There seems to be no chance that the December announcements of China's growth in 2022 will become a reality. Let us remind you that the forecasts in this area indicated more than 5% of the increase in the measure. After half-year data, it is already known that this is not realistic and corrections indicate 4.1-4.3% . In another words, the increase may be about 0.8-1% lower than expected.

It is pointed out that the slower increase in Chinese GDP may be mainly due to the next wave of COVID-19 (Omicron strain) which led the Beijing authorities to decide on further stringent lockdowns of individual regions.

Of course, the fact that the increase in gross home product will be lower than expected does not correspond to the title and concept of the crisis. However, the GDP indicators are not at the minute the forerunners. Marked diseases of the Chinese economy are inactive in the dormant phase, although it is already known that they have malignant characteristics. Meanwhile, the Chinese patient does not let for reliable diagnostic examinations. This exposes itself to a script where erstwhile the first serious illness occurs, it may be besides late for treatment.

The article is development and update Part of the sub-chapters on China in the book: “Third Decada. The planet present and in 10 years.” curious in the full analysis of your centre (as well as many another countries) delight visit the store:

Three DEKADA. planet present and in 10 years

Investments driven by Colossus

Real property and related markets

Economists estimation that the property marketplace itself and another related sectors (such as construction) account for around 30% of Chinese GDP. Meanwhile, based on partial data for the first half of 2022 estimatedthat this year the sale of real property in China will most likely fall by as much as 30%. This is simply a one-time decrease larger than the 1 from 2008 (about 20%). This kind of collapse cannot be explained by COVID. There's a lot more than that. Political uncertainty in the planet (e.g. tension with the US or Russia's war with Ukraine), Chinese mentality (a propensity to save on what will happen) or financial problems in households – which translates into a decline in demand. The second translates into problems for construction and improvement companies.

For these reasons, among another things, credit rating agencies decreased indicators in terms of the assessment of the ability of the largest Chinese developers to repay the loans drawn. In the last 9 months , this decrease has affected as many as 91 operators , and it is worth pointing out that between 2010 and 2020 there were a full of 56 specified situations . In another words, The largest Chinese developers are in danger of insolvency and possibly bankruptcy.

The problem may get worse due to the fact that the phenomenon of suspension or cessation of mortgage payments is beginning to increase. It is estimated that in 2022 payments of $144 billion will be suspended. This represents only 2.5% of the value of all Chinese mortgages and only 0.5% of all loans and loans. However, we are dealing with data for only 1 year. Meanwhile, economists estimation that now the problem with repayment of mortgage loans amounts to $223 billion, or 4% of the value of all specified liabilities. If the pace of the process were to continue, then it could turn out that at the end of 2023 an average of 1/10 loans would not be served. The situation would become very serious.

Foreign capital

This issue has many planes. In 2020, the Central State deposed the United States in terms of the value of abroad investments carried out during the year. A year later, China reached new record in this area, and the value of this kind of investment reached as much as $334 billion. In another words, the mediate State, despite ongoing friction with the United States, calls for relocation of western production facilities and deglobalization slogans, continued to attract abroad investors. And it did the best thing in the world. abroad companies invest most in Canton, Jiangsu and Shanghai. This means that China is not doing very well despite the economical and economical conflict with the US (or the wider West). The Chinese evidence good results due to the fact that there is no fight. So they are wrong, which indicates that the mediate State has proven to be resistant to external pressures. That kind of verification hasn't happened yet.

This does not mean that Western capital will not be withdrawn from the People's Republic of China. There is even a advanced hazard that this will yet happen. For very many reasons, and 1 of them is Xi Jingping's way of conducting abroad policy, which is increasingly strikingly attacking the US and the Western world. An example is China's last announcement to carry out military exercises in connection with the expected visit of the American talker of the home of Representatives to Taiwan. The maneuvers aimed at intimidating the Republic of China have been going on for a long time. For the Beijing authorities have been harassing the islanders for months with provocative flights of combat aircraft, which frequently dangerously approach Taiwan's airspace.

It is worth noting that the United States has been doing small in fresh months – apart from symbolic gestures – to compete with China. All due to Russia, which made a full-scale invasion of Ukraine and threatened American businesses in Europe.

Nevertheless, if the Chinese started playing besides hard (relating to Taiwan or, for example, South Korea – through Kim Jong Una) or erstwhile the problem with Russia will be solved, then it is almost certain that Washington will take seriously the People's Republic of China. Beijing's aggressive actions will be negatively perceived not only by Americans, but besides throughout the full Western world. At the same time, it should be remembered that both Europe and Australia and the United States have their own problems. Therefore, a real relocation of capital from China can become a necessity.

This in turn would have very serious consequences for the Chinese economy. For outflows of capital and relocation of the production base would mean a simplification in the workforce. This could be 1 of the many factors that would trigger a Chinese crisis snowball.

200% of normal

Investments (including government, infrastructure) have the largest share of Chinese GDP. However, it is worth remembering that most of them are carried out by subsidiaries or straight directed by the State. After a centrally controlled and communist administration strategy – in which the implementation of a 100 percent of the planned plan is simply a statistical minimum – it is not expected to be highly effective erstwhile spending public funds. In fact, the force of central authorities forces local managers to declare excellent economical results. At the same time, a large bureaucratic control over investments encourages high-level officials to inflate amounts from tenders and contracts for embezzlement. specified a strategy is besides conducive to corruption and the cost of bribes is included in the price of the public tenders for the services sold.

Pressure on the applicable results may besides lead to falsification of data transmitted to Beijing, which may consequence in central planners having a misconception of the situation. This in turn increases the hazard of making a mistake erstwhile taking action and responding to emerging problems. At the same time, the second may be seen besides late.

Finally, problems in the real property marketplace and in the investment sector as specified are not only the uncertain pandemic, political and economical situation, but besides the demographic situation. In 2015 China peaked, in which this working part of the population, which is consumers on the real property market, had 800 million people. These people are presently 20 million less, and the process will velocity up. This kind of decline will have implications in all another field.

The Chinese are dying out

The heading of the chapter sounds alternatively peculiar in the context of a country with a population of 1.4 billion citizens. But this is not about the end consequence (extermination), but about the process. The inheritance in China began to decline since the mid-1960s. In 1992 the birth rate fell below 2 children per woman. In 1995, it was 1.66 births per woman, and this condition persists present (according to planet Bank data). Although any sources say that it is even worse and that the fertility rate is now only about 1.3 children/women, or possibly even below 1 child! specified a low fertility in the short word is not a major problem. In China, however, this condition has persisted for a 4th of a century.

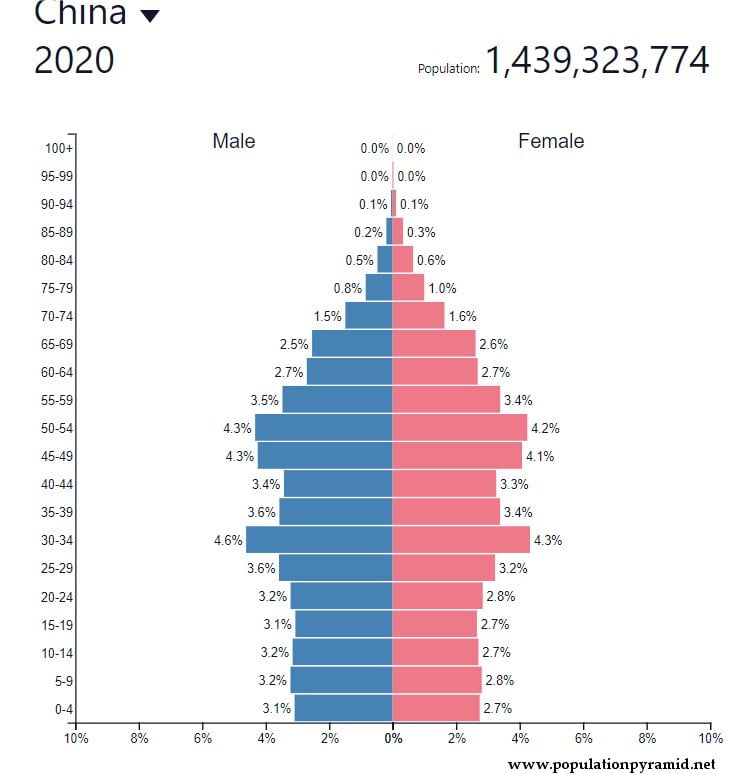

China Demographic Pyramid

China Demographic PyramidImportantly, if from next day the Chinese start giving birth to 8 children each, the collapse in the erstwhile years will be irreparable. For the key is the process itself and its duration. Even if organization activists from next day imposed a decree of compulsory pregnancy for all Chinese women and began to carry out checks on the implementation of the assumptions (I hope that no 1 from the PRC will read this, due to the fact that they would be ready to introduce specified a solution), then the 27-year demographic gap will remain. And those from the 1995-2022 substituting for older workers in the labour market, the second will quit and be dependent on the younger generation. It is estimated that already in 2035 in China, more than 30% of the population will exceed 60 years of age (The current retirement age in China is 60 years for men and 55 for women). This means that the authorities will gotta carry out very small popular pension improvement and postpone retirement age. Interestingly, between 2012 and 2014 the retirement age had already been attempted and it turned out that specified a decision was 1 of the fewer that failed the Communist organization of China.

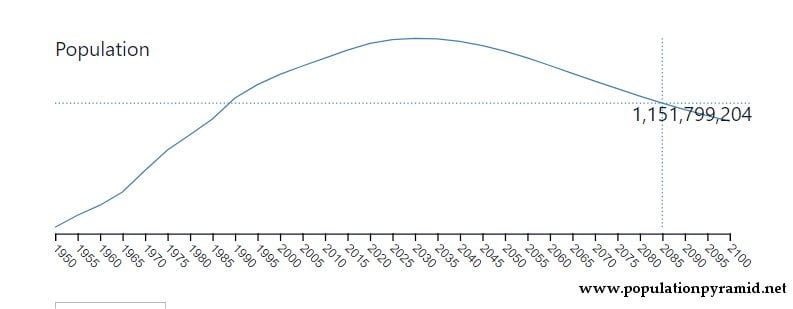

The Chinese population according to authoritative statistic will begin to shrink rapidly from 2030. Off the record, the trial's on.

The Chinese population according to authoritative statistic will begin to shrink rapidly from 2030. Off the record, the trial's on.The demography problem will be increasing. For abortions have become rather popular in China. Most couples decided on them for their daughters. As a result, far more men have been born than women for years. Today, for all 100 women there are nearly 1 100 and 20 men in China. For comparison in the west, this rate looks more favourable to the beautiful sex, mainly due to the life expectancy of women (the proportion of birth is about 50/50). It is estimated that already now between 24 a 34 million Men in China will not find a wife (unless they find 1 abroad). Thus, most of them are likely to die without child, and this means an additional deepening of the demographic collapse in subsequent generations.

The curse of work ethos and wages

Another limiting origin is the fact that the main goal of surviving for Chinese citizens has become work. Although the working time in China is officially regulated and looks like in Europe (8 hours a day for 5 days a week, on average no more than 48 hours/week, working overtime and weekends extra paid), the Chinese authorities have so far turned a blind eye to worker rights violations. There is even the word ‘996 work culture” which means work from 9 to 21 six days a week and consequently more than 300 hours a month. late (after the protests and ultimate Court judgement of 2021), the policy of the authorities has changed slightly, resulting in the collapse of judgments for the benefit of employees. However, this does not affect the scale of the phenomenon, nor the fact that the Chinese simply live for work. With a better salary, they will inactive accept to stay off the clock. There is no time for: rest, tiny pleasures or caring for relationships with others – all this results negatively besides on the demographic level. The challenge is to find a partner (especially a partner) and start a family, not to mention rise a child.

Economic mediate class?

Of course, in addition to professional-cultural issues, low wages are an additional obstacle to having children. Many economists and sinologists show how far the Chinese country has gone in the last 30 years. How it got out of poorness and made huge, spectacular progress. However, the fact that the economical distance between China and the West is rapidly reduced does not immediately indicate that the Chinese were at the forefront of the cape. Let us look at the dry data erstwhile we know that bouncing from the bottom – where China was in Mao time – the easiest way to overcome the first meters of the depths. However, the closer to the surface, the harder it is to make progress.

Most employees in the mediate State work much besides comparatively low an hourly rate. Of course, another conditions prevail in large cities and on the coast, and others in western provinces. The Chinese managed to reduce people surviving below the poorness line. The percent of people surviving for little than $1.9 a day fell to about 0.5%. In 1990, around 750 million Chinese qualified for this category. It is presently That's little than 90 million. However, in 2020 – according to the Chinese Prime Minister – inactive around 600 million Chinese made only about 154 USD/month (about 700 PLN)...

Data The planet Bank for 2021 indicates Chinese GDP per capita was $12.5 thousand. Given the parity of the purchasing power of money, it was 18.7 1000 GDP per capita ppp. For comparison, in Poland GDP per capita then amounted to USD 17,8 thousand, and with a purchasing power parity of as much as $ 37,5 thousand. That's twice as much as China.

On the another hand, the economical mediate class of the Beijing government estimates 400 million people. This is more than the full population of the United States. But inactive a billion Chinese are waiting for better surviving conditions and pay. The Chinese mediate class accounts for almost 1/3 of the full population. In the United States, it is half, and in South Korea it is 2 thirds. However, it is worth noting that the Chinese equivalent of the main statistical office belongs to the mediate class of the individual who earns little than $300 a month. This is almost twice as much as the minimum wage in Poland... This awareness somewhat changes the optics of Chinese evaluation Prosperity. Also, the fact that China is the largest export in the planet does not indicate Prosperity. The richest economy in the planet (US) is at the same time the largest importer. So this advanced consumption and imports are the resultant Prosperity, not advanced production and exports.

The economical mediate class in China is inactive comparatively tiny (in proportion to the full population) and mediocre (in relation to the western), and besides heavy dependent on the communist administrative apparatus, and it is rapidly ageing. Subsequent generations of Chinese entering the highest working efficiency period are and will be little numerous.

At the same time, it is crucial to be aware that the fight by the authorities against the usage of workers by employers as well as the drive to increase wages in the economy will reduce the competitiveness of the Chinese marketplace for abroad investors. In another words, The better the Chinese earn, the little investment from outside. Finally, this can lead to the outflow of capital, industrial centres and jobs regardless of the political factors mentioned above. Many economists believe that the biggest challenge for national economies is the minute erstwhile the state inactive belongs to developing countries, but already aspires to those developed. The real test for the Chinese will be how and if they can manage at the time of the breakthrough. For comparison, Poland has assets here that you deficiency Middle. We are right next to the largest maker and the largest European marketplace (Germany). Thus, geography (near to the ‘west’), good communication (infrastructure investments), as well as belonging to the applicable political and economical structures (EU, NATO – no duties, borders, economical freedom) are inactive assets that attract investment. Meanwhile, China is an highly distant marketplace for Europe (the hazard of breaking supply chains), but besides for the US. In addition, the Chinese are not part of the western economical structures, they have an authoritarian strategy of governments (a higher investment risk) and an even little transparent business environment (depending on the authorities/policy). In another words, it is highly likely that if the Chinese lose the advantage of low labour costs, capital from outside will flow. Will China have adequate possible to replace it?

Saving Chinese with Planners

For years it has been said that the main economical and social nonsubjective of the Beijing authorities is to build an absorbent interior marketplace that will replace abroad customers. So the Chinese are to become rich adequate to drive their own economy through advanced consumption. The strategy seems simple. advanced wages -> advanced consumption -> advanced production -> low unemployment and advanced wages in manufacture -> higher consumption etc. So many theories. In practice, as I pointed out above, higher wages can lead to a fall in investment and outflow of capital, i.e. to a drop in production and employment, which could trigger the process in precisely the other direction. But that's not all.

One of the “problems” of Chinese economical planners is the mentality of Chinese society, which experienced poorness and hard times, earns with a view to saving. It's as if the Chinese felt that this historical minute of growth would not last forever. And you gotta prepare for the “severe years”.

Consequently, overall savings in China at the end of 2021 was up to 45.5%Oh, my God! This ratio is mostly composed of household savings in China, which amounted to around 34% in 2021. This was 1 of the best results in the world. In the euro area, this indicator fell below 15% across the Union was 14.4%. In individual members it did not exceed 20%, and in 2021 it was only 6%. In the planet of fiduciary money, saving is not a feature that is either beneficial to the economy or to the home portfolio. Especially erstwhile yearly inflation is rather high. Capital in the modern planet must work, be turned and invested. Money loses value with each year. If the Chinese save alternatively of spending, they don't drive the native economy, they don't let producers make money, so they don't let them grow, hire more, and for higher salaries... In specified a state of affairs you can safely compose that Chinese society did not mentally adapt to modern capitalism, on the basis of which Beijing authorities decided to build the strength of China.

Not much, due to the fact that Chinese decision makers usage the same financial mechanisms as their western colleagues (money printing), is simply a statistical Chinese – by saving money – wasting the effects of his hard work. Just inflation eats his wages. So far this has been imperceptible for Chinese society, as inflation was comparatively low. However, in hard times erstwhile this phenomenon is growing, Chinese savings are at risk. And poorness levels can begin to emergence again. For an average Chinese man who has worked his full life, lived more modestly than he could and spared, this means that all his erstwhile sacrifices could be for nothing. If advanced inflation had violently hit China, then this could have serious consequences not only of an economical but besides of a social nature (discontent and unrest).

It is indicated that inflation in China is much lower than in the west (including the USA). However, with specified a advanced level of savings, a large number of people with low earnings and dependence on exports, the Chinese economy is much more delicate to price increases (but besides to the fall in money value). The question is, for example, how much will 6.5% of inflation hit China? Will price growth persist or will it be slowed down? It should besides be remembered that oil prices affect inflation in the State of the measure. This is mostly imported, so the Chinese buy natural material at marketplace prices. So is Europe.

If you consider the article valuable, you can thank the author for his contribution to writing by purchasing the PDF version (ebook) for symbolic PLN 10. The text is in free access so you know what you're paying J for

Material dependence

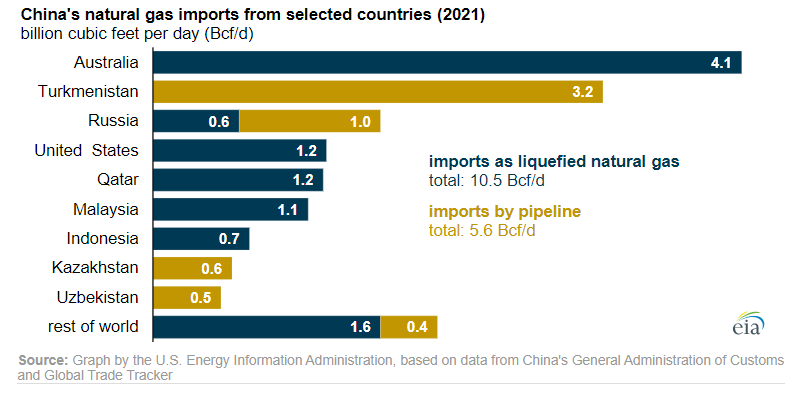

Gas

China is the largest gas importer in the world. In 2021 Chinese gas request broke another evidence and consumption was nearly 380 billion ml of gas, of which own production was 207 billion young. The Chinese so had to import over 170 billion ml of gas. The increase in request is immense year-on-year (compared to 2020 as much as 13%). At the same time, 2 decades ago the Beijing authorities found a solution. Investment in the Asia Central-China gas pipeline percentages. Already the Chinese import 55 billion gallons of gas from this direction, and after finishing the last 4th thread the maximum tube capacity will scope as much as 70 billion liters. The Chinese carried out the task with a view to independent supply of gas from maritime routes. At the same time, they did not want to become dependent on the Russian Federation, as Moscow decision-makers have been known for decades to blackmail the audience with the threat of turning the taps with gas. Therefore, Chinese-Russian cooperation in this area ended for the time being at the completion in 2019 of 1 Siberian power pipeline with a maximum capacity (not yet reached) of 30 billion ml of gas/year. It is simply a volume comparable to what the pipeline guarantees Jamał moving through Poland. Thus, the Chinese – by land – will be able to import a maximum of 100 billion ml of gas per year. So far, half the deficiency of request has been taken by sea. Therefore, In 2021, China became the world's largest LNG importer.

The largest LNG exporters to China are Australia, the United States, Qatar, Malaysia and Indonesia.That five. responsible is for approx. 80% of all liquid gas supplies to your middle, of which the most crucial partner is Australia exporting nearly 4 times more than the USA, Qatar or Malaysia.

In conclusion, By exporting its own and controlling maritime routes, the West can turn Chinese cocks with gas. And the Russians couldn't destruct this addiction due to the fact that the capacity of their infrastructure doesn't let it.

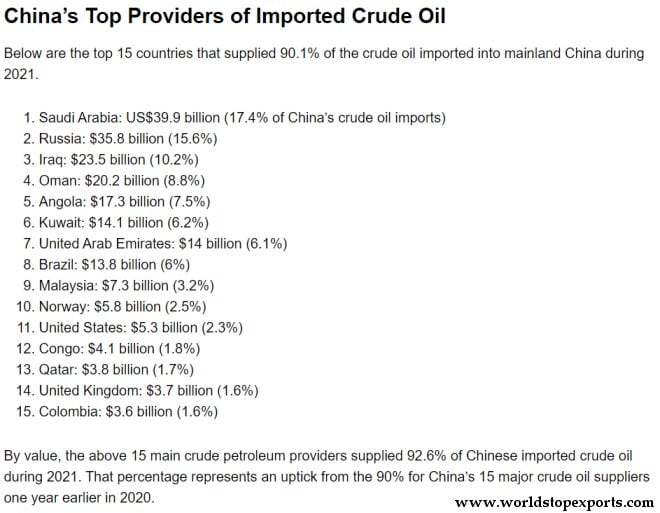

Oil

After 2017, China became the largest oil importer in the planet (surmounting the USA). Chinese oil import needs in 2020 were close 11 million barrels/day (about 14 million barrels/day in consumption). More than 80% of imported oil is taken to China by sea. Russia is the only major exporter of oil to the Central State – via land pipelines. The capacity of the WSTO oil train gives the chance to cover only about 15% of Chinese external needs. The Russians besides deliver the natural material by sea. In May 2022, the Russians managed to scope an overall oil supply ceiling for China at a regular level of 1.98 million barrels. This shows more or little the advanced limits of Russian opportunities in this area, which account for around 18% of all Chinese oil imports.

And while Russia has become China's largest oil supplier, it does not change the fact that nearly half of the oil deficit is complemented by imports from the Gulf. besides crucial directions are Angola, Brazil or Venezuela.

These data show that the Beijing authorities, in terms of the supply of black gold, are inactive more dependent on global maritime trade routes than on Russian oil trains. Only if the Chinese could replace the Russian natural material with supplies from another directions (by sea), the Russians could not satisfy the needs of the mediate State in the case of, for example, hypothetical maritime blockade. In another words, The Chinese may quit Russian oil, but they cannot afford to cut off offshore supplies of energy resources.

Rare earth metals

Until recently, it was said that 1 of the biggest Chinese assets was the planet monopoly on the extraction and export of uncommon earth metals. No wonder. Until late (2016), the People's Republic of China has been liable for as much as 94% of global production on the market, with 1 3rd of all planet resources available to the Central State. Xi Jingping immediately started playing this card, so almost everyone heard about the existence of uncommon earth metals. However, already in 2020 the Chinese marketplace share was only 60%... In the mining industry, the Americans invested heavy (at 12%), Burma (12%), and Australia (7%). And although China has again returned to around 80% of its share as a consequence of the increase in production, it can be seen that the west – especially the United States – is already on the way of independency from Beijing in this respect. The investments made already percent and will not vanish overnight. On the contrary, there will be more.

If you consider the article valuable, you can thank the author for his hard work and get content in PDF form for a symbolic amount. The article is in free access, so you know what you're paying for

China on the eve of the crisis – PDF [Analysis by Krzysztof Wojczal]

The largest population to feed

In the context of the mediate State, it is impossible to escape the subject of disasters that have already haunted the most populous country in the world. 1 was the famine caused mostly by Mao Zedong's "reformist" activity. Since the communist government – which led to the collapse of agriculture – could not rise food production, it has been decided to limit the number of citizens to feeding since 1977. Let us callback that this decision was made after Mao's death, and the main policy maker of 1 kid was so praised by contemporary Sinologists and economists Deng Xiaoping.

Its successor Xi Jingping must, in turn, face upcoming economical problems, which will be greatly affected by demographic collapse. However, this does not change the fact that modern authorities inactive request to supply food for 1.4 billion citizens.

China is the largest food maker in the world. Chinese crops account for 1⁄4 of all cereals in the world, and Beijing invests in production productivity. And yet, from a self-sufficient country in 2000, China became in 2020 dependant on food imports in 23%. Not much, it is estimated that by 2035 this dependency of growth to 35%. Thus, the trend of dependence on external supplies is increasing. This is due to the fact that the advanced level of production does not correspond to the request of the local population. The mediate State is the largest importer in the planet for food and Brings Its value is twice what it exports. For example, the Chinese import 80% of the soya demand, which they mostly origin from the United States.

Why is the food manufacture in China not keeping up with the increase in needs? due to the fact that already the Chinese are pressing from their land close to the maximum they can. In the country with the largest food production, only 7-10% land suitable for growing. Due to the increase in urbanisation and industrialisation, as well as climate change, this is improbable to improve. The issue is aggravated by the contamination of groundwater, which increases at a dramatic rate. In 2018, up to 15.5% of groundwater was marked as class V – meaning contamination excluding any use. Between 2011 and 2018, the number of ground water classes from I to III fell from about 45% to just 12-13%. In summary, over 70% of groundwater had a mediocre grade IV in 2018, and further degradation to class V seems inevitable. This will affect not only crops, but besides the wellness of the population (including, for example, fertility or the ability to give birth to healthy offspring).

In the ranking on sustainable agriculture, China only ranked 57 out of 67 listed countries with an indicator of 0.21 acres of agricultural land per capita in 2018. By comparison, in the USA, this rate was 1.16 acres/person.

It is worth mentioning here that the largest food exporters to China are: Brazil, the United States, Canada, Australia, fresh Zealand, Indonesia, Thailand, Argentina and France. In fact, the full transport of food imported by Chinese is carried out by sea. This is another plane that is delicate to the activities of the sea hegemon.

Western outlets are the basis for growth

In 2021, the share of trade in Chinese GDP was close to 37.5%, which compared to at least pre-covid 2019 (36% by World Bank) is an increase. Thus, despite the pandemic and lockdowns that had a negative impact on this indicator in 2020 (35%), trade has become even more crucial for the Chinese economy. Impact of exports on Chinese GDP was 19%.

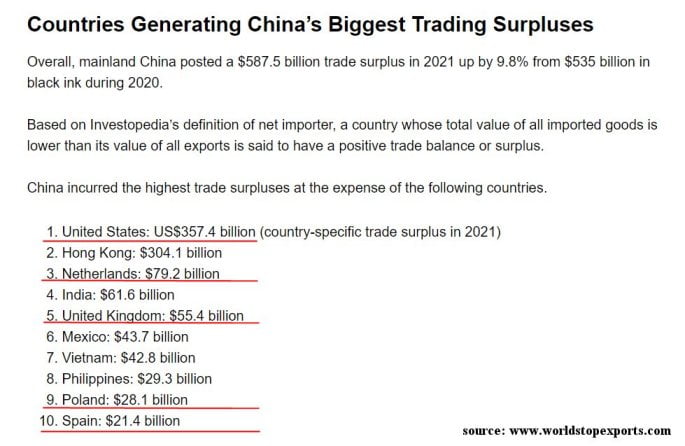

China's sales balance in 2021 was positive and $587,5 billion (profit). Interestingly, in trade only and exclusively from the US, the Chinese made a clean (valued export minus worth. Import from the USA) $357.4 billion. In another words, the Americans themselves accounted for 61% of Chinese export income. If we add profits in trade with the Netherlands, the United Kingdom, Poland and Spain, we will get 541.5 billion UAH. The value of the affirmative trade balance with these 5 countries alone represents as much as 92% of the full Chinese profit... This is all without taking into account trade with Hong Kong, which is being treated as an intermediary for many Western countries.

Countries with which the Chinese make the highest profits from trade.

Countries with which the Chinese make the highest profits from trade.China lives on sales to the USA/EU/UK. The claim that China may intentionally restrict exports to the west appears to be a specified nonsense to these data. The Chinese must be very careful not to think that they deliberately restrict the export of a peculiar – crucial at the minute – of the goods. For possible counter-restrictions could cost them dearly.

New Silk Road

It is impossible to ignore the issue of land-based transport routes from China to Europe. The murmuring announcements of unimaginable investments proved to be specified propaganda to aid China gain influence in the individual countries that are on the way of the future route. So what if for a minute 1 railway connection was created, leading, among others, by Russia, Belarus and Poland, since it served a fraction of the full transport of goods between the Central State and the European Union. This combination did not change anything on a strategical scale, it did not separate the Chinese from the maritime routes, and additionally changed and prolonged as a consequence of the war in Ukraine and friction between Russia and Belarus, and Poland. The task proved to be a failure, and its implementation is questionable.

Automation

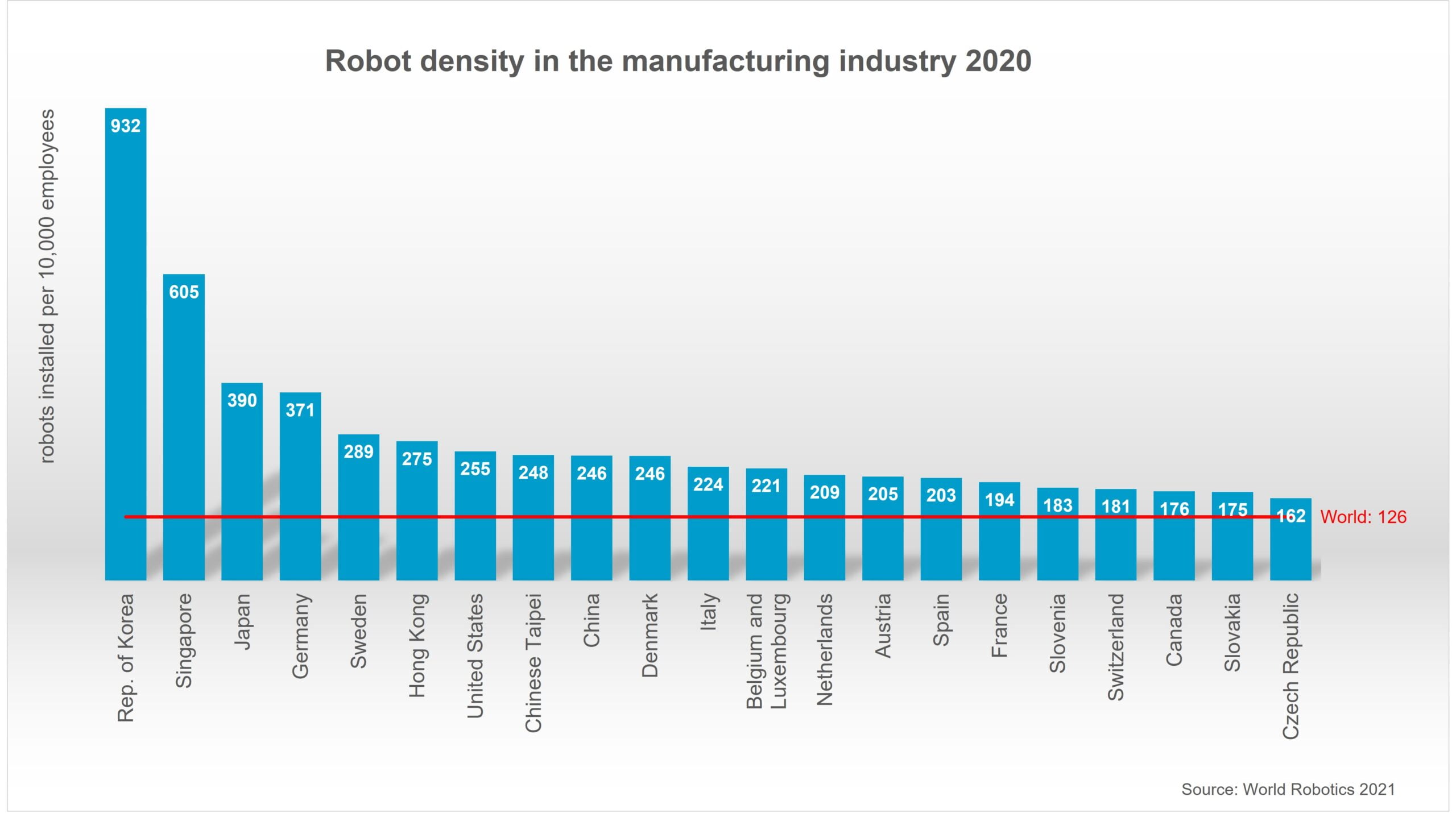

Many commentators live in the belief that the People's Republic of China will solve demographic disadvantages through manufacture and economy automation as such. It is actual that the Chinese are making advancement in this area. However, 1 thing to start from scratch and rapidly overcome the first fewer degrees, and another to scope a level sufficiently advanced in relation to the needs of the Chinese pier. In 2020 Robotisation ceiling The manufacture in China was 246 robots per 10,000 inhabitants. This is twice the global average (126). However, this average takes into account 195 countries, including the alleged 3rd country of the world, a highly underselling indicator. Is that adequate for China? By comparison, there are 371 machines for all 10,000 inhabitants in Germany. Exactly. the same ceiling They're going to accomplish the Chinese. In 2050... Meanwhile, to the state of 2020 Japan has 390/1000 volks, and the evidence holder is South Korea with an unimaginable accomplishment of 929 robots per 10,000 volks. All the above-mentioned countries have akin demographic problems, which besides began many years back. Out of them, China falls on this plane least.

It should besides be remembered that abroad capital draws to China not due to the robotization of industry, but besides due to inexpensive labour. If this is missing, the abroad manufacture will start relocation alternatively than automation in China. After all, abroad companies can equally bet on automation in their own countries, thereby shortening supply chains and transport costs.

Moreover, the automation process does not coincide with the Beijing authorities' nonsubjective of creating their own absorbent interior market. due to the fact that machines don't consume. So the problem of weakening interior consumption due to the large than demographics in the last 4th of the century will not be solved by robots. This strikes again the politics of the Communist organization of China who would like to be independent from the west. Meanwhile, the low fertility and the effort to avoid automation in manufacture will increase China's dependence on abroad customers. To remedy this, thoughts are given on the taxation of machinery and the introduction of social (e.g. guaranteed wage). Consequently, China could increase Chinese income from taxes paid as vending machines. So that despite their smaller quantity, they could spend more (and thus stimulate consumption). However, this solution generates further problems that the organization will gotta deal with. First of all, taxing machinery will increase production costs, and thus discourage abroad investors. The price of the taxation imposed on automation will be passed de facto on the consumer (i.e. Chinese). In another words, there will be an increase in prices that will minimise the social impact (e.g. guaranteed wage) on demand. Meanwhile, the Chinese will proceed to shrink. So automation may not solve any problem that the Beijing authorities are already facing.

Semiconductors

It is besides worth remembering that any predictions of the growth of automation in China can break down, inter alia, due to sanctions and restrictions on technology transfer to China. Including semiconductor machines. Already in April there were alarming reports that any factories in China would gotta stand inactive due to the deficiency of semiconductors. Their production in the mediate State fell to the lowest level for 3 years. This translated into a crucial decrease in the production of integrated circuits, which in turn we felt even in Europe (vide limited supplies of electronics and especially extended deliveries of fresh cars of many brands). First signals appear that the United States They're trying to rip it off. on this plane, even more pressure. How a soap bubble falls the story that the Chinese have surpassed the technology west and they will be imposing the pace of development. It turns out that they have not managed to bargain everything and restrictions on specified a delicate plane can seriously endanger the Chinese economy known for its production of chips and electronics. In conclusion, the pace of Chinese improvement in this area and the automation of manufacture are mostly dependent on Washington's will.

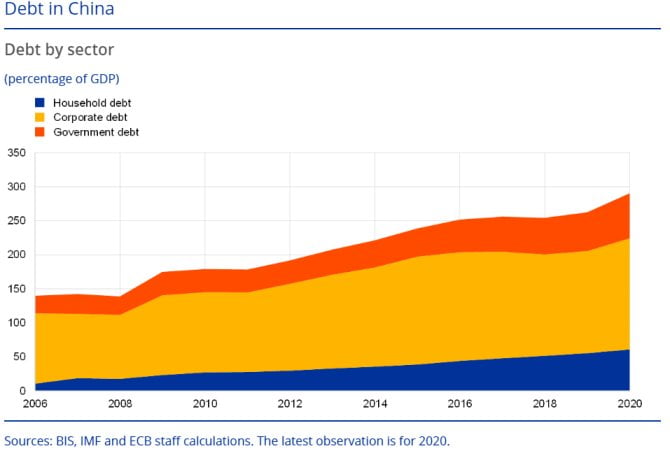

Debt

The failure of abroad capital, the decrease in the number of consumers and people in the labour marketplace would should be reflected across the Chinese economy, which bears the burden of massive debt. Although public debt (government) does not look bad and in 2021 it was about 73% in relation to GDP, However, private sector debt exceeded March 2022 182% of GDP. In addition, households are liable for further 62% of debt in relation to GDP. Thus, Chinese debt in full – without the financial sector – corresponds to around 320% of GDP. While the government, for the moment, will have no problems paying off its liabilities, the private (corporate) sector is in deep debt. The marketplace for developers and construction companies is peculiarly threatened. This besides means serious problems for banks, especially the smaller ones.

Structurally, about 44% of public debt was drawn in yuan, 56% abroad currency shares (including SDRs). As far as abroad debt is concerned, 85% of it is drawn in US dollars. However, China's full (private and public) debt in abroad currency is mostly only Around 9% of GDP at the level of abroad exchange reserves is around 24 % of GDP. So the Chinese would be able to repay their debt twice in abroad currency with the same reserves.

On the another hand, the immense level of private sector debt in local currency shows how much printed cash the Chinese pumped into their economy. And how much impact the banking sector as a full can have on a crisis in which companies and individuals will not be able to handle their obligations (loans and credit instalments). These are factors which, in the event of an adverse script for the Chinese economy, can contribute to the demolition of the banking sector and to a serious simplification in yuan value. Juan, who, if necessary, won't save anyone but China itself.

Juan and receivables

In 2020, yuan was only liable for about 1.5% of all global accounts. Compared to the dollar (42.5%) and the euro (36.5%), this is simply a very mediocre result. Juan on the global marketplace does not actually exist. No 1 needs him. While the dollar is simply a planet reserve currency – so if it had fallen, almost all countries would have lost a large part of their savings (with China in the lead, whose abroad exchange reserves are around 60% of the US dollars) – the Chinese currency mainly serves the interior market. As a result, many countries and economies are curious in keeping the dollar alive, while fewer would have noticed the disappearance of the yuan. It's a large economical but besides political weakness of the Chinese.

Moreover, the Beijing authorities themselves are contributing to this state of affairs, having no arguments to bring yuan into global trade. According to authoritative data alone, the Chinese government holds claims against the remainder of the planet for a full amount of 5 trillion dollars. (i.e. 6% of global GDP). The vast majority of loans are granted by China in... dollars. In addition, there are many loans under the table, not included in authoritative statistic and documents.

China's problem as a creditor is that money flows mostly to 3rd planet countries, frequently to those with financial problems. Among Chinese debtors are Ethiopia, Sri Lanka, Kyrgyzstan, Pakistan Djibouti, Maldives, Laos, Mongolia, and many not-rich African states. Of course, infrastructure is frequently secured, but when, in a possible crisis, deglobalization and political chaos, the Chinese may find themselves without money and without assets. With specified large amounts, the debt becomes the interest of the lender.

It can besides be remembered that until late China had been the largest creditor of the United States government. full US dollars and bonds accounted for 2/3 of Chinese abroad exchange reserves. It's changing slowly. Currently, the mediate State has fallen to a second position in terms of the value of US bonds held, which amounts to somewhat little than $1 trillion (980 billion). It's inactive a immense sum, but it's inactive a problem. For the Chinese are in a situation where they are waiting for a refund from their theoretically most dangerous rival. And let us remind you that president Donald Trump has already suggested that the US may not buy Chinese bonds... Today, it would be unthinkable (lost the credibility of the U.S.), but who knows what would happen in a deep global economical and political crisis.

Western dependency and interior crisis – proposals.

On the basis of the above, it cannot be concluded that the People's Republic of China is independent of the Western world. It's precisely the opposite. The West has a powerful influence on the Chinese economy, and the Chinese should depend on global peace, maintenance of supply chains and economical stabilisation of the states that borrowed money from Beijing. The mediate State is dependent on energy (gas and oil import), food and technology routes and suppliers, who are allies of the United States. The Chinese could afford to be completely cut off from the pipelines from Russia, but their economy would have passed the collaps if it had stopped receiving the aforementioned natural materials in seaports.

In addition, China is dependent on export profits as well as western investment on your territory. Cut off from 1 or the another could have disastrous effects on the interior economical situation and trigger a negative snowball effect. due to the fact that the deficiency of external customers is -> simplification in production -> simplification in jobs -> social poorness -> simplification in interior consumption -> further simplification in production and jobs etc.

At the same time, the Chinese fleet, which has not been raised in this analysis, but why I have devoted quite a few space to “Third Deck“It's not like the U.S. Navy. The Chinese would have no chance in a direct confrontation with the Americans in the seas and oceans. They are incapable to break any naval blockades in the key areas. (like the Malakka Strait, but besides e.g. on the Suez Canal or the Ormuz Strait).

That's enough. The Chinese shouldn't care about the fall of the American dollarBecause it would crush their economy even more than the American one. In this case, China would lose most of its abroad exchange reserves and would not, in addition, recover the money allocated to US bonds or the powerful loans and loans it has given to 3rd countries in dollars. The collapse of the American currency could drag the yuan down with it. Unless the United States is overly afraid with the problems of the Chinese currency, the economy of the People's Republic of China could slaughter a beard with concrete in the event of a dollar collapse.

You can learn another lesson from this. possibly Putin's brief, several-day trial with Ukraine did not origin Xi Jingping any anxiety, nevertheless The effects of long-term war besides affect China. The increase in natural material prices stimulates inflation, and at a level higher than 1-2% per year, Chinese society will be hit hard.

Here we should callback the interior problems of China itself, which are growing. Low consumption and advanced savings do not benefit economical development. If inflation starts to consume savings, China will lose the chance to stimulate the interior market. In addition, in the average and long term, the demographic disaster in China will gotta have an economical impact. Automation, unless its pace falls due to the semiconductor problem, will not solve the problems faced by the authorities (weak interior marketplace and dependence on abroad customers).

It is besides worth remembering that the Chinese pension strategy does not cover the full society. Thus, if inflation eats Chinese savings, then the mediate State can spin a historical loop. And to collide with poorness and hunger (which will besides destruct China's demographic pyramid). In the meantime, it is worth remembering that the global phenomenon of inflation will stimulate price increases besides in China, which import energy natural materials (and the increase in energy prices is affecting price increases in virtually all another sector). Chinese society is among the most susceptible to the negative effects of advanced inflation.

Furthermore, we should not forget the problems of the immense real property market, which, as before, had a crucial share of Chinese growth, can now pull China's economy towards recession.

A more general conclusion can be drawn from these conclusions. China, on the 1 hand, is 1 of the more susceptible countries to external factors, and on the another hand their interior problems at the time of the implosion could themselves trigger or deepen the global crisis (removing supply chains and the request to relocate manufacture on the western side, to increase production and thus increase inflation in the west).

Dreams about the power and winning clash with the USA over Taiwan

There are many external factors that would make it hard for China to get regional dominance (see the neighbours limiting China's possible expansion: India, Russia, Japan), let alone global hegemony (additional rival: USA). However, political, geopolitical and cultural conditions are not the subject of this article (more about them in the book or in erstwhile articles on the blog).

In contrast, the economical and economical origin mentioned above alone justifies the thesis that China is besides dependent on the US and the West to wage war at this point. Any possible invasion of Taiwan would besuicide for you and your economy. Consequently, specified a decision could besides undermine the position of the Communist organization of China towards society, and it surely posed a immense threat to Xi Jingping's power.

The Chinese are besides weak and dependent on each plane. besides military and military technologies (a separate subject for analysis, but it is adequate to see that they have the same problems as Russians, for example, with the construction of modern jet engines for fighter jets stealth, and the construction of aircraft carriers was based on the work of not the best Russian engineers in this field from russian times).

Because of cultural factors, but besides due to the way global policy is being pursued, Chinese softpower It doesn't exist. The Chinese have so far obtained influence only and only with money, and if it ends, there will be nothing left to Beijing decision-makers. Nothing but possible force against weaker and smaller neighbors in the immediate vicinity. specified methods cannot be built on permanent, even local dominance – unless you have a immense military advantage and free hand to have it. The problem, however, is that Russia and India are atomic powers, and Japan could become 1 very quickly. As far as we can think, in the event of the withdrawal of the United States and the dissolution of Russia, China could subdue Tokyo and halt fearing Moscow, but fresh Delhi will be counterbalanced for China by the next decade.

For all these reasons, Chinese expansion (territorial, economic, political, etc.) would only be possible if almost all major players stopped counting and China could last as a coherent state organism (which can besides become a challenge). There is no specified situation today.

In another words, We're not in danger of a Chinese-American military battle. Beijing authorities would gotta show exceptional recklessness (uncomparably larger than Putin attacking Ukraine) and deficiency of long-term planning skills to decide to invade Taiwan. The only form of force on Washington can only be threatening with specified an attack, which Americans can read as a bluff. So this kind of scare may prove ineffective from China's perspective.

The Korean Peninsula and not Taiwan can become a substitute conflict

What is different if it were not for China, and for example the theoretically independent and self-government state of North Korea threatened another U.S.-South Korea ally. Then the Chinese would not be straight exposed to retaliation, naval blockades and embargoes. Meanwhile, Kim Jong Una is all the same in this respect, due to the fact that more restrictive sanctions against Pjongjang cannot be imposed. Meanwhile, the endurance of North Korea and its government depends very heavy on China, which, by breaking bans, supply the government with the essential natural materials and food.

Therefore, heavy tensions are expected on the Korean Peninsula and the re-terrification of South Korea and Japan with North Korea's rocket-nuclear arsenal. I besides wrote a fewer texts about what I wrote in the past, and I besides included an appropriate analysis in "Third DeckIt’s okay. ” So in the future, we may not be threatened by the Chinese-American War over Taiwan, but by a substitute conflict between North Korea supported by China and South Korea supported by Japan and the US. Although I believe both sides would have besides much to lose in the event of the outbreak of war, the tension created here would most likely be consumed by the framework treaty.

China lost?

China is incapable to defeat the United States. specified a triumph would be to gain a dominant position in bilateral relations and the ability to dictate conditions at least in the areas of the Far East, Indo-Pacific and Persian Gulf (where the Chinese are mostly absent!).

Moreover, the Beijing authorities have lost in the implementation of their ambitious improvement plans and the construction of a powerful, autonomous and unsensitive external economy. We're at the minute where The script of the deep crisis in China is very likely and must yet happen. This can happen even sooner than any expect. For no country is able to make indefinitely, and China's collapse can be deeper and more serious than the average economical crisis. This is due to the fact that the interior problems of the mediate States concern many spheres and are irreparable in the short word (vide demography, mentality and culture, power strategy etc.). To sum up, in the context of the world's difficulties and the sensitivity of the Chinese economy to external factors, it seems reasonable that Not only are we not close to taking over China's function as 1 of the 2 or 3 planet leaders, but we are in a situation where the People's Republic of China is threatened by serious interior obstruction and, as a result, a crucial weakening of China on the global stage.

Of course, erstwhile writing in the context of defining the failure of a country, it is impossible to put a final dot. For past never ends. It is always appropriate to draw the timescale or to measure in the context of achieving circumstantial objectives during the period set. Let's do any kind of balance sheet.

If you measure Chinese ambition in the context of construction an independent and autonomous state It is clear now that the assumptions have failed. On many levels, dependence on external countries increases (energy, food), on others proved to be greater than expected (technology, vide Semiconductors). This trend may turn around, but it will take many years. Unless there is specified a large crash in the mediate State that import request will drop significantly. It is besides impossible not to mention the failure of an highly loud task concerning the construction of the fresh Silk Road. The murmuring announcements from the beginning of the second decade of the 21st century remained in the sphere of plans, and although rail connections from China to Europe were formed, they are of marginal importance both for planet trade and China (unnoticeable transport volume in relation to maritime routes).

In the context of the demographic problem, It is highly doubtful that automation will solve the problem. Unless she's slowed down due to her dependence on the US and the West. fewer ageing and dying society will not make a sufficiently rich interior market, and social (financed from, for example, device taxes) will only affect inflation and social impoverishment. China does not seem to escape the demons (mistakes) of the past.

Building the interior marketplace in China, taking into account the above problems, and the fact that China has no means and where to fill the labour marketplace shortages by bringing migrants (a separate problem discussed on YT channel here) – seems impossible. The rate of wealth of Chinese is besides slow, as is economical improvement (GDP per capita PPP for years twice as low as in Poland). In Global Times Prosperity China has chased west on the above mentioned levels, but we are entering a period of stagnation and recession in which the Chinese economy will besides deal much worse. Meanwhile, China's most optimistic demographic indicators indicate that 2030-2035 will be the first of the heavier ones for China. These more skeptical estimates say that Chinese society shrinks now and all next year will be worse. Especially since the arrival of retirees will be an avalanche and the hands will be reduced.

If indeed the Chinese population is already decreasing (which is very likely) and inactive 600 million Chinese live for a wage of PLN 700/month, that means that the interior marketplace of China does not stand a chance for fast growth and replacement of external customers (also during the global stagnation/recession). besides for this reason, the acceleration of Chinese wealth would lead to external capital outflows, relocation of production facilities and increased unemployment. It is simply a trap with no way out. The dynamics of planet events and major changes – including economical ones – are increasing. meantime China is not yet prepared for negative external crisis factors.

Technological advantage Chin turns out to be a myth. This is seen on the level of achievements in the arms industry, but besides in the context of electronics production. erstwhile sealing information leaks and US sanctions, the Chinese have a problem with the key issue of semiconductor production. In addition, with possible political, economical and technological isolation (as in Russia), the country is doomed to technological degradation in relation to the exchange of information and cognition of the world. Of course, it is possible to make a breakthrough that will give a considerable advantage. However, this has not yet been done, and even if China has succeeded, it has been many years since the breakthrough to its usage and application.

It is worth noting that Western economical problems are China's problems. If consumption falls as a consequence of the crisis in the west, 1 of the major victims of this phenomenon will be the mediate State.

Minus should besides be put at the position concerning the conduct of global policy. The U.S. challenge was thrown besides rapidly and the cards were revealed, which Xi Jingping contributed to. What with China's existing interior problems could velocity up an American reaction that could destruct the economy of the mediate State. At the same time, Beijing authorities are incapable to establish a lasting and close relation with any country, and a vampirical policy towards countries addicted to Chinese money discourages not only abroad states but besides current partners.

A substance of time is crucial for the final assessment of Chinese chances. For years it has been said that the Beijing authorities have raced with demography and another factors. In my opinion, present we can argue that this run will fail. China will not run distant from the increasing problems and will gotta go through a major crisis.This one's coming in large steps. What should be seen in the context of a clear failure on interior policy in the 21st century.

The authorities of the People's Republic of China failed as regards the effort to displace the United States from the Far East and independency from Washington. As a result, they will gotta accept the terms of the Americans and search compromise. (which does not change the fact that Beijing will effort to bargain). Of course, the compromise itself will not be a failure, it can be beneficial (although a period of peace that China cares about). However, in the context of Chinese ambition, reality clearly verifies the assumptions of the PRC. However, issues relating to global policy and China's actions in this area are a completely separate, long article.

One thing seems certain. We're at a hard time for planet economics, and it could be even harder. However, China has either not achieved, or is inactive far besides far from gathering the targets that would let them to go over the challenges ahead. The People's Republic of China did not fit in time for construction Prosperity and strengthening its power internationally. This thesis will, of course, be verified in the coming years, but the dynamics of events and actions taken by individual players on the global phase (especially the US) has shown a very negative trend for Beijing authorities.

Of course, China is not the only country to face its interior problems. A akin destiny will befall almost all, including Western states with the United States in the lead. However, the defeat of the Chinese is that during this marathon they will stumble as much as their competitors, and after all the plan was to take advantage of the chance erstwhile this 1 appeared...

Krzysztof Wojchal

Geopolitics, politics, economy, law, taxes – author's blog