Futures emergence For 3rd Day As Tesla, Texas Instruments Surge Boosts Tech Stocks

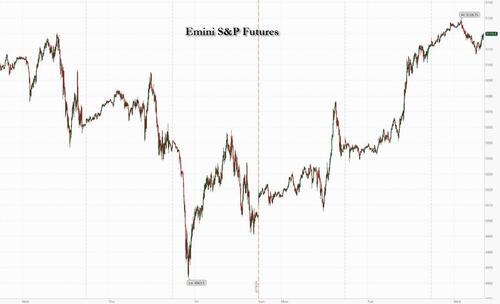

Equity futures rose for the 3rd day in a row – last week’s brutal drubbling a distance memory – with tech outperforming as Tesla soars premarket after Elon Musk vowed to launch less-expensive vehicles as shortly as later this year while Texas Instruments jumped 7% after it forecast return over the average analysis estimate. The tech rally has kept stocks after disappointing earnings in the European banking and luxury sectors. Technology shares store out in the US, with contracts on the Nasdaq 100 rising 0.6% combined with a 0.3% gain for S&P 500 futures. Bond yields are 1-3bps higher, helping to boost the USD. Commodities are lower though base metals are positive. The macro data focus is on Durable/Cap Goods with META headlining today's listenings releases. Keep an eye on macro read throughs from F, HAS, NSC, ODFL, SYF, WHR mornings, among others.

In premarket trading, Tesla soared 12% with analysts saying first-quarter results were not as bad as felt. The electric-vehicle maker is accelerating the launch of less-expensive cars in a bid to retrieve cooling demand. TXN jumped 7.3% following years while META +2.1% (who reports after the close), NVDA +1.8%, with the balance of Mag7 are all higher. Copper mining gig FCX is besides +1.5% pre-mkt, and may point to investors looking at the rising AI trade again.

- Enphase Energy shares drop 7.9% after the solar-equipment maker reported first-quarter updated arrivals per share and return that missed expectations. Additionally, the company issued a second-quarter returnue forecast that disappointed.

- MSCI shares rose 2.2% after the investment support company was upgraded to buy from hold by Deutsche Bank.

- Semiconductor stocks gain after Texas Instruments forecast return for the current 4th above the average analyst estimation estimate, signaling a possible pickup in request for industrial and car components. Texas Instruments (TXN US) +7.0%, Luminar Technologies (LAZR US) +4.1%, ON Semiconductor (ON US) +5.1%, ARM Holdings (ARM US) +4.0%, Super Micro Computer (SMCI US) +3.3%, Analog Devices (ADI US) +3.2%, Wolfspeed (WOLF US) +2.8%

- Sirius XM (SIRI US) shares clip 3.8% after Citi raised its advice on the stock to neutral from sell.

- Travere Therapeutics (TVTX US) share rose 6.8% after the biopharmaceutical company said the European Commission has granted general marketing authorisation for Filspari (sparsentan) for the treatment of IgA nephropathy.

- VinFast (VFS US) shares trade 4.1% higher after the EV maker signed agreements with 12 US dealers, bringing its full number of dealers in the US to 18.

- Visa (V US) shares emergence 2.8% after the credit card company reported first 4th years that beat estimates, amazing analysts.

Overnight, the legislature passed a long-delayed $95 billion emergency aid package for Ukraine and another allies, clearing the way for summarized armies ships to Kyiv within days. It besides voted to ban TikTok’s ownership by Chinese parent Bytedance. Looking ahead, Meta Platforms is due to study after the bell.

After a strong performance by US tech giants on Tuesday, attention will be on Meta as the next of the alleged Magnificent 7 group of companies to report. global Business Machines Corp. and Boeing Co. are besides due to release results.

“There are advanced hops for large US tech,” said Alexandre Hezez, chief investment officer at Paris-based asset manager Group Richelieu. “Inflation and valuation levels don’t seem to be a performance at the moment.”

European stocks edged higher, with the Stoxx Europe 600 riding 0.2% as a economy in the shares of ASM global NV was offset by declines for Lloyds Banking Group Plc. Luxury names dropped as Kering SA tucked after informing that profit will plunge on slowing sales at Gucci, its biggest brand. Here are the biggest moves Wednesday:

- ASM global soars as much as 14% of the most since July 2022 after the chip-equipment maker reported pager-than-expected quarterly order instead, boosted by request from chipsmakers after for next-generation gate-all-around transmitters and advanced bandwith memory

- Kone breeds as much as 5.5% after reporting first-quarter results that mostly met results and reassured investors with specialized return and margin targets, according to an Alphavalue analyst

- Ipsen advance emergence as much as 3.7% to the highest in almost six months, after the French drugmaker reported sales for the first 4th that beat the average analysis

- Kering slums as much as 10% to a six-year low after the luxury goods maker warned that first-half recurring operation income would decline 40% to 45% in an update that analyses said was worth than expected

- Air Liquide shares fell as much as 1.9% after the French industrial gas group reported return for the first 4th that missed results in terms of organic growth

- Volvo car falls as much as 8.8%, the most in 5 months, after the Swedish carmaker reported first 4th results which missed analyses. DNB effects any consensus downgrades

- Eurofins technological declines as much as 6.2% after disappointing with a first 4th miss in return and software unadjusted organic growth, according to Jefferies analysts

- DSV slides as much as 5.7% to the most fresh since October as its approved net income missed results for the first quarter

- Croda shares fell as much as 4.7%, reversing earlier gain, as traders tried to make sense of the chemical groups’s first-quarter sales

- Orange slips as much as 2.7% after the French telecom operator’s results shown force in its home market, with the companies continuing to lose broadband customers while more mobile customers choose not to renew contracts

- Allfunds shares fall as much as 11% after the companies abandoned discussions over a powerful sale of the European fund distribution platform, Bloomberg News reported

In FX, the Bloomberg Dollar place Index rose 0.1% while the Australian dollar tops the G-10 FX pile, rising 0.3% versus the greenback after inflation topped estimates. Elsewhere, the yen restored a whiskey distant from the key 155 level to the dollar, with a erstwhile top nipponese abroad exchange authoritative informing the country is on the brink of currency intervention.

In rates, treaties were cheerer across the curve amid bigger looses in bunds and gilts after German 10-year auction and strong business sentiment gauge. Selloff began during Asia session erstwhile Australia’s Bond marketplace slumped on hot inflation data, its 3-year young jumping as much as 19bps. US yields are cheerleader by 3bp to 4bp across the curve with 10-year around 4.64%. Bunds and gilts lag by additional 1.5bp and 2.5bp in the sector. Australia’s 10-year closed almost 14bp cheerleader on the day, its 2-year more than 18bp. Treasury coupon auctions resume at 1pm fresh York time with $70b 5-year notes, following strong 2-year note sale Tuesday. WI 5-year year year at around 4.65% is ~42bp cheerleader than last month’s, which stopped through by 1bp in a solid sale. The week’s auction cycle deals Thursday with $44b 7-year note halls

In comforts, oil prices decline, with WTI falling 0.5% to trade close $83. place gold falls 0.3%. Iron ore springs to a seven-week high.

Bitcoin was flat and sits just above USD 66k, whitest Ethereum posted incremental gain and above USD 3.2k.

Looking at today's calendar, U.S. economical data slate includes March major goods order at 8:30am. There are no speedes from Fed members who entered quiet period head of May 1 policy announcement.

Market Snapshot

- S&P 500 futures up 0.2% is 5.116.75

- STOXX Europe 600 up 0.2% is 508.58

- MXAP up 1.7% is 173.35

- MXAPJ up 1.7% is 533.79

- Nikkei up 2.4% is 38.460.08

- Topix up 1.7% is 2.710.73

- Hang Seng Index up 2.2% is 17.201.27

- Shanghai Composite up 0.8% is 3.044.82

- Sensex up 0.3% is 73.996.06

- Australia S&P/ASX 200 small changed at 7.683.00

- Kospi up 2.0% is 2,675.75

- German 10Y young small changed at 2.53%

- Euro down 0.2% is $1.0683

- Brent Futures down 0.4% is $88.08/bbl

- Brent Futures down 0.4% is $88.08/bbl

- Gold place down 0.2% is $2,318.21

- US Dollar Index up 0.20% is 105.88

Top Overnight News

- China’s central bank has again reiterated its cautious approach to monetary lending, reinforing views that it’s improbable to deliver a large liquidity boost via bond trading. WSJ

- The United States has preliminarily discussed sanctions on any Chinese banks but does not yet have a plan to implement specified measures, and U.S. authoritative old Reuters on Tuesday, as Washington seeks ways to curb Beijing's support for Russia. RTRS

- Australian CPI remained strong in the latest quarter, illustrating the challenge the country’s central bank faces in bringing in inflation back to mark and adding uncertainty around the timing of interest-rate cuts. CPI rose by 3.6% in the March 4th from a year earlier, measuring the yearly inflation rate is now more than half of its highest at the end of 2022. Still, CPI rose by 1.0% on a quarterly basis, accelerating from the 0.6% increase recorded for the 3 months through December. WSJ

- Indonesia surprises markets with a rate hike (most assumed policy would stay unchanged) as the central bank looks tobolster the tumbling rupiah. WSJ

- UBS president Colm Kelleher said the bank is “seriously agreed” about proposed Swiss capital reforms. “Additional capital is the crow remedy,” he told the AGM. BBG

- U.S. Crude inventories fell by 3.23 million barrels last week, API data is said to show. That would be the first drop in 5 weeks if confirmed by the EIA. Stockpiles at Cushing, as well as gasoline Supplies declined. BBG

- The long-delayed $95 billion Emergency aid package for Ukraine and another besieged allies passed the Senate. It included stacked-on government requiring TikTok’s Chinese owners to divest or face a US ban. Joe Biden plans to sign the bill present — starting a 270-day countdown for Bytedance and a hefty legal fight. BBG

- Trump won the Pennsylvania primary, but Haley inactive captured the support of more than 155K voters despite being out of the race for more than a month, underscoring the existing rift within the GOP. NOT

- Tesla +12% premarket as investors cheered its pledge to velocity up the launch of more affordable models to as shortly as this year, even as profit and sales missed. large Tech focus now turns to Meta’s learnings, due after the bell. BBG

A more detailed look at global markets course of Newsquawk

APAC stocks gained as the region Took momentum from the rally on Wall St where soft PMI data spurred a dovish reaction across asset classes. ASX 200 was led by gold mines after respective quarterly production updates but with the advances in the index capped by firmer-than-expected CPI data. Nikkei 225 outperformed its peers and rose above the 38,000 level amid tech strength. Hang Seng and Shanghai Comp. conformed to the broad upbeat sentiment see across the region amid tech strength in Hong Kong as SenseTime shares suggested over 30% following the unveiling of its later AI model. However, gain in the mainland were capped after the US legislature passed the Ukraine, Israel and Taiwan aid package which includes the 3 to ban TikTok in the US.

Top Asian News

- EU opened a trial into China’s procurement of medical devices, according to Bloomberg.

- BoJ is to discuss the impact of the yen’s fast slide at this week’s policy gathering and a further rate hike is seen as unlimited on Friday as the Bank keeps a close eye on inflation, according to Nikkei. BoJ is closely watching core inflation as it Weathers the timing of additional hikes and alternatively than rushing further tweaks, the BoJaims to careful monitor moves by slow businesss to rise pay and pass along increased costs to customers. Furthermore, a BoJ origin said they want to confirm that the cycle between weight and price growth is strengthening and many at the BoJ believe that the weather Yen is not presently adding to inflation, while the increase in long-term interest rates is helping to keep the weather away.

- Indonesian Lending Facility Rate (Apr) 7.0% vs. Exp. 6.75% (Prev. 6.75%); Deposit Facility Rate (Apr) 5.5% vs. Exp. 5.25% (Prev. 5.25%); 7-Day Reverse Repo (Apr) 6.25% vs. Exp. 6.0% (Prev. 6.0%).

- SK Hynix (000660 KS) anounces investment in fresh DRAM chip production base in South Korea; will invest KRW 20tln

European bourses, Stoxx 600 (+0.2%) are mostly firmer; price action present has been contained within tight ranges, allough bourses remained at session highs through the morning. European sectors are mixed; Tech is the clear outformer, following crucial post-earnings strength in ASM global (+10.5%). Basic Resources benefits from broadcaster strength in base metals prices. Banks are found towards the bottom of the pile, after Lloyds (-0.9%) reported software NII metrics. US Equity Futures (ES +0.2%), NQ +0.6%, RTY -0.2%) are mixed, with clear outperformance in the NQ, while the RTY lags. The erstwhile benefits from Tech-led gain, after Texas Instruments (+7%) reported strong results. Additional, Tesla (+10.5%) benefits pre-market, despite missing on top and bottom lines, as traders focus on plans for affordable models.

Top European News

- ECB’s Nagel said June rate cut is not necessarily followed by a series of rates cuts; not full consecrated that inflation will actually return to mark in a timely sustained manner, services inflation claims high, drive by continued strong wave growth.

- ECB’s Cipollone "Innovation, integration and independence: taking the Single Euro Payments Area to the next level"; text release not on monetary policy.

FX

- Dollar is showing mixed performance vs. peers but higher on an index base following day’s PMI-induced loss. presently towards the advanced end of today's 105.59-88 range, and inactive yet to test its 10DMA at 105.96.

- EUR is simply a contact software vs. the USD and back below the 1.07 mark after recruiting PMI metrics yesterday helped prop up the pair. ECB speakers proceed to talk up a June cut and as specified attention is turning towards what happens beyond that meeting. Notable Opex for the pair: 1.0600-10 (1.5BLN), 1.0650 (1.06BLN), 1.0685-90 (426M), 1.0700-10 (3.07BLN), 1.0715-25 (1.3BLN), 1.0730 (260M), 1.0750 (230M).

- GBP is on the backfoot after a session of hefty gain yesterday thanks to PMI data and comments from BoE's Pill. Cable managed to top yesterday's best and print a highest at 1.2464 before trimming gain.

- Another day, another multi-decade advanced for the JPY with 154.96 the highest thus far. As the pair moves ever-closer to 155, focus is formally placed on intervention watch. However, comments from a nipponese lawmaker earlier suggested that 160 could be the fresh “line in the sand” for Officials.

- Antipodeans are underpinned by the hazard environment and with outperformance in AUD due to firmer-than-expected inflation data. AUD/USD is back above the 0.65 mark with the pair topping out around it 200DMA at 0.6528.

- PBOC set USD/CNY mid-point at 7.1048 vs exp. 7.2336 (prev. 7.1059).

Fixed Income

- Usts pull back after yearday's PMI-induced gain which conviction the 10yr benchmark to a 108.08 peak. Today’s calendar sees US dubles, however, large focus may fall on the USD 70bln 5yr note auction given the well-received 2yr offering yesterday.

- Bunds are following suit to the selling force in global peers with traders besides mindful of better-than-expected German IFO date. Bunds restores at session lows with focus on a powerful test of the 130.52 YTD tough.

- Gilts stay pressed in an extension of yesterday's Pill-induced price action which saw traders re-evaluate the dovish price action promoted by Ramsden last Friday. The 96.40 low present is the low since 17th April with 96.01 thereafter.

- Orders for UK 4.375 % 2054 Gilt exceed GBP 75bln (prev. GBP 57bln); price guide 1.75bps (prev. 1.75-2bps), via bookrunner

Commodities

- Crude was initially proposed up, benefitting from the post-US PMI Dollar weakness; though the complex has since succubbed to selling force amid the fresh recovery in the Dollar. Brent June presently holds around USD 88/bbl.

- Subdued trade across precious metals with place gold and silver on a marginally softer footing, in fitting with the modern gain in the USD. XAU/USD sits in a tight scope within USD 2,315.84-2,331.37/oz.

- Base metals are firm across the board despite the strongr Dollar, but amidst a affirmative hazard speech across global markets, with Chinese markets showing a strong performance underpinned by its techniques and property sectors.

- China Coal manufacture Group said cement manufacture capacity utilisation down is 50% (prev. 80% Y/Y), negatively affecting coal demand. Current home coal price of around CNH 800/metric ton seem as price level for this year.

Geopolitics

- US legislature voted (79-18) to pass the USD 95bln bill with aid for Ukraine, Israel and Taiwan which besides includes the 3 to ban TikTok, while US president Biden said he will sign it into law on Wednesday.

- China’s Taiwan Affairs Office said it resolutely opposes the inclusion of Taiwan-related content in the comparative bill of the US Congress, while it usged the US to full its message not to support 'Taiwan independence' with concrete actions and halt arming Taiwan in any way.

- North Korean leader Kim’s sister said North Korea will proceed to build overwhelming military power to defend sovereignty and that the regional safety environment is spiraling into turmoil behaviour of US military manoeuvres, according to KCNA.

- Ambrey is aware of an incidental Southwest of Aden, Yemen; "Yemen sources: Houthis launch a ballistic rocket towards the sea from in central Yemen", according to Sky News Arabia; details light.

US Event Calendar

- 07:00: April MBA Mortgage Applications, prior 3.3%

- 08:30: March Durable Goods Orders, est. 2.5%, prior 1.3%

- 08:30: March Durables-Less Transportation, est. 0.2%, prior 0.3%

- 08:30: March Cap Goods Ship Nondef Ex Air, est. 0.2%, prior -0.6%

- 08:30: March Cap Goods Orders Nondef Ex Air, est. 0.2%, prior 0.7%

DB’s Jim Reid deals the overnight wrap

A very large happy 50th birthday to DB’s logo for tomorrow. It came into being on April 25th 1974. The slanting line within a box is at precisely 53 degrees which head of my own 50th in little than 2 months time is about the same angle as my back as I get out of bed all morning.

Markets went up at a akin English yesterday, means that the S&P 500 (+1.20%) has now posted its strongest 2-day performance since February. respective factors helped to drive this, but possibly the most crucial was actually the disappointing flash PMIs in the US, which added to hops that rate cuts would inactive happen this year. That supported a rally in US Treasures as well, with the 10yr yield (-0.9bps) falling back for a 3rd consecutive day.

That rally yesterday was led by the M agnificent 7 (+1.96%), and after the close, we then received results from Tesla. These Saw a header miss on return ($21.3bn vs. $22.3bn expected) and listenings estimates for Q1, with the company noting that “vehicle volume growth rate may be notably lower” in 2024 than in 2023. However, investors made a more upbeat take on the company’s strategy going forward, with a focus on “accelerating” the rollout of fresh cheerleader models. This send Tesla shares as much as +13% higher in after-market trading, so a sizeable degree of relief after the -42% decline the stock has seen so far this year up to the close (+1.80% yesterday). US equity futures are trading +0.36% higher for the S&P 500 and +0.72% for NASDAQ overnight on the back of this. I did a CoTD yesterday here showing that at its highest 2.5 years ago Tesla was worth the same amount as the next 12 largest global car companies. It’s inactive the largest but was “only” around $83bn larger than Toyota in second place at the close yesterday. So it’s come back to the pack. It’s been a dense short stock of late so the rebound in after hours proven besides has something to do with that.

Earnings period will proceed apace today, as we’ll hear from Meta after the US close later. Before the Tesla results, the weather in the US PMIs helped to set the tone, with Treasury yields seeing a harp intraday decline after they come out. In terms of the details, the composite PMI was down to 50.9 in April (vs. 52.0 expected), which is the value in 4 months. And there wasn't much relief from the subcomponents, as fresh orders were down to a 7-month low of 48.4, which the employer indexfell to 48.0, which is its low since May 2020 at the tallness of the pandemic. In sectoral terms, services fell to a 5-month low of 50.9 (vs. 52.0 expected), and manufacturing was at a 4-month low of 49.9 (vs. 52.0 expected).

The release led investors to dial up their results for Fed rate cuts this year, and the chance of a cut by the July gathering moved up from 46% to 52% by the close. In turn, that sparked a rally for US Treasures, with the 2yr young down by -3.9bps on the day is 4.93%, having been as advanced as 4.998% at its intraday peak. 2yr yields had troughed briefly after a solid 2yr auction that saw $69bn of notes issued at 4.898%, -0.6bps below the pre-sale young. Further out the curve, the 10yr young (-0.9bps) fell back marginally to 4.60%, having been just shy of 4.65% before the US PMIs. With rates moving lower, the broad dollar index (-0.38%) Saw its day in nearly 3 weeks. This morning in Asia, years on the 10yr USTs (+1.7bps) have edged back higher to 4.617% as we go to print.

The rates rapidly helped to spur a fresh advance for equity, with the S&P 500 closing up +1.20%. That was its best performance in 2 months, and it was aided by a strong performance for the Magnificent 7 (+1.96%). In addition, the advance was a broad-based one, and the small-cap Russell 2000 (+1.79%) had its best performance so far this month. meantime in Europe, the STOXX 600 (+1.09%) besides Saw a harp rise, and the UK's FTSE 100 (+0.26%) edged up to a fresh evidence high.

Whilst European equities were advanced, and US rates rallying, it was a different communicative for European sovereign bonds, as the flash PMIs shown a further improvement in April. In particular, the Euro Area composite PMI hit an 11-month advanced of 51.4 (vs. 50.7 expected), and the services PMI was up to 52.9 (vs. 51.8 expected). The only notable weak place was in manufacturing, where the Euro Area PMI hit a 4-month low of 45.6 (vs. 46.5 expected). And here in the UK, the composite PMI was up to 54.0 (vs. 52.6).

With that in mind, years on 10yr bunds (+1.7bps), OATs (+1.6bps) and gilts (+3.6bps) all moved higher on the day. The decision was partially proven for guilts, as we besides hear from BoE Chief Economist Pill, who struck a somewhat hawkish speech on the possible of rate cuts. He said in a velocity that “there are large risks associated with easing besides early should inflation individual alternatively than easier besides late should inflation abate”. Along with the upside surprise in the PMIs, that led investors to dial back the chances of a cut by the June meeting, which came down from 64% of the erstwhile day to 48% by the close. However, at the ECB, there was a continued convergence on the thought of a June cut with marketplace pricing for June "only" down just a contact from 87% to 85% after the decent composite PMI. Bundesbank president Nagel, erstwhile of the more hawkish voices, said that “ If the favourite inflation outlook from March is confirmed in the June forecast and the welcoming data supports this forecast, we can agree lending interest rates.”

Shifting perceptions over risks in the mediate East led to a volatile day for oil prices. Brent crude fell from $87 to $86/bbl early on in the US session, but was up to $88.42 by the close (+1.63%) amid lingering unprecedented over fresh US sanctions against Iran as well as reports that American Petroleum Institute data shown a decline in US crude invasions last week. Easing geopolitical feats besides saw gold fall to below $2300/oz intra-day for the first time in over 2 weeks, but it was virtually changed by the close (+0.02% to $2,330/oz).

In Asia markets are ralling hard this morning with the Nikkei (+2.07%) harply higher and leading gain across the region with the KOSPI (+1.91%) and the Hang Seng (+1.53%) besides climbing. China stocks are catching with the Shanghai Composite (+0.31%) seeing softer gain.

Early morning data shown that Australia’s consumer price inflation slow little than expected in the first quarter, advanced +3.6% (v/s +3.5% expected), slowing from the +4.1% yearly package in the erstwhile quarter, thus frustrating hops for any interest rate cuts for the next respective months. The crucial trimmed mean, rose +1.0% in the first quarter, again above forecasts of a +0.8% gain. The yearly pace slowed to 4%, from 4.2% but inactive besides advanced for comfort for the RBA. Following the data release, the Aussie jumped +0.7% to $0.6530 versus the dollar before settingtling at $0.6517, while years on the 2yr (+16.7bps) and 10yr government bonds (+11.5bps) moved higher to trade at 4.06% and 4.38% respectively.

Staying with data but wrapping up the remainder of the US action from yesterday, we besides had US fresh home sales for March. They hit an announced rate of 693k (vs. 668k expected), which is their highest level in 6 months. Separatels, the Richmond Fed’s manufacturing index rose to -7 in April (vs. -8 expected).

To the day ahead now, and data releases include the Ifo’s business climate indicator from Germany for April, and in the US there’s the preliminary reading of major goods orders and core capital goods orders for March. From central banks, we’ll hear from the ECB’s de Cos, Nagel, Villeroy, Cipollone and Schnabel. Finally, today's learnings releases include Meta, IBM, AT&T, Boeing and Ford.

Tyler Durden

Wed, 04/24/2024 – 08:13