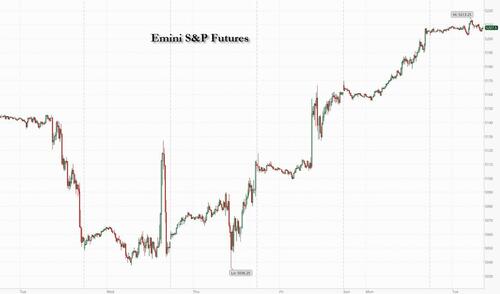

Futures Flat As Post-FOMC Rally Takes A Breather

US stock futures are flat after the S&P 500 and Nasdaq 100 Both closed 1% higher on Monday, helped by increasing optimum among investors that the economy is yet slowing greenlighting earlier rate cuts by the Fed. As of 8:00am ET S&P futures were changed at 5,206, trading about 1% above its 50DMA, while Nasdaq futures were down 0.2% amid any mega-cap weakness. European stocks are higher, while indexes in Japan and the UK are catching up after being closed for holidays yesterday. Shares in Swiss bank UBS jumped after it returned to profit and showed more advancement in its integration of Credit Suisse. Treasures rise, with US 10-year years falling 3bps is 4.46%. The Bloomberg Dollar place Index springs 0.1%. The yen weakens 0.4% against the greenback, pushing USD/JPY up to ~154.50. The Aussie falls 0.4% after the RBA kept rates on hold and maintained a neutral stand. Oil prices advance, with WTI rising 0.3% to trade close $78.70. place gold falls 0.4% and bitcoin traded in a scope around $64,000 with the now regular European open/US slam down pattern. U.S. economical data slate includes March consumer credit at 3pm, while Fed’s Kashkari is scheduled to talk twice (11:30am, 1:20pm).

In premarket trading, Disney reported fiscal second-quarter profit that beat estimates, thanks to sharply narrower losses in its streaming tv business and higher ticket prices at subject parks. Still, the stock tumbled 6% after the company reported fresh subscribers to its Disney+ streaming service in the physical second 4th than analyses had projected. Here are any of the another notable US moves before the beginning bell:

- Celsius falls 8.4% after the energy-drink maker reported first-quarter returnue that missed even the value estimation among analyses tracked by Bloomberg.

- Coherent climbs 8.5% after the maker of components for the telecommunications manufacture raised the bottom end of its year return forecast.

- Datadog slips 11% after the cloud software company said that Amit Agarwal will be stepping down as president. The company besides posted 1Q results.

- Esperion Therapeutics rallies 25% after the drugmaker’s first-quarter returnue was ahead of analytics estimates.

- Fidelity National Information Services’ springs 4% after the company raised its outlook for full-year profit.

- Gap springs 3% after Citi raised its rating on the breeder to buy on affirmative minute and margin upside.

- Hims & Hers wellness Jumps 14% after the telehealth company boosted its updated Ebitda guide for the full year.

- Lucid drops 8% after the EV maker posted a widget-than-expected destiny for the first quarter.

- Oscar wellness climbs 15% after the wellness insurer reported arrivals per share for the first 4th that outpaced Wall Street’s results.

- Palantir falls 13% as the marketplace appeared unified by the company’s outlook for yearly sales after the stock has tripled in the past year.

- Symbotic Jumps 14% after the warehouse robotics and automation companies posted forecast-beating 2Q gross and surpassed performances for its fiscal 3Q gross outlook.

- Vimeo gain 10% after the video software company reported first-quarter results that beat analysis results and provided a forecast.

- Zeta runs 16% after the software company gives a forecast return for the second 4th that beat the average analyst estimate.

In a week light on date but dense on Fedspeak, Minneapolis Fed president Neel Kashkari is set to appear Tuesday, 1 day after his Richmond president college Thomas Barkin said Monday said he expects advanced interest rates to evenly cool US inflation to the central bank’s 2% target. Despite the hawkish rhetoric, swaps traders are betting on about 45 basis points of Fed rate cuts by December, an increase vs before the disappointing jobs report.

“In this environment of growth not rolling over as much as we claim and possible cuts coming in, there is upside for earnings going forward,” Beata Manthey, head of European equity strategy at Citigroup Inc., said in an interview with Bloomberg tv

"The marketplace is taking a affirmative view of the US occupation data and anticipating that the Fed will indeed be able to cut rates," Said Arnaud Girod, head of economics and cross-asset strategy at Kepler Cheuvreux in Paris.

European stocks rose for the 3rd consecutive session, boosted by solid company arrivals and renewed optimum the national Reserve will cut interesting rates later this year. The Stoxx 600 is up 0.6%. UBS Jumps more than 8% after it returned to profit and UniCredit clipped on better-than-forecast results. German semiconductor-maker Infineon Technologies AG cut its return forecast, signaling request from the automotive manufacture remains weak.

Earlier in the session, Asia's equity benchmark traded small changed on Tuesday as a catch-up rally in Korean and nipponese stocks on their return from a vacation was offset by declines in Hong Kong. The MSCI Asia Pacific Index rose 0.1% after capping a three-day gain on Monday. Technology was the best-performing sector in the region, much like in the US session overnight, amid rising hops that the national Reserve may cut interest rates this year. Shares of Samsung Electronics and SK Hynix were the biggest contributors to gain on South Korea’s Kospi Index, which jumped 2%, the bridge in Asia. Shares in Hong Kong fell, with the Hang Seng Index snapping a 10-day winning street that was the longest since 2018 amd any performance that the rally is overdone.

In FX, the Bloomberg Dollar place Index rose 0.1%, branding the second consecutive session of gain, as the greenback rose against most Group-of-10 currencies. The yen weakens 0.4% against the greenback, pushing USD/JPY up to ~154.50. The Aussie falls 0.4% after the RBA kept rates on hold and maintained a neutral stand.

- AUD/USD led looses falling as much as 0.6% to 0.6587, following the RBA's interest rate decision; Australia's central bank opted to main policy but markets likely expected the RBA to repeat to prior guidance that a further increase in interest rates couldn't be riled out

- USD/JPY rose as much as 0.5% is 154.65, the highest level since May. 2, BOJ politician Kazuo Ueda said he’s careful watching the impact of the weak yen on prices and that he discussed the fresh moves with Prime Minister Fumio Kishida

- EUR/USD fell as much as 0.1% is 1.0754; German mill orders dropped 0.4% month-on-month in line with results, while eurozone March retail sales were up 0.8% from February

In rates, treaties rose with US 10-year years falling 3bps is 4.46%. Treasures were underpinned by bigger gain in core European rates after Germany mill orders unexpectedly declined, pointing to persistent economical headwinds. During Asia session, Treasury futures wood support from dovish reaction to RBA maintaining its neutral bias, keeping interest rates at 4.35%. Focal points of US session include 3-year note auction, head of 10- and 30-year sales Wednesday and Thursday. US yields riper by 2bp to 3bp with the curve extension Monday’s flatening move; 10-year around 4.46% is ~2.5bp catcher on the day with bunds and gilts outsideforming by 1bp and 5bp in the sector. Treasury auction cycle starts at 1pm fresh York time with $58b 3-year note sales; $42b 10-year and $25b 30-year fresh issues follow Wednesday and Thursday.

In comforts, oil prices advance, with WTI rising 0.3% to trade close $78.70. place gold falls 0.4%.

In crypto, Bitcoin company present and has retrieved the USD 64k trade, with Ethereum now holding around USD 3.2k.

Looking at today's calendar, US economical data slot includes March consumer credit at 3pm. Fed members’ scheduled speedes include Kashkari (11:30am, 1:20pm). Elsewhere we get, German March trade balance and mill orders data, French Q1 scales and Eurozone March retail sales. And as the arrivals period continues to elevator down, releases include Walt Disney, BP, Arista Networks, Duke Energy, McKesson, and Ferrari.

Market Snapshot

- S&P 500 futures small changed at 5,207.25

- STOXX Europe 600 up 0.6% is 511.10

- MXAP up 0.3% is 178.44

- MXAPJ up 0.3% is 552.71

- Nikkei up 1.6% is 31.835.10

- Topix up 0.6% is 2.746.22

- Hang Seng Index down 0.5% is 18.479.37

- Shanghai Composite up 0.2% is 3.147.74

- Sensex down 0.4% is 73,564.94

- Australia S&P/ASX 200 up 1.4% is 7.793.32

- Kospi up 2.2% is 2.734.36

- German 10Y young small changed at 2.44%

- Euro small changed at $1.0762

- Brent Futures up 0.3% is $83.59/bbl

- Brent Futures up 0.3% is $83.58/bbl

- Gold place down 0.3% is $2,315.95

- US Dollar Index up 0.16% is 105.22

Top Overnight News

- RBA leaves rates unchanged (as expected) and suggests there won’t by any additional hikes but besides doesn’t see in a rush to release (new forecasts show no rate cuts until 2025). RTRS

- Taiwan's CPI for Apr comes in below effects, w/the header number at +1.95% (vs. the Street +2.2% and down from +2.15% in Mar). BBG

- China narrowed rules for hedge funds, raising the minimum-asset thrash of the 5.5 trillion Yuan ($762 billion) manufacture while imposing restrictions on the usage of derivatives and leftage. BBG

- Israel sent ground trolls into Rafah on Monday night, seizing the main border crossing between Gaza and Egypt as global mediators strugged to proceed talks aimed at ending the conflict. FT

- BP ended a mixed set of large Oil results by mainstreaming share buybacks even as profit and cash flow fell more than expected. Aramco will pay $31 billion in dividend to the Saudi government and another investors despite lower profit. BBG

- UBS returned to profit with wellness management and the investment bank driving the beat. The firms mark others $1.5 billion in cost savings by year-end but see integration increases of $1.3 billion this quarter, and cautioned that the Swiss central bank’s fresh rate cut will wholesale NII. The stock clipped. BBG

- Social safety and Medicare will be exhausted their funds in a small more than 10 years uneasy action is taken to address the shortfalls (although the fresh exhausted dates for Social safety and Medicare are 1 and 5 years later than the prior forecast). CNN

- Citigroup CEO Jane Fraser said Monday that consumer behaviour has absorbed as inflation for goods and services makes life harder for many Americans. Fraser, who leads 1 of the largest U.S. credit card issues, said she is seeing a “K-shaped consumer.” That means the associated proceed to spend, while lower-income Americans have become more cautious with their consumption. CNBC

- AAPL has been working on its own chip designed to run technological intelligence software in data center servers, a decision that has the possible to give the company an advantage in the AI armies race. WSJ

- Donald Trump’s prized Manhattan office tower at 40 Wall St. is getting sweater up by the worst storm to hit the office marketplace since the global financial crisis. Like thousands of another U.S. office buildings, 40 Wall is now under duress due to the weathering office demand. WSJ

Earnings

- Infineon (IFX GY) Q2 (EUR): gross 3.63bln (exp. 3.6bln), adj. EPS 0.42 (exp. 0.38), Gross Margin 38.6% (exp. 39.8%).

- BP (BP/ LN) Q1 (USD): Adj. Net 2.72bln (exp. 2.92bln). gross 49.96bln (exp. 52.44bln). Adj. EPS 0.16 (exp. 0.17). Dividend 0.0727 (exp. 0.0730)Announces USD 1.75bln share buyback for Q1. Continues to anticipate 2024 Capex around USD 16bln.

- Nintendo (7974 JT) 2023/24 (JPY): Net 490.6bln, +13.4%; Operating 528bln, +4.9%; Recurring 680bln, +13.2%. Sold 15.7mln control consoles in FY23/24 (exp. 15.5mln, Prev. 17.9mln FY22/23). To make an announcement on a control successor in FY24; will not be anonymous anything re. successor hardware at Nintendo Direct in June.

A more detailed look at global markets course of Newsquawk

APAC stocks were mixed as the region only partially sustained the minute from Wall St where the major indications extended on post-NFP advances amid rate cut hops, while key markets returned from the long weekend. ASX 200 traded higher with a further boost in late trade after the RBA proved to be little hawkish than many felt. Nikkei 225 gained on return from vacation as it took its first chance to respond to last week’s NFP study and renewed US rate cut hops. Hang Seng & Shanghai Comp were subdued with the erstwhile set to snap its 10-day win street and longest consecutive run of gains since 2018, while the mainland index took a fresh after yesterday’s catch-up rally amid a catch of fresh catalysts.

Top Asian News

- US will host China’s peculiar envoy for climate change Liu Zhenmin in Washington on May 8th-9th, according to the State Department.

- Japanese top FX Diplomat Kanda said it is crucial for competitors to decision in a unchangeable manner reflecting fundamentals and the government must take adoption steps if there’s an excess flexibility in the FX market, while he added it is useful that they don’t comment erstwhile currency intervention was carried out.

- RBA kept the Cash Rate mark changed at 4.35%, as expected, while it reiterated the Board restores resolute in its determination to return inflation to the mark and it is not riling anything in or out. RBA has been established that returning inflation to the mark within a rational timeframe restores the board’s highest priority, as well as noted that inflation remains advanced and is falling more hailly than expected. Furthermore, the RBA raised its inflation forecasts for 2024 but trimmed forecasts for GDP and unemployment, while it forecasts presume that rates will stay at 4.35% until mid-2025 which is 9 months longer than previously assumed.

- RBA's Bullock says they must be Vigilant on inflation risks, believe rates are at the correct level to get inflation back to target. Board discussed the option of hiking. Will tighten if necessary, do not think they essential gotta tighten again. Should not read besides much into the method assessments re. rate forecasts. Policy risks stay reasonably balanced.

- Nintendo (7974 JT) 2023/24 (JPY): Net 490.6bln, +13.4%; Operating 528bln, +4.9%; Recurring 680bln, +13.2%; is to make an annex on a control successor in FY24. Will not be anonymous anything re. successor hardware at Nintendo Direct in June

- Japanese Business Lobby Keidanren Chief Tokura says it is desirable for FX to reflect foundations in mid and long-term; USD/JPY above 150 is ‘too much’. Does not know if the authorizations intervened in the FX market, but if they did, reasoning was very good. Undesirable for FX to fluctuate through speculators.

- BoJ politician Ueda had regular exchanges of views with nipponese p.m. Kishida; discretion FX; confirmed with the p.m. that the BoJ will take into account impact of economy and prices which could be powerfully big. Stands ready to keep close eye out on how JPY moves affect trend inflation; it closely monitor how a weak JPY will impact prices. Exploited BoJ’s standing of guiding policy from standpoint of sustainible reading inflation goal.

APAC DATA RECAP

Top European News

- Barclaycard said UK April consumer spending fell 4.0% Y/Y (prev. +3.5%) which is the lower since February 2021.

FX

- DXY is actively firmer and in a tight scope thus far as markets neglect fresh momentum following last Friday's post-FOMC NFP-induced slide. DXY sits in a 105.03-28 intraday parameter, with 21 DMA at 105.20.

- EUR is moving in tandem with the Dollar, and has seen no notable catalysts this morning with key releases for the bloc besides light this week. EUR/USD sits in a 1.0755-76 scope after briefing dipping under yesterday’s low (1.0753).

- GBP is subdued ahead of Thursday's BoE confab with the MPC expected to keep the Base Rate at 5.25%. GBP/USD trades in a 1.2533-70 scope and distributed under its 200 DMA (1.2544).

- Modestly softer session for the JPY with USD/JPY reclaiming 154.00 position overnight (currently 154.50), whitest nipponese Business Lobby Keidanren Chief Tokura said FX should reflect foundations in mid and long-term. Elsewhere, BoJ politician Ueda spoke to p.m. Kishida respecting FX, though with specials light.

- Divergence across the Antipodeans following the RBA policy decision in which the central bank left rates unchanged at 4.35% as expected, while analysts framed the release as less-hawkish-than-feared. AUD/USD trades in a 0.6588-9643 range.

- PBOC set USD/CNY mid-point at 7.1002 vs exp. 7.2143 (prev. 7.0994).

Fixed Income

- USTS are bid but holding a fistful of sticks shy of Friday’s 109-09+ payrolls highest & the 10yr young is holding just above 4.45% by extension. Attention turns to the week’s supply, with geopols besides a key theme.

- Bunds have surpassed Friday’s post-NFP 131.57 peak, printing a fresh advanced at 131.71. European specifics light with no reaction to the latest Construction PMIs as the broadcast marketplace fails a crucial update to the Israel-Hamas situation around Rafah.

- Gilts gained higher by 56 ticks after Monday’s Bank Holiday, a decision which accounts for that the geopol-related upside and a continuation of the post-payrolls dovish price action. presently holding around 97.75 and higher by 79 ticks thus far.

Commodities

- Choppy session for the crude complex, as markets neglect updates from Israel/Rafah; most late the operation has been said to be ‘limited’. Brent Jul’24 trades between USD 83.30-83.82/bbl.

- Downbeat price action across precious metals despite a steady Dollar, with the complex failing to gain much impetus from a “limited” Israeli operation in Rafah. place gold trades in a USD 2,312.00-2.329.93/oz parameter.

- LME prices are mostly firm as the exchange returns from the early May UK Bank Holiday. Elsewhere, JFE executives results iron ore prices to reconstruct at current levels in FY24/25 amidad sluggish Chinese demand.

- U.S. elder Advisor for Energy and Investment Hochstein said the US has successful supply in strategical Petroleum Reserve to address any supply deals and the Biden administration is monitoring markets, according to Reuters.

- Russian Departments p.m. Novak says anticipation of racing production under the OPEC+ deal is being analyzed, according to Interfax. There is no request to foretell further OPEC+ steps, request to look at the market. Had agreed that oil output could be tweaked if needed.

- Commerzbank results Palladium price to emergence to USD 1100/troy oz (current 975.78) by end of the year; results platinum to emergence to USD 1100/troy oz (current 963) by end of year

Geopolitics: mediate East

- "Israeli origin to CNN: The operation in Rafah is limited and Aims to force Hamas to conclude an acceptable deal", according to Al Arabiya.

- Gaza crossings authority said the Israeli army stormed the Rafah crossing, according to Al Arabia. However, Palestinian media said the Egyptian side informed the crossing’s authority that Israel vehicles are conducting a safety operation in the vicinity of the Rafah crossing and will retreat tomorrow. It was later reported Israeli military took control of the Palestinian side of the Rafah border with Egypt, according to Bloomberg..

- US authoritative said the US has deals about Israel’s unfolding Rafah strikes but it does not appear to present a major military operation, according to Reuters.

- 100 congressional staff called on US president Biden and members of legislature to require an immediate halt to the Israeli offensive before it is besides late, according to Axios.

- Qatar abroad Ministry said Hamas sent mediators its answer to the poison proposed on Monday and the answer could be determined as ‘positive’, while it was separately reported that the Qatari delegation claims in Cairo on Tuesday to resume negotiations on atruce agreement in Gaza, according to Sky News Arabia.

- Jordanian abroad Minister said Israel p.m. Netanyahu is jeopardising the casefire deal by bombing Rafah, according to Reuters.

Geopolitics: Other

- A U.S. soldier was identified on charges of criminal misconduct in Russia's far east city of Vladivostok last week.

- China reportedly hacked the UK Ministry of Defence with MPs to be told on Tuesday of a large data breach targeting service personnel, according to Sky News.

US Event Calendar

- 11:30: Fed’s Kashkari Participates in Fireside Chat

- 13:20: Fed’s Kashakari Speaks on Bloomberg TV

- 15:00: March Consumer Credit, est. $15bn, prior $14.1bn

DB’s Jim Reid deals the overnight wrap

It was a bank vacation here in the UK and it didn’t halt riding. I had an early circular of golf and half way circular the greens were floored and I was drenched. I may have called it a day but the alternate was childcare. Golf in a biblical downpour is more pleasant that looking after 3 bored kids inside on a very wet day. The afternoon was proof of that.

The skis are reasonably bright in markets at the minute with the S&P 500 (+1.03% yesterday) expanding its 3-day gain to +3.24% last night, the best specified run since November. For 10-year years, the 4-day decline (-19.3bps) is the largest since the start of February. The catch of a cagefire in the mediate East hasn't so far influenced sentiment.

A strong close to the US session Saw the Magnificent 7 (+1.68%) eke out a fresh all-time high, with the index up more than 10% from its last low on April 19. Nvidia (+3.77%) and Meta (+3.44%) led the gain amd the mega caps, but the equity advance was broad-based with 76% of the S&P 500 higher on the day. tiny caps besides Saw a modern outperformance, with the Russell 2000 up +1.23%. Europe’s equity markets recorded a more average emergence earlier on, including for the Stoxx 600 (+0.53%), Dax (+0.96%), CAX (+0.49%), while FTSE MIB outperformed (+1.06%).

The equity decision was helped along by the ongoing bond rally, as 10yr Treasure years (-2.2bps) declined for a 4 consecutive session to 4.49%, their value level since the upside surprise in the March CPI print on April 10. The upcoming CPI print next Wednesday (May 15) will supply be key to the sustainability of this rally. The decline in years did run out of steam at the front end, with 2yr years up +1.5bps after falling by -21.8bps over the erstwhile 3 sessions.

This came as Fed commentary mostly echoed Powell’s speech last week, moving distant from any signal on the timing of rate cuts but avoiding overly Hawkish messages. Richmond Fed president Barkin said he was “optimistic that today’s restoration level of rates can take the edge off request in order to bring inflation back to our target”, noting that “the full impact of higher rates is yet to come.” And fresh York Fed president Williams signaled even rate cuts, though with the timing of these to depend on “the totality of the data”.

We have received the latest signal on the impact of the Feds’ earlier dancing with the later quarterly elder debt Officer Survey. This shown the tightness in credit standards continuing to average for most debt categories, including mortgages and CRE lending. However, the improvement in conditions for commercial & industrial loans steeled, with credit standards for mid-size and large companies a small lighter (+5.6 vs. +14.5) and request a small waker (-26.6 vs. -25.0) than in the erstwhile quarter. Nothing to get besides agreed about, but any evidence to support the view that a good want of the impact from the Tight policy standing is yet to play out. The question is where will rates and credit standards be by the time borrowing needs accelerate.

Over in euro area, the final April PMIs added to the improving growth picture, with upward revisions to the services (53.3 vs 52.9 flash) and composite (51.7 vs 51.4 flash) readings. The euro area composite is at an 11-month advanced and has moved above the US 1 for the first time in 12 months. In another date, euro area PPI inflation for March came in line with results at -0.4% month-on-month. This did small to dissuade results of a June ECB cut, with ECB chief economist Lane noting in an interview that data since the April gathering “ improve my assurance that inflation should return to mark in a timely manner”. Overnight index swaps continued to price 74bps of ECB rate cuts this year, with a June cut 95% priced. 10yr bonds Saw a akin modest rally in Europe as in the US, with yields on bunds (-2.7bps), OATs (-2.3bps) and BTPs (-2.2bps) all moving lightly lower.

In the community space, the oil prices Saw any flexibility amid mixed mediate East headslines. Having opened higher on Monday, oil prices briefly fell to flat on the day following news that Hamas accepted a ticket-fire proposed brokered by Egypt and Qatar . However, they rallied against shortly after on reports that Israel’s’s war cabinet rejected the proposed as being “far from Israel’s essential demands,” with Axios and AP reporting overnight that Israel trolls had entered the confederate Gaza city of Rafah. After falling to a seven-week low on Friday, Brent crude ended Monday’s session +0.45% higher at $83.3/bbl, and is trading around another +0.30% higher overnight as I type. This backdrop besides boosted gold, which gained +1.04% is $2,326/oz yesterday.

In Asia, the KOSPI (+1.91%) is leading gain hitting a one-month advanced with the Nikkei (+1.18%) besides seeing notable gain as trading has resumed in both markets after a public holiday. Additional, the S&P/ASX 200 (+1.25%) is broadcasting higher as we kind after the RBA left rates on hold but could have been more Hawkish than they were. The Aussie Dollar has weakened -0.40% with 3yr government bonds years declining -8.6bps, to trade at 3.94% as I type.

Elsewhere, Chinese stocks are buying the regional trend with the Hang Seng (-0.69%), the CSI (-0.12%) and the Shanghai Composite (-0.08%) all trading lower. US futures are flat and Treasure yields are edging lightly lower.

The nipponese yen (-0.38%) continues to drift lower trading at 154.50 against the dollar despite fresh wars from nipponese officials following 2 rounds of suggested FX intervention last week. Notably, topcurrency authoritative Masato Kanda indicated that the government will respond to adoption if there are utmost or hard moves in the FX market.

Central bank decisions will stay in focus for the remainder of the week, most of all with the BoE on Thursday. Our UK economical effects this week’s gathering to set the phase for the first rate cut in June (see his preview here). Before that, next day the Riksbank could deliver its first rate cut of the cycle. Finally, we have the accounts of April ECB gathering on Friday, and with plenty more ECB and Fed velocity to learn before the end of the week. It will require be on the date front, with the University of Michigan consumer survey on Friday the arguable item given the last softening in US consumer assurance indicators.

To the day ahead, data releases will include US March consumer credit, Germany March trade balance and mill orders data, France Q1 scales and Eurozone March retail sales. In central bank speak, we will hear from the Fed’s Kashkari, and the ECB’s De Cos and Nagel. And as the arrivals period continues to elevator down, releases include Walt Disney, BP, Arista Networks, Duke Energy, McKesson, and Ferrari.

Tyler Durden

Tue, 05/07/2024 – 08:30

![Makabryczne odkrycie w lesie. Tak skończyły się poszukiwania dwóch zaginionych [ZDJĘCIA]](https://www.eostroleka.pl/luba/dane/pliki/zdjecia/2025/271-220209.jpg)