Billions Spent On Data Centers – But Where Is The AI Adoption Rate?

This week, readers were given fresh insights from UBS (read: here & here), highlighting the explosive surge in data center investments. As we’ve noted before, one asset manager—backing a multi-billion-dollar AI data center project in Texas—described to us the current AI infrastructure buildout as a multi-year „sprint.”

With hundreds of billions pouring into data center development—concentrated in Texas and the Heartland due to cheap land and reliable power—investors should be asking one critical question: how fast is AI adoption scaling across corporate America?

According to Goldman Sachs’ latest AI Adoption Tracker for Q2 2025, the enterprise implementation of AI continues to expand, particularly across sectors most vulnerable to automation. At the same time, productivity gains are becoming more measurable, even as AI-related layoffs have yet to materialize.

Analysts Jan Hatzius, Joseph Briggs, and others offered clients a clear snapshot of the current AI investment tsunami:

AI-related investment growth remains strong, particularly for semiconductor firms, where equity analysts expect revenue growth of 36% from current levels by the end of 2026. Since the release of ChatGPT, analysts have upgraded their end-2025 revenue projections for semiconductors by $200bn (0.7% of US GDP) and AI hardware enablers by $105bn (0.4%).

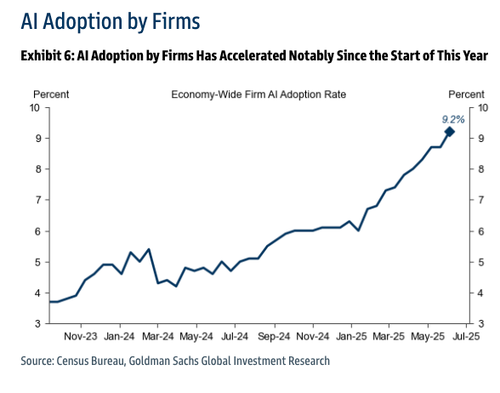

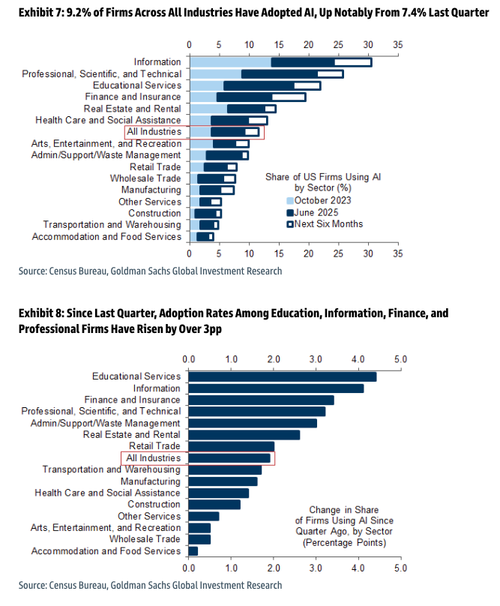

As for the AI adoption rate, analysts found that as of May, approximately 9.2% of U.S. firms reported using AI in the production of goods or services—up from 7.4% in 4Q24.

The most significant quarter-over-quarter gains occurred in the education, information, finance, and professional services sectors.

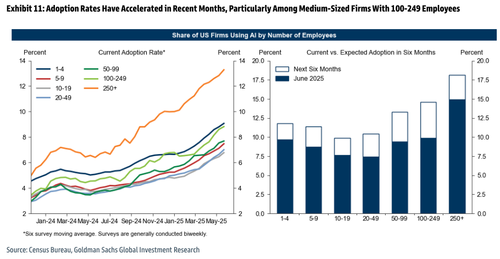

„Large firms with 250+ employees continue to report the highest adoption rate (14.9%) while medium-sized firms with 100-249 employees reported the largest expected increase in adoption over the next 6 months (+4.7pp to 14.6%). Adoption rates have also accelerated among medium-sized firms with 150-249 employees,” the analysts said.

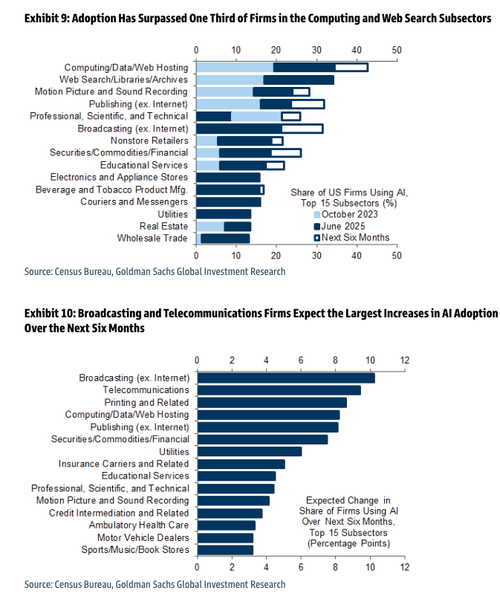

Certain subsectors—especially in computing, web hosting, and telecom—are seeing adoption rates exceed 30%. Broadcasting and telecommunications firms anticipate the largest adoption gains through the rest of 2025.

Given the increasing AI adoption rate, the analysts noted that AI’s impact on employment metrics has been marginal:

AI’s impact on the labor market remains limited and there is no sign of a significant impact on most labor market outcomes. AI-related job openings now account for 24% of all IT job openings and 1.5% of all job postings. AI has not been mentioned in major corporate layoff announcements in recent months and the unemployment rate for AI-exposed positions has reconciled with the broader unemployment rate.

However…

We continue to observe large impacts on labor productivity in the limited areas where generative AI has been deployed. Academic studies imply a 23% average uplift to productivity, while company anecdotes imply similar efficiency gains of around 29%.

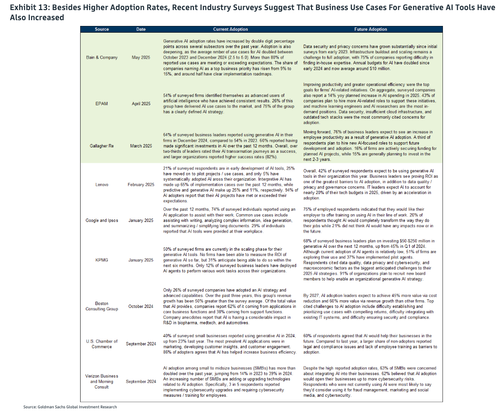

Here’s what companies and trade organizations are saying about current and future AI adoption…

Ultimately, investors will need to see AI adoption across corporate America continue to climb in order to justify the massive infrastructure buildout.

The looming question now is: At what point does rising adoption trigger a wave of AI-driven layoffs?

Tyler Durden

Sat, 06/07/2025 – 08:45