Bitcoin ETFs endure Worst Day Ever

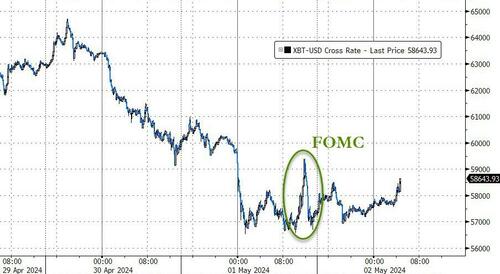

Despite the catch of full carnage in place bitcoin prices, yesterday was an oblique (nay the ugliest) day for the recently minted ETFs (although bitcoin is down 10% of this week).

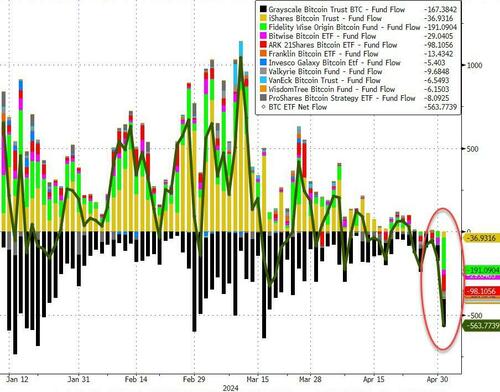

Most notably, BlackRock’s ETF Saw Around $37 million in outflows for the first time, while the remaining place Bitcoin ETFs Collectively notched over $526.8 million in outflows.

The largest outflow for the day was the Fidelity Wise Origin Bitcoin Fund, which Saw $191.1 million in net outflows. The Grayscale Bitcoin Trust took the second place with outflows of $167.4 million.

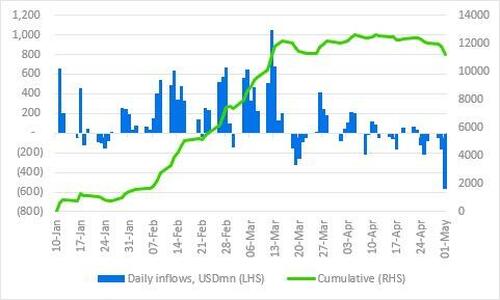

This means the full net inflow since admission has fallen to USD11.2bn.

On the crypto-specific we have now had 6 days in a row of outflows from the US place ETFs and, as important, we are now below the average ETF acquisition price of around 58k...

Source: Geoffrey Kindrick

Bloomberg ETF analyst James Seyffart noted that the Bitcoin ETFs are inactive “operating smoothly across the board” and that “inflows and outflows are part of the standards in the life of an ETF.”

Coinglass data shows that there has been around $200mm in 'long liquidations' in the last coupled of days...

“Bitcoin is our favourite canary,” ByteTree Asset Management Chief Investment Officer Charlie Morris gate in a note.

“It is informing of problem ahead in financial markets, but we can be assured it’ll bounce back at any point.”

But this is not a time to panic, as CoinTelegraph reports, ETF store president Nate Geraci pointed out that the iShares Gold ETF and SPDR Gold ETFs have had $1 billion and $3 billion in outflows so far this year.

Yet, gold is up 16% year-to-date, Geraci noted in a May 2 X post.

As CoinDesk reports, the current lull is likely to be followed by a fresh wave from a different kind of investor, said Robert Mitchnick, head of digital assets for BlackRock, the world’s largest asset-management company.

The coming months will probally see financial institutions specified as sovereign wellness funds, pension funds and endowments start to trade in the place ETFs, Mitchnick said in an interview. The companies are seeing “a re-initiation of the discussion around bitcoin,” which turns on the subject of allocating to bitcoin (BTC) and how to think about it from a portfolio construction perspective.

“Many of these curious companies – who we’re talking about salaries, endowments, sovereign wellness funds, insurers, another asset managers, household offices – are having ongoing diligence and investigation conversations, and we’re playing a function from an education perspective,” Mitchnick said.

And finally, Geoffrey Kendrick – who correctly predicted $4k in ETH fewer months ago – is contacting with his 150k mark for year-end 2024 and 200k for year-end 2025 (with chance of overshoot to 250k).

“The next 3 to 4 months will be little bullish and more risk-oriented, with the marketplace closily monitoring inflation, employment and economical data for any unexpected shocks or to gain assurance about possible rate cuts,” said Youwei Yang, Chief Economist and vice president of crypto miner BIT Mining Ltd.

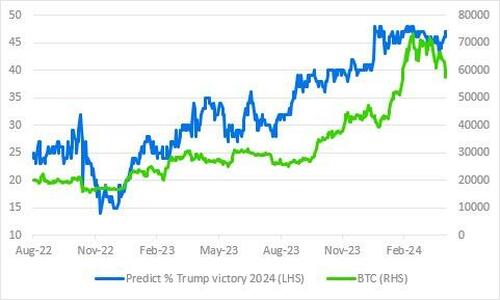

But, Kendrick notes, the next leg higher may take any time and require us to be closeer to the US election.

At that time we would anticipate BTC to rapidly into year-end, partially if a Trump presidential election victim becomes more likely, as a Trump administration will be more crypto friendly than a Biden one.

Tyler Durden

Thu, 05/02/2024 – 10:35

![Makabryczne odkrycie w lesie. Tak skończyły się poszukiwania dwóch zaginionych [ZDJĘCIA]](https://www.eostroleka.pl/luba/dane/pliki/zdjecia/2025/271-220209.jpg)