Fed’s Favorite Inflation Indicator Ticks Higher In June

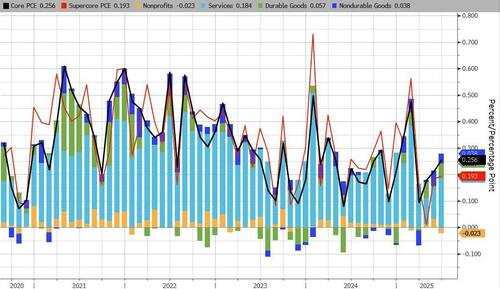

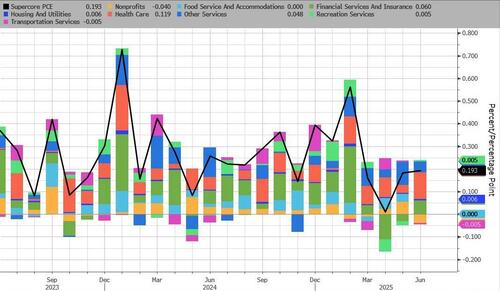

The Fed’s favorite inflation indicator – Core PCE – rose 0.3% MoM (as expected) which pulled it up 2.8% YoY (hotter than the +2.7% YoY expected) – the hottest since February…

Source: Bloomberg

Not exactly the hyped-up inflationary surge the tariff fearmongers had been pushing.

Services inflation is accelerating as are Durable Goods costs on a MoM basis…

Source: Bloomberg

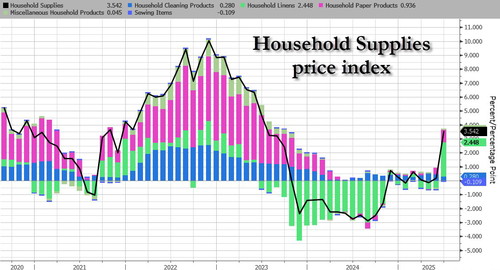

Deeper under the hood, household supplies seems to be getting hit with tariff trauma…

Source: Bloomberg

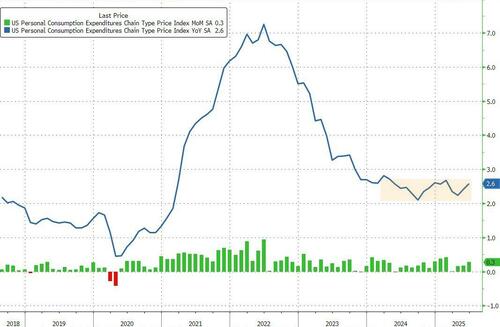

Headline PCE rose 0.3% MoM (as expected) and +2.6% YoY (hotter than expected)…

Source: Bloomberg

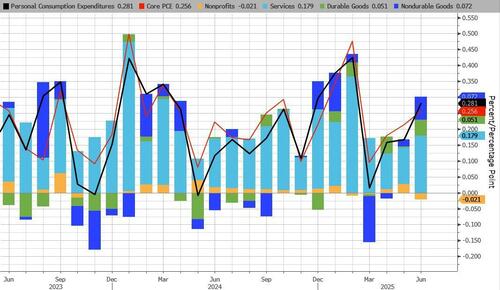

At the headline level, all the sectors (aside from non-profits) are accelerating…

Source: Bloomberg

Super Core PCE – Services Ex-Shelter – dropped to +3.18% YoY in June…

Source: Bloomberg

Healthcare costs are starting to pick up (not exactly tariff-driven)…

Source: Bloomberg

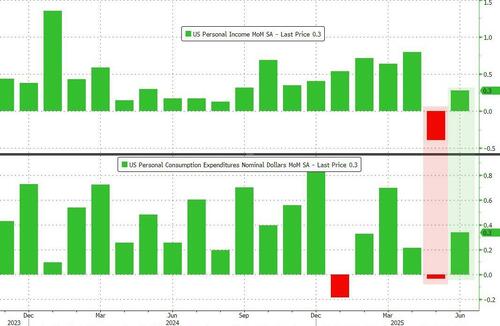

Both income and spending rose 0.3% MoM in June (after May’s surprise decline in both)…

Source: Bloomberg

Wages are re-accelerating:

-

June Private worker wages and salaries up 4.7% YoY, up from 4.5% in May

-

June Govt worker wages and salaries up 5.5% YoY, up from 5.4% in May

On a YoY basis, Spending and Income are both up 4.7% (in nominal terms)…

Source: Bloomberg

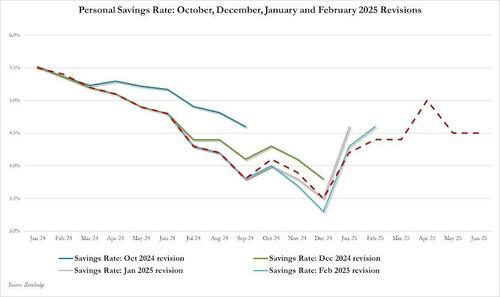

With the savings rate unchanged at 4.5%…

Source: Bloomberg

Is there enough here to nudge The Fed towards a cut? Or do we keep waiting for the 'lagged’ effect of tariffs to finally show up in prices?

This is the 'transitory’ no inflationary impact period!

Tyler Durden

Thu, 07/31/2025 – 08:45