Chinese gold

Last year, gold mining in China amounted to 84.97 tonnes, 1.88% more than the year before. For the purposes of the jewelry industry, industry, medicine utilized in the first 4th of this year 291,58 tons of this gold. According to information from the Central People's Bank of China (中国人民银行) gold reserves in the first 4th of this year increased by 57.85 tonnes. This is the 5th consecutive period (November 2022 – March 2023) of the increase in Chinese gold reserves, despite expanding usage in various sectors of the Chinese economy.

At the end of March this year, these reserves amounted to 2068.38 tonnes.

By comparison, Polish gold reserves at the end of 2022 were around 228 tonnes.

Source:

State of the Chinese economy – image

Source: State Statistical Office (国家统计局).

(r/r – year per year; m/m – period per month; )

Collecting data in 1 place allows you to see a synthetic image of the current state of the Chinese economy. And this 1 is clear: despite respective negative signals (increase in youth unemployment or deflation affecting producers, etc.), the economy is very vibrant, which contrasts with data on economies of another countries.

What may be worrying is the unexpected investment slowdown in manufacture observed in April. The decrease in investment is besides observed in the real property sector, although it is smaller than in the same period of the erstwhile year. But that's inactive over 6% little in terms of r/r. Inflation of CPI and PPI indicates a hazard of deflation and a hazard of slowing the pace of economical development. A pace that is inactive unsatisfactory. Import inactive does not recover the earlier vigor, but export is developing amazingly well.

Unemployment among young people (16-24 years) again exceeded 20% in April. This phenomenon has been deepening for many years. This is most likely the biggest challenge for decision-makers.

Source:

RMB grows stronger

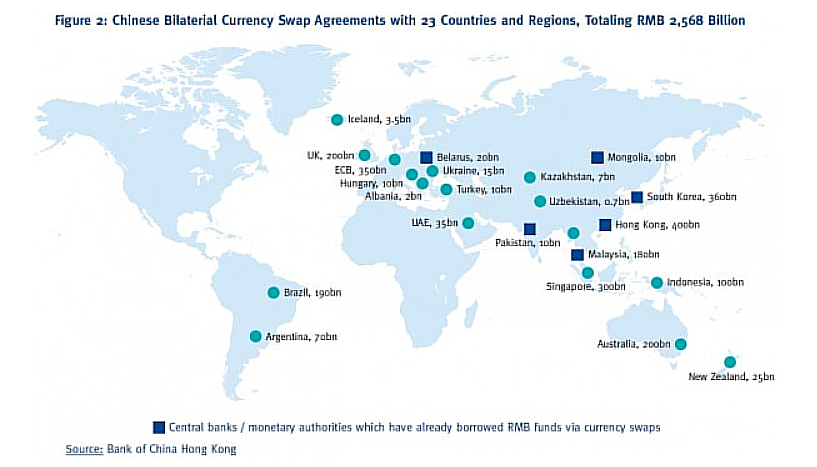

There is simply a increasing group of countries that accept Chinese yuan (RMB) in the settlement of transactions with China alternatively of US dollar (USD).

China thus settles with Russia (the change occurred before the outbreak of the war with Ukraine), Iran, Saudi Arabia and another Gulf states), Pakistan, Argentina, Brazil and many another countries of Asia, Africa and South America.

It turns out that Bank of China (中国银行) works with BNP Paribas, the largest French bank, to make and introduce a common digital portfolio of RMB. 1 reason for taking this action is the expanding number of Chinese tourists in France after the epidemic break. Among them, as throughout China, there will be a group of people utilizing Chinese digital currency. Allowing them to settle in a digital RMB in France means an additional stream of tourism revenues for that country.

Argentina is among the countries that will pay yuan for imports from China and not, so far, dollars. In the first pilot tranche of goods, specified settlement will apply to goods worth USD 1.04 billion (about PLN 4.328 billion). erstwhile this amount has been exhausted, the amount of the RMB settlement limit will be gradually increased.

Such an event does not mean breaking the global position of the dollar as the dominant means of account in global trade. And they prove that this position was not given erstwhile and for all. Change is progressing.

SWAP agreements of the Central Bank of the PRC with central banks of 3rd countries, as of April 2023.

Source:

Author: 梁安基 Andrzej Z. Liang, 上海 Shanghai, 中国 China

Email: [email protected]

Editorial: Leszek B.

Email: [email protected]

© China: Facts, Events, Opinions – www.chiny24.com