Beige Book Finds US Economy Diverging By Party Lines, No Trace Of Runaway Inflation

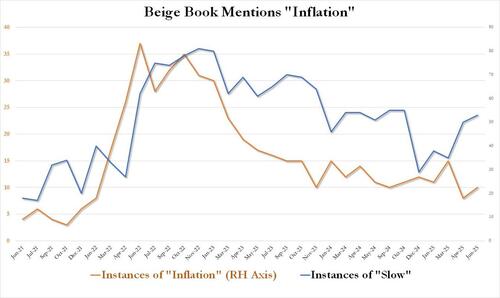

Many were stunned after the latest inflation and core PCE data confirmed that the experts were once again dead wrong, and instead of the widely expected inflation tsunami, Trump’s tariffs have so far sparked only continued disinflation (which will only become more acute as home prices slide). And yet, anyone who read our Beige Book analysis from last month (not to mention our prediction from last June that „The Experts Are All Wrong About Inflation Under A Trump Presidency”) would have known just that: as we laid out, „Beige Book Finds Inflation Mentions Tumble To 3 Year Low” which was the clearest indication that despite the prevailing narrative, rising prices is simply not a thing businesses across the US are worried about.

Fast forward to today when the latest, May, Beige Book was released, and it revealed that according to reports across the 12 Fed district, „economic activity has declined slightly since the previous report” with half of the districts reporting slight to moderate declines in activity, three Districts reported no change, and three Districts reported slight growth. And here an interesting divergence appears, because the Beige Book appears to reveal another party-line split. Here are the districts that reported declines in activity:

- New York

- Boston

- Philadelphia

- San Francisco

- Minneapolis

- Kansas City

- Cleveland

- Dallas

- Richmond

- Atlanta

- Chicago

- St Louis

In any case, the Beige Book said that all Districts reported elevated levels of economic and policy uncertainty, which have led to hesitancy and a cautious approach to business and household decisions. Manufacturing activity also declined slightly, while consumer spending reports were mixed, with most Districts reporting slight declines or no change; however, some Districts reported increases in spending on items expected to be affected by tariffs.

Elsewhere, residential real estate sales were little changed, and most district reports on new home construction indicate flat or slowing construction activity. Reports on bank loan demand and capital spending plans were mixed. Activity at ports was robust, while reports on transportation and warehouse activity in other areas were mixed.

On balance, the outlook remains slightly pessimistic and uncertain, unchanged relative to the previous report. Yet, here too, confusion was the dominant them, with a few District reports indicating the outlook has deteriorated while a few others indicating the outlook has improved.

Focusing on labor markets, the Beige book reported the following:

- Employment has been little changed since the previous report.

- Most Districts described employment as flat, three Districts reported slight-to-modest increases, and two Districts reported slight declines.

- Many Districts reported lower employee turnover rates and more applicants for open positions.

- Comments about uncertainty delaying hiring were widespread: all Districts described lower labor demand, citing declining hours worked and overtime, hiring pauses, and staff reduction plans.

- Some Districts reported layoffs in certain sectors, but these layoffs were not pervasive.

- Two Districts noted that, for many of their contacts, hiring plans had not changed since the start of the year.

- Wages continued to grow at a modest pace, although many Districts reported a general easing in wage pressures.

- A few Districts indicated that higher costs of living continued to put upward pressure on wages.

As for prices, it should come as no surprise by now that the runaway inflation everyone was expecting just isn’t there. Here is Beige book confirmation:

- Prices have increased at a moderate pace since the previous report.

- There were widespread reports of contacts expecting costs and prices to rise at a faster rate going forward (although expectations don’t pay the bills).

- A few Districts described these expected cost increases as strong, significant, or substantial (once again, it’s all expected, nothing is realized).

- All District reports indicated that higher tariff rates were putting upward pressure on costs and prices (so high that price increases were at most moderate, i.e., in line with history).

- However, contacts’ responses to these higher costs varied, including increasing prices on affected items, increasing prices on all items, reducing profit margins, and adding temporary fees or surcharges.

There was a new section added to this month’s Beige Book, one looking at the fate of US energy:

- Energy industry contacts reported moderate growth across most sectors.

- Liquefied natural gas production, exports, and overall global demand remained an area of strength.

- While domestic demand for U.S. crude oil was steady, global demand softened.

- Utility companies described robust residential power demand, modest growth in commercial, and some slowing in industrial.

- Although utility sector contacts reported growth opportunities linked to data center development, some noted a slight deceleration in activity, attributed to concerns over potential tariffs increasing the cost of power infrastructure and impeding investment.

- Offshore wind contacts reported a significant decline in demand, resulting in downsizing.

In short, for yet another month, the sky is not falling.

Here is a snapshot of highlights by Fed District:

- Boston: Economic activity decreased slightly overall. Consumer spending at retail stores and restaurants slowed modestly. Employers paused hiring because of heightened uncertainty, with employment declining slightly and wages increasing just barely. Prices increased only slightly, but larger price increases were expected for the summer. Contacts expressed mixed views concerning the outlook.

- New York: Economic activity in the Second District continued to decline modestly amid heightened uncertainty. Employment held steady, though demand for workers softened and wage growth slowed to a modest pace. Selling price increases remained moderate, but input prices grew strongly with tariff-induced cost increases. Capital spending plans declined, and the outlook was quite pessimistic.

- Philadelphia: Business activity declined modestly in the current Beige Book period, as it did in the last period. Employment declined slightly, despite an uptick in manufacturing sector jobs. Wages increased slightly, and firm price inflation was up moderately. Existing home sales grew slightly, and new home sales declined moderately. Expectations for future growth rose moderately for manufacturers and slightly for nonmanufacturers.

- Cleveland: District business activity continued to be flat in recent weeks, and contacts expected activity to remain flat in the months ahead. Retailers noted a pullback in consumer spending, and manufacturers reported softer orders. Many contacts attributed robust cost increases to tariffs and said that their selling prices increased moderately.

- Richmond: The regional economy continued to grow mildly in recent weeks. Consumer spending and nonfinancial services demand picked up slightly, financial services demand and real estate activity were little changed, and manufacturing activity contracted slightly. Port volumes increased strongly due to a surge in import activity. Employment rose slightly, wage growth was modest, and overall price growth remained moderate.

- Atlanta: The economy of the Sixth District grew slightly. Employment was steady, and wage pressure decreased. Prices increased moderately. Consumer spending was flat, and travel and tourism declined modestly. Home sales rose slightly. Transportation activity grew at a modest pace. Loan growth slowed. Manufacturing fell, but energy activity rose slowly.

- Chicago: Economic activity increased slightly. Consumer spending and employment increased modestly; business spending and construction and real estate activity were flat; manufacturing declined slightly; and nonbusiness contacts saw a slight decline in activity. Prices and wages rose modestly, and financial conditions loosened slightly. Prospects for 2025 farm income increased some.

- St. Louis: Economic activity has remained unchanged, but the outlook has slightly deteriorated. Employment levels were unchanged, and wage growth has been modest. Contacts expressed elevated uncertainty and concern that tariffs would result in further cost increases.

- Minneapolis: The District economy contracted slightly overall. Employment was flat and wages grew moderately. Some employers were preparing contingency plans for potential layoffs. Prices increased moderately overall; some contacts were adding or considering tariff surcharges. Manufacturing increased moderately and consumer spending fell. Agricultural conditions remained weak, but crop progress was solid.

- Kansas City: Overall activity declined moderately, driven by lower retail spending, a decline in the demand for single-family homes, and a slight contraction in manufacturing. Businesses indicated they were increasingly cautious about hiring plans and capital expenditures, but employment levels were steady.

- Dallas: Economic activity in the Eleventh District economy was little changed over the reporting period. Nonfinancial services activity held steady and growth in the manufacturing sector slowed. Loan volumes grew slightly, and the housing market remained subdued. Employment was flat and price pressures held steady except for the tariff-related increases seen in the manufacturing sector. Outlooks generally deteriorated, and tariff uncertainty was making it hard for businesses to plan for the future.

- San Francisco: Economic activity slowed slightly. Employment levels were generally stable. Wages rose slightly and prices increased modestly. Retail sales and consumer and business services demand eased. Conditions in manufacturing, agriculture, and real estate markets softened slightly. Activity in the financial services sector was stable.

And finally, confirming that contrary to conventional wisdom the economic picture has been largely unchanged since April, the latest February Beige Book saw just 1 mention of recessions, the lowest this year, and down sharply from 6 three months prior. Where there was some concern is that mentions of „slow” rose from from 50 in April (which was down to 53, the biggest highlight for another month is that contrary to prevailing media narratives, mentions of inflation actually rose ever so modestly from a three-year low of 8 to 10, the second lowest going back to the start of 2022.

All of which suggests that the US economy – while hardly on fire as it was during the hyperinflationary period of Biden’s admin – continues to chug along and is hardly collapsing as so many Trump foes would like to see; and it certainly is not seeing prices explode higher.

Tyler Durden

Wed, 06/04/2025 – 15:59