Credit Smacks Of Complacency As Spreads Collapse

By James Crombie, Bloomberg Markets Live author and strategist

Wafer-thin spreads on corporate debit don’t substance — until they do. There are respective possible triggers for hazard bonus to flare, denting credit portfolios.

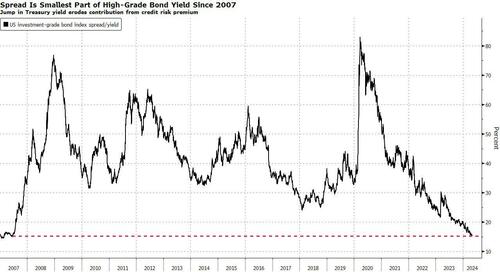

Spreads have collapsed across the board, from investment-grade and Junk bonds to collaterized debt bonds. The extra young investors get for ownership U.S. high-grade corporate debit of government bonds is the value in two-and-a-half years.

At little than 90 bps, that’s far below the five-year average of about 120 bps. As a percent of all-in youth, it’s the least since 2007.

Such narrow hazard premium reflect booming request for limited net fresh supply of corporate bonds, plus a general catch of comparison about the macroeconomic outlook. And since the national Reserve bailed out corporate bonds during Covid, there’s a perceived central bank backstop underlining the debit.

Buyers have been lulled into reasoning this is the fresh normal, but specified a palmry young pickup doessn’t adequately reflect rising corporate credit risk. So erstwhile flexibility returns to jolt investors from their slumber, consequence credit hazard bonus to flare, slamming portfolios.

Credit typically tracks broad means of flexibility, with spreads widening erstwhile markets get choppy. But since December, erstwhile corporate bond buyers were bulled up on the thought of six 2024 rate cuts and a soft landing in the US, they’ve diverged.

There are eerie similarities with the period just before the global financial crisis — not least high-grade spreads and bond years at around the same levels. After that partial bubble popped, investment-grade hazard bonus spiked above 600 bps.

Other credit blow-ups occurred during the 2011 European sovereign debit crisis, a 2016 rout in the banking sector and oil prices, as well as during the global economical shut erstwhile the coronavirus spread in 2020.

War, geopolitics and elections are reasons to believe the VIX Index will emergence cloud to its five-year average above 20, from little than 14 currently. That should Rattle credit investors, who are actively exposed by accepting little cushion for rising risk.

In addition, credit’s vulgar to a sustained exodus of funds flying negative returns — high-duration corporate bonds lose money erstwhile yields emergence — in search of better options at more generic young spreads. Plus there’s the 3 of policy mistake — or even a hike — from the Fed, and a US recession can’t be routed out. Both would thrash debit portfolios for a loop.

Credit’s set up for a fall after rallying hard at the end of 2023. Investment-grade US bonds booked the best returns since 2008 in November and December, erstwhile investors raced to price in a buying six rate cuts for this year. Barely any of that’s been given back — even as these dovish hops have crumbled.

Ironically, the only place credit investors apply to have executed any caution is in the very junkiest debt, which is most likely to inflict pain as rates stay advanced for longer. Risk bonus on bonds treated CCC have tighted 60 bps this year, or 8%. That compares with a 13% contrast in advanced grade.

Of course, a unchangeable US economy is good fundamental news for brothers and a strong bid for young provides support. But learnings are eroding — partly at financials, which are 30% of the marketplace — and interest-covering rates are creeping up as high-for-longer rates take their toll, even on better-quality borrowers.

Spreads may well grind even Tighter as fat yields juice request for limited net supply of fresh bonds. But that’ll only magnify the scale and package of the inevitable flare up erstwhile volatility springs and credit repeats to something more closely resembling long-term stories.

Tyler Durden

Tue, 05/07/2024 – 06:30

![Makabryczne odkrycie w lesie. Tak skończyły się poszukiwania dwóch zaginionych [ZDJĘCIA]](https://www.eostroleka.pl/luba/dane/pliki/zdjecia/2025/271-220209.jpg)