CPI, PPI, i.e. what's next with consumer goods prices and maker prices?

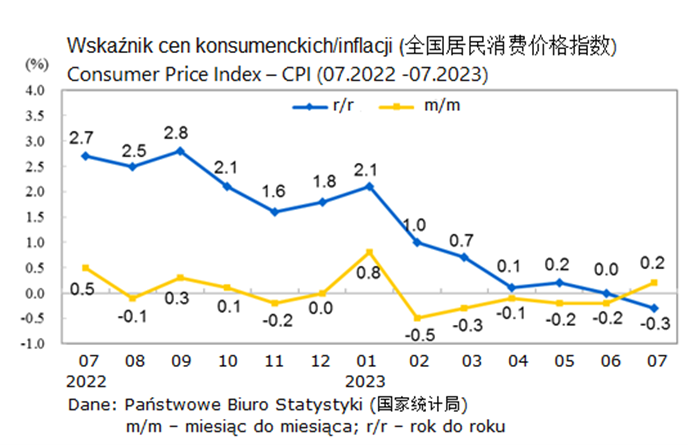

Jeśli look at the July consumer price index CPI (全国居民消费价格指数CPI), 1 of the 2 most crucial indicators of inflation level, it is no longer the case: China is facing deflation. Inflation measured by CPI was in China in July this year. -0.3%.

Negative inflation has been recorded here for the first time since February 2021, erstwhile further restrictions and blockades were introduced in China in consequence to the COVID epidemic 19.

The falling prices of food and everyday usage items can be enjoyed by the average Chinese, but they are not good for the economy, which gives headaches to decision makers at the highest levels of Chinese power apparatus.

More efficient measures are needed to stimulate the economy and increase consumption. Which isn't that simple. The Chinese have always spared and reduced spending in the face of uncertain tomorrow, and this is happening today.

However, inflation measured in relation to a period to a period may be a light in the tunnel. In July inflation increased to +0.2% (m/m) in this position erstwhile in June it was -0.2% period to month.

The actual trend of the Chinese economy should show August results. If inflation increases from 1 period to the next, this could mean coming out of the deflationary hole.

China's economical plans for 2023 assumed inflation of up to 3%. I don't think there's a chance that the plan will be implemented today. There are no economical reasons for a abrupt emergence in inflation.

The government is taking further steps to revive consumption. At the last gathering of the Political Bureau, the PSC was called upon to increase home request in order to stimulate economical growth. The request for implementation was highlighted "new improvement doctrine in all sectors“ including, among another things, promoting the acquisition of electrical cars, electronic products and expanding request in agrarian areas. On the another hand, the State improvement and improvement Committee (国家发展和改革委员会, the central planning body) has developed for the second half of this year 20 fiscal and another activities to stimulate the economy and improvement of consumption. This includes:

- increasing the availability of consumer credit,

- incentives to buy electrical cars at preferential prices,

- building affordable housing for young people,

- promoting the consumption of electronic goods,

- issuing consumer vouchers to residents by local governments.

Whether these actions will produce the desired results will be seen in any time.

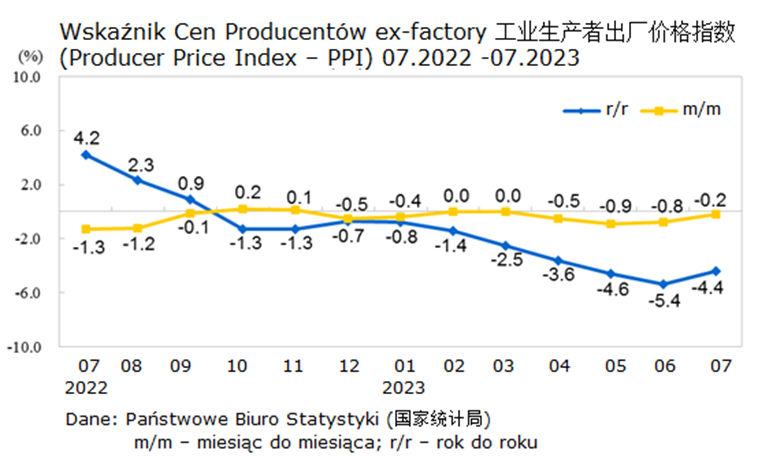

The price index of producers of PPI (chin. 工业生产者出厂价格指数, maker Price Index – PPI) in July this year was -4.4% year-on-year and -0.2% month-on-month.

In June it was -5.4% y/y and 0.8% m/m.

From the beginning of January to the end of July this year, maker prices decreased by 3.2% y/y in total.

The largest price decreases in July were recorded in the mining manufacture (-14.7%), chemical natural materials (-13.3%), another natural materials (-7.6%), fuels and energy (-12.2%).

Source:

Author: 梁安基 Andrzej Z. Liang, 上海 Shanghai, 中国 China

Email: [email protected]

Editorial: Leszek B.

Email: [email protected]

© China: Facts, Events, Opinions – www.chiny24.com