France’s Fiscal Reckoning: Is The Eurozone’s Second Giant Next In Line?

Submitted by Thomas Kolbe

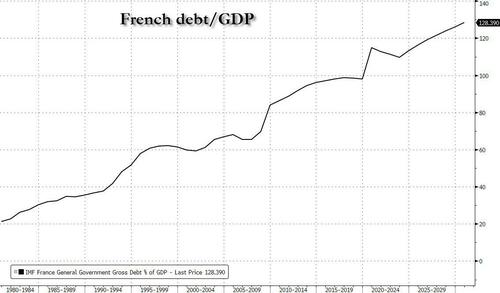

France is caught in a debt spiral. Now the president of the French Court of Auditors is warning of the consequences of political inaction.

Pierre Moscovici has served as president of the French Court of Auditors for five years, overseeing regular audits of the nation’s public finances. From 2012 to 2014, he was France’s finance minister and then spent five years as EU Commissioner for Economic and Financial Affairs, Taxation and Customs. The man knows his way around empty coffers.

On Wednesday, Moscovici called on Prime Minister François Bayrou to take urgent steps to consolidate public finances. France’s budgetary situation, he said, has spun out of control, especially in 2023 and 2024. If a turnaround is not achieved soon, the capital markets will force one. “We can still act voluntarily,” he warned the government, “but tomorrow, the markets may impose austerity.”

For Now, Calm in the Bond Markets

Once the dominoes start falling, it goes fast. Investors dump French government bonds en masse. Yields spike, prices plummet, and refinancing the country’s massive debt becomes even more costly. Already, interest payments consume 10.6% of France’s state budget—roughly the same as education spending. As debt levels rise, fiscal maneuvering space shrinks.

With sovereign debt at 114% of GDP, the trap could snap shut unexpectedly. For now, European officials still point fingers at the U.S., whose debt ratios are similar. But no one can say how long that deflection tactic will work. Credit risk materializes suddenly—usually without warning.

Point of No Return

What we do know is this: historically, a debt ratio above 100% of GDP is already considered critical. At that point, even ambitious reform efforts are rarely enough to grow out of the mess. And unless the indebted country happens to issue the world’s reserve currency, capital markets will deliver their verdict—as we saw during the Eurozone debt crisis fifteen years ago.

What follows is familiar: central bank intervention to keep government finances liquid by running the printing presses—transferring the bill to citizens through inflation.

France has never been known for fiscal conservatism. Years of political stalemate, shifting majorities, and unstable coalitions have pushed annual deficits far beyond the Maastricht 3% threshold. In 2024, the deficit reached 5.8% of GDP. Even with early consolidation steps, it is expected to remain at 5.5% this year—far above the target.

No Economic Comeback in Sight

If French policymakers are banking on a comeback in economic growth, they may be disappointed. In May, the Purchasing Managers’ Index (PMI) for manufacturing came in at 48.1 and for services at 49.6—both in contraction territory. PMIs reflect business sentiment, with readings above 50 indicating growth and below 50 signaling decline. They are considered early indicators of economic and industrial trends.

In other words: despite—or perhaps because of—massive government spending, the French economy is stuck in recession.

Contagion Risk

France’s brewing fiscal crisis is more than a national tragedy. Alongside Germany and Italy, France is under close scrutiny from analysts and investors worldwide. Can Paris pull off fiscal consolidation? Confidence in France’s creditworthiness has been shaky for years. In 2023, Moody’s was the last major rating agency to downgrade France’s AAA status, assigning a negative outlook.

If capital markets further downgrade French debt, the consequences would spill across the Eurozone. Here, the old rule applies: hang together, or hang separately. Bond markets tend to move from one weak link to the next, rigorously reassessing creditworthiness in crisis situations. Those who falter pay higher interest—or lose market access altogether. Moscovici knows this.

The pressure is mounting on national governments: either push through tough budget reforms or increase the tax burden on citizens.

The French Exception

France is a special case. With a government spending ratio of 57.3% of GDP, it ranks among the top welfare states in the world. Accordingly, the overall tax burden has risen to 45.6%—well above the EU average of around 40%. Citizens are already surrendering nearly half their income to maintain Paris’s welfare illusions.

Social peace is being purchased with money that no longer exists—financed by debt and propped up by the illusion of fiscal sovereignty. When even the nation’s top auditor demands consolidation, one thing is clear: it’s about to get serious. The social budget—the bedrock of the political quiet pact keeping unrest in the banlieues at bay—is at stake.

History teaches us: when governments cut social programs in France, social peace crumbles. Then the suburbs—from Paris to Marseille to Lyon—go up in flames.

* * *

About Thomas Kolbe: for over 25 years, he has worked as a journalist and media producer for clients from various industries and business associations. As a publicist, he focuses on economic processes and observes geopolitical events from the perspective of the capital markets. His publications follow a philosophy that focuses on the individual and their right to self-determination.

Tyler Durden

Sun, 07/06/2025 – 07:00

-images-15.jpg)