PKO The Bank of Poland again draws the attention of its customers to an crucial function that can supply protection against fraud. This is simply a banking app that is available for installation on mobile devices.

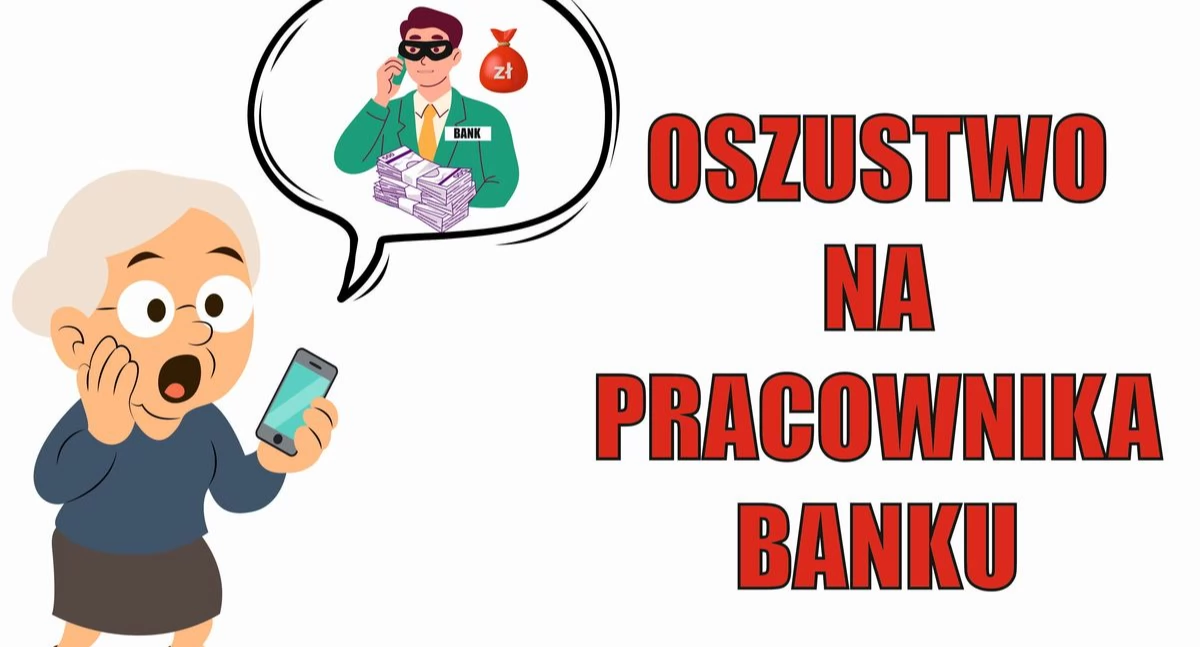

Cheaters are active especially during the upcoming holidays and increased purchasing activity. PKO is peculiarly afraid about its customers, as there are increasingly situations where fraudsters impersonate employees of financial institutions specified as banks. This practice, known as spoofing, is an object of the bank's attention, which constantly reminds customers of the methods of defence against it.

PKO BP appeals to customers

PKO BP recommends a simple way to defend against fraud. erstwhile we get a call from individual claiming to be a bank employee, it is worth verifying their identity with the IKO app that can be installed on the phone. The bank describes this process in item on its social media profiles.

During the conversation you should express your desire to verify the identity of the advisor utilizing the application. shortly after, we will receive a push notification at IKO. Then you should ask the worker to give you the name, name and place he calls from. erstwhile you confirm this information in the app, you can proceed the conversation, having assurance that we are talking to the right person.

This process provides an additional layer of safety in relations with the bank. As a result, fraud can be effectively limited, and customers can be certain that they are talking to a real typical of a financial institution.

How do you admit individual impersonating a bank employee?

Once the verification is done correctly, we can be certain that we are in contact with an authentic bank employee. However, erstwhile a fraud finds himself on the another side, he will most likely effort to discourage us from verifying or simply break the connection. It's a signal that we managed to avoid trying to cheat.

It is crucial to be alert in specified situations. Cheaters frequently effort to confuse and confuse the victim to get confidential information. They can usage different tricks, so it is crucial to keep a healthy approach and to adhere to safety procedures.

The question of identity verification or safety procedure should not be feared. These are crucial steps that aid safe our finances and individual data. If something seems suspicious, it is always worth consulting a financial institution or individual afraid to make certain that we contact the right person.

Ignacy Michałowski

OSINT investigator with experience in global journalism projects. It has been publishing materials for over 20 years for the largest releases. In social activities he engaged in various projects and initiatives aimed at improving the quality of life of people, especially those of mediocre communities. He was besides active in the fight for human rights. Contact: [email protected]

Here’s News from the country,Events of the day,Last minute,Bank,bank pko bp,ipko,PKO BP-related post from

Bank PKO BP issued an urgent announcement. For all bank customers: