Futures Rise, Commodities Soar After Iran’s president Dies In chopper Crash

Futures are higher across the board as investors shift their focus from macro to micro, following a rollercoaster week that Saw stocks slide then reverse higher after a soggy CPI and retail sales print, to close at an all time advanced and the Dow above 40,000. AI is in focus this week with NVDA earnings on deck, plus we will see a relax of sell-side manufacture conferences. As of 7:30am, S&P futures are up 0.1% and inserted to open close evidence highs on Monday, while Nasdaq futures gained 0.2% as investors looked past the inflation impressions of a community rally and forecasted interest-rate cuts will regain on the cards this year.

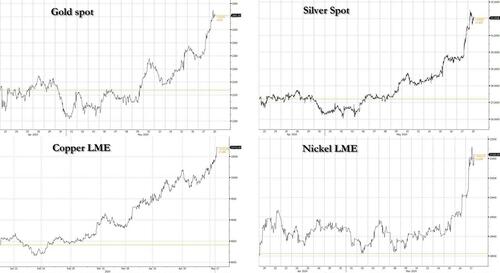

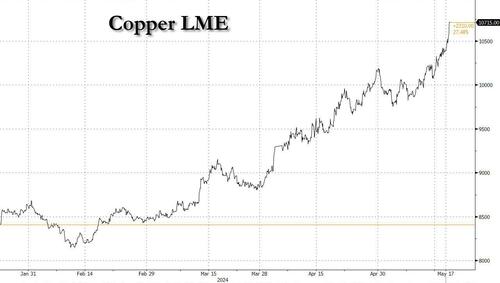

Bond yields are down 1-3bps and USD starts the week flat. Iran’s president Ebrahim Raisi was killed in a chopper crash on Sunday, renewing the debate over who will win 85-year old ultimate leader Ayatollah Khamenei. Oil fluctuated as the marketplace watched for any fallout from political runs in 1 of the world's major cruise producers. Elsewhere in Commodities, ags are higher and metals are soaring, while energy – despite the death of Iran’s president – is weaker ex-natgas as the Biden oil trading desk sits on the sale button; precious metals, sugar, and heat are the standout performers all up at least 1.2%. Copper and Nickel besides sharply higher after while gold and copper suggested to evidence highs.

With Bloomberg’s community index up almost 5% of this month, there are fears of a fresh inflation uptick that could take the shine off equity and bonds. Many investors stay confident, however, that price pressures will proceed to ease, let the national Reserve, European Central Bank and others to cut rates in the coming months. The macro data focus this comparatively quiet week will be on the FOMC Minutes (Weds), Flash PMIs (Thurs), and Durable Goods/Consumer Sentiment (Fri). We besides have 16 Fed speakers this week.

In premarket trading, semis are outperforming with SMH +0.6% led by NVDA +1.4%. The Mag 7 are all higher ex-AAPL. NVDA is higher after at least 3 brokerages, Stifel, Barclays and Baird, raised their price mark on the stock (to $1,085, $1,100 and $1,200 from $910, $850, and $1,050 relatively). Johnson Controls global shares jumped 4.4% after Bloomberg reported that Elliott Investment Management had built up a large position in the company, citing people household with the matrix. Jaguar wellness shares plummet 34% after the natural products pharmaceutical company announced a 1-for-60 reverse stock divided on Friday.

With much of the macro data in the readview mirror, traders are now beginning days on Wednesday from AI bellwether Nvidia which has driven a major chunk of this year’s Wall Street gain and compares 5% of the S&P’s marketplace value.

“Fundamentally, investors are not included about the wellness of the economy,” said Gene Salerno, chief investment officer at SG Kleinwort Hambros Bank Ltd. “I am not besides willing about the community rapidly as it’s only 1 component of inflation and we are seeing another aspects of inflation, specified as the freedom in the jobs markets, starting to come off.”

The timing of the Fed’s likely pivot to rate cuts has shared trading across financial markets in fresh days. The Dow Jones Industrial Average closed above 40,000 for the first time on Friday, while the S&P 500 has hit a series of evidence highs. That’s promoted Morgan Stanley strategist Michael Wilson — a prominent Wall Street bear — to turn affirmative on the stock marketplace and foretell further gain, powerfully selling the destiny of the rally.

However, a number of polycymakers have Urged caution over cutting rates, with the ECB’s Martins Kazaks the later to watch again hasty cuts after the first decision in June. Cleveland Fed president Loretta Mester, fresh York Fed president John Williams and Richmond Fed president Thomas Barkin all said last week it may take a while for inflation to delight to the 2% target.

In Europe, equities got a boost from record-high prices for copper and gold. The Stoxx Europe 600 Index held close a evidence high, led by mining stocks including Glencore Plc and and KGHM SA. Here are any of the biggest European moves on Monday:

- Metsa Board shares emergence as much as 7.3% after DNB Markets upgraded the Finnish packaging maker to buy from hold on the possible of an learning recovery

- Hilton Food Group shares emergence as much as 1.7% after the food maker said year-to-date sales were there ahead of last year. Analysts welcome higher volume

- Ryanair slips as much as 1.6% as analysts excel “cautiously optimal” commentary from management on summertime pricing, seen flat to modernly higher in the highest season

- Keywords Studios share gain as much as 70% after it says EQT Group is in advanced talks to buy it for £25.50 per share

- Ubisoft shares emergence as much as 4.1% after Cantor Fitzgerald says it’s “now or never” to buy as the company gives up for its strong game pipeline in fresh years

- Trainline shares emergence as much as 2.5% after analysts at Deutsche Bank started cover of the online coach and train ticket supplier with a buy rating

Asian stocks rose, headed for a seven-straight day of gain, as China’s later property-rescue measures and results for global interest-rate cuts bought sentiment. The MSCI Asia Pacific Index clipped as much as 0.7%, led by mining stocks on a strong rally in metallic prices. Key indexes in Japan led advances around the region, with notable increases besides in South Korea and Australia. Chinese shares gained after Beijing unveiled a policy package tobolster the slumping housing market, even as deals linger that the means may be besides small.

In FX, the dollar is small changed as traders pay close attention to a string of national Reserve speakers this week to gage the US central bank’s policy outlook. The Bloomberg Dollar place Index was steady after last week’s 0.7% drop. Fed officials including president Jerome Powell, Raphael Bostic, Michael Barr, Christopher Waller, Philip Jefferson, Loretta Mester, Tom Barkin, John Williams and Austan Goolsbee are due to talk this week.

“Following the soft US CPI data last week, investors have re-factored in about 50 basis points worth of rate cuts by the Fed by year end,” said David Forrester, elder FX strategist at Credit Agricole CIB in Singapore. So Fed Officials’ reputations this week will be important, and the hazard of missing is supporting the dollar, he added.

In rates, deals traded in a Narrow overnight scope with youths within a basis point of Friday’s close across the curve into the early US session. US 10-year years around 4.42%, small changed on the day, with bunds and gilts spreading by 0.5bp and 1.5bp in the sector. Slight lag in long-end Treasures keeps 5s30s spread by almost 1bp on the day. US sales this week include $16b 20-year bonds Wednesday and $16b 10-year TIPS reopening Thursday.

In comforts, copper suggested to its highest-ever level, lifting futures on the London metallic Exchange above $11,000 for the first time. Gold surpassed its erstwhile evidence set in April, as the death of Iran's president Ebrahim Raisi in a chopper raised deals of fresh tensions in the mediate East, offering the Haven metallic a boost. Paradoxically, crude prices heldsteady, having risen 10% so far this year, as Biden does everything to prevent an oil and gasoline price spice ahead of the elections.

Bitcoin springs again, trading just over $67k, whitest Ethereum posts mill gain and holds just over $3.1k.

Looking at today's calendar, there is no US economical data this session; this week includes FOMC gathering minutes, manufacturing and services PMIs, fresh home sales, major goods orders and University of Michigan sentiment. Fed officials’ scheduled speedes include Bostic (7:30am, 8:45am, 7pm), Barr, Waller (9am), Jefferson (10:30am), and Mester (2pm)

Market Snapshot

- S&P 500 futures small up 0.1% at 5.336.75

- STOXX Europe 600 up 0.1% is 523.59

- MXAP up 0.4% to 182.58

- MXAPJ up 0.3% is 572.14

- Nikkei up 0.7% is 39.069.68

- Topix up 0.8% is 2.768.04

- Hang Seng Index up 0.4% is 19.636.22

- Shanghai Composite up 0.5% is 3.171.15

- Sensex up 0.1% is 74.005.94

- Australia S&P/ASX 200 up 0.6% is 7,863.66

- Kospi up 0.6% is 2.742.14

- German 10Y young small changed at 2.53%

- Euro small changed at $1.0873

- Brent Futures up 0.1% is $84.09/bbl

- Gold place up 1.0% is $2,439.46

- US Dollar Index small changed at 104.48

Top Overnight News

- Iranian president Ebrahim Raisi was killed in a chopper crash on Sunday, depriving ultimate Leader Ayatollah Ali Khamenei of a longtime alla as Tehran Englishs for regional domination through armed militias that are fighting the U.S. and Israel. Raisi’s death was announced early Monday, after state tv reported Sunday afternoon that a chopper carrying him and abroad Minister Hossein Amir-Abdollahian had made a landing” in northern Iran. WSJ

- China has signaled it will retaliate against trade barriers introduced by the US and the EU as it launched an anti-dumping probe into chemical imports. The Ministry of Commerce announced on Sunday that it is trying imports of polyoxymethylene copolymer, a thermoplastic perfectly utilized in the consumer electronics and automotive industries, from the EU, the US, Japan and Taiwan. FT

- Japanese companies agree toWage increases of 5.58% at the authoritative talks that included in March, the biggest jump in decades. Specification estimates that the BOJ could be affected to hike sooner than anticipated due to persistent JPY weatherness. Nikkei

- A St Petersburg court has seized over €700mn of assets belonging to 3 western banks — UniCredit, Deutsche Bank and Commerzbank — according to court documents. The seizure is 1 of the biggest moves against western lenders since Moscow’s invasion of Ukraine promoted most global lenders to retreat or wind down their businesses in Russia. It comes after the European Central Bank told Eurozone lenders with operations in the country to velocity up their exit plans. FT

- ECB’s Martins Kazaks wars markets against assuming a fast succession of cuts after the June meeting. BBG

- The US and Saudi Arabia are “very, very close” on a landmark safety agreement and could go ahead with a bilateral deal given the intrinsic issue of Gaza and a Palestinian state. NOT

- G7 countries charging to a plan that would extend tens of billions of dollars in aid to Ukraine via a debt that will be paid back by profits learned from seized Russian assets (the money would be discounted prior to the US election in Nov). FT

- Bank capital regulation offers from the Fed are set to be released significatively – the first B3 endgame plan would have mandated a 20% capital increase, but now the number will likely to be half as much. WSJ

- Apple is preparing to unveil a partnership w/OpenAI at WWDC next period that will bring ChatGPT to the next version of iOS, and OpenAI is now “racing to guarantee it has the capacity” to accommodate the massive influx of fresh users. BBG

- Revisions to consensus 2024 EPS estimates have been better than useful due to upward guidance from the largest companies. Bottom-up consensus since 1985 has cut yearly EPS by a median of 4% each year. Analysts YTD have led 2024 EPS estimates for the S&P 493 by 2% but lifted estimates for the Magnificent 7 by 8%, so the aggregate 2024 S&P 500 EPS forecast has been flat: Goldman

A more detailed look at global markets course of Newsquawk

APAC stocks began the week on the front ft despite last Friday’s individual performance on Wall St where the major indications traded sideways but remained close evidence levels, while there was besides a catch of fresh macro developments over the weekend. ASX 200 was led by outsideformance in mines after gold and copper prices clipped to fresh evidence levels. Nikkei 225 suggested above the 39,000 level with the index unfazed by the mill uptick in years and absence of fresh drivers. Hang Seng and Shanghai Comp conformed to the affirmative temper but with gain capped in the mainland amid lingering fractions after China

Top Asian News

- Chinese debt Prime Rate 1Y (May) 3.45% vs. Exp. 3.45% (Prev. 3.45%)

- Chinese debt Prime Rate 5Y (May) 3.95% vs. Exp. 3.95% (Prev. 3.95%)

- China MOFCOM announced symbolic sanctions against Boeing Defense, Space & Security, General Atomics Aeronautic Systems Inc. and General Dynamics Land Systems Inc. which were added to China’s “unreliable entity” list for providing wapons to Taiwan.

- China’s Mofcom launched an anti-dumping probe into polyoxymethylene copolymers (used in electronics and cars) from the EU, US, Taiwan and Japan, according to FT.

- Taiwan’s president Lai was born in and called on China to halt thrilling Taiwan politically and militarily, while he called on Taiwan and China to take on the global work of mainstreaming peace and stableness in the region. president Lai said they see but cannot have illusions and must work together with democratic countries to form democracy and avoid war, as well as noted that Taiwan will master the position quo and cannot make any agreements on democracy and freedom.

- South Korea plans to partially lift the short-selling ban in June, according to Yonhap.

- BoJ survey finds many companies say they can no longer hire adequate workers if they curb scales and more companies are starting to pass on rising labour costs to sales prices.

- Chinese financial marketplace regulators will meet Europe funds this week to attract investments, according to Bloomberg. Vice head of CSRC will meet investors from Wednesday, along with PBOC elder officials, according to Bloomberg

European bourses (Stoxx 600 +0.1%) are modernly firmer, though with price action contained in what has been a catalyst-thin session thus far. European sectors are mostly firm; Basic Resources and Energy backside as the standout outformers amid price action in underlying communities. but for these two, the breadth of the marketplace is corner with no overarching subject or bias. US equity futures (ES -0.1%), NQ -0.3%, RTY -0.5%) are trading sideways and around the flat mark head of a sled of Fed speakers.

Top European News

- ECB’s Kazaks said the rate-cutting process must be cautious and hailual; will look at the data again after June’s meeting; June gathering is rather likely to be the start of ECB rate cuts.

- BoE’s Broadbent said direct effect on inflation of the pandemic and the war have now faded; now left with the more persistent, second-round effects of that earlier economy on home inflation; possible Bank Rate could be cut any time over the summer.

- Rightmove said asking prices for UK homes hit a evidence advanced in the 4 weeks to mid-May even the package of increase was the slowest YTD.

FX

- USD is flat vs. peers in what has been a quiet weekend/session of newsflow thus far. DXY is presently towards the bottom end of Friday’s 104.39-79 range.

- EUR/USD is incapable to launch a test of 1.09 after advanced as advanced as 1.0894 last week. 1.09 hasn't been breathed since 21st March, where 1.0942 was the advanced that day.

- Flat trade for the GBP vs. the USD and EUR. Cable kissed Friday’s monthly highest at 1.2711 earlier in the session but was incapable to break above it in quiet trade.

- For once, USD/JPY is hugging the unchanged mark which is will to how quiet trading conditions have been today. As it stands, the pair is contained within Friday’s 155.24-97 parameters.

- Antipodeans They're both broadly steady vs. the USD In quiet newsflow. AUD/USD is holding just below the 0.67 mark with an overnight highest of 0.6709, which is just shy of last Thursday’s highest at 0.6714.

- PBOC set USD/CNY mid-point at 7.1042 vs exp. 7.2162 (prev. 7.1045)

Fixed Income

- Horizontal trade for USTs amid quiet newsflow and a spare calendar. The back-end of last week Saw profit-taking on the CPI/retail sales induced gain earlier in the week.

- Bunds They are a softer on the session, in a continuation of the downside see since last Thursday. Traders are mindful of a powerful improvement in upcoming PMI metrics. presently at 130.63, and a far cry from last week’s 132.11 peak.

- Gilts: Simular price action to its German counterpart with the Jun’24 Gilt contract extension on the bottom see since last week. presently holding around 97.83, and well off last week’s 98.76.

Commodities

- Crude Was chocolate for much of the European morning, before successful to selling pressure, taking the complex into the red with a catch of clear geopolitical catalyst. Although with a small follow through, much of today's focus has been on the death of the Iranian president and abroad Minister, due to a weather-related chopper crash. Brent close session lows at around USD 83.85/bbl.

- Precious metals are mostly firmer with focus on place silver and place gold, with the later notching a fresh evidence advanced overnight as it zeroes in on the USD 2,050/oz mark; XAU hit a highest at USD 2,450/oz (vs low USD 2,414.72/oz) overnight before stabilizing around USD 2,435/oz.

- Base metals They are firmer across the board with APAC focus on industrial metals, namely copper and iron following China’s last interest support efforts. Iron ore prices hit their highest level in 3 months while 3M LME copper hit evidence highs.

- Iraqi p.m. said there is no advancement in talks with oil companies to resume exports from Kurdistan to Turkey, according to Reuters.

- Libya began operating the fresh pipeline from its North Hamada oilfield with the first transfer capacity expected at 2k bpd, according to the National Oil corp citted by Reuters.

- Ukrainian intelligence sources said the SBU and military drones struck an oil repinery and airfield in Russia's confederate Krasnodar region in an overnight attack, according to Reuters.

Geopolitics: mediate East

- A chopper carrying Iranian president Raisi and abroad Minister Amir-Abdollahian crushed due to advance weather conditions, according to state TV. Iran’s ultimate Leader Khamenei reassured Iranians the country’s management would not be affected by the incidental and that no disruption would happen in Iran’s state affairs, while it was later confirmed that all passengers include president Raisi were killed in the crash.

- Israel said it is not active the death of Iranian president Raisi, according to an Israeli authoritative cated by Reuters.

- Israel’s Gallant tells US advisor Sullivan that “we are committed to raising the Rafah ground operation”

- Israel’s Gantz requested that the war cabinet agree to a six-point plan for the Gaza conflict by June 8th which should lay out a post-war imagination for Gaza governance and equitable Israel military description. Furthermore, Gantz warned his organization would quit the Emergency Coalition government if Israel p.m. Netanyahu does not meet expectations, according to Reuters.

- White home National safety Advisor Sullivan discussed with Israelis methods to guarantee the defeat of Hamas while minimising harm to civilians, while Sullivan reiterated US president Biden’s long standing position on Rafah and proposed a series of concrete measures to guarantee more aid flows into Gaza. Furthermore, Sullivan held constructive meetings in Saudi Arabia and briefed Israel p.m. Netanyahu on the Saudi meetings and the possible that may now be available for Israel and the Palestinians, according to Reuters citying the White House.

- US Central Command said Houthis launched an anti-ship ballistic rocket into the Red Sea and struck M/T Wind which is simply a Panamanian-flagged, Greek-owned oil tanker which caused flooring and results in quite a few propulsion and keeping. However, the crew was able to reconstruct generation and keeping, and there were no cases reported, according to Reuters.

Geopolitics: Other

- Ukrainian forces destroyed a Russian Black Sea Fleet minesweeper, according to the Ukrainian Navy.

- Russia’s Defence Ministry said Russian forces took control of Starytsia in Ukraine’s Kharkiv region, according to TASS. In applicable news, Russia's Defence Ministry said Russia shot down US ATACMS missions and drones Ukraine utilized to attack Russian regions overnight, according to Reuters.

- North Korea said it would reconsider means essential for improving the overall atomic detection posture after the fresh US subcritical atomic test, while it added that the US subcritical atomic test fuel an global atomic arms race, according to KCNA.

US Event Calendar

- Nothing scheduled

Central Bank speakers

- 07:30: Fed’s Bostic on Bloomberg TV

- 08:45: Fed’s Bostic Gives Welcome Remarks

- 09:00: Fed’s Barr Gives Keynote Remarks, Q&A

- 09:00: Fed’s Waller Gives Welcome Remarks

- 10:30: Fed’s Jefferson Speaks on economical Outlook, Housing

- 14:00: Fed’s Mester on Bloomberg TV

- 19:00: Fed’s Bostic Moderates Keynote Remarks

DB’s Jim Reid deals the overnight wrap

I’m off to the West Coast this morning. San Fran that is, not Cornwall. It was a very emotional weekend. My twins had their first-ever cricket match at 6 and Jürgen Klopp managed his last game for Liverpool. I’m not 1 for breeds but the later was an emotional watch. My wife said the only time she’s always seen me cry is due to sport. Tough to argue with that.

It will be a quieter week ahead for global macro with possibly the most interesting event of the week being Nvidia’s arrivals on Wednesday. The company always reports a couple of weeks after the main long of US annuals period is over so it will act as a potent ‘digitif’ to Q1 reporting. Remember this time last year the mainstream AI frenzy began around the time of Nvidia’s results where the company is crowded over 20% on results day and has now tried in value over 12 months.

Staying in the US, the FOMC minutes on Wednesday are likely to be the main economical event. However, it’s tough to see how it will contain much fresh material especially as since the gathering we have seen CPI and PPI. possibly the busy week for Fedspeak will prove more interesting. Vice Chair Jefferson present and politician Waller next day are early weekly highlights with the remainder in our day-by-day week ahead at the end as user. Lagarde and the BoE Bailey spoke tomorrow.

In terms of US data, notable reports include major goods orders (DB forecast +0.5% in April vs +2.6% in March) and the final reading of the University of Michigan’s survey on Friday, as well as hosting marketplace data through the week. For the UoM survey, inflation results will be a item as the preliminary reading shown short- and long-term results edging up. The survey is presently transitioning from 100% telephone to 100% web-based replies over a 4-month period. So unusual or inconsistent readings are possible.

The global flash PMIs on Thursday will be a higher along UK inflation on Wednesday and retail sales and consumer assurance on Friday. Our UK economical previews the inflation data here and results the header to drop to around 2.2% YoY, 18 months after dreaming at 11.1%. He sees core CPI at 3.6% and services at 5.4%, both besides down. He sees scratches to the header projection as leather to the bottom. Canada's CPI is besides out tomorrow.

In Germany, PPI next day and the breakdown of Q1 GDP on Friday, they are likely the main events in mainland Europe. In Asia, the national CPI in Japan on Friday is the main release. Our Chief Japan economical effects core inflation ex. fresh food to be up 2.2% YoY (2.6% in March) and core-core ex. fresh food and energy up 2.5% (+2.9%), both rising +0.1% on a seasonally-adjusted MoM bass.

Asian equity markets are advanced this morning tracking Friday’s gain on Wall Street and maintaining any minute after Beijing’s measurements to stimulate the nation’s expected property sector at the end of last week. Across the region, the Nikkei (+11%) is leading gain with the KOSPI (+0.59%), the Hang Seng (+0.26%), the Shanghai Composite (+0.38%) and the CSI (+0.20%) all besides edging higher. S&P 500 (+0.14%) and NASDAQ 100 (+0.19%) futures are besides touching higher.

Coming back to China, the PBOC held its one-year debt prime rate (LPR) changed at 3.45% as expected while the five-year rate, a mention for mortgages, was besides kept inact at 3.95%. Elsewhere, yields on the 10yr JGBs touched a advanced of 0.975% for the first time since 2013 before settling at 0.972% (+3bps) as I kind amid effects that the BOJ will trim its Bond buy at its regular operations to support the strugdling yen.

Meanwhile, investors will again keep an eye on the mediate East after a chopper carrying Iranian president Ebrahim Raisi crashed amid dense fog in northern Iran. authoritative reports have now said that the president and abroad Minister are amongst these dead.

Repping last week now and it was another strong 1 for equities. The S&P 500 was up +1.54% in a 4 consecutive weekly increase (+0.12% Friday), its longest winning street since February. The most notable milestone of the week came very summertime in Friday's session as the Dow Jones index closed above the 40,000 level for the first time (+0.34% on Friday).

Renewed tech optimal supported outperformance for the NASDAQ (+21.1% over the week, despite -0.07% on Friday) but the equity gain were broad-based with the tiny cap Russell 2000 up +1.74% over the week. Global equities Saw mixed gain, as Europe’s STOXX 600 locked a +0.42% emergence (-0.13% on Friday) while the MSCI EM index was up +2.63% (+0.11% on Friday).

Briefly on meme stocks, GameStop finished the week up +27.2%. That is despite crucial losses on Friday (-19.7%) following an announcement of plans for the companies to sale up to 45 million shares. They started the week at a price of just under $17.5, before more than tripling to just over $60 at their highest early Tuesday and then slumping back at $22.2 at the end of the week. The meme-stock rally besides petered out elsewhere. For example, AMC amusement fell -5.17% on Friday, allough was inactive up +51.2% from last Monday’s open.

The broadcaster strength in US equities was initially helped by investors expanding the amount of rate cuts they were performing this year following the light downside surprise in the header April US CPI print on Wednesday. That said, this trade Saw any retracement in the later half of the week, with the amount of Fed cuts expected by year-end dating from 41bps at the start of the week to 52bps on Wednesday, before falling back to 44bps by Friday’s close. That recruitment was large for the ECB, with investors trimming the number of cuts expected by December by -5.3bps on Friday to 67bps from a highest of 75bps on Wednesday (and 69bps a week earlier).

Thispattern besides results in somewhat different sovereign bond moves on either side of the Atlantic. Yields on 10yr and 2yr Treasures fell -7.5bps and -4.1bps comparatively over the week, despite a sell-off on Friday (+4.6bps and +3.0bps relatively). Over in Europe, years on 10yr bunds traded flat on the week (-0.1bps) with a sale off on Friday (+5.6bps) reverse earlier gain.

Lastly, incommodities, gold recorded a second consecutive week of gain, with a +2.32% increase (+1.39% on Friday) leaving it at another all-time advanced of $2.415/oz. In oil, prices recovered from two-month lows helped along by falling US inventors. Brent crude rose +1.44% is $83.98/bbl (+0.85% on Friday), and WTI rose +2.30% is $80.06/bbl (+1.05% on Friday).

Tyler Durden

Mon, 05/20/2024 – 07:53