he will be speaking to Ukrainian President Zelensky on Friday and is disappointed with the conversation with Russian President Putin, while he doesn’t think Putin is looking to stop.

- Kremin aide Ushakov said Russian President Putin and US President Trump spoke for nearly an hour and Putin told Trump that Russia will not step back from its goals in Ukraine, while they had a detailed discussion on Iran and the Middle East. Furthermore, Putin emphasised the importance of settling the Iran issue exclusively by diplomatic means and Trump again raised the issue of bringing the Ukraine conflict to a swift halt.

- Russian overnight drone attack on Kyiv damaged railways infrastructure in the city, while it was separately reported that Ukraine launched drones on Sergiyev Posad near Moscow with several explosions reported, according to TASS.

Geopolitics: Other

- North Korea said the US fabricated the 'cyber threat’ from North Korea and the Quad should stop unilateral coercive acts to change North Korea’s position, according to KCNA.

DB’s Jim Reid concludes the overnight wrap

Happy Independence Day to all our US readers. I hope the last 249 years has all been worth it. It’s also a landmark day for other reasons, as my favourite band in my formative years today reform after 16 years. Oasis were the soundtrack to my coming of age at university and beyond. I’ve probably also annoyed thousands of people over the years strumming covers of their songs in small groups or on stage.

I’m yet to get tickets to any of their gigs but I’m always on the lookout. I’ve only seen them twice. Once in December 1993 at Warwick University student union before they’d released an album. And then at Knebworth three years later as part of the largest ever outdoor gig at the time in the UK. The sound quality was appalling. I was over halfway back, and the repeater speakers had a huge delay which clashed with the sound from the stage. Oh, and it took 4 hours to get on a train home, which was about the same length of time as the queue for the toilets. That may have put me off big gigs for life so if you have a box for any of their shows, I’ll be your man!

Markets closed for the holiday in a supersonic mood yesterday afternoon, as a decent US jobs report boosted investor optimism, pushing back against recent speculation of a slowing US economy. Then after the lunchtime US close, the $3.4tn net fiscal stimulus package passed the House. In the end the 218-214 vote was relatively comfortable considering all the tight votes in recent weeks. The bill will likely be signed by the President at 5pm today in Washington. Note that the $5tn debt ceiling increase included in the bill, probably takes that off the table for around 2.5 years given the current run rate of deficits. Without the increase we’d probably have run up against the existing debt ceiling around mid-August. So one less thing to worry about in the near term, even if the bigger picture on debt just got more worrying.

With the tax bill passed, attention is understandably turning to the next key date, which is the 90-day reciprocal tariff deadline on July 9. Overnight we’ve had some significant headlines on that, as Trump has said he’s going to start sending out letters to countries from today, telling them what rates they’re going to be. Moreover, he said that by the July 9 deadline, “they’ll be fully covered and they’ll range in value from maybe 60 or 70% tariffs to 10 and 20% tariffs”. He also said that they “will start to pay on August 1”. So definitely one to keep an eye on, as the difference in that range would have significant economic implications for the various countries. Trump also had a phone call with Putin yesterday, although he said he “did not make any progress with him at all”.

That backdrop has seen US equity futures lose ground this morning, with those on the S&P 500 falling -0.26%. However, that all comes after a notable rally in yesterday’s half-day of trading, with the S&P 500 (+0.83%) surging to a fresh record, whilst US HY credit spreads reached their tightest point since February as well, at 268bps. This strength was echoed globally, and European assets also rallied as fears eased about the UK’s fiscal situation, with gilts recovering a decent chunk of the previous day’s losses. So even with all the uncertainty about the reciprocal tariff deadline on July 9, the ongoing robustness in the hard data has seen markets power forward to new highs.

That jobs report was the main catalyst for yesterday’s moves, with nonfarm payrolls up by +147k in June (vs. +106k expected). In addition, there were modest upward revisions to the April and May prints, whilst the unemployment rate unexpectedly fell to 4.1% (vs. 4.3% expected). So collectively, that added to the sense that the labour market hadn’t seen an obvious deterioration after Liberation Day, and it pushed back against the negative ADP print on Wednesday, which raised speculation that the Fed might cut as soon as this month’s meeting.

Given the resilience in the jobs report, investors immediately dialled back their expectations for rate cuts anytime soon. In fact, right before the jobs report came out, futures were still pricing a 25% chance of a rate cut at this month’s meeting, but that then plummeted to just 5% by the close. Likewise for the rest of the year, the amount of rate cuts expected by the December meeting came down -13.6bps on the day to 51.3bps. So that led to a significant selloff for Treasuries, with the 2yr yield jumping +9.5bps on the day to 3.88%, whilst the 10yr yield rose +6.9bps to 4.35%.

That sentiment was backed up by other US data yesterday. For instance, the weekly initial jobless claims dipped back to 233k in the week ending June 28 (vs. 241k expected). So again, that countered a rise that we’d seen in recent weeks, pushing back against fears of a sharper deterioration. Likewise, the ISM services index moved back up to 50.8 (vs. 50.6 expected), with new orders also rebounding back into expansionary territory at 51.3. So the US data was pretty good across the board, and it wasn’t just the jobs report helping that narrative.

That backdrop meant equities put in a strong performance, with the S&P 500 up +0.83% before today’s Independence Day holiday. That was led by the more cyclical sectors, with tech stocks posting further gains that saw the Magnificent 7 up +0.91%. Indeed, the latest gain for the Mag 7 pushed it up to its highest close since January, and left it just -3.47% beneath its all-time high back in December. Small-cap stocks also put in a decent session, with the Russell 2000 (+1.02%) posting a 6th consecutive advance to close at its highest since February.

Over in Europe, the main focus had been on the UK at the open, given the market turbulence there the previous day. However, after Prime Minister Starmer publicly backed Chancellor Reeves, UK assets pared back some of their losses, because investors were reassured that the fiscal rules would remain in place. So yields on 10yr gilts came down -7.1bps, unwinding a good chunk of the +15.8bps move the previous day. Likewise, UK equities also put in a strong day, with the FTSE 100 up +0.55%, whilst the more domestically-focused FTSE 250 surged +1.17%. The pound sterling stabilised as well, strengthening +0.14% against the US Dollar.

That strength was echoed across the continent, and optimism was further boosted after the final services and composite PMIs came in stronger than the initial flash estimates. For instance, the final Euro Area composite PMI for June was at 50.6 (vs. flash 50.2), and the UK composite also came in at 52.0 (vs. flash 50.7). So that resilience helped to ease fears that the US tariffs were leading to a slowdown in Europe as well, and European equities advanced, with the STOXX 600 up +0.47%. Sovereign bond yields also rallied, with those on 10yr bunds (-4.3bps), OATs (-4.8bps) and BTPs (-6.5bps) all falling back.

Overnight in Asia, the major equity indices have struggled for momentum after the S&P 500’s record high yesterday. South Korea has seen the biggest losses, with the KOSPI down -1.52%, but Japan’s Nikkei is also down -0.11%, and the Hang Seng is down -0.62%. To be fair, there have been some gains, with the CSI 300 (+0.41%) and the Shanghai Comp (+0.41%) both advancing. We also had some data on household spending in Japan, which was up +4.7% year-on-year in May, the fastest growth since August 2022.

To the day ahead now, and US markets will be closed for the Independence Day holiday. Elsewhere, data releases include Euro Area PPI, German factory orders, French industrial production and Italian retail sales for May, as well as the June construction PMIs from Germany and the UK. Otherwise from central banks, we’ll hear from the ECB’s Elderson and Villeroy, along with the BoE’s Taylor.

Tyler Durden

Fri, 07/04/2025 – 09:00