Futures Drop Ahead Of July 9 Tariff Deadline

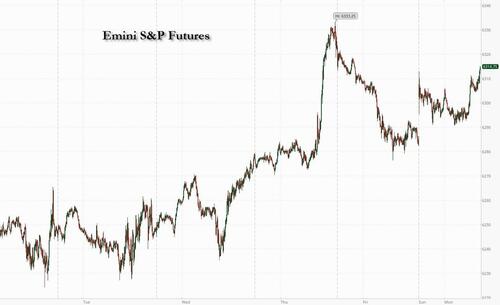

US equity futures are weaker with investors on edge about the potential for more tariffs from the Trump administration as we head into the July 9 deadline which appears to have been rolled to Aug 1. As of 8:15am ET, S&P 500 contracts declined 0.2% although well off session lows after Treasury Secretary Bessent indicated that some countries may get a three-week extension to trade negotiations. Nasdaq 100 futures dipped 0.4% with small caps underperforming but tech is being dragged by TSLA sliding 6% after Elon Musk announced he will form a new political party. Apple (-1.0%) after phone shipments from China in May were down 9.7% Y/Y for the tranche that includes iPhones. Semis/Cyclicals under pressure. Trump said either a deal will be done, or a country will get a letter on Monday with 12 letters set to be sent today. Additionally, the president said late on Sunday that Anyone aligning with BRICS „Anti-American” stance is subject to an additional 10% tariff. Oil was flat, rebounding from session lows after OPEC+ did another supply hike, this time for 548k bpd. Yield curve is twisting steeper, USD stronger, and cmdtys declining (Ags, metals). This is a light macro data week into next week’s CPI and kick off to earnings season.

In premarket trading, Mag7 stocks were mixed: Tesla was the biggest drag among Magnificent 7 stocks, falling 6%, as President Donald Trump slams Elon Musk’s bid to form a new political party (Microsoft +0.1%, Amazon +0.09%, Meta Platforms -0.3%, Apple -0.5%, Alphabet -0.5%, Nvidia -0.7%).

- Apogee Therapeutics (APGE) gains 20% after saying the Phase 2 Apex part A trial of APG777 in patients with moderate-to-severe atopic dermatitis met all primary and key secondary endpoints.

- Cogent Biosciences (COGT) rises 23% after announcing positive top-line results from the Summit trial of bezuclastinib in patients with non-advanced systemic mastocytosis.

- CrowdStrike Holdings (CRWD) slides 1.8% in premarket trading as Piper Sandler cut the software company to neutral from overweight after it surpassed the investment bank’s price target.

- Goldman Sachs initiates coverage of MGM Resorts International (MGM -1.8%) with a recommendation of sell due to a volatile Las Vegas market, while Caesars Entertainment (CZR -0.5%) gets a buy rating.

- Geo Group (GEO) gains 6% and CoreCivic (CXW) climbs 4% after the Senate and House of Representatives approved Donald Trump’s tax and spending bill that will add billions of dollars for immigrant detention centers.

- MGM Resorts International (MGM) slips 1.8% after Goldman Sachs initiates coverage of with a recommendation of sell due to a volatile Las Vegas market.

- Progressive Corp. (PGR) declines 1% after Morgan Stanley cut its recommendation on the insurance company to equal-weight as competition increases.

- Shoals Technologies Group (SHLS) rises 4.7% after Jefferies upgraded its recommendation on the renewable energy equipment company to buy, saying President Donald Trump’s tax-and-spend legislation will spur short-term activity in solar.

- WNS Holdings Ltd. (WNS) soars 14% after France’s Capgemini SE plans to acquire IT outsourcing company for $3.3 billion in cash.

Trade tensions are back on investors’ radar, with Trump pledging to impose unilateral rates on dozens of countries in the coming days. US officials have signaled Aug. 1 as the start date for higher levies, while Treasury Secretary Scott Bessent indicated some countries may be offered a three-week extension. The deadline “will create near-term uncertainty,” noted Mohit Kumar, chief European strategist at Jefferies International. “But the letters are meant as an incentive for other countries to agree to come to a deal quickly. Any dips in risky assets should be used as a buying opportunity.”

The dollar rose 0.4%, putting the greenback on course for its biggest advance in three weeks on growing trade fears. Emerging-market currencies fell, with the South African rand sliding 1%, after US President Donald Trump warned he would add extra tariffs on any country that aligns with “the Anti-American policies of BRICS.”

European stocks gained with the Stoxx 600 climbs 0.2% with insurance, travel and financial services as the strongest-performing sectors. DAX outperforms peers, adding 0.6%. Shell and Capgemini are the day’s most notable movers, the former falling on a second-quarter update while the latter retreats after announcing it will acquire US firm WNS. Here are the biggest movers Monday:

- Swissquote shares increase as much as 6.4%, the most since April 10, after the Swiss financial services company bought out partner PostFinance and took complete control of digital finance app Yuh

- Bilfinger rises as much as 5.6% after analysts at Bankhaus Metzler raised their price target on the industrial services business to a new Street-high, arguing it has stronger pricing power than previously thought

- European shipping companies are outperforming on Monday after Israel launched airstrikes on Houthi-controlled ports in Yemen, raising the prospect of higher freight rates if shippers avoid the Red Sea

- Shell shares fall as much as 3.2% after the oil giant’s second-quarter update pointed to a weaker performance than anticipated, which is set to hit earnings expectations, according to analysts

- Capgemini shares fall as much as 4.4% to the lowest since April 30 after the French IT firm said it will acquire business process management company WNS Holdings for $3.3b in cash

- Stellantis falls as much as 3.3% as Bank of America cuts the automaker to neutral from buy, with the broker expecting to see a “very weak” first-half report on July 29, as well as bad positioning in Europe

- Currys drops as much as 7.2% after RBC downgrades to hold, saying the UK consumer-electronics retailer’s valuation is “more reasonable now” after strong gains for the shares since late 2023

- Pandora shares fall as much as 2.3% after the Danish jeweler is downgraded to hold at HSBC, which cites a lack of short-term positive catalysts; Broker also cuts price target to DKK1,250 from DKK1,450

- Pantheon Resources shares drop as much as 12% after the oil and gas producer raised cash through a placing and subscription priced at a discount to Friday’s close

- Krones shares fall as much as 5.7%, the most since April, after Oddo BHF downgraded the German manufacturer of packaging and bottling machines to neutral from outperform

- European medical technology stocks pare drop, with Philips reversing declines, after China hit back at the European Union’s restrictions on its medical device makers. Analysts see limited impact from the curbs

Earlier in the session, Asian stocks fell as investors remained on edge ahead of the deadline for President Donald Trump’s pause on reciprocal tariffs, even after the administration hinted at possible extensions. The MSCI Asia Pacific Index dropped as much as 0.8%, the most in two weeks, with TSMC and Samsung Electronics among the biggest drags. Benchmarks in Taiwan and Japan underperformed. Stocks dropped in Malaysia and Thailand after news that the US plans to restrict shipments of AI chips to these nations. Trump’s latest threat to charge an additional 10% tariff on any country aligning themselves with “the Anti-American policies of BRICS” caused further uncertainty Monday. Still, investors are waiting to see what actually happens. “Reactions are often short-lived, especially as he usually fails to deliver on his threats,” said Vey-Sern Ling, a managing director at Union Bancaire Privee.

Japan’s 30-year yield surged 10 basis points to 2.96% on concerns that the outcome of this month’s upper house election may result in bigger fiscal spending. US Treasuries were little changed, with the 10-year yield at 4.35%

“Treasuries are starting to find their footing a bit, but the problem is if the tariff impact on inflation comes back and the Fed needs to back-pedal, at least temporarily, I think Treasuries, unfortunately, are also a bit vulnerable,” Christian Mueller-Glissman, head of asset allocation research at Goldman Sachs Group Inc., told Bloomberg TV.

In FX, the dollar extends gains, outperforming most of its G-10 peers in anticipation of US tariff letters from today. EM currencies slump, with the South African rand and Indian rupee among the session’s laggards after President Trump said any country aligning with BRICS’ “Anti-American policies” would face an additional 10% tariff.

In rates, treasuries are mixed with the yield curve steeper after US officials signaled that trading partners will have until Aug 1 before tariffs kick in, about three weeks beyond their July 9 deadline to reach agreements. Bonds are relatively muted versus other assets, with slight outperformance seen in gilts across the curve compared to Treasuries and bunds. Front-end yields are about 1bp richer on the day with long-end tenors cheaper by ~2bp, steepening 2s10s and 5s30s spreads by 2bp-3bp. 10-year near 4.3576% is 1bp higher, outperforming German counterpart by 1bp and lagging UK by 1bp. Japan’s 30-year yield surged 10 basis points to 2.96% on concerns that the outcome of this month’s upper house election may result in bigger fiscal spending. US Treasuries were little changed, with the 10-year yield at 4.35%. Treasury auction calendar resumes Tuesday with $58 billion 3-year notes, followed by $39 billion 10-year notes and $22 billion 30-year bonds Wednesday and Thursday.

In commodities, Brent crude futures erase losses, trading up 0.3% to above $68/bbl even after OPEC+ agreed to a bigger-than-expected production increase next month. Spot gold fell $28 to trade near $3,309/oz.

“OPEC’s production pivot, after years of cutting output, is a sign that they remain confident over demand,” wrote Kathleen Brooks, research director at XTB. “This is good news for inflation across the world.”

Looking at today’s calendar, the US economic data slate is empty for Monday. Fed speaker slate also blank, with Musalem and Daly schedule later in the week

Market Snapshot

- S&P 500 mini -0.2%

- Nasdaq 100 mini -0.4%

- Russell 2000 mini -0.3%

- Stoxx Europe 600 +0.2%

- DAX +0.5%

- CAC 40 little changed

- 10-year Treasury yield +1 basis point at 4.35%

- VIX +0.4 points at 17.83

- Bloomberg Dollar Index +0.5% at 1196.42

- euro -0.4% at $1.1727

- WTI crude -0.3% at $66.8/barrel

Top Overnight News

- Trump has warned that any country embracing the “anti-American policies” of the Brics bloc of nations will face an extra 10% tariff on exports, in a new threat at the start of a pivotal week for Trump’s trade war. FT

- TSLA -6.7% in the pre mkt after Elon Musk said he formed a new “America Party” and hinted it may back a presidential candidate, as well as noted that increasing the deficit from USD 2tln under Biden to USD 2.5tln is insane and will bankrupt the US. Trump derided the effort, calling it “ridiculous.” BBG

- Tariffs will revert back to their April 2 rates on Aug. 1 for countries that fail to nail down new trade deals with the United States, Treasury Secretary Scott Bessent said Sunday. The announcement pushes back on the original deadline of July 9. Politico

- Trump will have dinner with Benjamin Netanyahu at the White House as he seeks to put Israel and Hamas on a path toward ending the war in Gaza this week. Indirect talks between the two sides started in Qatar, the AFP reported. BBG

- Trump’s administration plans to restrict shipments of AI chips from the likes of Nvidia Corp. to Malaysia and Thailand, part of an effort to crack down on suspected semiconductor smuggling into China. BBG

- EU-China tensions ramped up. Beijing said it will exclude EU-based companies from Chinese government procurement for certain medical devices, while France’s Finance Minister urged tariff barriers to counter Chinese imports. BBG

- China is reviewing and approving applications for exports of controlled items to the U.S., as Beijing and Washington speed up the implementation of their trade framework, the Chinese commerce ministry said. American officials have informed China that they are lifting a series of restrictive trade measures, a ministry spokesperson said Friday. WSJ

- Japanese real wages in May fell at the fastest pace in nearly two years as persistent inflation continued to outpace wage growth and hinder consumption-led growth in the world’s fourth-largest economy, government data showed on Monday. RTRS

- German industrial production unexpectedly rose 1.2% in May from a month earlier, suggesting companies rushed production before potentially much higher tariffs on exports to the US. BBG

Corporate News

- President Donald Trump blasted Elon Musk’s bid to start a new political party, intensifying a feud between former allies and deepening investors’ concerns about implications for Tesla Inc. and other companies led by the world’s richest man.

- France’s Capgemini SE plans to acquire IT outsourcing firm WNS Holdings Ltd. for $3.3 billion, beating rival suitors to a deal aimed at expanding its AI operations.

- Apple Inc. appealed a €500 million ($580 million) fine from the European Union, calling the penalty “unprecedented” and the regulator’s required changes to its App Store as “unlawful.”

- Shell Plc said its second-quarter trading results in both gas and oil will be significantly lower than the previous three months, in an indication of how major energy companies have navigated recent market volatility.

- Nissan Motor Co. plans to sell about $5 billion in debt to help fund Chief Executive Officer Ivan Espinosa’s turnaround of the ailing automaker, part of a broader financing initiative to keep operations on track.

- Billionaire Richard Li’s FWD Group Holdings Ltd. rose in its trading debut in Hong Kong after raising HK$3.5 billion ($442 million) in an initial public offering.

Tariffs/Trade

- Trump said trade letters are signed and are going out on Monday addressed to 12 countries but declined to say which countries or the different tariff levels involved. Trump later commented that they will have a deal or letter with most nations done by July 9th and could send out 12 or 15 letters on tariffs on Monday.

- Trump posted „I am pleased to announce that the UNITED STATES TARIFF Letters, and/or Deals, with various Countries from around the World, will be delivered starting 12:00 P.M. (Eastern), Monday, July 7th”

- Trump posted „Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff. There will be no exceptions to this policy.”

- Bessent said Trump will send letters to trading partners notifying them if no deal is reached, they will revert to April 2nd tariff levels with the tariffs to take effect on August 1st, while Bessent added that they are close to several deals and expect to see some big announcements in the next days. Furthermore, Bessent said 100 smaller countries will get set a tariff rate and many never even contacted the US.

- Russian President Putin told BRICS through a video link that it is important to enhance cooperation at BRICS and the usage of national currencies, while he commented that the liberal globalisation model is becoming obsolete.

- White House Economic Adviser Hassett said it is possible that some trade negotiations will push past the deadline, while he added that trade deals with the UK and Vietnam provide guidelines for additional agreements with other countries, according to a CBS interview.

- EU diplomats said on Friday that EU negotiators failed to achieve a breakthrough in US trade talks and negotiations to continue into the weekend, while EU negotiators were looking to secure a US tariff pause extension if no wider trade deal is agreed. It was also separately reported that the US threatened the EU with a 17% tariff on food exports, according to FT.

- Japan’s tariff negotiator Akazawa held in-depth phone talks with US Commerce Secretary Lutnick on Thursday and Saturday, according to Japan’s government.

- Japanese automakers are reportedly exploring all options to help reduce trade imbalances with the US, via Nikkei; one idea is Toyota Motor (7203 JT) importing cars made in the US back to Japan.

- China retaliated against the EU ban regarding public tenders for medical devices by imposing import restrictions on medical devices. China’s Finance Ministry said it is to exclude imports of medical devices exceeding CNY 45mln from the European Union from July 6th, while imports of medical devices from non-EU countries should not contain EU-made components worth more than 50% of the contract value.

- India and the US are likely to take the final decision on a mini trade deal in the next 24-48 hours (reported on Sunday), with an average tariff under the mini trade deal likely to be 10%, while talks have currently only been completed on a mini-trade deal and negotiations on a larger bilateral trade agreement will begin after July 9th, according to CNBC-TV18.

- Thailand is to offer the US more trade concessions to avert a 36% tariff with Thailand’s Finance Minister expected to submit the revised orders before July 9th with a proposal to boost bilateral trade volume and reduce Thailand’s USD 46bln trade surplus with the US by 70% within 5 years, according to Bloomberg.

- South African Trade Department spokesperson says it remains committed to a trade deal with the US; conversations are constructive and fruitful.

- US-Indonesia trade deal includes buying US soybean, corn and energy products, according to an official.

- German government spokesperson says time is money when it comes to tariff negotiations; adds, Chancellor Merz is coordinating with EU President von der Leyen, Italy PM Meloni, and French PM Macron on tariff talks.

A more detailed look at global markets courtesy of Newquawk

APAC stocks were mostly subdued following a lack of bullish catalysts from over the weekend and with the region cautious ahead of upcoming key events, including central bank announcements and the July 9th tariff deadline. ASX 200 marginally retreated amid weakness in miners and as gold producers suffered due to a decline in the precious metal, although the downside in the broader market was limited by resilience in defensives and ahead of tomorrow’s RBA announcement where the central bank is widely expected to deliver a consecutive 25bps rate cut. Nikkei 225 was pressured following softer-than-expected growth in Labour Cash Earnings which resulted in the largest decline in Japan’s real wages in almost two years, while automakers were weighed on by the ongoing US tariff threat. Hang Seng and Shanghai Comp conformed to the uninspired mood amid trade uncertainty and frictions with China retaliating against the EU ban on public tenders for medical devices by imposing import restrictions on medical devices.

Top Asian News

- China released a plan to expand the domestic service industry and help promote rural revitalisation.

- China signed an agreement with Brazil to strengthen cooperation in infrastructure, medicine and new energy.

- US President Trump said they pretty much have a deal on TikTok and the US will start talks with China regarding TikTok on Monday or Tuesday. It was separately reported that TikTok is building a new version of the app planned for the US with the existing app to eventually shut down in the US in March 2026, according to The Information.

- South Korea passed an expanded extra budget worth KRW 31.8tln.

European bourses began the session with modest gains but overall action is choppy/tentative as we await trade updates, Euro Stoxx 50 +0.3%; awaiting Trump to send the letters to 12-15 nations today and clarity on whether the July 9th tariffs have been pushed to August 1st, as commentary indicates. Sectors are mixed and split down the middle, Energy names show the deepest pressure after OPEC+ increased oil output more than expected at its weekend meeting, sources signalling further supply increases at the upcoming August meeting; furthermore, Shell (+2.8%) trimmed production guidance for Q2 across LNG and integrated gas. Insurance names outperform, benefitting from a broker upgraded to Generali (+1.5%) while Travel & Leisure names cheer lower crude benchmarks this morning, in the first part of the session at least.

Top European News

- UK Chancellor Reeves has warned ministers that taxes will need to increase after the government U-turned on its welfare bill, despite repeated pledges not to increase the taxes of working people, according to CityAM.

- UK ministers are to launch a GBP 500mln scheme to help struggling families, according to FT.

- EU is to stockpile critical minerals due to war risk, according to FT.

- ECB’s Centeno says he „does not know if 25bps will do the trick”, says risks remain tilted to the downside. Current stance will remain restrictive at 2% if output does not recover, via Econostream’s X; amount and timing of further cuts is difficult to say. Big risk that the investment level will be short of projections. Article adds: a correction in EUR/USD is likely if the economy is too weak to support appreciation; undershooting inflation is currently the main risk for the ECB and it is conceivable to cut or pause at the July meeting.

- ECB’s Nagel says, on the German economy, growth at the start of the year was stronger than anticipated. „the German economy faces significant headwinds in the short term. Nevertheless, there are grounds for cautious optimism as we look to the future.”

- UBS expects the ECB to cut by 25bps in its July meeting; adds, if there is a benign outcome in EU trade talks, will abandon forecast for a July cut.

FX

- USD firmer vs all major peers. Strength comes despite uncertainty on the trade front as we await the tariff letters. Instead, the USD is potentially drawing support from the pro-Dollar approach the administration is taking as Trump threatened an additional 10% tariff on nations aligning themselves with „Anti-American policies of BRICS”; DXY at a 97.439 peak, marginally taking out last week’s 97.42 best.

- Antipodeans suffer the most given the risk tone, though specific newsflow has been light. However, this will pickup with the RBA and RBNZ rate decisions due on Tuesday and Wednesday, respectively.

- JPY hit by the USD and softer-than-expected domestic wage data which has further trimmed the odds of a BoJ hike by end-2025, now at sub-50%. USD/JPY as high as 145.48, looking to 145.95 from June 25th.

- GBP also suffers. Pressure remains on the Pound after the PMQ-sparked sell off for UK assets last week. Since, reports suggest the Chancellor has told the Cabinet taxes will need to increase. Otherwise, UK specific news light and potentially to remain the case as the UK already has a US deal. GBP/USD sub-1.36 to a 1.3576 base.

- EUR also hit, though not to quite the same degree as the above peers; EUR/USD at the low-end of a 1.1723 to 1.1790 band. Single currency attentive to the imminent trade letters, as newsflow in recent days has been on the negative side. Elsewhere, a handful of ECB speakers on the wires but nothing that has fundamentally shifted the narrative.

- PBoC set USD/CNY mid-point at 7.1506 vs exp. 7.1626 (Prev. 7.1535).

- PBoC surveyed financial institutions about their views on recent USD weakness, according Reuters sources; did not explicitly state the purpose of the survey but once source said they interpreted it as a sign authorities are concerned about sharp CNY appreciation

Fixed Income

- Generally speaking, contained two-way trade into Trump’s tariff letters.

- USTs had a firmer start, posting gains of around five ticks though this waned alongside pressure in EGBs into/after the European cash equity open. Since, developments have been light as we await a tariff update. Holding around the unchanged mark in a 111-05+ to 111-12+ band.

- Bunds also contained at first, but then succumbed to around 10 ticks of pressure on strong German industrial data. However, this was then quickly retraced and Bunds lifted to a 130.62 peak before waning into and after the cash equity open, to a 130.19 low. No move to Sentix or ECB speakers since, but Bunds have managed to pick themselves up off worst but remain in the red.

- Gilts the marginal outperformer. No tariff update expected, as the UK already has a deal. The reported honesty from the Chancellor around the need for tax increases potentially welcome by Gilts, with gains of around 25 ticks at best; however, they remain shy of Friday’s 92.79 best and markedly shy of Wednesday’s pre-PMQs 93.41 peak. As a reminder, BoE Gilt ops. recommence today with a short-term offering.

Commodities

- Crude began on the backfoot, with modest discrepancy in terms of performance amid the lack of settlement. Follows on from OPEC+ action at the weekend which saw a larger than expected supply increase and further bearish sources via Reuters since (outlined in detail below), updates that pushed WTI and Brent to lows of USD 65.40/bbl and USD 67.22/bbl.

- Across the European morning benchmarks had been gradually lifting off lows, potentially driven by a refocussing on Saudi lifting its August OSPs by more than expected and/or a fading of some of the OPEC+ driven pressure. More recently, a modest bounce to highs of USD 67.04/bbl and USD 68.72/bbl has occurred, though with no clear fundamental driver behind the move.

- Metals await trade updates. Despite the tepid risk tone, XAU is under pressure this morning hit by the USD strength. XAU down to USD 3300/oz at worst, but is currently holding modestly off that low. A base that takes XAU back to support from the last few weeks at USD 3255/oz and USD 3246/oz.

- Base metals also in the red, with the tepid tone and USD strength weighing. 3M LME Copper is under pressure, drifting further from the USD 10k mark it reclaimed on July 1st, hit a three-month peak at USD 10.02k in the following session and since has been on a downward trajectory. Today, as low as USD 9.77k

- OPEC+ said eight member countries agreed to raise oil output by 548k bpd in August (prev. 411k bpd increases) and will next meet on August 3rd.

- OPEC+ „will likely” approve another output increase of around 550k BPD for September, according to Reuters sources; September hike will complete the return of 2.17mln BPD in voluntary output cuts. A September hike would also accommodate 300k BPD production quota rise for the UAE.

- Saudi Arabia set the August Arab light crude to Asia at plus USD 2.20/bbl vs Oman/Dubai average, while it set the OSP to NW Europe at plus USD 4.65 vs ICE Brent and set the OSP to the US at plus USD 3.90 vs ASCI.

- Qatar set the August Marine Crude OSP at Oman/Dubai plus USD 1.40/bbl and Land Crude OSP at Oman/Dubai plus USD 1.30.

Geopolitics: Middle East

- Israeli military issued an evacuation order to people at Yemen’s ports of Hodeidah, Ras Isa and Al-Salif, as well as to those inside the Hodeidah power station, while it announced to carry out airstrikes in those areas due to military activities being conducted there. Israel’s Defence Minister later confirmed military strikes on Houthi targets in Yemen’s ports of Hodeidah, Salif, Ras Isa, as well as the Ras Qatib power plant

- A Liberia-flagged, Greek-owned bulk carrier was attacked 51NM off Yemen’s Hodeidah, while the UKMTO later announced that all crew abandoned a ship that was attacked southwest of Yemen’s Hodeidah.

- Israeli PM’s office said the changes requested by Hamas to the Qatari proposal are not acceptable to Israel, while the negotiating team will depart to Qatar for Gaza talks.

- Israeli PM Netanyahu said he is determined to ensure hostages’ return to Israel and remove the Hamas threat from Gaza, while he said his negotiators in ceasefire talks have clear instructions to achieve an agreement under conditions Israel has accepted. Furthermore, Netanyahu said ahead of his White House meeting that he believes the discussion with US President Trump can certainly help advance these results.

- US President Trump said he will discuss Iran with Israeli PM Netanyahu and noted Iran’s nuclear program was set back permanently but they may restart in a different location, while Trump also said there could be a Gaza deal during the week ahead.

- First session of indirect ceasefire talks between Israel and Hamas in Qatar ended inconclusively and the Israeli delegation does not have sufficient mandate to reach an agreement with Hamas as it has no real power, according to two Palestinian officials cited by Reuters.

- Hamas government office rejected a US State Department accusation that Hamas was involved in an attack on Americans at a Gaza Humanitarian Foundation site on Saturday.

- UK government re-established diplomatic relations with Syria.

- The second round of (Israel-Hamas) negotiations in Doha will begin this afternoon, via Al Arabiya sources. Subsequently, there is reportedly a positive atmosphere in Israel-Hamas negotiations, no breakthrough so far, according to Al Hadath.

Geopolitics: Ukraine

- US President Trump said they won’t be sending patriot missiles to Ukraine but talked about it and noted they have to be protected, while he said Russian President Putin is worried about sanctions and understands it may be coming.

- Russian military forces gained control of Sobolivka in Ukraine’s Kharkiv region and Piddubne in Donetsk region.

- Russian Foreign Minister says Russia does not need a temporary ceasefire, but rather a lasting peace.

US Event Calendar

- Nothing on the calendar

DB’s Jim Reid concludes the overnight wrap

Not every chart may leave you speechless, but we’ve aimed to include plenty that offer a fresh perspective—either by taking a longer-term view or by framing current themes in a slightly different light.

Later today Extel launch the annual flagship global fixed income analyst survey (formerly II). They’ll likely launch it as the US market opens. We’d love to do well in it so if you receive a ballot later, I’d especially appreciate a vote (5 stars please) in the following. Global macro strategy, Global Economics, European Cross Asset Strategy, and European Fixed Income. There are other categories I’m in as well. Many thanks. More details to follow.

The week after payrolls is usually quiet for data so of course, all eyes will focus on Wednesday’s 90-day extension to the reciprocal tariffs announced on Liberation Day back on April 2nd. However, there are increasingly suggestions that August 1st might be the new July 9th as we’ll see below.

As a benchmark, our economists believe the current effective rate is around 15%, which is obviously a good deal below the implied rate from Liberation Day but well above the low single figures before Trump returned to office. It is good news for markets that Section 899 (the revenge tax) has been consigned to the history books after not making it into the tax bill. It’s also good news that Bessent has recently sounded more positive on the direction of travel in recent talks.

However, with financial conditions easy again and with the S&P 500 back at all-time highs, it wouldn’t be a surprise to see the Trump Administration take a tough stance with those who they don’t think negotiations are going in the right direction.

President Trump said at the end of last week that by the July 9 deadline, tariffs would be „fully covered and they’ll range in value from maybe 60 or 70% tariffs to 10 and 20%.” Then over the weekend he said that he’d “signed some letters and they’ll go out on Monday – probably 12”. Overnight this was firmed up to noon Washington time today.

On Thursday he’d mentioned that the letters could go out on the Friday holiday and apply from August 1st if no deal can be made. This gave some comfort that there could be yet another extension and time to do deals. Bessent has also reiterated over the weekend that some countries would be able to negotiate a three-week extension to August 1st. So maybe we’ll just be here again in three weeks when everyone is on the beach apart from the trade negotiators.

For Europe, Bloomberg reported that the union is willing to accept a 10% universal tariff if exemptions for areas such as autos (25%) and steel and aluminum (50%) are provided. For Japan, the mood turned negative last week as President Trump said that they should „pay 30%, 35%, or whatever the number is that we determine, because we also have a very big trade deficit with Japan.” On the bright side, Treasury Secretary Bessent said they were „very close” to a deal with India, and on Thursday the US reached a trade deal with Vietnam.

Then overnight Trump posted on social media that „Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff,” This follows a BRICs summit in Rio over the weekend where the group condemned US and Israeli strikes on Iran.

So lots of headlines in recent days, stand by for lots more over the next two days, and then likely beyond.

A focus of the Asian session this morning is the surprise increase in oil production announced by OPEC+ on Saturday. Markets had broadly expected an increase similar to the +411k barrels in May, June and July, but members agreed to a +548k increase. This would be music to Mr Trump’s ears. Brent crude prices (-0.69%) have begun the week a bit lower at $67.83/bbl.

Asian equity markets are a little nervous this morning, perhaps on Trump’s BRICs comments. As I check my screens, the Nikkei (-0.46%), the Hang Seng (-0.41%), the CSI (-0.57%), the Shanghai Composite, and the S&P/SX 200 (-0.33%) are all showing losses, while the KOSPI (+0.10%) is fluctuating between gains and losses. S&P 500 (-0.42%) and NASDAQ 100 (-0.46%) futures are also weak.

Early morning data showed that real wages in Japan have decreased for the fifth consecutive month, falling by -2.9% in May compared to a year earlier (versus an expected -1.7%), following a revised -2.0% decline in April, marking the steepest drop in 20 months. Nominal wages increased by +1.0% year-on-year in May (expected +2.4%, prior +2.0%), representing the slowest growth rate since March 2024. The Japanese yen (-0.38%) is falling, trading at 144.85 against the dollar, reversing gains from the previous session as disappointing wage data has tempered expectations for additional rate hikes by the BOJ.

In terms of key events this week, a highlight will be June’s FOMC meeting minutes released on Wednesday. Our US economists expect more details to emerge around the extent of divisions among Committee members. Staying with monetary policy, central bank decisions are due in Australia tomorrow and New Zealand on Wednesday. Our economist forecasts 25bps cuts for both (see more here). See our day-by-day calendar at the end for the rest of the week ahead.

Recapping last week now and markets continued to perform well after the „Big Beautiful Bill” was signed on Friday by President Trump after being passed on Tuesday by the Senate (51-50) and Thursday by the House of Representatives (218-214). On the back of positive employment data and trade deal announcements, the S&P 500 surged to a new record on Thursday, ending the week +1.72%. In Europe, the narrative was a bit different, with the STOXX 600 declining -0.40% (-0.40% on Friday) and the Nikkei losing -0.85% (+0.06% on Friday), due to new fears that the outcome of tariffs after July 9th might not be as positive as previously expected.

In the UK, gilts were the main focus. On Wednesday, 10-year gilt yields (+15.8 bps) saw their biggest daily jump since the Liberation Day turmoil in April, amid growing fears that Chancellor of the Exchequer Rachel Reeves could lose her post (and may be replaced by someone looser fiscally) after a major loss in the government’s welfare bill and the obvious strains that have been placed on a chancellor that will now likely have to find tax rises in the autumn as spending cuts have been hard to administer even with a huge majority. 10-year gilt yields ended the week only +5.5bps as Prime Minister Starmer subsequently publicly backed Chancellor Reeves, helping to reverse earlier week losses. In the US, 10-year Treasuries also sold off, ending the week +6.9 bps higher as data largely improved and perhaps a little due to the tax bill finally passing. Elsewhere, 10-year bund yields rose +1.7 bps (+0.5 bps on Friday), with OATs (+1.6 bps) following a similar path, while BTPs (-2.6 bps) ended the week tighter.

Last week saw a plethora of data releases, with the most important being the nonfarm payrolls, which were up by +147k in June (vs. +106k expected), and the JOLTS report showing job openings were up to a 6-month high of 7.769m in May (vs. 7.3m expected), pushing back against the negative ADP (-33k in June vs. +98k expected) print on Wednesday. The ISM services index moved back up to 50.8 (vs. 50.6 expected), with new orders also rebounding back into expansionary territory at 51.3. In Europe, the EU-harmonized inflation reading unexpectedly fell to +2.0% (vs. +2.2% expected), whilst the Italian reading remained at +1.7% (vs. +1.8% expected), while in China the Caixin manufacturing PMI increased to 50.4 in June (vs. 49.3 expected). The EURUSD continued to push higher, trading +0.50% on the week to 1.1778, while the dollar index was down -0.45%, trading at the lowest level since February 2022

Tyler Durden

Mon, 07/07/2025 – 08:27