China Drowning In Soaring Coal Inventories Amid Sinking Power Demand, Crashing Coal Price

China’s overarching central planning model, meant to keep the economy from keeling over, has become so tangled up it is next to impossible to keep track of fake supply and even faker demand. It is also starting to dangerously resemble late stage USSR, when supply-side economics covered up the rot in the economy until the absolute end.

According to Reuters, with its economy slowing, if not contracting, China is pressing its coal-fired power plants to stockpile more of the fuel and import less in an effort to shore up domestic prices, but traders are skeptical the measures will help to stop the slide.

The coal industry in China faces rising coal stockpiles after a massive expansion of output following shortages and blackouts in 2021 is churning out more coal than even the world’s largest thermal power fleet can consume.

To support money-losing miners whose profits are under growing pressure, the state planner has asked power plants to prioritize domestic coal and increase thermal coal stockpiles by 10%, setting an overall target of 215 million metric tons by June 10, the sources said. However, with inventories piling up along the supply chain, the guidelines would be unlikely to spur much buying or support prices.

Mine stockpiles are up 42% from a year ago, while northern Bohai area port inventories are up 25% annually, the state-run China Energy Daily has said. Buyers are also being asked to procure coal from northern ports to chip away at high port stockpiles, three Reuters sources said.

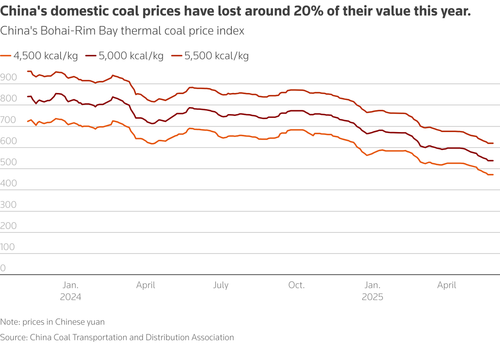

The NDRC’s moves follow months of calls from industry groups and companies to curb coal imports and output. Chinese coal prices have marched steadily downwards, however. Prices for medium-grade coal with a heat value of 5,500 kilocalories per kilogram stood at 620 yuan ($86) per metric ton on Tuesday, the lowest since March 2021.

Prices have fallen so far that some buyers have tried to wiggle out of long-term contracts in favor of spot sales.

China imported a record 542.7 million tons of coal in 2024, but the total is expected to fall this year. Coal imports slid 16% in April on the year.

Chinese mine production continues to grow despite the collapse in prices, with a government haunted by the shortages and blackouts of 2021 and 2022 unlikely to consider output cuts.

„I think they’re very mindful to avoid a repeat of that,” said LSEG lead coal analyst Toby Hassall. „They will tolerate a period where some domestic production is really struggling.”

China’s coal production rose 6.6% on the year during the period from January to April, to stand at 1.58 billion tons. At the same time, industry profits fell 48.9% year-on-year for the same period, official data showed on Tuesday.

Tyler Durden

Thu, 05/29/2025 – 20:30